Finder’s RBA Survey: Rising inflation means RBA rate hike likely

A sudden jump in inflation means the RBA is likely to hike interest rates on Tuesday, as mortgage holders nationwide brace for the decision.

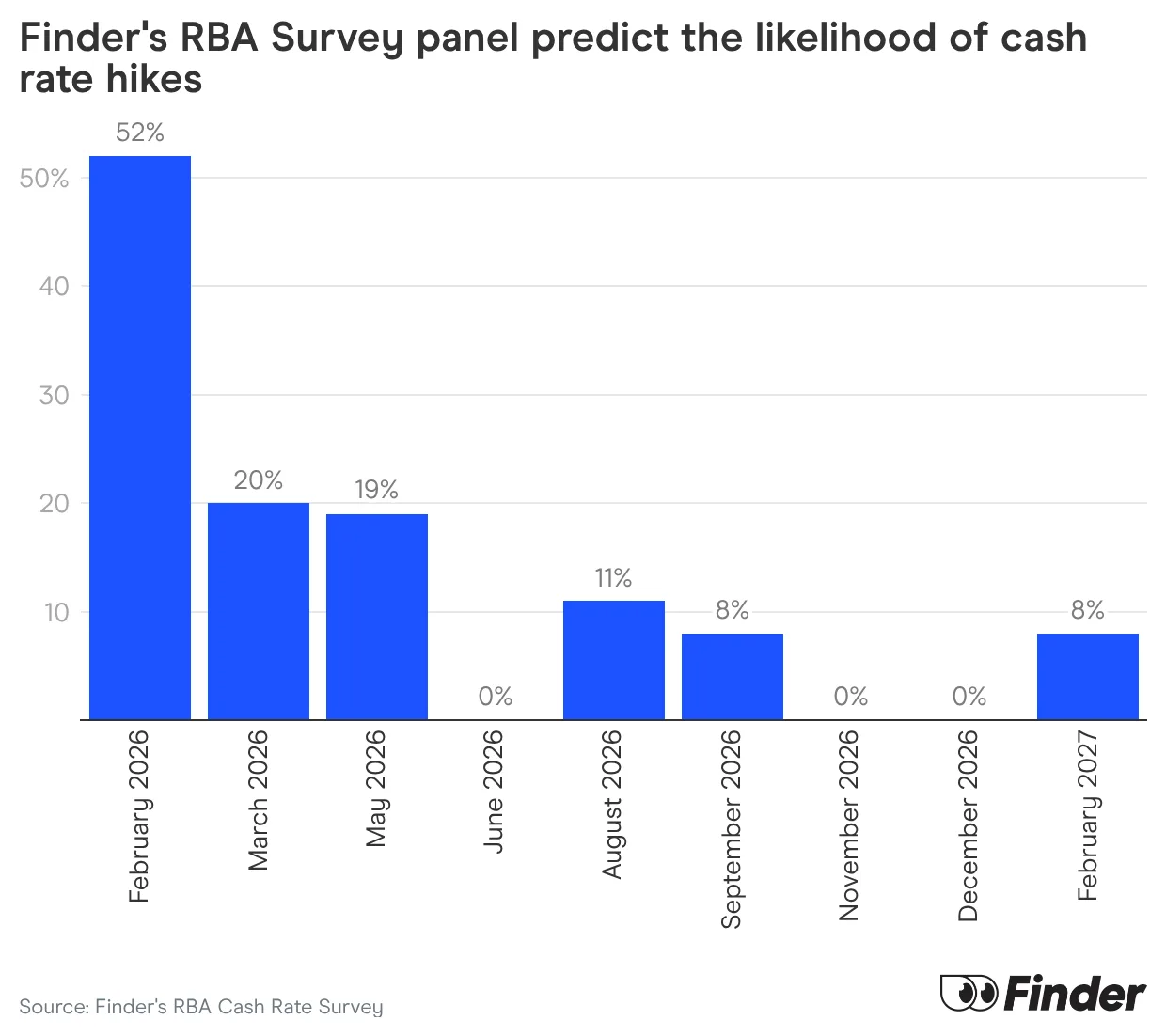

In this month's Finder RBA Cash Rate Survey™, 33 experts and economists weighed in on future cash rate moves and other issues relating to the state of the economy.

