Finder’s RBA Survey: 88% of experts predict cut

A rate cut appears imminent, and not just one, according to a new poll from Finder.

In this month's Finder RBA Cash Rate Survey™, 41 experts and economists weighed in on future cash rate moves and other issues relating to the state of the economy.

The overwhelming majority, almost 9 in 10 (88%, 36/41), believe the RBA will cut the cash rate on Tuesday.

Of those who are forecasting a cut, nearly all (94% 34/36) expect a 25-basis-point cut while 6% (2/36) expect a super-sized 50-basis-point cut.

Panellists predicting a cut cited a return to trimmed mean inflation to the RBA's 2-3% target band as a primary justification.

They also pointed to weak GDP growth and consumer spending as well as global uncertainty following the Trump tariffs as justification for a rate cut.

Graham Cooke, head of consumer research at Finder, said even more cuts appear to be on the way.

"With a February cut and now one expected in May, homeowners might finally start to feel tangible relief.

"Our experts are predicting several more cuts later this year, and we could be looking at a cash rate of close to 3% by Christmas."

"With any rate cut, if you can continue making the same payment each month, you will knock more off the principal and pay less interest over the long run," Cooke said.

David Robertson from Bendigo Bank expects a cut of 25 basis points next week, but would like to see more.

"I expect the RBA to cut rates by another 25 basis points on May 20, with some risk of a larger cut (35 bp would be ideal) but in the absence of a sudden sharper downturn in global conditions a 50bp cut appears unlikely."

Sean Langcake of Oxford Economics Australia agrees we will see a cut.

"News from abroad on the tariff front has improved. But the economy will still need to weather a sizable 'uncertainty shock' through Q2 at least. With upside inflation risks dissipating, the RBA can afford to lend the economy some more support."

Still a handful of experts (12%, 5/41) expect a hold.

Malcolm Wood of Ord Minnett said, "The labour market remains tight, driving above trend wages growth. With no productivity growth, this puts unit labour costs above the RBA's inflation target."

Mark Crosby from Monash University also is predicting a hold, citing the reversal of many of the Trump tariffs.

"US policy randomness is settling into a pattern of reversals which make US and global slowdowns less likely."

