Wise (TransferWise) review

- Number of Currencies

- 40+

- Minimum Transfer Amount

- $1

- Pay By

- Bank transfer, Credit card, Debit card, PayID

- Fees (Pay by Bank Transfer)

- From 0.63%

Our verdict

Wise offers a low-cost way to make international money transfers.

Wise is a breath of fresh air in the money transfer space because they're transparent with fees and offer the mid-market rate. Some providers aren't as open when it comes to the cost and make you do extra digging. Wise have accounts for both standard users and business owners with extra features like Xero integration. It's hard to beat Wise for smaller transfers but if you're transferring more than $10,000 in a single transaction, it's worth using a currency broker like TorFX or OFX.

In our customer satisfaction awards for money transfers, Wise ranked second behind World Remit with an overall score of 4.4/5. 90% of the 883 people surveyed said they would recommend.

Pros

-

Good for transparent fees and no margin on the exchange rate.

Cons

-

Not so great if you need to transfer to less-popular currencies.

Details

Product details

| Product Name | Wise |

| Pay By | Bank transfer, Credit card, Debit card, PayID |

| Receiving Options | Bank account, Alipay (China only) |

| Customer Service | Phone, Live chat, Email |

| Maximum Transfer Amount | $1,800,000 |

| Number of Currencies | 40+ |

What do Australians think of Wise international money transfer brand?

- 4.64/5 overall for Customer Satisfaction - higher than the average of 4.35, and this was the highest score in the category

- 4.91/5 for Trust - higher than the average of 4.69, and this was the highest score in the category

- 4.54/5 for Customer Service - higher than the average of 4.31

Based on Wise international money transfer brand scores in Finder's 2024 & 2025 Customer Satisfaction Awards.

What we like about Wise

- Easy to use. We were able to sign up for an account and initiate a transfer in less than three minutes.

- Access to the mid-market rate. Wise offers the mid-market rate on all transfers sent through its network. All you have to think about are fees when comparing transfers. In comparison, Australian banks typically add a 3-5% markup.

- High daily sending limits. A cap of $1 million per transfer is in place, but some sending methods and locations may lower that limit.

- Multiple payment options. Pay with a debit card, credit card, bank account. When using the Wise mobile app, you can pay with Google Pay and Apple Pay.

What to be aware of

- Bank account transfers only. Funds must be sent to the recipient's bank account; there is no option for cash pickup.

- Requires ID verification. You'll need to provide your photo ID, proof of address, and/or a picture of you holding your ID before sending your first transfer.

- Expensive for large transfers. If you're sending over 10,000 AUD, providers such as TorFX and OFX could be cheaper. Australian residents are charged an annual holding fee of around 0.4% on amounts over £13,000, €15,000, $18,000 USD and $23,000 AUD.

- Limited customer support. Customer service isn't their strong point and they make it difficult to contact them via phone or live chat.

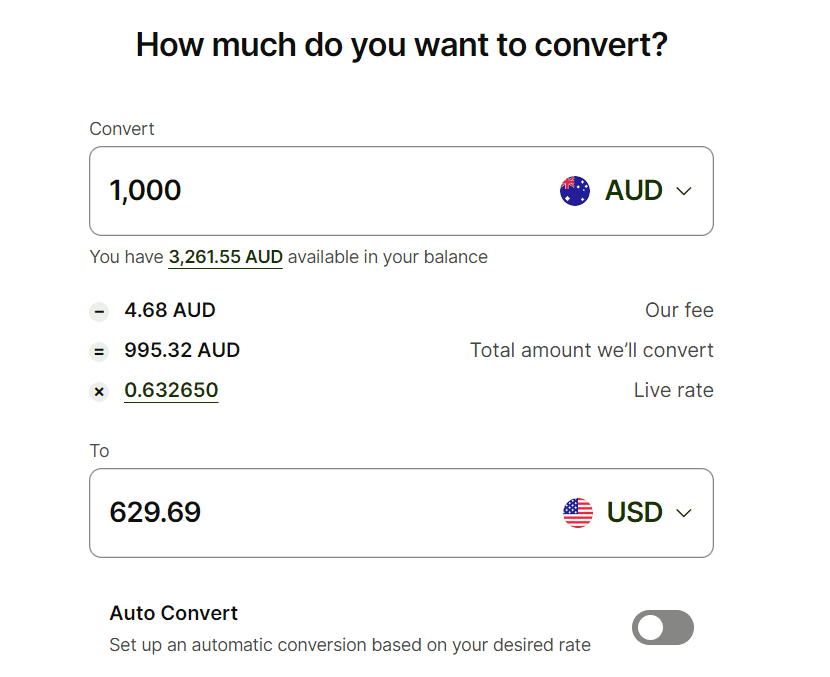

How much are Wise's transfer fees?

I like how Wise is transparent with transfer fees and you will see the cost upfront. It charges a fixed fee and a variable fee which is a percentage of the amount being converted. For example, if you're sending $1,000 AUD to the UK, Wise charges a fixed fee of $0.54 AUD and a variable fee of 0.48%. Wise also charges a flat fee of $0.57 AUD to withdraw money to your bank account.

