Congratulations, Interactive Brokers!

Interactive Brokers was a big winner in the 2025 Finder Awards.

- Winner, Best Global Stocks Trading Platform

- Winner, Best US Stocks Trading Platform

- Winner, Best Options Share Trading Platform

- Winner, Best Features Share Trading Platform

- Highly commended, Best Active Share Traders Platform

- Highly commended, Best Low Cost Share Trading Platform

Full list of 2025 share trading platform winners

What do Australians think of Interactive Brokers Australia share trading platform?

- 4.17/5 overall for Customer Satisfaction - lower than the average of 4.18

- 4.68/5 for Trust - higher than the average of 4.55

- 4.04/5 for Customer Service - lower than the average of 4.11

Based on Interactive Brokers Australia share trading platform scores in Finder's 2024 & 2025 Customer Satisfaction Awards.

Interactive Brokers trading platforms

Interactive Brokers offers 7 trading platforms designed to target different types of investor and investment approach:

IBKR GlobalTrader

A mobile app for trading more than 90 global stock markets and options.

Suitable for: beginner and intermediate investors

Client Portal

Client Portal is an easy-to-use web-based trading platform.

Suitable for: beginner and intermediate investors

IBKR Desktop

A desktop trading platform that lets you trade stocks, options and futures on more than 170 global markets.

Suitable for: beginner, intermediate and advanced investors

IBKR Mobile

An advanced mobile platform offering access to stocks, options and futures in more than 170 global markets.

Suitable for: intermediate and advanced investors

Trader Workstation (TWS)

IB's flagship desktop trading platform that lets you trade stocks, options, futures, FX and bonds on more than 170 global markets.

Suitable for: intermediate and advanced investors

IBKR APIs

An API trading platform aimed at more experienced traders.

Suitable for: advanced investors

IMPACT

A dedicated mobile app for ESG investing.

Suitable for: beginner and intermediate investors

What is Interactive Brokers?

Interactive Brokers Group was launched in the United States over 40 years ago and opened offices in Australia in 1997.

Today, it’s one of the oldest share trading platforms on the market, offering access to more than 170 global markets and with clients in more than 200 countries.

Its suite of products includes stocks, options, futures, forex, funds and fixed income.

It’s fully licensed and regulated by the Australian Securities and Investments Commission (ASIC) and is a participant of ASX, ASX 24 and CBOE Australia.

What is IB's Traders Workstation?

Interactive Brokers' Traders Workstation (TWS) is a desktop day trading platform.

New investors may find IB's platform overwhelming, but the positive here is that almost everything on Interactive Brokers is customisable to suit your personal trading style, whether you're trading shares, options, futures, forex or a mix of the above.

