Congratulations, Webull!

Webull was a big winner in the 2025 Finder Awards.

- Winner, Best Active Share Traders Platform

- Winner, Best Auto-investing Share Trading Platform

- Winner, Best Mobile Share Trading App

- Highly commended, Best Share Trading Platform

- Highly commended, Best Casual Share Trading Platform

- Highly commended, Best US Stocks Trading Platform

- Highly commended, Best Low Cost Share Trading Platform

- Highly commended, Best ETF Investing Platform

- Highly commended, Best Options Share Trading Platform

Full list of 2025 share trading platform winners

How we rated Webull's features

| Fees |

| It charges $0 brokerage on US and Australian ETFs and no commission fees on your first 20 trades. Account fees are on par with competitors. |

| Research and tools |

| Reporting tools and charts are standout platform features. |

| Available securities |

| Access ASX shares, US stocks, ETFs and US options. |

| Customer support |

| Contact support in several ways, but we waited 20 minutes to speak to a rep. |

To learn how our star ratings are calculated, read our methodology at the bottom of the page. Please note our methodology is based on Webull's US offering.

Webull is best for: Casual and active traders

Webull's low-free trading and no minimum deposit requirements give newbies a platform to trade without high fees eating into their balances. Beginners can also develop trading skills through the demo account without risking their money.

Long-term investors will find Webull's zero commission ETF trades appealing alongside its auto-invest feature that lets you set recurring deposits into your ETF or stock of choice.

Meanwhile, active traders should find its advanced charts, indicators and screeners attractive.

What you can trade on Webull

- US Stocks and ETFs

- Australian Stocks and ETFs (ASX and Cboe)

- US Options

- Hong Kong stocks

- Chinese A-Shares

Where Webull shines

Webull has some of the lowest fees in the industry, as well as no minimum deposits and $0.00 brokerage on Australian and US ETFs.

Plus there are no annual or inactivity fees. Fractional trading gives investors access to thousands of companies that might otherwise be out of reach. Webull also offers margin accounts.

Key features include:

- Auto-investing: Set recurring deposits into stocks and ETFs

- $0 commission ETFs: Pay zero brokerage fees when you purchase Australian or US ETF units

- Market data access: You can access real-time market data including level 2 data and ASX live prices (subscription only)

- Advanced charting: Customisable technical analysis charts with up to 60 technical signals

- Stock and ETF screeners: Customisable screeners based on 40+ technical and fundamental signals

Where Webull falls short

Webull gets negative feedback from clients for a lack of quality customer service and for a slow money transfer process. Webull currently has a "bad" rating on TrustPilot, with an average review score of 1.4 out of 5, based on more than 300 reviews (last checked September 2025).

If you're looking to invest in Australian equities or assets like managed funds, futures, bonds or forex, you'll be forced to look elsewhere as these aren't offered by Webull.

Is Webull legit?

Yes, Webull is a legitimate fintech. It started out in 2017 in the US and is registered with the Securities and Exchange Commission (SEC), the Financial Industry Regulatory Authority (FINRA) and the Securities Investor Protection Corporation (SIPC). With its launch into Australia, it is now also licensed under ASIC (Australian Securities & Investments Commission).

Webull's platform is easy to use

Here are some of the tools you can use to trade with on Webull:

