Block Earner review

We currently don't have this product on Finder

- Supported assets

- 364

- Fiat currencies

- 1

Our verdict

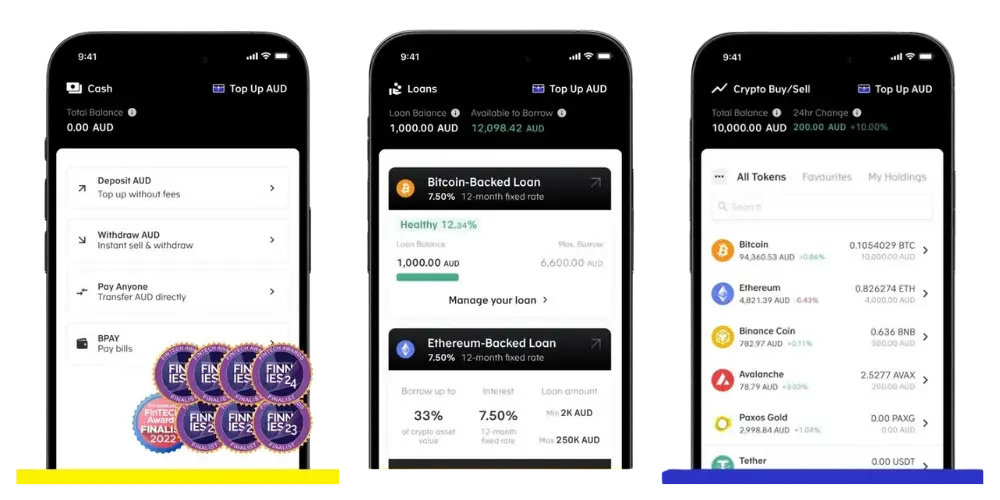

Trade, save and borrow with a Block Earner account

Block Earner offers a suite of products for cryptocurrency investing, including an exchange, yield-earning accounts, crypto-backed loans and support for self managed super funds (SMSFs).

Setting up and verifying an account can be completed in a few minutes. Once approved, you’re ready to trade on the exchange or start earning yield.

The platform has over 360 popular cryptos for trading including Bitcoin, Ethereum, Dogecoin and Polygon.

The charting is not as comprehensive as some other exchanges and does not support built-in candlestick charts, indicators or advanced order types. That said, it offers a streamlined UI, historical pricing data and market data provided by CoinMarketCap. This information is displayed in AUD and is well-suited to long-term traders or investors.

Block Earner’s suite of products includes a unique way for investors to earn yield on their digital assets. By depositing USD Coin (USDC), Bitcoin (BTC) or Ethereum (ETH) into Block Earner DeFi Access, you’ll receive a compounding yield – generated via the popular DeFi lending protocol, Aave. Your funds will also be available to withdraw to AUD at any time.

You’re also able to borrow AUD using your Bitcoin or Ethereum as security. Crypto-backed loans between AUD$50-$250,000 are available on the Block Earner platform with a fixed rate and 12-month terms.

Block Earner is registered with the Australian Transaction Reports and Analysis Centre (AUSTRAC) and also allows you to pay your bills using cryptocurrency.

If you’re looking to trade cryptocurrency, earn yield on your crypto or are interested in managing your own super, Block Earner provides a convenient way to manage your assets from a single platform.

Pros

- Borrow against BTC and ETH. Borrow up to $250,000 AUD using your crypto as a security. T&Cs apply.

- Popular cryptos supported. Trade 360+ popular cryptos and manage your portfolio on the go.

- Regulator registered. Block Earner is AUSTRAC registered as a digital currency exchange and independent remittance provider.

- Earn yield on your assets. You can use Block Earner DeFi Access to generate compounding yield on selected cryptos and withdraw funds to AUD at any time.

- Easy transactions. Manage everyday transactions and send AUD instantly with Block Earner Cash.

Cons

- Limited advanced features. The trading interface is less comprehensive than some exchanges, and there are no advanced charting or order types.

- Counterparty risk. Block Earner DeFi Access is not a traditional savings account and your funds are not insured the way a bank account is.

- Comparatively high trading fees. Block Earner charges maker/taker fees of 0.60/0.60% on the spot market which is high compared to some other platforms. If low trading fees are important, use our table to compare trading fees between platforms.

Details

Product details

| Product Name | Block Earner |

| Fiat Currencies | AUD |

| Cryptocurrencies | BTC, ETH, XRP, USDT, SOL, BNB, USDC, DOGE, ADA, TRX & 354 more |

| Deposit Methods |

Bank transfer Cryptocurrency |

| Trading Fee | 0.6% |

| Deposit Fees |

AUD - None Cryptocurrency - None |

| Withdrawal Fees |

AUD - None Cryptocurrency - Fees vary |

About Block Earner

Block Earner is a blockchain-powered fintech headquartered in Sydney, Australia. The company was founded in 2021 by crypto entrepreneurs Charlie Karaboga and Jordan Momtazi and backed by leading VCs, including Coinbase Ventures, Longhash and Sequoia Capital.

The team at Block Earner strives to deliver financial services at the convergence of traditional and decentralised applications. Its vision and mission are to help make money borderless, frictionless and accessible through blockchain technology while allowing customers freedom of funds.

“Money as we know it is evolving, so we built Block Earner, to give everyday Aussies (and then the world) greater access to the utility of this new era in finance.

Since day one, we’ve been laser-focused on giving our users more transparency and freedom around how their money is stored, moves and grows.” – Charlie Karaboga, Block Earner CEO

Block Earner supported assets

Block Earner supports over 363 cryptocurrencies, but some notable assets are missing. Namely, Lido Staked Ether, LEO Token and USDS, which are in the top 20 cryptos by market cap. In total, 17 of the top 20 cryptos are available on Block Earner.