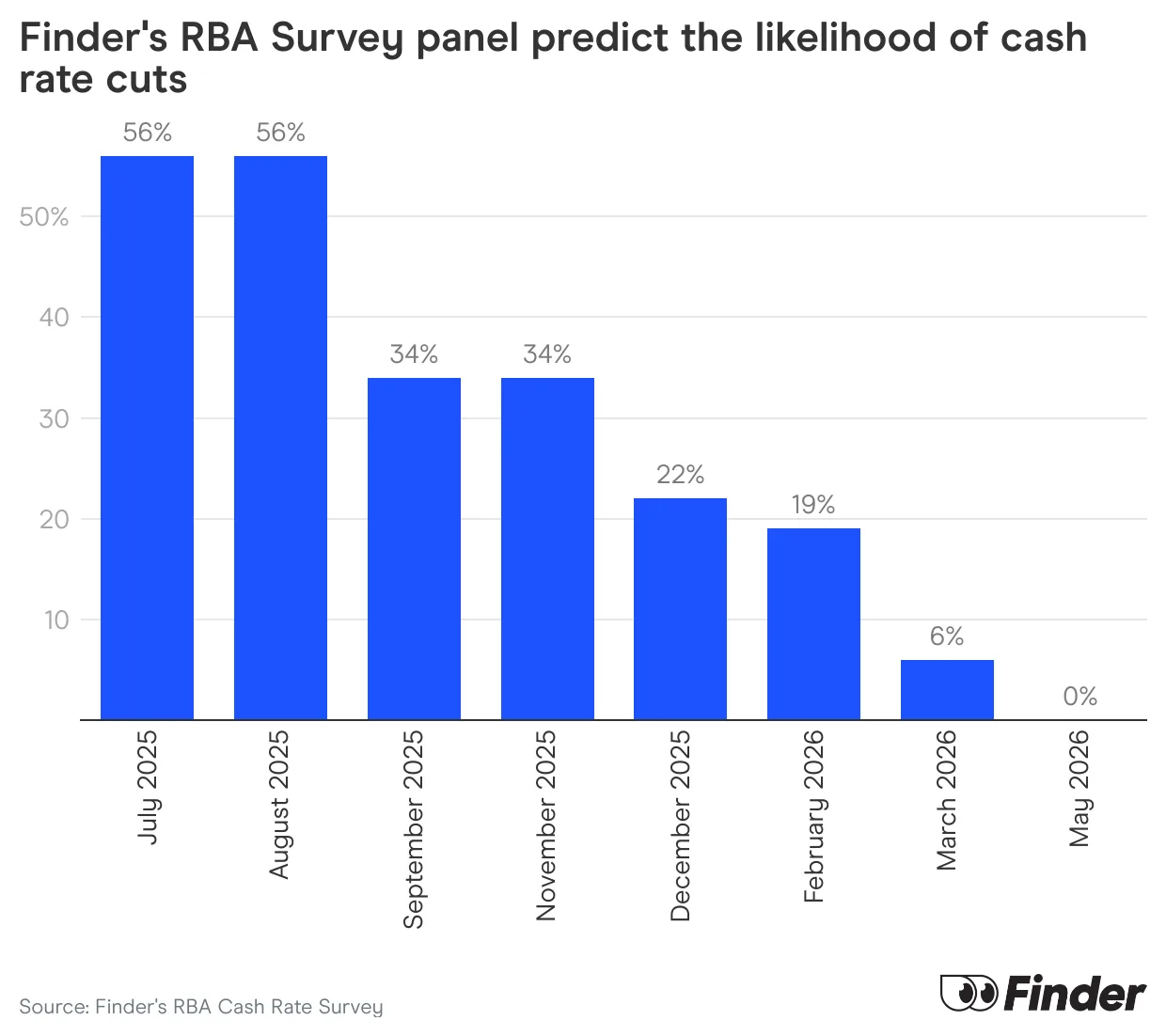

The majority of the panellists who gave their predictions for the rest of the year* (56% 18/33) expect another rate cut in both July and August.

89% of experts say Labor won't build 1.2 million new homes by 2029

Despite Labor's sweeping win, only 11% (3/28) of Finder RBA experts believe it will reach its target to build 1.2 million new homes by 2029.

One in five (21% 6/28) panellists think that even if the target is reached, it won't improve housing affordability.

Two-thirds (68%, 19/28) say it won't happen, but it would improve housing affordability if it did.

Do you think Labor will reach its target to build 1.2 million new homes by 2029?

| No, but it would improve housing affordability if they did reach it | 68% |

| No, and it wouldn't improve housing affordability if they did reach it | 21% |

| Yes, and it will improve housing affordability | 11% |

| Source: Finder RBA Cash Rate Survey, 28 expert responses, May 2025 |

Shane Oliver from AMP sees a rise in new homes, but ultimately a shortfall to the 2029 target.

"That said, if the target is reached or we come close to it, it should improve affordability as the implied 240,000 dwellings a year will be well above underlying demand for housing which is expected to be around 180,000 homes a year."

Others cited Australia never building at this rate before and other issues.

Stella Huangfu of University of Sydney said, "There are too many structural barriers — including shortages of labour and materials, slow planning approvals, and the high cost of construction — that make [hitting the 1.2 million house target] unlikely at the current pace.

Nicholas Gruen of Lateral Economics had a more positive view on the goal.

"I don't know if they'll get to the target, but giving it a shot will improve housing affordability. It is good that both state and federal governments now place a higher priority on this than they did five years ago."

Cooke said it's simple supply and demand.

"While I'd argue encouraging more Australians to buy with just a 5% deposit isn't the ideal strategy, I'm a big supporter of the plan to ramp up home building, especially with a portion of new houses reserved for first home buyers.

"We are at a supply deficit that is affecting renters and those looking to get on the property ladder.

"While economists seem doubtful, it will be interesting to see if Labor can keep this promise," Cooke said.

*Experts are not required to answer every question in the survey

Here's what our experts had to say:

Malcolm Wood, Ord Minnett (Hold): "The labour market remains tight, driving above trend wages growth. With no productivity growth, this puts unit labour costs above the RBA's inflation target."

Mala Raghavan, University of Tasmania (Hold): "Though the "Trump Tariff" created lots of anxiety and uncertainty, looking at some of Australia's key indicators, they appear to be moving in the right direction. Inflation rate is within target i.e. 2.4% (12 months to the March quarter), while consumer spending remains unchanged and the selected living cost indexes are between 2.4% to 3.5% while business indicators are pointing to the right direction. Given these scenarios, I think the RBA will hold the cash rate this round."