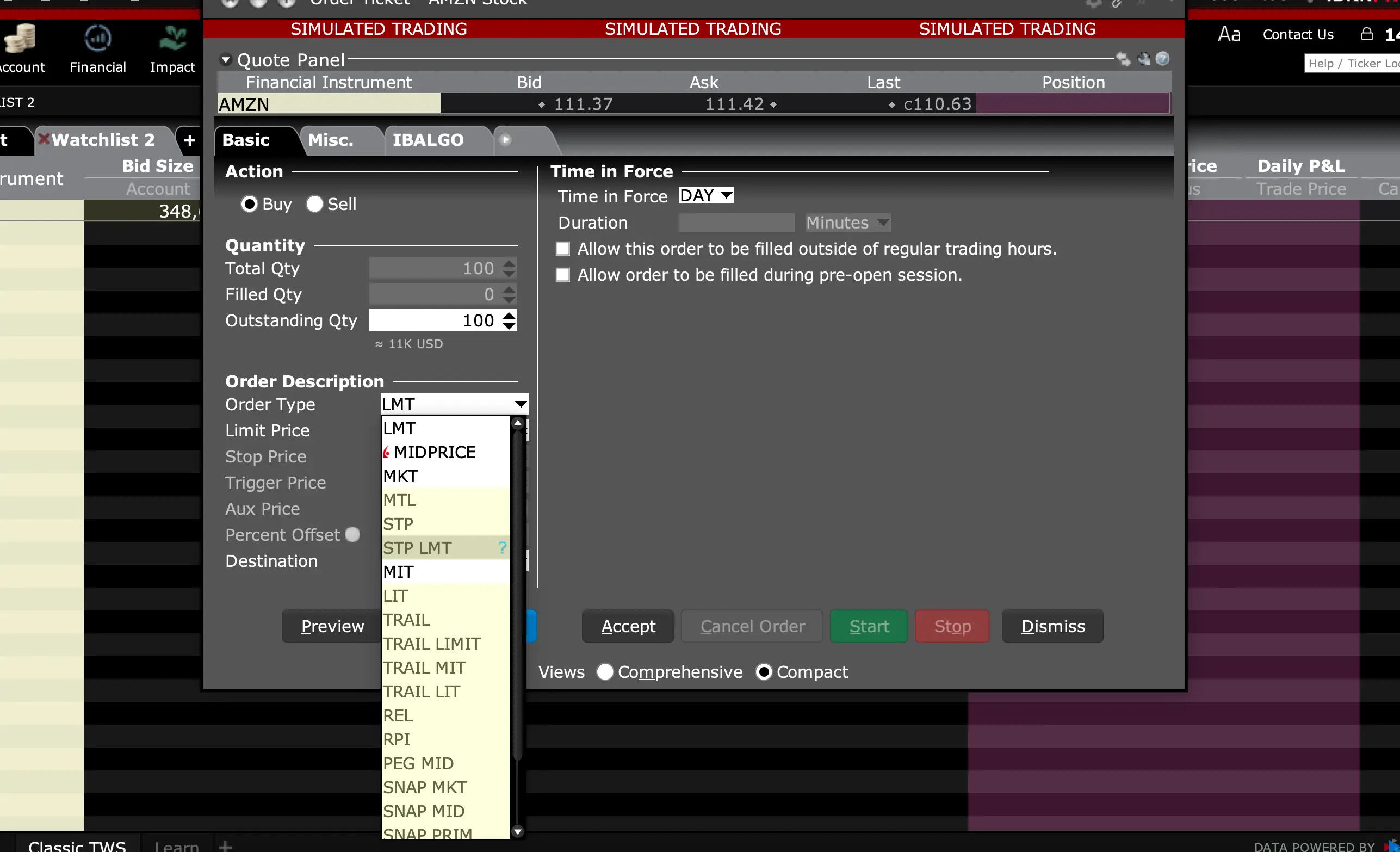

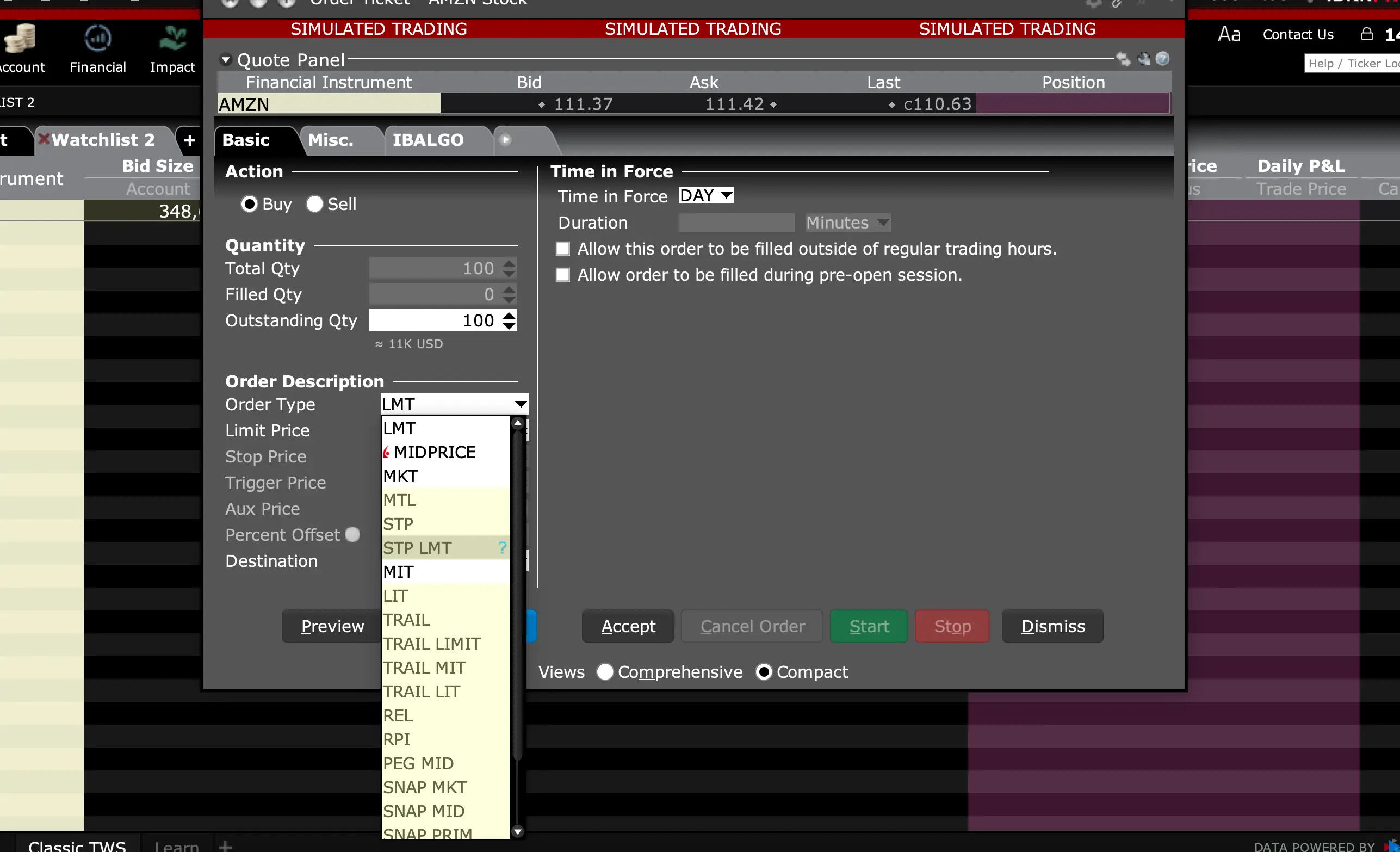

Unfortunately, to optimise your account through TWS, you’ll need to really understand what you want to get out of it – no easy task for beginners. For example, when you place a trade, you'll see an extensive list of conditional orders to choose from (check out the pic).

Source: Interactive Brokers Trader Workstation demo | July 2022

If you don’t understand how the trading terms shown above can be applied, you're probably not ready to use TWS. As Interactive Brokers states on its website, this platform is targeted toward advanced investors. Make sure to check out the trial version of TWS to test whether you’re ready to launch the real deal.

How does IB's Client Portal compare?

While Trader Workstation is mostly suited to algorithmic or day traders, Client Portal is user friendly enough that even relatively new investors should be able to pick it up with a little practice and self learning.

Unlike TW, which requires you to download the platform, you can easily sign into Client Portal from any desktop.