Fees are also determined by the following:

- Amount. The more money you send, the more fees you pay due to their fee structure. Each currency has its own percentage fee - USD (0.48%), GBP (0.48%), INR (0.59%) and Euro (0.47%).

- Payment method. You can pay by PayID, bank transfer, debit card or credit card - each uses its own fee based on the amount you are sending, but the percentage will typically be the same no matter how much you send.

When we checked on April 17, 2023, Wise's fees for sending $1,000 to India were as follows:

| Payment fee | Wise fee | Total fees | |

|---|---|---|---|

| Bank transfer | $0 | $7.30 | $7.30 |

| PayID | $0 | $7.30 | $7.30 |

| Debit card | $3.59 | $7.28 | $10.87 |

| Credit card | $9.80 | $7.24 | $17.04 |

How are Wise's exchange rates?

Wise is unusual as it uses the mid-market rate for transfers and allows you to lock in a desired rate to get an improved exchange rate. Most money transfer providers add a markup to their exchange rate to make a profit. When we checked Wise's rates against the mid-market rate on Google, they were identical.

Compare other products

We currently don't have that product, but here are others to consider:

How we picked theseFinder Score for money transfer

We review money transfer providers for different features to assign them a score out of 10. The higher the score, the more competitive the product.

Wise reviews and complaints

Wise is rated as "great" on Trustpilot and has a score of 4.2 out of 5, based on 195,625 reviews. Positive reviews highlight their ease of use, exchange rates and transfer speed. Negative reviews mention their compliance policies, Wise have to follow strict anti-money laundering regulations and require users to submit supporting documents for verification.

Some customers have had issues with Wise closing their accounts when making large payments. Wise has responded to 46% of negative reviews on Trustpilot which is lower than competitors. 83% of customers rated them 5 stars and 10% gave them a score of 3 stars or lower.

What are the ways I can send money abroad with Wise?

Wise only supports bank account transfers, but the transaction is easy to complete online.

How to transfer money online with Wise

Follow these six steps to have money sent in as little as a few minutes:

Case study: Katia's experience

I began using Wise when I moved to the US from Australia a few years ago. I tested a few money transfer services and Wise was - and still is - my favourite for a couple of reasons:

- It's transparent. As soon as you enter the amount of money you want to send, you'll see the real, mid-market exchange rate as well as Wise's fees. The rate changes so much that if I get distracted and come back to the site a few minutes later, it may have already changed. That's how I know it's current.

- The fee is small. Especially compared to the traditional banks - as someone who regularly transfers money between two continents, I appreciate this. The funds usually appear in my account in 24 hours, but it can take longer if I hit send just before the weekend.

What are Wise's payment options?

Customers using Wise in Australia can pay using the following methods:

- Debit or credit card

- PayID

- Bank transfer

- Apple Pay and Google Pay (mobile app only)

The funds are deposited directly into your recipient's bank account once Wise receives your payment. Wise allows you to make secure one-off transfers, but currently has no option to set up recurring transfers.

How long does an international transfer with Wise take?

Wise's money transfer speeds are dependent on how much you are willing to pay in fees and when you send your transfer. With a credit or debit card, you'll pay more in fees, but your money arrives instantly in your recipient's bank account. However, keep in mind that your credit card might charge an additional cash advance fee, increasing the cost of the total transfer.

Making a bank transfer is typically the cheapest way to send money through Wise, but it's the slowest. Based on my experience, it should take less than 24 hours for Wise to receive your money. Then it is an additional 1 to 2 days to transfer the funds to your recipient's bank account.

Transfers typically take![]()

1 day

Is Wise safe to transfer money?

Founded in 2011, Wise has 16 million customers globally and is a trusted brand in the money transfer space. Wise Australia Pty Ltd has an Australian Financial Services licence (number 513764) and is regulated by the ASIC. They use the following global standards to protect your money:

- Follows regulatory guidelines. In every country where Wise operates, it is registered with the appropriate regulatory agency and follows the strict rules that are set out.

- Bank-level data security. Although Wise isn't a bank, encryption and data storage are handled in a similar way as a bank. A security team monitors transactions for suspicious activity and accounts for fraudulent logins.

- Two-factor authentication. Protect your account with 2FA and with optional biometric locks on the Wise mobile app.

Does Wise have a mobile app?

Wise has a mobile app on both the Google Play and Apple App stores. The app makes it possible to do the following:

- Quickly repeat a transfer. See a complete list of past money transfers and send to past recipients in a few taps.

- Log in with biometrics. On phones that support face scanning and thumbprint reading, use these features to lock your Wise account.

- Get rate updates. Waiting for the perfect exchange rate? Set up rate tracking to get updates when the price is in your favor.

