Uphold review

We currently don't have this product on Finder

- Supported assets

- 237

- Fiat currencies

- 27

Summary

Introducing Uphold, a multi-currency wallet that supports cryptocurrency, fiat currency and even precious metals.

Uphold boasts a selection of cryptocurrencies, precious metals and national currencies for its users to trade. The features it has introduced have expanded it beyond a simple exchange where users can trade between digital assets. These features enable the platform to be used for payment services, trading, taxes and much more.

However, the large list of digital assets and features carries higher fees when compared to other exchanges. Overall, Uphold is a very strong exchange with a wide range of digital assets and features to choose from, but users should expect to pay slightly higher fees for the convenience.

Pros

-

Expansive list of digital assets

-

Available in 184+ countries

-

Intuitive UI

Cons

-

Limited customer service

-

Certain services are limited to geographical availability (debit card, bank transfers)

-

Hidden fees

Details

Product details

| Product Name | Uphold |

| Fiat Currencies | USD, GBP, AUD, EUR, CAD, CNY, JPY, SGD, INR, NZD & 17 more |

| Cryptocurrencies | BTC, ETH, XRP, BCH, EOS, LTC, ADA, XLM, TRX, NEO & 227 more |

| Deposit Methods |

Bank transfer (ACH) Credit card Debit card Apple Pay Google Pay |

| Trading Fee | $1 flat fee on trades Spreads also apply |

| Deposit Fees |

Bank transfer: None Credit card: 3.99% Debit card: 2.49% Google Pay: None |

| Withdrawal Fees |

Cryptocurrency: $2.99 + coin fees Bank transfer: None Credit/debit card: None Google Pay: None |

Finder ratings for Uphold

| Supported cryptocurrencies | ★★★★★ |

| Transferring money or assets | ★★★★★ |

| Fees and costs | ★★★★★ |

| Ease of use | ★★★★★ |

| Customer service | ★★★★★ |

| Staking/earning | ★★★★★ |

| Trustworthiness/security | ★★★★★ |

| Overall score | 3 |

What is Uphold?

Uphold is a multi-asset digital money platform that offers financial services to the global market. The platform was founded in 2013, launched in 2015, and is based out of London, UK. It has offices all over the world. The platform is available in 184+ countries and carries over 80 different currencies (both fiat and crypto), as well as commodities.

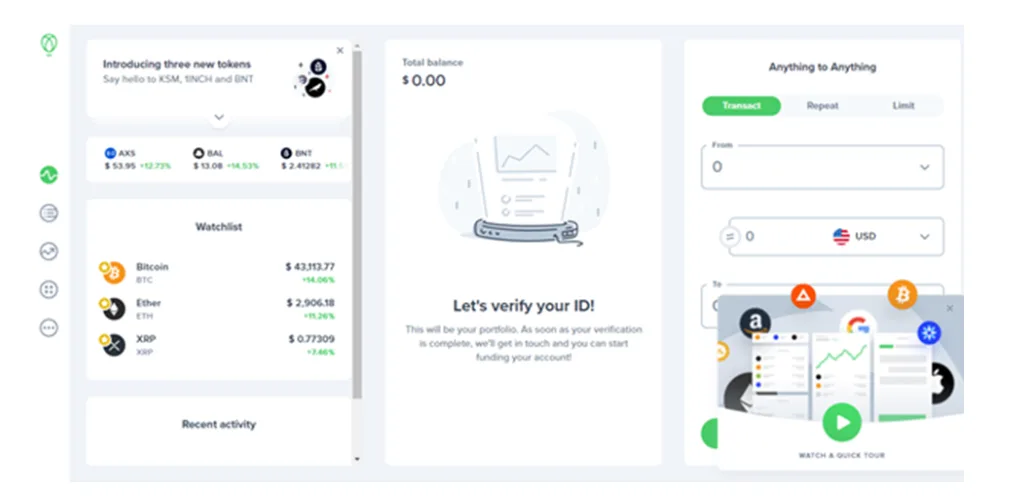

The platform runs on the motif of being able to "trade anything for anything". Uphold is a platform for sending cross-border remittance payments while offering savings and investment tools to experienced traders.

Uphold provides multiple features, earning tools, and the ability to introduce third-party apps to a user's profile. It does carry additional fees for some features and operates on a spread for trading any of its digital assets.

- If this is your first exchange: Uphold has an easy and quick registration process with an easy-to-navigate UI.

- If you're switching exchanges: Uphold has an expansive list of digital assets that go beyond a simple cryptocurrency exchange.

What to know about Uphold

The main aspect of Uphold that users should familiarise themselves with is that Uphold operates on a spread for all its digital assets. This means there is a difference between the buy price and the selling price of each digital asset. The difference in the spread is how the platform makes a profit. Operating on a spread allows the exchange to offer zero deposit fees and minimal withdrawal fees for certain nations. However, Australians can only utilise credit/debit card deposits, which incur a 3.99% fee.