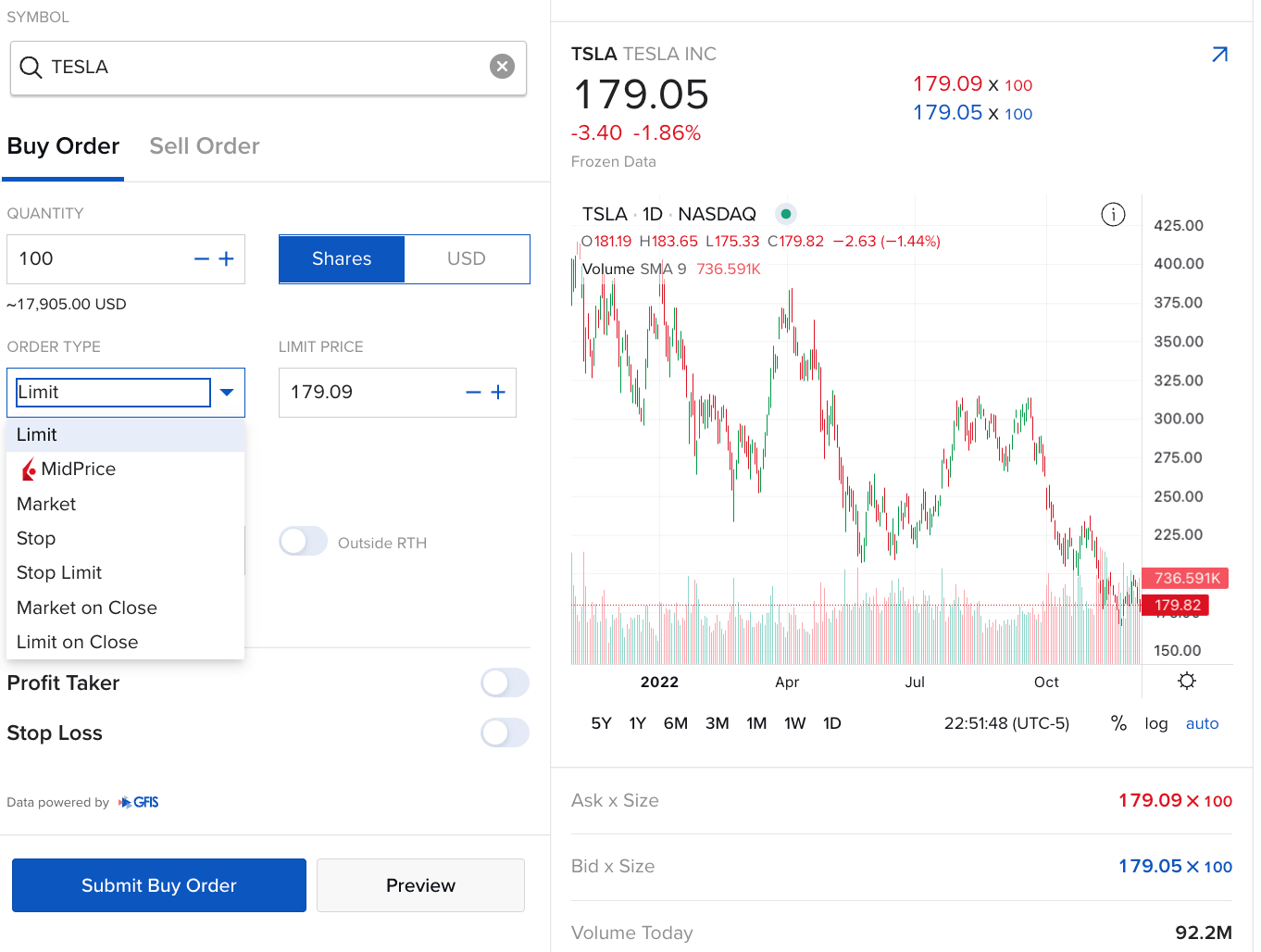

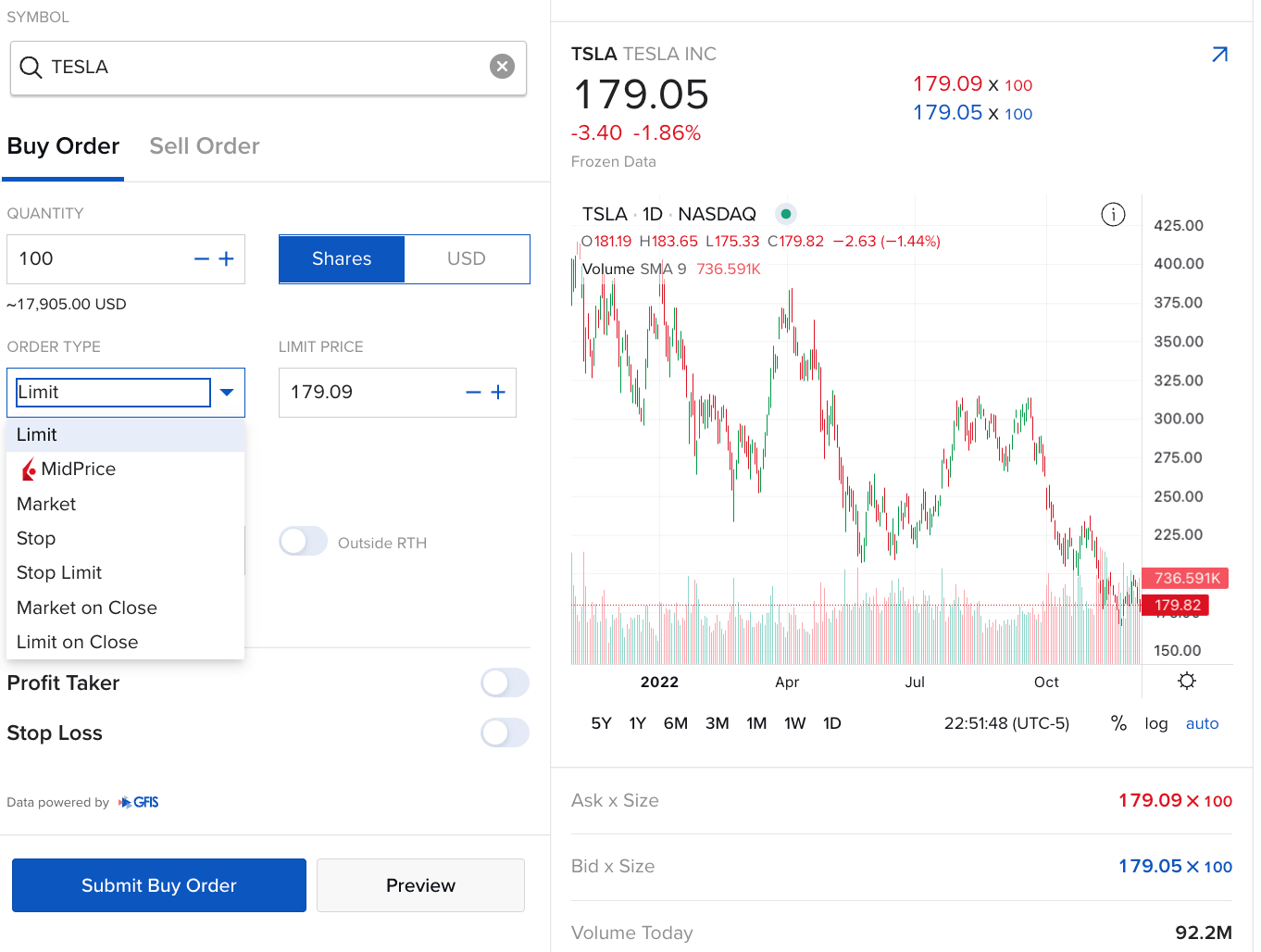

Here's what the stock order window looks like from Client Portal:

Interactive Brokers' Client Portal Image: Supplied

As you can see, you get fewer conditional order types to choose from when buying or selling stocks but the whole process is much easier to navigate.

What are the key features of IB share trading?

If you're thinking of opening an Interactive Brokers account from Australia, here are some of the features you can expect:

| Fees |

★★★★★ 3.9/5

|

|

| Trading tools |

★★★★★ 5/5

|

|

| Research and education |

★★★★★ 5/5

|

|

| Available securities |

★★★★★ 4/5

|

|

| Customer support |

★★★★★ 5/5

|

|

| Available countries |

★★★★★ 5/5

|

|

To learn how our star ratings are calculated, read the

methodology here.

Single account for stocks, forex and CFDs

Unlike other trading platforms where you need multiple accounts to trade different products, IB allows you to access Australian stocks, international stocks, futures, options, fixed income, CFDs and ETFs all from a single account.

Invest in global markets

You can buy and sell stocks and other securities from 34 different countries 24 hours a day, 6 days a week using a single account. Unfortunately, IB does not list its conversion rates on the website.

To find out what rate IB is offering for each currency, you’ll need to manually enter the details into the trading platform.

Fractional investing

Interactive Brokers offers fractional investing on eligible US, European and Canadian stocks and ETFs, with no minimum trade requirement.

Say a certain stock is trading for $500. Instead of having to invest $500 to buy a single share, you could invest say $100 and buy part of one share.