- Increase your payment methods. Pay for your Wise transfer with Apple Pay and Google Pay while using the mobile app.

| Ratings accurate as of October 5, 2023 | |

|---|---|

| Google Play Store | 4.7 out of 5 - based on 593,000 customer ratings |

| Apple App Store | 4.6 out of 5 - based on 15,389 customer ratings |

Compare Wise to other transfer services

Compare other products

We currently don't have that product, but here are others to consider:

How we picked theseFinder Score for money transfer

We review money transfer providers for different features to assign them a score out of 10. The higher the score, the more competitive the product.

Want to compare Wise with other services side-by-side?

- Wise vs. PayPal

- Western Union vs. Wise

- WorldFirst vs. Wise

Frequently asked questions

Sources

Your reviews

Zak Finder

Publisher

You are about to post a question on finder.com.au:

- Do not enter personal information (eg. surname, phone number, bank details) as your question will be made public

- finder.com.au is a financial comparison and information service, not a bank or product provider

- We cannot provide you with personal advice or recommendations

- Your answer might already be waiting – check previous questions below to see if yours has already been asked

Finder only provides general advice and factual information, so consider your own circumstances, or seek advice before you decide to act on our content. By submitting a question, you're accepting our Terms Of Service and Finder Group Privacy & Cookies Policy.

This site is protected by reCAPTCHA and the Privacy Policy and Terms of Service apply.

Nikki Angco

March 05, 2020

Hi Werner,

Thanks for contacting Finder. I hope you are doing well.

To answer your question about sending euros using a German bank to an AU bank, yes, you may send EUR using Transferwise as EUR is one of its acceptable currencies. You can transfer money via Online, Bank Account to Bank Account.

Just a quick reminder when sending money – read through the transfer process of the provider such as transfer fees, transfer options and transfer speed to set expectations for the receiver. Take note of any reference or tracking numbers should any transaction delays come up during the transit. Also, it’s important to check the exchange rate beforehand to maximise the funds to be exchanged.

Kindly note that exchange rates vary on a daily basis, the rate today may differ from the rate tomorrow. Observe the fluctuations of exchange rates more frequently days before you exchange your money.

I hope this helps and feel free to reach out to us again for further assistance.

Best,

Nikki

Show more Show less

tammy

July 15, 2019

If an expat sends money from a Vietnam to Australia do i need to know the bank swift code. I am trying to work out how this works. So i would from a Vietnamese bank account transfer money in to a Transferwise account and then on send that money to an australian account.

Nikki Angco

July 16, 2019

Hi Tammy,

Thanks for getting in touch!

A bank’s swift code is needed when a sender transfers money to the receiver’s bank account. Wise offers a multi-currency account where you can hold over 25 currencies. You’ll also get local bank account details if you want to send or receive money in EUR, AUD, USD, and GBP.

When you are sending money to an Australian bank account, you would need a bank swift code to send the funds to Australia.

Hope this helps! For any further questions, feel free to reach out to us again, we’re here to help.

Best,

Nikki

Show more Show less

September 05, 2018

Can you send money to Ghana?

Jhezelyn Finder

September 05, 2018

Hello,

Thank you for your comment.

Yes, TransferWise can let you send money to Ghana. To start, just click the Go to Site button above to be redirected to their website and start the sending process.

Should you wish to have real-time answers to your questions, try our chat box on the lower right corner of our page.

Regards,

Jhezelyn

Show more Show less

Raf

February 12, 2018

Hi, I want to send 1000 AUD to my friend who lives in Thailand into her bank account. Do I have to know the SWIFT code of the recipient bank? Or just straightforward the way we transfer money in Australia in between two bank account? Thank you

Rench Finder

March 04, 2018

Hi Raf,

Thank you for your inquiry.

With TransferWise, there’s no need for SWIFT code to transfer money to Thailand. You can transfer money to the recipient’s bank directly. You will only need to use SWIFT code if you will send JPY or ZAR using TransferWise.

Alternatively, you can also check other money transfer service options that you can compare to send money to Thailand. Use our comparison to help narrow down your options. Make sure to enter the amount you’d like to send and press “Calculate”. When you are ready, press the “Go to Site” button to be redirected to the provider’s website where you can proceed with your transfer.

Best regards,

Rench

Show more Show less

Margaret

December 12, 2017

Hi I would like to send AUD to USA. The account I will be transferring to has an Account Number and a CHASUS** number. Is this ok.?

Rench Finder

December 13, 2017

HI Margaret,

Thanks for your inquiry. Please note that we are not affiliated with TransferWise or any company we feature on our site and so we can only offer you general advice.

If you are referring to TransferWise, all you have to do is enter the amount you want to send, a destination and whether you want a debit card or bank transfer (Poli pay is also available). Then you can fill in your details and upload your money. You can also send money to an email address.

Once that’s done, TransferWise converts the funds to your currency of choice using the mid-market exchange rate. The money is then paid to the recipient in your nominated currency, with the whole process taking just one to four working days.

Please click on the green ‘Go to Site’ button on this page to direct you to TransferWise official site.

Cheers,

Rench

Show more Show less

Werner

March 04, 2020

Can I send Euros from a German bank to an Australian bank?