The majority of panellists (51%, 17/33) expect the RBA to raise the cash rate on Tuesday by 25 basis points, bringing it to 3.85%.

This comes after just 9% of economists predicted a rate hike for February when Finder last asked in December.

Graham Cooke, head of consumer research at Finder, said the forecast has taken a sharp turn.

"With rising inflation proving more stubborn than the RBA anticipated, most economists and the big four banks now expect a rate hike on Tuesday.

"This news will feel like a cold shower for homeowners after a brief reprieve.

"Many who refinanced or entered the market during the 2025 easing cycle may feel blindsided, as the pivot from falling to rising rates in just 6 months has created significant whiplash."

Scott Kuru from Freedom Property Investors believes the latest rise in inflation has turned a previously uncertain February 2026 RBA rate hike into an absolute certainty.

"I thought the case for the RBA to raise rates in February was more "line-ball" than some of the dodgy tennis shots at the Australian Open.

"Unfortunately, with inflation increasing again, I think it's a case of "Lock it in, Eddie" for an RBA rate rise in February 2026," Kuru said.

Tim Reardon from Housing Industry Association argues rate hikes are counterproductive because they worsen the housing shortage – the very thing driving inflation.

"There is an irony at play at the moment, that the main driver of inflation is a shortage of housing and higher interest rates will make this shortage worse.

"The housing shortage is now a macro economic challenge and it can not be fixed with higher rates," Reardon said.

More than 4 in 5 experts who weighed in* (82%, 23/28) believe a rate cut in the next 12 months is unlikely.

This includes 14% (4/28) who say there is no chance of a cut.

RBA pivot will cost homeowners an extra $1,300 a year

Homeowners on the average home loan of $693,802 will see an annual increase of $1,313 to their mortgage repayments if the RBA raises the cash rate by 25 basis points on Tuesday.

On a $1 million mortgage, the same hike would cost a homeowner nearly $1,893 a year more in interest – a rise of $158.

Cooke said now is the time to look hard at your interest rate with the easing cycle unlikely to restart again soon.

"We've seen some lenders slowly raise fixed rates over the past few months in anticipation of the winds changing.

"If your rate isn't one of the best, now might be a good time to give yourself a rate cut. Many banks will also throw in some cash for your trouble."

Mortgage repayments on average home loan of $693,802

| Cash rate | Average home loan rate* | Average monthly repayment | Average monthly increase | Average annual increase | |

| November 2025 | 3.60% | 5% | $3,935 | ---- | ---- |

| February 2026 (full rate rise applied) | 3.85% | 6% | $4,044 | $109 | $1,313 |

| Source: Finder, RBA. *Owner-occupier variable discounted rate. Repayments based on the average loan of $693,802 (ABS data analysed by Finder). |

Mortgage repayments on home loan of $750,000

| Cash rate | Average home loan rate* | Average monthly repayment | Average monthly increase | Average annual increase | |

| November 2025 | 3.60% | 5% | $4,254 | ---- | ---- |

| February 2026 (full rate rise applied) | 3.85% | 6% | $4,372 | $118 | $1,420 |

| Source: Finder, RBA. *Owner-occupier variable discounted rate. Repayments based on the average loan of $693,802 (ABS data analysed by Finder). |

Mortgage repayments on home loan of $1,000,000

| Cash rate | Average home loan rate* | Average monthly repayment | Average monthly increase | Average annual increase | |

| November 2025 | 3.60% | 5% | $5,672 | ---- | ---- |

| February 2026 (full rate rise applied) | 3.85% | 6% | $5,829 | $158 | $1,893 |

| Source: Finder, RBA. *Owner-occupier variable discounted rate. Repayments based on the average loan of $693,802 (ABS data analysed by Finder). |

The 4 critical pillars that will dictate the RBA's trajectory for 2026

Economists were asked which inflationary drivers will be the 'make or break' factors for the Australian economy this year.