Earn interest on idle cash

Interactive Brokers will pay up to 4.83% interest on cash sitting in your account, but there are some caveats.

First, that rate only applies to US dollars and you must have at least US$100,000 sitting in your account to receive the full rate. For Australian dollars, you can earn up to 3.84% interest on accounts with AUD$15,000-$150,000.

Mobile apps

Interactive Brokers has two mobile apps - the flagship IBKR Mobile and IBKR GlobalTrader - which both offer similar functionality to IB's web and desktop platforms.

Signing up to its mobile apps is relatively straightforward and you can start trading in only a few minutes. It also still allows investors to trade in over 90 stock exchanges across the US, Canada, Europe and Asia.

IBot

IBot is Interactive Broker's AI tool that can help you manage your account, access market data, make trades and answer customer support queries, amongst other functions. It is available on Trader Workstation, Client Portal and IBKR Mobile.

IBKR GlobalAnalyst

Designed for investors who are not sure what to buy, the IBKR GlobalAnalyst scanner will help find undervalued opportunities.

You will simply need to choose a region, country, industry, market capitalisation and currency. The scanner will try to find undervalued stocks that can be bought.

Auto-investing

Interactive Brokers lets you set up an investment strategy that is then carried out by automatic recurring investments.

Overnight trading

You can trade global markets outside of regular market hours, including 10,000 US stocks and ETFs, options, and bonds, as well as European bonds and UK gilts.

Very low brokerage fees

Interactive Brokers offers brokerage fees starting from 0.015% of your trade value for Australian stocks. While that’s incredibly low, that fee only kicks in once you start trading amounts of $300,000,000 or more, which is really only applicable to institutional investors.

That being said, the fees are still pretty low for casual investors, from $5.00 on trades of less than $300,000 per month (for the fixed fee structure - see below).

Wide range of order types

On basic retail trading platforms, investors are usually presented with 1 or 2 order types: limit orders or market orders. Interactive Brokers offers a much wider selection to suit professional traders. Along with limit and market orders, you can choose from the following:

- Stop

- Stop limit

- Limit on close

- Market on close

- Trailing stop

- Trailing stop limit

Confused? Interactive Brokers has a great video explaining what these order types mean and how to use them on the platform.

PortfolioAnalyst

PortfolioAnalyst is an additional tool that lets you view all your trading accounts from a single dashboard. It lets you track the performance of each account and offers tools to help you analyse your portfolio and build an investment strategy.

You can use the Allocation Goals tool to see if your portfolio is on track to meet your investing goals and the Retirement Planner tool to map out your investment strategy for retirement.

Risk Navigator

Interactive Broker's Risk Navigator helps you measure your risk exposure across multiple asset classes and global markets.

IMPACT ESG investing app

Interactive Brokers also offers an ESG trading app called IMPACT which is available on mobile. The app lets you filter stocks and ETFs to match your specific ethical requirements and build up a value-based portfolio. You can also trade stocks and options directly from the app.

What are the fees?

Interactive Brokers markets itself as having among the lowest fees on the market. That may be true, but the fee structure can be a little tricky to get your head around.

Broker or commission fees

IB offers two different pricing structures: Fixed-fee and volume-tiered. Whichever pricing model is more suitable for you depends on your trading frequency, so be sure to keep that in mind.

Trades for global stocks, options, futures, forex, fixed income and more also come with their own fee structures.

For example, when trading US stocks you'll need to pay both a commission and FX fee when converting your AUD to US dollars.

However, Interactive Brokers does not charge additional FX spreads or platform fees and has a low FX conversion fee, making it one of the most cost-effective places to trade US stocks.

Subscriptions to real-time streaming market data is free in some instances, but you may need to pay when exchanges charge Interactive Brokers for the data.

Fixed fee structure

IBKR Pro’s fixed rates (either per share or as a percent of trade value) include exchange and regulatory fees. This straightforward, flat-fee structure works best for regular, occasional traders.

| Monthly trade value (Fixed fee structure) | Online broker fee |

|---|

| Australian stocks | 0.08% or $6 (whichever is higher) |

| US stocks | US$0.005 per share, min $1/max 1% per trade |

Tiered fee structure

If you choose the tiered fee structure, your brokerage fee becomes lower the more you trade per month. As you can see in the table below, this will only affect investors that plan to trade more than $3,000,000 per month.

