- Superhero is a new Australian ASX share trading app that launched September.

- It offers a flat $5 commission for all Australian shares and ETFs.

- You can invest in ASX stocks and ETFs starting at $100 (not $500).

- There's no inactivity or monthly fee for the basic account.

With dozens of brokers competing for space in Australia’s market, it’s not easy to find a new angle. However, Australia’s newest ASX share trading platform has a few features that do just that.

Superhero officially launched in September 2020 with a flat $5 brokerage fee on all Australian shares and minimum investments starting from just $100.

The flat fee structure makes it the cheapest ASX share trading platform on the market* and half the price of the lowest rate offered by Australia’s most popular broker, CommSec.

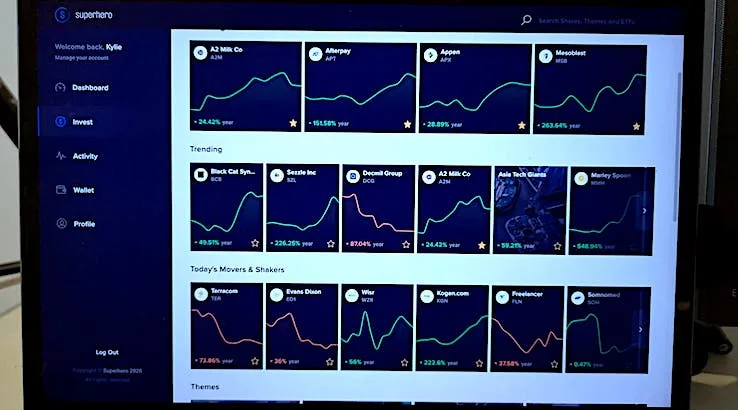

However at first glance, it's the clean design elements of the platform that help it stand out from other ASX trading apps in Australia.

Superhero co-founder John Winters has worked in Australia’s private wealth sector for over a decade at firms including Shaw and Partners and Macquarie Bank. He said one issue that always stood out to him was how disconnected the investment sector was from new technologies.

“I really struggled with how archaic the industry is,” Winters told Finder ahead of the launch. “It’s built for the boomers, and they’re in their retirement phase.”

“Even today there’s this process of setting up an account where you fill in an eight page form and then get a certified copy of your ID and post it into the office. There’s got to be a better way to bring people into the market.”

Winters and co-founder Wayne Baskin have been working quietly on Superhero for the past two years. While the app has been active for some weeks during its trial period, the official launch is Monday.

“We’ve kept it really quiet, on purpose,” said Winters. Ahead of the launch, they’ve raised $8 million, with key investors including Zip co-founder Larry Diamond and Zip chairperson Philip Crutchfield sitting on the board.

What are Superhero's highlights?

With a $5 flat commission and no monthly or inactivity fee for the basic account, Superhero is among the most competitive on costs for ASX share trading in Australia.

Arguably the key feature that sets it apart from the others is the $100 minimum investment for Australian shares. Due to ASX requirements, you normally need to invest at least $500 for every Australian-listed company – a rule that doesn't apply to US stock trading apps.

Superhero will be just the second platform to break this mould, after CommSec Pocket offered $50 minimum investments for a small selection of Australian exchange-traded funds (ETFs) last year. Currently, Superhero is the only platform on the market that does so for ASX stocks.

The design elements of the platform also set it apart from other share trading apps. The stylistic and minimalist interface is more comparable to the likes of US trading apps that appeal to "next-gen" traders, such as Robinhood, eToro or Stake.

What’s the catch?

While Superhero's standard account is about as cheap as you can get for Australian-listed stocks, it doesn’t offer live pricing (20-minute delay) and it has minimal trading features compared to other share trading platforms.

For example, the basic account only offers a market order – there are no limit order options – there’s no dividend or performance reporting and you can only follow up to five companies in your stock list.

Basic account – Free

- Brokerage – $5 flat fee

- Order options – Market order

- Follow – Follow your five favourite investments

- Reporting – Basic reporting: transactions and holdings

- Basic market data – Delayed pricing and charts

Live account – $9 per month

- Brokerage fee – $5 flat fee

- Order options – Market and limit

- Watchlists – Follow all of your favourite investments

- Live market data – Real-time pricing, charts and market depth

- Reporting – Comprehensive tax and performance reporting

To access more features, including a limit order option, live pricing and unlimited stock watchlists, you need to pay a $9 subscription fee for the “Live Account”.

Importantly, while Superhero's proprietary system allows them to reduce the minimum investment needed for ASX stocks, its model is unique from other traditional SRN/HIN models that most investors are used to.

According to Winters, shares are held on a single special-purpose HIN on ASX’s CHESS system. They're able to consolidate settlements at the end of the trading day to reduce costs.

