Spaceship US Investing review

We currently don't have this product on Finder

- Standard brokerage fee

- $0.00

- Available markets

- USA

- Support

- Phone, Email, Live chat

Our verdict

Begin your US investing journey with only $10 on a user-friendly platform, but there are limitations.

Spaceship's launch into US investing gives another option for Australians looking to tap into the the vibrant American stock market.

With an entry point as low as $10 and $0 brokerage, it opens up the opportunity for investors of all levels to gain exposure to sought-after US stocks and ETFs, including the option to invest in fractional shares.

The platform's straightforward approach, allowing investments to be made in Aussie dollars, removes the hassle of currency exchange.

This feature, coupled with access to popular ETFs and shares from major companies, underscores Spaceship's appeal to those who wish to dive into investing in the major markets.

However, while Spaceship offers a gateway into US investments, it's important to note the limitations.

The platform only currently offers specific investing options: US Investing and the micro investing Spaceship Voyager. Investors looking for a broad portfolio through a single platform including global stocks, ASX listings or leveraged trading options such as CFDs, forex and cryptocurrencies, might find Spaceship's offerings restrictive.

Bottom line: For those interesting in investing in the US market, Spaceship provides a streamlined and accessible platform, but those looking for a more diversified portfolio with a single platform may find the offering limited.

Pros

-

Low entry point. Start investing in the US market with as little as $10, making it accessible for beginners or those with limited funds.

-

Access to US stocks and ETFs. Offers the opportunity to invest in sought-after US stocks and ETFs from major providers, appealing to those looking to tap into the American market.

-

Fractional shares. Enables investment in fractional shares, allowing for diversification of your portfolio even with limited investment.

-

Invest in AUD. Investments can be made directly in Aussie dollars, simplifying the process by eliminating the need for currency exchange.

Cons

-

Limited investment options. Unlike platforms like eToro and IG, it lacks access to global and ASX stocks, CFDs, forex and cryptocurrencies.

-

Not suitable for leveraged trading. The absence of leveraged trading options like CFDs may deter investors seeking higher risk-reward investments.

-

Narrow focus. Primarily caters to Australian residents interested in the US market, which may not be ideal for those seeking extensive international exposure or diversified global portfolios.

Details

Share trading details

| Type of broker | Online |

| ASX products | Shares, Exchange traded funds |

| Available markets | USA |

| Standard brokerage fee | $0.00 |

| Support | Phone, Email, Live chat |

About Spaceship: Company history and background

Founded in 2016, Spaceship set out with a mission to innovate the personal investment landscape. It made its debut in 2017 with Spaceship Super, a superannuation fund designed to invest in future growth areas. This was quickly followed by the launch of micro-investment app Spaceship Voyager in 2018. Spaceship has since attracted over 200,000 customers, establishing itself as a significant player in the Australian investment market.

Note: The company operates through Spaceship Capital Limited (ABN 67 621 011 649, AFSL 501605), which oversees the Spaceship Origin Portfolio, Spaceship Universe Portfolio and Spaceship Earth Portfolio, known together as Spaceship Voyager. Spaceship Capital Limited also promotes Spaceship Super, a part of the Tidswell Master Superannuation Plan managed by Diversa Trustees Limited.

On 6 September 2023, Spaceship expanded its offerings with the introduction of the US Investing service. It facilitates investments in the US market through a partnership with a US broker-dealer.

Market fees

Spaceship's US Investing service introduces a straightforward fee structure designed to make investing in the US market accessible for Australians.

Here's a summary of the fees involved:

- Monthly fee: $2 (if you've paid the Spaceship Voyager monthly fee within the last month) or $4, including GST, charged monthly if you hold US securities.

- Foreign exchange (FX) fee: 70 pips of the trade value, applied whenever you buy or sell a US security.

Other fees involved (third-party fees):

- Securities and Exchange Commission (SEC) fee: US$0.00 for every US$10,000 sold, applicable only when selling US securities.

- Trading Activity Fee (TAF): US$0.000166 per share or unit sold, capped at US$8.30 per trade, changing to US$0.000166 per share or unit sold, capped at US$8.30 per trade from 1 January 2024.

- Automated Customer Account Transfer Service (ACATS) Transfer: No fee for transferring into Spaceship, but $200 per transfer request for transferring out.

- Voluntary Corporate Actions (VCA) fee: US$100 per processed VCA.

- ETF management fee: Variable, charged by the ETF issuer and reflected in the unit price of the ETF.

Consider reading Spaceship's US Investing fee schedule document to understand more.

Is Spaceship safe?

Spaceship operates under strict regulatory oversight in Australia, managed by Spaceship Capital Limited, which holds an Australian Financial Services Licence (AFSL 501605).

This regulatory framework ensures that Spaceship adheres to stringent compliance and operational standards designed to protect investors' interests.

Although among popular user review sites, feedback has been mixed. On the complaints side, reviewers primarily point to poor returns on their investments. On the positive side, users highlight the platform's user-friendly platform.

Ratings from review sites:

- AU Product Review: 3.1*/5

- AU Trustpilot: 2.2*/5

Benefits of investing with Spaceship US Investing service

Here are the notable account features worth highlighting:

- No brokerage fee. Enjoy no brokerage fee and no commission fees on stock trades, setting it apart from competitors who may charge for similar transactions.

- Competitive fees. Spaceship stands out with its competitive fee structure, offering a more cost-effective option without the complex fee models found elsewhere.

- Investment minimums. With a low $10 minimum investment, it's more accessible compared to some other platforms, which often require higher initial investments for US stock trading.