Additional clearing and exchange fees depend on which exchange the security is listed on. To trade stocks listed on the ASX, the clearing fee is 0.011695% of the trade value plus an exchange fee of 0.00165% of the trade value. Telephone orders are $40 per order.

Australian stocks commission (tiered)

| Monthly trade value (Tiered fee structure) | Online broker fee |

|---|

| First $3,000,000 | $5.00 |

| $3,000,000 – $30,000,000 | $4 or 0.05% of trade value |

| $30,000,000 – $100,000,000 | $3 or 0.03% of trade value |

| $100,000,000 – $300,000,000 | $2 or 0.025% of trade value |

| > $300,000,000 | $1 or 0.015% of trade value |

International share trading fees

Stocks listed in the US, Canada and Mexico charge brokerage fees per stock rather than value. Stocks listed in Europe use trade value to set the fees. Here are some of the fees on international stocks:

| Location | Broker fee |

|---|

| US (<= 300,000 shares per month) | Tiered: $0.0035 per share capped at 1.0% of trade value |

| Fixed: $0.005 capped at 1.0% of trade value |

| UK (up to GBP£50,000 trade value) | Tiered: GBP£1.00 per order or 0.05% of trade value |

| Fixed: GBP£6.00 |

| UK (over GBP£50,000 trade value) | Tiered: GBP£1.00 per order or 0.05% of trade value up to GBP£40,000,000 |

| Fixed: 6.00 + 0.05% (of incremental trade value > GBP£50,000) |

How do you pay?

You can transfer money into your Interactive Brokers account via a bank transfer or using BPAY.

How do I open an Interactive Brokers account?

It’s relatively simple to open an Interactive Brokers account.

Signing up to Client Portal, IBKR Mobile or IMPACT does not require you to prove assets or experience level.

Depending on which platform you sign up to, you’ll need to provide the following information:

- Your name

- Date of birth (you must be 18 years or over)

- Contact details and residential address

- Asset and income details

- Employer name and address

- Proof of identification – passport, driver’s licence or ID card number

- Bank details for funding purposes

- Investment objectives and experience details

Account profiles

There are 5 main account profiles that you could qualify for with Trader Workstation, depending on whether you’re a professional or an amateur trader.

- Investment account. This is the most basic account for individual or company investors. To open an investment account, you’ll need a $2,000 minimum deposit and minimum liquid net worth of $20,000. Your options are limited here for leveraged products. You’ll only have access to some low-leverage derivatives and unleveraged spot forex. You won’t have access to margin lending.

- Trading account. This is similar to the investment account but with fewer restrictions. You’ll also need a higher minimum deposit of $10,000 and a minimum liquid net worth of $20,000 plus an income over $50,000 or a total liquid net worth of $100,000. You still don’t get margin trading using this account, but you can trade spot forex unleveraged.

- Leveraged trading account. This is only available for company or wholesale investors and requires a minimum of $10,000 and a minimum liquid net worth of $100,000. This account allows trading on margin.

- Professional trading. Available for professional traders with a minimum deposit of $100,000 and a liquid net worth of more than $1 million. It offers leveraged sport forex trading, margin trading and a wider range of options-trading strategies.

- Self managed superannuation funds (SMSFs). This is only available to SMSF trustees, and you don’t have access to margin selling, limited options trading or unleveraged forex trading.

This information should not be interpreted as an endorsement of futures, stocks, ETFs, CFDs, options or any specific provider, service or offering. It should not be relied upon as investment advice or construed as providing recommendations of any kind. Futures, stocks, ETFs and options trading involves substantial risk of loss and therefore are not appropriate for all investors. Trading CFDs and forex on leverage comes with a higher risk of losing money rapidly. Past performance is not an indication of future results. Consider your own circumstances, and obtain your own advice, before making any trades. Read the Product Disclosure Statement (PDS) and Target Market Determination (TMD) for the product on the provider's website.

Chris

October 25, 2025

do you work on the chess statement system