Essentially, Superhero uses a custodian model, rather than a CHESS-sponsored model. This is actually fairly common among brokers including Vanguard Personal Investor and IG, as well as by micro-investment apps such Raiz and Spaceship. This means shares bought on Superhero will not be registered on own unique HIN on CHESS, instead they're "beneficially" held in your name.

How does it compare on cost?

Superhero is very competitive on costs, even when adding in the additional $9/month subscription fee for the live account.

Only two other online brokerages, OpenTrader and IG, offer brokerage starting as low as $5 on Australian shares. However, they have tiered systems where higher trade amounts incur higher costs.

For example, IG offers $5 or 0.05% (whichever is higher) commission but only if you make 3 or more trades in the previous month, after that you pay $8 or 0.1%. Meanwhile, OpenTrader offers $5 for trades up to $2,500, after that you pay $2,501. Plus, there's a $99 per month fee for the live pricing account.

By that same token, Superhero is a minimal app compared to many others. While you pay more for Australian shares on IG, it also offers $0 brokerage on global share trading along with live data and advanced trading features.

CommSec charges at least double that of Superhero on brokerage for Australian shares, but it has live pricing (depending on how often you trade) along with nine order options and additional features such as broker ratings and market analysis.

Meanwhile, SelfWealth, the only other trading app with a flat fee structure, charges almost double the brokerage ($9.50), but also offers live pricing, stock analysis and several unique social features, such as portfolio comparisons.

My final verdict

Superhero is easy to pick up and enjoyable to use. The most exciting feature for me is its lower minimum investment of $100 rather than $500. Paired with a flat $5 brokerage and user-friendly layout, and it's an attractive entrant to the market for new or younger investors.

Its biggest limitation is the lack of trading features, such as conditional orders, broker ratings and stock analysis. That being said, for anyone that is after a straightforward platform to get the job done without all the fuss, it's certainly an appealing option.

Disclaimer: This information should not be interpreted as an endorsement of futures, stocks, ETFs, options or any specific provider, service or offering. It should not be relied upon as advice or construed as providing recommendations of any kind. Futures, stocks, ETFs and options trading involves substantial risk of loss and therefore is not appropriate for all investors. Past performance is not an indication of future results. Consider your own circumstances, and obtain your own advice, before making any trades.

More headlines

-

All the big savings account interest rate rises: ING, AMP, Westpac + more

6 Feb 2026 |

-

Australian credit card debt soars 10% in a year: How can you escape the trap?

6 Feb 2026 |

-

4 cashback home loan offers to ease the pain of RBA rate hike

4 Feb 2026 |

-

Finder’s RBA Survey: Easing cycle ends as RBA delivers first rate hike since 2023

4 Feb 2026 |

-

Ubank Save is increasing its bonus rate up to 5.35% p.a.

3 Feb 2026 |

*Based on Finder's analysis of 23 online brokers. To find out more about how we rank our brokers head to our guide.

Ask a question

More guides on Finder

-

Ubank Save is increasing its bonus rate up to 5.35% p.a.

Ubank is about to lift its savings rates even higher - here's how to get the new market-leading bonus rates on offer.

-

Top savings account rates after the RBA’s cash rate increase

The RBA increasing the cash rate is good news for savers as we can expect to see banks begin to lift their savings account rates.

-

RBA cash rate increases, but here’s the good news

The RBA has had its first meeting of 2026, deciding to increase the cash rate for the first time since 2023.

-

Finder reveals Australia’s best home loans for 2026

To help Australians find the best mortgages in the country, Finder has announced the winners of its Home Loans Awards 2026.

-

Home insurance pricier thanks to climate change: where to find cheaper cover

A new survey commissioned by the Climate Council has found that more than half (54%) of Aussies think home insurance will become unaffordable in the area they live due to extreme weather.

-

Finder’s RBA Survey: Rising inflation means RBA rate hike likely

A sudden jump in inflation means the RBA is likely to hike interest rates on Tuesday, as mortgage holders nationwide brace for the decision.

-

5 must-haves when you join a crypto membership program

SPONSORED: Thinking about joining a crypto membership program? We take a closer look at the Level Up program from Crypto.com.

-

7 features to look for on the Crypto.com App in 2026

SPONSORED: With 2026 kicking off, we take a look at some of the key features offered by Crypto.com's trading app.

-

Could inflation numbers signal an RBA rate rise next week?

The RBA is due to meet next week to make its first cash rate decision of 2026. The latest inflation data suggests a rate hike might be on the cards.

-

Looking for an Optus coupon code? Get up to $350 back

Don't miss out on these cashback offers!