Mark Crosby, Monash University (Hold): "US policy randomness is settling into a pattern of reversals which make US and global slowdowns less likely."

Cameron Murray, Fresh Economic Thinking (Hold): "Honestly, a bit of a guess. Inflation is in the target band. Not big changes globally. So where would be the economic impetus for change?"

Jakob B Madsen, University of Western Australia (Hold): "Not much has changed since last meeting."

Evgenia Dechter, University of New South Wales (Decrease): "The headline inflation rate is settling within the target."

Tomasz Wozniak, University of Melbourne (Decrease): "Unsurprisingly! In line with expert opinions and market expectations, the combined forecasts from my models indicate a decisive CUT of the cash rate in May. The predictive intervals do not include the rate's current value and include a 25bp cut. All the bond yield curve models' predictions align with these projections, and those that rely more on exchange rates or cash rate persistence do not. Longer-term scenarios will become more realistic after two or three more cuts. My forecasts are available at: https://forecasting-cash-rate.github.io/"

Matthew Greenwood-Nimmo, University of Melbourne (Decrease): "Inflation continues to moderate, which creates space for a rate cut. The case for a cut is strengthened by the risks to confidence and economic activity posed by current global uncertainty and trade tensions."

Nalini Prasad, UNSW Sydney (Decrease): "Expectations are that the RBA will decrease the cash rate. I think the RBA will be concerned about developments in the global economy and look to cut the cash rate for this reason."

Shane Oliver, AMP (Decrease): "Since the last meeting we have seen a further fall in underlying inflation to within the target range and wages growth in line with RBA forecasts adding to confidence inflation is falling sustainably to the mid-point of the target range. At the same time GDP growth looks to be running weaker than expected with flat consumer spending in the March quarter and global trade uncertainty poses a downside risk to the economic outlook."

Anthony Waldron, Mortgage Choice (Decrease): "Given inflation has continued to ease and is now sitting within the Reserve Bank's target band, I expect the RBA will cut the cash rate at its May monetary policy meeting. We've also seen a number of lenders reduce their fixed rate home loans recently, a sign that the market is anticipating that the cash rate will fall."

Tim Nelson, Griffith University (Decrease): "Inflation within target range. Global tariff uncertainty may cause the RBA to seek to get ahead of any business confidence declines etc."

Stella Huangfu, University of Sydney (Decrease): "Both headline and underlying (trimmed mean) inflation have now fallen within the RBA's 2–3% target range — a key milestone that opens the door to possible rate cuts."

Rich Harvey, PROPERTYBUYER (Decrease): "Given that the inflation rate is now well and truly in the RBA preferred band and the drag higher interest rates are having on the economic growth, and unsettled international economic conditions, the time is justified for a rate cut. I am predicting a 0.35% cut this month which will be followed by another 4 cuts over the next 12 months taking the cash rate to its equilibrium level at 3%."

Leanne Pilkington, Laing+Simmons (Decrease): "With inflation moderating back to the Reserve Bank's target range, and the global economy continuing to grapple with the actual and potential fallout of a fluctuating tariff situation, household spending is constrained. This supports the case for a rate cut."

Adelaide Timbrell, ANZ (Decrease): "Uncertain global backdrop, weak consumption Q1, encouraging trimmed mean inflation Q4 and Q1."

Sveta Angelopoulos, RMIT University (Decrease): "Uncertainty and risk in the global environment may weaken the domestic economy."

Sean Langcake, Oxford Economics Australia (Decrease): "News from abroad on the tariff front has improved. But the economy will still need to weather a sizable 'uncertainty shock' through Q2 at least. With upside inflation risks dissipating, the RBA can afford to lend the economy some more support."

Nicholas Gruen, Lateral Economics (Decrease): "It's generally expected."

Jeffrey Sheen, Macquarie University (Decrease): "It's been reasonably clear for a while that inflation has stabilised within the RBA's target range. The RBA should immediately return the cash rate from being restrictive to its neutral level. The RBA may need to ease further later this year in the event of a global recession induced by the policy chaos of the White House."

Adj Prof Noel Whittaker, QUT (Decrease): "This is a difficult call but markets are pricing a cut in and inflation is now within the banks target range. But I say that with less than perfect certainty."