They identified 4 primary factors – persistent services costs, the housing and rental crisis, stagnant productivity versus wage growth, and high government spending – as the key issues that will influence the RBA's decision making.

Economists say if these local pressures do not ease, all 3 of the 2025 rate cuts may be reversed in short order.

Tim Reardon, principal economist with the Housing Industry Association said housing costs will remain central and the RBA will be cautious to make this macro economic challenge worse.

James Morley, professor of Macroeconomics at the University of Sydney, said inflation expectations remain anchored and it would likely take bad news to see rate cuts.

"If these [measures] were to tick up, then the RBA would likely shift to being more hawkish.

"I think the passthrough of a higher dollar to lower import costs and the working off of the effects of energy rebates playing out as expected would allow the RBA to keep rates only a bit higher than currently.

"So only fairly negative news on the real side of the economy would likely push the RBA back into a cutting mode in 2026," Morley said.

Peter Boehm with Pathfinder Consulting said the recent inflation figures indicate a number of drivers which will impact the remainder of 2026, noting a top 10 list that are affecting RBA decisions:

- Inflation is not under control.

- Last year's three rate reductions may have been one too many.

- Excessive Federal Government spending is fuelling inflation and has been for some time.

- Inevitable demands for pay increases will, unless productivity gains are delivered, add to inflationary pressures.

- Current economic policy will push out any potential interest rate reductions.

- Excessive immigration levels are pushing up demand thereby adding to price increase pressures.

- Home ownership will become more difficult as the cost of finance will increase.

- High unemployment levels do not support a rate reduction.

- A high taxing, high spending Federal Government is not helping the economy.

- The future interest rate outlook is uncertain but leaning towards future rate rises.

Please reach out for the full list of comments.

*Experts are not required to answer every question in the survey.

Here's what our experts had to say about the cash rate:

Sveta Angelopoulos, RMIT University, School of Economics, Finance and Marketing (Increase): "The main problem is that although headline inflation has gone up, the trimmed mean has also ticked up. Even though the increase in the trimmed mean inflation is very small, it is still above the RBA's 2-3 percent band. This suggests that core inflation may not be 'under control' and action early to prevent a series of hikes later in the year."

Anthony Waldron, Mortgage Choice (Increase): "The latest data from the ABS suggests that borrowers should brace for a rate hike at the RBA's first meeting of 2026. Labour Force data showed the labour market remains tight, with the unemployment rate falling to 4.1% in December 2025. And the December quarter Consumer Price Index revealed that inflation moved further away from the RBA's target range of 2-3%, rising 3.8% annually."

Nicholas Gruen, Lateral Economics (Increase): "It's a wild guess. I think Trump's excesses may finally spook the markets. It's already done a lot of harm to the real economy with US investment stalling except in data centres."

Craig Emerson, Emerson Economics (Increase): "The trimmed mean rate exceeds the 2-2 per cent band and has done so for several months."

David Robertson, Bendigo Bank (Increase): "The latest inflation numbers together with the recent strong jobs data leaves the RBA in a very challenging position as core inflation has risen to 3 1/3 %; so while I expect a close call the chances of a February hike are now above 50%."

Geoffrey Kingston, Macquarie University Business School (Increase): "The Bank will probably hike in February because, taken in conjunction with the latest labour market data, the latest CPI data were like the sound of the second shoe dropping. Government overspending, revealed by the latest MYEFO, suggests a hike in February is unlikely to be the last this year."

Mathew Tiller, LJ Hooker Group (Increase): "Inflation has lifted again, CPI is 3.8% over the year to December, trimmed mean is 3.3%, and unemployment is still just 4.1%, so the RBA may feel it needs to stay on the front foot. For the housing market, a hike should cool momentum rather than turn it. Demand remains supported by jobs, population growth, and active investors, while listings remain tight, so we may see decision time slow and price growth moderate, not a broad pull back."