Popular assets on Block EarnerBlock Earner fees review

Deposit and withdrawal fees

| Transaction type | Fee |

|---|---|

| Deposit funds | AUD - None Cryptocurrency - None |

| Withdraw funds | AUD - None Cryptocurrency - Fees vary |

Block Earner uses a maker taker fee structure for spot market trading. Instant purchases incur a separate fee.

| Type | Fee |

|---|---|

| Maker | 0.60% |

| Taker | 0.60% |

Maker fee explained. A maker fee is the fee charged when you propose an order for other traders to take. In other words, this fee is charged when you place a limit order to sell an asset, but that order is not filled immediately.

Taker fee explained. A taker fee is a fee charged when a buy order is matched immediately with a sell order on the books. This is the fee charged when you place a market buy order.

Block Earner deposit methods

- Bank transfer

- Cryptocurrency

How to sign up on Block Earner

Before you can get started trading on Block Earner, you'll have to go through a Know Your Customer (KYC) verification process (which usually involves proof of identification).

- Get started

Visit Block Earner's site. After selecting the Get Started button, fill in the create account form. - Set up payment

Before you can start trading, you have to add your bank account to your Block Earner account. There are several options to choose from, so choose the option most compatible. - Provide identification

Before you can make withdrawals and increase your transaction limits, you must submit proof of address and some additional identification. Use either a passport or a driver's license for this. - Start trading

After all that is processed, you're ready to trade on Block Earner.

About the Block Earner app

The Block Earner mobile is available on both Apple and Android devices. All of the same features offered on the desktop version are supported on mobile devices, including buying and selling, save and earn accounts and instant AUD deposits and withdrawals via bank transfer or PayID.

Once your account is verified and you've downloaded the app, you're ready to go. It offers a streamlined UI to make investing, saving and sending money on the go beginner-friendly and convenient.

| App store | Rating | Total reviews |

|---|---|---|

| Google Play | 3.8 stars | 12 reviews with 1k downloads |

| Apple Store | 4.6 stars | 44 reviews |

Is Block Earner safe?

Block Earner is AUSTRAC registered as a digital currency exchange and independent remittance provider.

Like all digital currency exchanges, assets held on Block Earner are at risk of hacks or theft.

The company was sued by the Australian Securities and Investments Commission (ASIC) in November 2022. ASIC stated that Block Earner provided unlicenced fixed-yield earning products and that consumers lacked crucial financial safeguards.

Since this time, Block Earner has reviewed and updated its products to comply with Australian regulatory guidelines.

Past hacks. Block Earner has never experienced a hack, security breach or loss of customer assets.

Security audits. Block Earner DeFi Access provides users with one-click access to the well-known DeFi lending platform, Aave. As a result, customers who utilise this feature may be exposed to potential smart contract vulnerabilities.

Smart contracts are self-executing pieces of code and carry the inherent risk of containing bugs or exploits that could be exploited by malicious actors, potentially leading to the loss of crypto assets within the affected protocol.

To mitigate this risk, Block Earner requires that Aave and all other third-party partners verify that the smart contract has undergone an audit. This is considered standard practice for reputable DeFi projects to ensure the security of their smart contracts.

User verification. Block Earner uses extensive security protocols to verify users and prevent unauthorised access to users funds. They enforce a strict 2FA system for withdrawals and use biometrics and transaction monitoring to prevent unauthorised withdrawals incase your account is compromised.

Insurance. Block Earner is not a bank and customer funds are not insured by the Financial Claims Scheme (FCS) in the same manner as assets held in a traditional bank account.

Keeping your crypto secure

All centralised exchanges, including Block Earner, are vulnerable to counterparty risks like hacking, theft and insolvency. Using a self-custodial or hardware wallet is widely accepted as the best way to improve the security of your funds. We've shared some of our top picks below.

Ledger Nano X Wallet |

Trezor Model T Wallet |

SafePal S1 Wallet |

|

|

|

|

|

|

|

|

|

|

|

|

Supported assets 5,500+ |

Supported assets 1,000+ |

Supported assets 30,000+ |

|

Price (USD) $99 |

Price (USD) $129 |

Price (USD) $49.99 |

See more of the best crypto wallets

Block Earner customer support

Block Earner is highly rated on Trustpilot, with an average of 4.5 stars. The majority of customers were satisfied with the platform services, customer support, fast verification and instant cash withdrawals.

Although one customer raised concerns regarding their investment's transparency, Block Earner responded and explained in detail where and how the platform's yield is generated.

Block Earner can be reached through a contact form or live chat on their website. When we tested the live chat we received a reply within minutes by their team based in Sydney.

How to reach Block Earner customer support

- Live chat

Alternatives to Block Earner

Compare other products

We currently don't have that product, but here are others to consider:

How we picked theseSources

James Finder

Journalist

You are about to post a question on finder.com.au:

- Do not enter personal information (eg. surname, phone number, bank details) as your question will be made public

- finder.com.au is a financial comparison and information service, not a bank or product provider

- We cannot provide you with personal advice or recommendations

- Your answer might already be waiting – check previous questions below to see if yours has already been asked

Finder only provides general advice and factual information, so consider your own circumstances, or seek advice before you decide to act on our content. By submitting a question, you're accepting our Terms Of Service and Finder Group Privacy & Cookies Policy.

This site is protected by reCAPTCHA and the Privacy Policy and Terms of Service apply.