Uphold is constantly expanding its digital offerings and features. The exchange offers a staking option for its users that have passed KYC. Another feature that separates it from other exchanges is the enabling of third-party integrations. These integrations enable users to add apps to their exchange profile for recording taxes, play-to-earn games, and other uses.

Uphold supported cryptocurrencies

Uphold offers 100+ different cryptocurrencies for trading on its platform, including the most popular cryptos, Bitcoin and Ethereum. The only asset missing of note is Ethereum Classic (ETC).

Transferring fiat and cryptocurrency

Uphold offers multiple funding options for both fiat and cryptocurrency. If depositing via fiat, users have the option of depositing via bank transfer, debit or credit cards. When depositing via bank transfer, users are required to deposit in USD, EUR or GBP, which will then give the user the conversion price. Australian users cannot use this deposit method, and instead must use a debit/credit card. Transfer times vary by method.

Crypto deposits are a simple transfer from 1 wallet address to another. Additionally, users are able to make use of the Hyperledger network to deposit cryptocurrencies, utility tokens, national currencies, stablecoins or metals.

Uphold fees and costs

Fiat withdrawal and deposit fees

Users are able to deposit funds through either a bank transfer, debit or credit card, though this varies depending on the customer's region. There is a 4–5 business day cooling-off period for debit card deposits.

| Deposit | Withdrawal |

|---|---|

| 3.99% | N/A |

*Additional fees may apply for geographical regions and wire transfers.

Crypto withdrawal and deposit fees

| Deposit | Withdrawal |

|---|---|

| $0 | $2.99 + gas fees* |

What is it like to use Uphold?

Uphold has a straightforward layout, many users of the platform are people that use the Brave Browser, as Uphold is the automatic wallet for BAT rewards. Overall, it is an intuitive user experience.

Brave Rewards

Brave is a blockchain-based web browser with an emphasis on users' privacy. Uphold enables you to connect your Brave account and Uphold account so your BAT can be deposited directly to Uphold.

Uphold debit card

The Uphold debit Mastercard is a rewards-based payment card. Every time a user pays with their Uphold debit card, they receive a percentage of the payment back into their account. There is a waitlist and it's still limited as to which countries it is available in. Australians can join this waitlist to gain priority access to the card upon its global release.

API integration

API integration is a service that businesses can take advantage of for payment processing. API integration allows businesses the ability to receive payments in 1 form and convert it automatically for their own payments into another form, or multiple forms.

Cryptionary

Uphold has supplied a glossary on cryptocurrency for its users. The cryptionary page is a good tool for introducing new users to the products.

Affiliate program

Uphold has a generous affiliate referral program. Users who are approved for the affiliate program will qualify for 50% revenue share for their first 3 months and 30% after that initial period. The referred account must be from the US, UK or a number of other American nations, though it is unclear whether the referer must also be from these countries.

Does Uphold have good customer support?

Uphold has only a couple of options for customer support options. Users can visit the FAQ page which has a list of the most frequent issues that users have come across with their remedies. If a user wishes to speak directly to customer service, they can do so through the Uphold Contact Us form. The customer support is very responsive with an average time of around 15 minutes.

| Support offered | Wait times | |

|---|---|---|

| Contact us form | 15 mins | |

| FAQ page | Instant |

List of services on Uphold

Trading on Uphold

Trading on Uphold uses a spread. The spread varies on each digital asset or currency, what they are being traded for, and the region they are being traded in.

Cryptocurrencies: In the US and Europe, cryptocurrencies operate on a spread from 0.8–1.2%. Outside of these regions, the spread is around 1.8%.

Precious Metals: Around 3%

Fiat Currencies: Around 0.2% for most major national currencies

Mastercard debit/credit on Uphold

Uphold offers a Mastercard debit card for users. There is a physical and digital version of the card, and it carries a $9.95 processing fee. The card enables users to use any of their assets to make payments, but there are conversion fees for using a non-fiat currency. At this time, the card is only available in the US, but there are plans to expand the service globally.

Earning on Uphold

Uphold offers more than 20 coins for staking which is fairly competitive. Rates are variable and change depending on the amount of stakers participating. Rewards are paid out weekly with Uphold taking a commission which varys substantially depending on the coin being staked.

Promotions on Uphold

Uphold runs an affiliate rewards program that users can sign up for. Users are rewarded with 50% revenue share for the first 3 months after successfully signing up to become an affiliate, and 30% after that. It is unclear whether Australian residents can capitalise on this promotion, however referred accounts must come from a limited list of nations, notably the UK and the US.

Uphold trust rating

Uphold has a strict KYC protocol in place, as well as requiring all of its users to add a 2-Factor Authentication security setting before allowing them to fund and trade on their registered accounts. Uphold holds 90% of its digital assets in cold storage and is audited quarterly to verify its solvency.