- Opportunity for fractional ownership. The service offers the chance to purchase fractional shares, making it feasible to invest in high-value US stocks at a fraction of the cost.

- Curated selection of US equities and ETFs. Gain access to a hand-picked range of prominent US stocks and ETFs, positioning investors to leverage the growth trajectories of leading global companies.

- Educational opportunities. Spaceship's platform offers users, especially beginners, opportunities to get market exposure via its "Spaceship Learn" offering.

- User-friendly interface. The platform's intuitive design ensures that users can easily manage their investments and stay updated on market trends, catering to both beginners and experienced investors alike.

What are the risks?

All investments carry risk and the following risks are not unique to Spaceship (US Investing) alone.

Different investment strategies may carry different levels of risk depending on the assets that make up the strategy. Assets with the highest long-term returns may also have the highest levels of short-term risk.

- Market risk. This is the risk of negative returns resulting from unfavourable investment market conditions. Unit values reflect the market value of the assets in the portfolio and consequently may rise and fall in line with market variations.

- Country risk. There is a risk that a country where assets are located could become politically or economically unstable. This risk is generally higher in countries classified as emerging markets.

- Foreign currency risk. Investing in global companies exposes the portfolio to foreign exchange rate movements. Spaceship does not use currency hedging to manage the impact of this risk. When foreign currencies fall in value relative to the Australian dollar, this can have an adverse impact on investment returns.

- Inflation risk. Changes in inflation may impact the value of your investment as inflation reduces the purchasing power of assets or income over time.

- Interest rate risk. This is the risk of investment losses resulting from an increase in interest rates.

- Liquidity risk. This is the risk that you may not be able to convert your investments into cash on a timely basis with little or no loss of capital. During extreme market volatility, Spaceship Capital may choose to suspend redemptions and defer payments for a period of time to protect investors.

Who is the Spaceship US Investing service designed for?

The service is tailored for Australian investors seeking a simple, low-cost entry into the US stock market.

It caters especially to beginners and those with modest investment amounts, offering the ability to buy fractional shares from just $10. The platform is a good fit for individuals who prefer a straightforward, no-fuss approach to investing, without the complexities of dealing with foreign currencies or navigating broad, global markets.

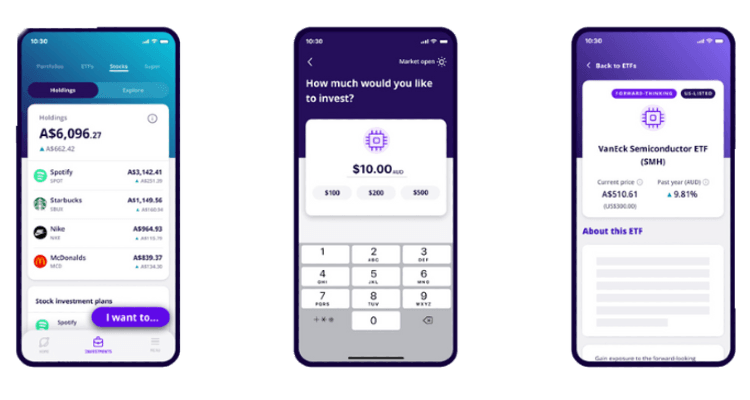

Take a look at the app

App store reviews

| Google Play app reviews | 2.4/5 stars based on 129,000+ reviews (100K+ downloads) |

| Apple App Store app reviews | 4.5/5 stars based on 5,000 reviews |

What customer support options are available?

If you have a question about your account, Spaceship has support options.

- Email support: Customers can reach out via email (hello@spaceship.com.au) for detailed queries and support issues.

- Phone support: For immediate assistance or for those preferring verbal communication, Spaceship offers phone support during business hours (1300 049 532).

- FAQs and help centre: A comprehensive online resource, including FAQs and articles, is available on the website.

- Live chat: There's a live chat feature on its website or app, providing real-time assistance to users navigating the platform or requiring immediate answers.

How do I open an account?

Spaceship's US Investing service is a fully digital investment product, which means setting up, investing and withdrawing must be done electronically through your Spaceship customer account.

- Create an account via the app or online.

- Choose which portfolio you would like to invest in and submit an application. This will include complying with anti-money laundering requirements and providing identification information.

Note: You must be an Australian resident to apply. - Transfer funds to make an initial investment (there is no minimum initial investment for either portfolio). You will receive confirmation of your investment through your Spaceship account. That confirmation will set out the number of units issued to you, the entry price of those units and the date the units were issued.

- Additional investments can be made on an ad hoc basis or you can establish a recurring investment plan. No minimum amount applies to additional investments.

- You can ask to withdraw all or part of your investment at any time through your Spaceship customer account, but it will only be processed during the business day. No minimum amount applies to withdrawals.

It's free and easy to create an account on Spaceship to access the US Investing service. Simply apply online by clicking the "Go to site" button below and follow these steps:

- Enter your full name.

- Enter your email address and phone number.

- Create a username and password.

- Supply proof of ID and tax file number.

Frequently asked questions

Sources

Your reviews

Shubham Finder

Writer

You are about to post a question on finder.com.au:

- Do not enter personal information (eg. surname, phone number, bank details) as your question will be made public

- finder.com.au is a financial comparison and information service, not a bank or product provider

- We cannot provide you with personal advice or recommendations

- Your answer might already be waiting – check previous questions below to see if yours has already been asked

Finder only provides general advice and factual information, so consider your own circumstances, or seek advice before you decide to act on our content. By submitting a question, you're accepting our Terms Of Service and Finder Group Privacy & Cookies Policy.

This site is protected by reCAPTCHA and the Privacy Policy and Terms of Service apply.