Brodie Haupt, WLTH (Decrease): "While inflation has fallen substantially since the peak, the RBA board mentioned they needed to see sustainable progress towards the target band. Furthermore, wage pressures have reportedly eased which could give the RBA more confidence about a rate cut."

Mathew Tiller, LJ Hooker Group (Decrease): "At its last meeting, the RBA held steady seeking more evidence that inflation was sustainably returning to the target range. Since then, inflation has eased further, with both headline and underlying figures now sitting within the band. With a slight softening in jobs data, ongoing cost-of-living pressures and global trade uncertainty clouding the outlook, a May rate cut is highly likely."

Garry Barrett, University of Sydney (Decrease): "Easing of inflationary pressure."

James Morley, University of Sydney (Decrease): "Even underlying measures like 2.8% trimmed mean inflation have come back into the 2-3% target range in the latest reading. So the RBA can continue a gradual return to a neutral stance of policy. Global uncertainty and likely economic weakness due to tariffs also argues for cutting rates even if Australia is not so directly exposed to US tariffs. The US tariffs on China are likely to lead to cheaper prices of imports in Australia, so the RBA can forecast that inflation is likely to remain in the target range even if the government removes energy price rebates at some point."

Devika Shivadekar, RSM Australia (Decrease): "With headline inflation sitting below the mid-point of 2.5% for two consecutive quarters and trimmed mean inflation breaching the target range in the previous quarterly print, the RBA should feel comfortable to deliver another 25bps cut."

Geoffrey Kingston, Macquarie University Business School (Decrease): "The Bank will probably lower the cash rate because the latest data show that trimmed mean inflation is now within the target band and the labour market is slightly weaker."

Craig Emerson, Emerson Economics (Decrease): "GDP growth is slow and there is no sign of a price-wage spiral."

Tim Reardon, HIA (Decrease): "CPI back in target band."

Kyle Rodda, Capital.com (Decrease): "Trimmed mean CPI is back within the RBA's 2 to 3% target band and the central bank has scope to ease policy to take pressure off households and get ahead of a likely slowdown in global growth."

Peter Munckton, Bank of Queensland (Decrease): "Inflation is compatible with target"

Nicholas Frappell, ABC Refinery (Decrease): "Weakness in consumer spending and lowering inflation expectations."

David Robertson, Bendigo Bank (Decrease): "I expect the RBA to cut rates by another 25 basis points on May 20, with some risk of a larger cut (35 bp would be ideal) but in the absence of a sudden sharper downturn in global conditions a 50bp cut appears unlikely."

Michael Yardney, Metropole Property Strategists Pty Ltd (Decrease): "Inflation has finally fallen within the RBA's 2–3% target band, with underlying inflation now at 2.9%, and services inflation has cooled from 4.3% to 3.7%. Even energy price pressures are moderating."

A/Prof Mark Melatos, School of Economics, University of Sydney (Decrease): "Monthly inflation readings have been falling precipitously for a while. The March quarter CPI report showed headline and underlying inflation within the RBA's target range. The RBA might be tempted to wait for further confirmation of this reversion of the trimmed (quarterly) mean to the target range. However, for this they would need to wait until next quarter's reading. The monthly readings have already been within the target range since late 2024. Given that the Federal election has been held, there seems to be little stopping the RBA moving to ease now."

Peter Boehm, Pathfinder Consulting (Decrease): "The economic outlook is still a bit uncertain but there is considerable political and public pressure to reduce interest rates and this may hold sway with the RBA rate setting board."

Stephen Koukoulas, Market Economics (Decrease): "Weak growth, low inflation and a softening labour market make the current 4.10% cash rate too high – by a large margin. 50bp cut is needed.

Matt Turner, GSC Finance Solutions (Decrease): "With the trimmed mean inflation measure very much in the target band and macro-economic issues caused by trade wars, there is a case that the RBA could do more, however given the economy is reasonably healthy they would probably exercise caution and decrease slightly."

Saul Eslake, Corinna Economic Advisory Pty Ltd (Decrease): "Because 'underlying' inflation is now back within the 2-3% target band, and will likely fall some more. And the economy is still sluggish."

Stephen Miller, GSFM (Decrease): "Inflation is OK in line with projection. Policy is currently "restrictive". Downside risks to global growth and by extension Australian growth and inflation abound."

Richard Holden, UNSW (Decrease): "Trump tariff concerns."

Ask a question