Stella Huangfu, University of Sydney (Increase): "First, underlying inflation remains too high. While headline CPI was 3.8% in December, the trimmed mean was 3.3%, which is still above the RBA's 2–3% target band. That tells the RBA inflation pressures are broad-based, not just driven by volatile items. Second, the labour market remains tight. The unemployment rate fell to 4.1% in December, which is close to full employment. This suggests the economy still has underlying momentum."

Scott Kuru, Freedom Property Investors (Increase): "Until I saw the latest quarterly inflation numbers, I thought the case for the RBA to raise rates in February was more "line-ball" than some of the dodgy tennis shots at the Australian Open. Unfortunately, with inflation increasing again, I think it's a case of "Lock it in, Eddie" for an RBA rate rise in February 2026."

Leanne Pilkington, Laing+Simmons (Increase): "Jobs growth and housing-driven inflation point to a rise which, for many households, will be unwelcome news. Most people will have expected the next rate movement to be up, but they may not have expected it to be so soon."

Trent Wiltshire, RLB (Increase): "With trimmed-mean inflation overshooting the RBA's November forecasts, the labour market remaining strong (an unemployment rate of 4.1% per cent), and productivity growth sluggish, the RBA will need to raise rates in 2026. A February rate hike of 25 basis points is now likely, with a follow-up hike at the May meeting if data shows that inflation remains elevated."

Mala Raghavan, University of Tasmania (Increase): "There is a strong likelihood of an increase in the cash rate as inflation continues to rise without any signs of easing. The latest labour force statistics from the ABS indicate that the job market is tight, with the unemployment rate stable at 4.2%, underemployment at 5.9%, and participation at 66.8%. Until we observe consistent moderation in price pressures, the RBA is likely to maintain a hawkish stance."

Peter Boehm, Pathfinder Consulting (Increase): "Without knowing next month's inflation figures it's difficult to predict the next move. But if inflation stays where it is or ticks up, there is a real possibility rates may rise again in March."

Mark Crosby, Monash University (Increase): "Latest CPI increase brings forward 1 or 2 rate rises pre budget. Further increases will depend on whether we see any fiscal discipline in the budget."

James Morley, University of Sydney (Increase): "With even trimmed mean inflation ticking up to 3.3% in 2025 Q4 and the unemployment rate at 4.1% in December, the RBA will see its current stance of policy as not being restrictive enough. The neutral rate will be viewed to be slightly higher than previously thought. As a result, the RBA will show a clear response to inflation coming in higher than expectations to help bring the forecast back into the target range over the next year or so. The stronger dollar will help with inflation, as will the effects of energy rebates ending eventually working their way out of headline inflation (higher electricity prices as a result of rebates ending was a major reason headline inflation ended up so high at 3.7% in 2025 Q4). I suspect this high inflation will mean the RBA will also move in March, but will then wait and see if a somewhat more restrictive stance (and stronger dollar) has desired effects. By signalling that rates may go up further, the announcement will be seen as somewhat hawkish, although it will be interesting to see if the current market path of expectations for interest rates will be sufficient to bring forecasted inflation back to the target range in a timely enough manner."

Nicholas Frappell, ABC Refinery (Increase): "inflationary pressure, a decent labour market are likely to force a rate hike in Feb, and then a pause before another, most likely in May."

Michael Yardney, Metropole Property Strategists (Increase): "December quarter inflation confirmed that underlying inflation was stronger than the RBA was forecasting back in November when it last met. The RBA will need to humbly admit its third rate cut was a little premature and raise the cash rate by 0.25%. Interestingly, many lenders have already raised their rates in anticipation of this move."

Dr Andrew Wilson, My Housing Market (Hold): "Although clear upward pressure on inflation likely to continue and labour market remains resilient RBA likely to remain on the sidelines over the shorter-term."