Past hacks

Uphold has been operating since 2015 and has not experienced any successful hacks to date.

Security audits

Uphold states it undergoes regular security audits and penetration testing, but has no specifics.

Insurance

Uphold has no insurance in place for users.

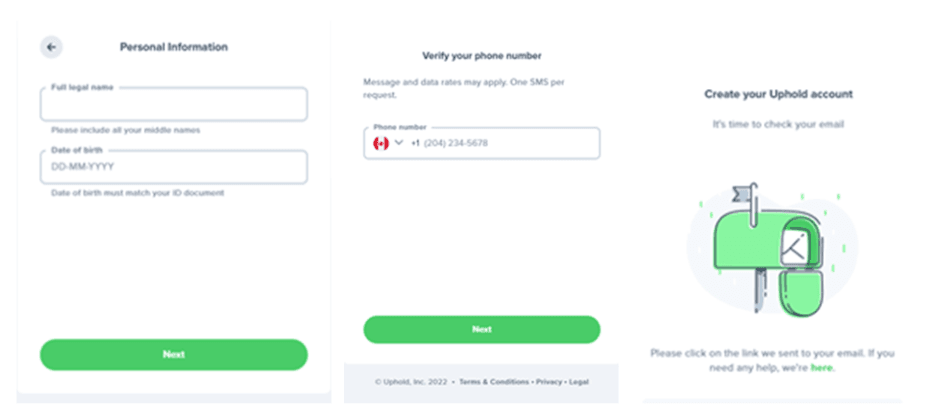

Signing up on Uphold

Step 1

To start the registration process, you can click the "Sign Up" tab in the top right of the homescreen.

Step 2

Users will be brought to a registration page where they will need to register an email account to Uphold. They will be sent a verification email with a link. They will then be asked to verify some brief personal information to attach to the account.

Step 3

You can now access your account. You will need to verify your ID before you will be allowed to fund your account and begin trading.

Step 4: KYC

Verifying your ID is straightforward. Uphold will display a link on your screen which you can either continue with on your phone through a provided QR code or a link sent via SMS. You will be required to submit a copy of your ID and a selfie. Once this process is complete, you're ready to start funding your account and begin trading.

Compare Uphold against other crypto platforms and exchanges

Compare other products

We currently don't have that product, but here are others to consider:

How we picked theseUphold frequently asked questions

Is Uphold better than Coinbase?

It depends on what the user is looking for. Uphold offers crypto, precious metals, and national currencies for trading, whereas Coinbase is focused on just cryptocurrency.

Does Uphold take a fee?

Uphold operates on a spread for trading all of its assets. There are no deposit fees for any asset on Uphold, but it does charge for withdrawals and debit/credit card transfers. There is a $2.99 fee (+ gas fees) for withdrawing crypto.

Is Uphold legit?

Yes, Uphold is a trustworthy exchange. It publishes a live broadcast of all its digital asset holdings, is audited quarterly, and imposes a strict KYC protocol, with every user being required to have a 2FA security measure in place.

What is Uphold used for?

Uphold is used for the frictionless foreign exchange of its over 80 different currencies (fiat and crypto) and commodities. Uphold provides cross-border remittance payments for its users.

Where is Uphold available?

Uphold is available to users in a long list of countries around the world, including the US. You can find a full list of supported countries on the Uphold website. However, residents from the following countries can't access Uphold's services:

- Central African Republic

- Cuba

- Iran

- Libya

- North Korea

- Somalia

- Sudan

- Syria

Can I make direct bank account deposits and withdrawals to and from Uphold?

To deposit from or withdraw to your bank account, you'll need to reside in one of the following countries: Austria, Belgium, Bulgaria, Croatia, Cyprus, Czech Republic, Denmark, Estonia, Finland, France, Germany, Greece, Hungary, Ireland, Italy, Latvia, Liechtenstein, Lithuania, Luxembourg, Malta, Monaco, Netherlands, Norway, Poland, Portugal, Romania, San Marino, Slovakia, Slovenia, Spain, Sweden, Switzerland, the United States and the United Kingdom.

Sources

Your reviews

Tim Finder

Writer

You are about to post a question on finder.com.au:

- Do not enter personal information (eg. surname, phone number, bank details) as your question will be made public

- finder.com.au is a financial comparison and information service, not a bank or product provider

- We cannot provide you with personal advice or recommendations

- Your answer might already be waiting – check previous questions below to see if yours has already been asked

Finder only provides general advice and factual information, so consider your own circumstances, or seek advice before you decide to act on our content. By submitting a question, you're accepting our Terms Of Service and Finder Group Privacy & Cookies Policy.

This site is protected by reCAPTCHA and the Privacy Policy and Terms of Service apply.