- Auto-invest

- In-depth market data

- Real-time pricing

- Stock watchlist

- Advanced charts

- Demo account

- Screeners

- Portfolio

- Nasdaq TotalView

- Educational videos

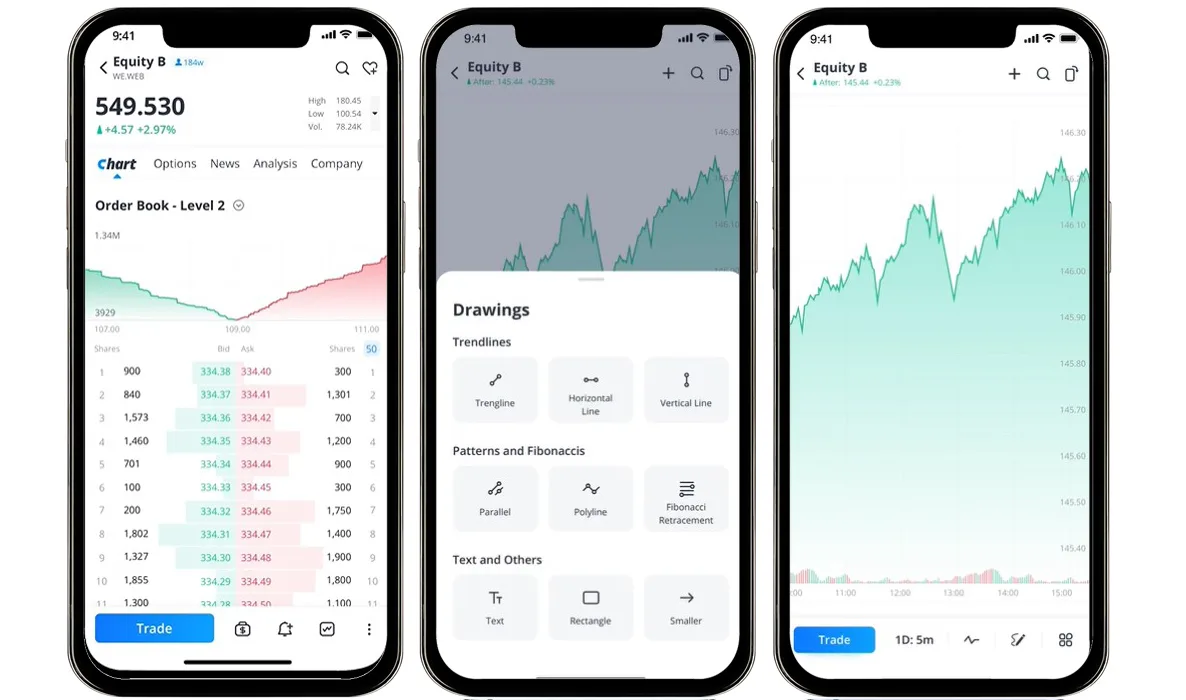

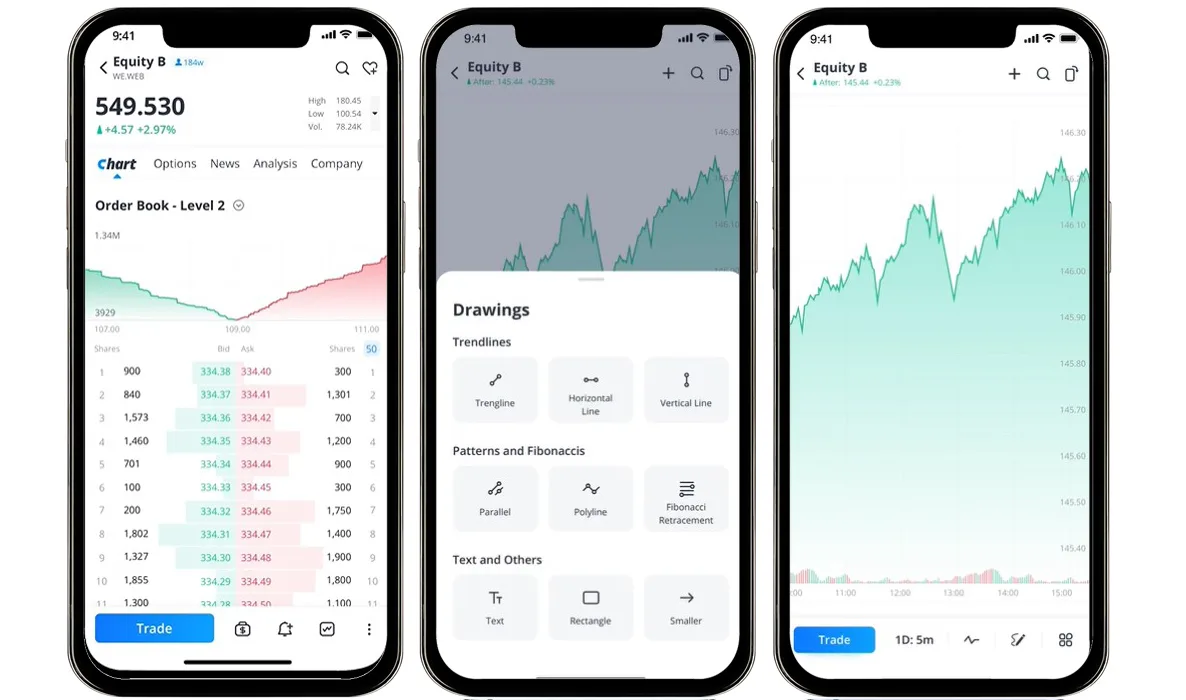

Webull's app

Webull offers a powerful mobile app that lets you manage your portfolio on the go. Stay across positions and consolidate watchlists, analyse charts and place orders. Create your own screener and monitor what you want by market cap, prices, percent changes, volume, turnover rates and listing dates.

Webull's desktop tools

Webull traders have access to the desktop terminal's comprehensive suite of research and analysis tools. And its platform is intuitive and can be customised to suit your needs.

On the desktop terminal you can access real time market data including ASX streaming and Nasdaq level 2 (via subscription). Its advanced charting tools are better than most out there and include 60 technical signals and 50 customisable indicators.

Plus, you can create your own stock screeners based on over 40 indicators from technical to financial.

If you're looking to practice or trial strategies, you can switch to the demo account without investing any money.

Webull's app store reviews

| Google Play app reviews | 4.3/5 stars, based on over 457 reviews |

| Apple App Store app reviews | 4.4/5 stars based on over 642 ratings |

Webull's customer support

Connect with Webull in 3 ways:

- Email support

- Phone

- Secure message via app

How to open an account with Webull

- Hit the "Sign up now" button above (you can also download the Webull app for Android or iPhone).

- Select the "Open account" tab, then "Open account".

- Enter your personal information, employment details and investment specifics.

- Upload a photo of your ID to verify your identity.

- Answer questions about your affiliations, then agree to account terms and disclosures.

- Choose your account type, verify your email and submit your application.

Sign up now

This information should not be interpreted as an endorsement of futures, stocks, ETFs, CFDs, options or any specific provider, service or offering. It should not be relied upon as investment advice or construed as providing recommendations of any kind. Futures, stocks, ETFs and options trading involves substantial risk of loss and therefore are not appropriate for all investors. Trading CFDs and forex on leverage comes with a higher risk of losing money rapidly. Past performance is not an indication of future results. Consider your own circumstances, and obtain your own advice, before making any trades. Read the Product Disclosure Statement (PDS) and Target Market Determination (TMD) for the product on the provider's website.

Choong

December 10, 2024

Have you reviewed the Customer Reviews (as at December 2024) for WeBull on Trust Pilot?

What do you think?

Should these reviews raise “RED FLAGS” regarding WeBull?