Saul Eslake, Corinna Economic Advisory Pty Ltd (Hold): "It's a finely balanced decision, but while the year-to measures of both 'headline' and 'underlying' inflation are clearly above the top end of the RBA's target band, much of that appears to be attributable to the 'spike' in both measures in July (which in turn drove the spike in the September quarter), which the most recent data suggests has not continued - the seasonally adjusted trimmed mean rose 0.26% in November and 0.23% in December, which, annualized, are consistent with the on-going pace of 'underlying' inflation being at the top end of the target band. Which, given that at 3.6% the cash rate is still on the restrictive side of 'neutral', doesn't to me add up to an overwhelming case for making monetary policy more restrictive, i.e. for raising rates. I certainly expect that option will be on the table: but my hunch is that the MP Board will decide to leave it there rather than take it up."

Nalini Prasad, UNSW Sydney (Hold): "I think the RBA will take a wait and see approach and keep the cash rate unchanged at this meeting. Inflation has been higher than the RBA would have liked. The latest inflation reading for December showed high inflation owing to some one off factors like the end of electricity rebates. But I think the RBA will need to act sooner rather than later to stem inflationary pressures."

Kyle Rodda, Capital.com (Hold): "The RBA will take a slow and cautious approach to tightening policy from here. Inflation data was too spicy, but the trimmed mean was as expected and the central bank won't want to be seen as jumping at shadows."

Tim Reardon, Housing Industry Association (Hold): "There is an irony at play ATM, that the main driver of inflation is a shortage of housing and higher interest rates will make this shortage worse. The housing shortage is now a macro economic challenge and it can not be fixed with higher rates."

Tim Nelson, Griffith University (Hold): "Underlying inflation is nearly in the 2 to 3 percent band."

Brodie Haupt, WLTH (Hold): "Headline inflation now reaching 3.8% with underlying inflation at 3.3% signal to us that the RBA board may be forced to increase cash rate to meet the target 2-3% band once again. Inflation has been on a steady rise since the September quarter, reportedly fuelled by rising housing construction costs and electricity."

Dale Gillham, Wealth Within (Hold): "Whilst in December CPI was up marginally, we are not seeing signs that require the RBA to raise rates in the short term."

Jeffrey Sheen, Macquarie University (Hold): "Core inflation in December 2025 increased marginally by 0.1% to 3.3% as expected, but is likely to fall into the RBA's target range through 2026. The recent CPI increases were mainly due to rising housing energy costs, which should begin to ease. The RBA will be concerned about the unexpected stronger labour market outcomes in December 2025 but will wait to see if this is repeated in the next few months."

Adj Prof Noel Whittaker., QUT Business school. (Hold): "It's important to step back and look at the big picture. Australia has a chronic shortage of workers, and construction sites are everywhere. At the same time, families are feeling the annual squeeze as post-Christmas credit card bills arrive and school expenses kick in. Lifting interest rates now would do nothing to fix the labour shortage and would simply add to the pressure on household budgets. A rate cut is clearly off the table, but given the Reserve Bank's well-known tendency to wait and see, my view — and my hope — is that rates will stay on hold at the next meeting."

Garry Barrett, University of Sydney (Hold): "Movement in CPI (esp trimmed mean)."

Jakob B Madsen, University of Western Australia (Hold): "The inflation rate is still above target and the cash rate low."

Cameron Murray, Fresh Economic Thinking (Hold): "No main reason. Incentive to decrease has subsided with inflation and higher bond rates globally."

Matt Turner, GSC Finance (Hold): "Inflation isn't as under control as the RBA believe, still plenty of families are feeling pressure on increased cost of living. There is also too much heat in the property market which will lead to higher inflation via increased rents etc."

Stephen Koukoulas, Market Economics (Hold): "Inflation will ease through 2026 and the labour market will weaken. Rates are still restrictive and that is inappropriate."

Shane Oliver, AMP (Hold): "The February meeting is a very close call, i.e. 50/50. December inflation came in above target and was higher than expected which may lead to a hike but against this the trend in underlying inflation has been down in the last few months from the July high. On balance we think the RBA should hold and wait for more information as a premature hike could snuff out the recovery in consumer spending."

Ask a question