Revolut launches in Australia: How does it compare to rival neobanks and fintechs?

As Revolut announces it's open for business in Australia, we look at how it compares to the likes of Up bank, TransferWise and 86 400.

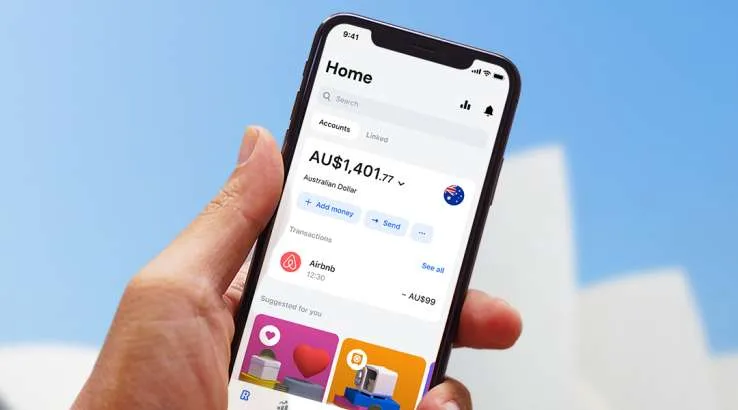

Revolut is now officially available in Australia, letting Australians download the app and create an account. Revolut launched a beta version of its app mid-last year to a limited number of customers who were quick enough to join the waitlist and create an account (Finder's fintech editor was one of them). Now that the beta is complete, it will begin onboarding its 30,000-strong waitlist from today and will be welcoming new customers to create an account.

Send money abroad with Revolut

Send money abroad with Revolut

Send money with great rates and low fees in 40+ currencies. Plan fees apply.

- Great exchange rates and low transfer fees on 40+ currencies

- User-friendly mobile app and easy sign-up process

With more than 12 million global customers, you've probably already heard about Revolut – particularly if you've got friends overseas already using the app. If you're considering opening a Revolut account but aren't sure if it's the way to go, here's how the app compares to other leading Australian finance apps.

Pricing structure

The most notable difference between Revolut and other neobanks and fintechs is Revolut's pricing structure. Revolut offers three account types, Standard, Premium and Metal, each with a monthly subscription fee of $0, $10.99 and $29.99 respectively. Each plan offers different benefits and features, with the Standard plan offering no-fee currency exchange on up to $9,000 a month and no-fee ATM withdrawals for up to $350 a month.

The top-tier plan would be more suited to someone who makes a huge amount of ATM withdrawals a month, exchanges a lot of money between different currencies and enjoys premium perks like a metal card, airport lounge access and cashback offers.

Hold multiple currencies

One of Revolut's key product features is the ability to hold and exchange different currencies, making it a good option for travelling and for sending money abroad. A Revolut standard account allows you to hold and exchange 27 currencies at the real exchange rate. There's no exchange rate mark-up or margin added when you exchange currency on Monday to Fridays. However, if you exchange currency on the weekend, there's a mark-up of up to 2% added.

There's also no transaction fee when exchanging currency for the first AUD$9,000 exchanged each month on the Revolut standard account, but a 0.5% fee applies after this. On the Premium and Metal account tiers, you can exchange an unlimited amount each month with no transaction fees.

If you're looking for the ability to hold and exchange multiple currencies, the TransferWise Borderless Account is the closest competitor. TransferWise allows you to hold and exchange 50 currencies at the real exchange rate, and it doesn't charge a mark-up on weekends. However, TransferWise does charge a small transaction fee on each currency exchange (this fee varies depending on the currencies).

Other popular neobanks like Up and 86 400 don't allow you to hold any currencies other than the Australian dollar.

Card access and banking status

Revolut offers a free Visa card, which you can use in stores and online in Australia and internationally without fees. One of Revolut's most-hyped features is its unique metal card, exclusively available only with the top-tier "Metal" monthly account plan that's $29.99 a month. The Metal card is exclusive, sleek and the first of its kind in Australia. However, it's not a debit card as Revolut doesn't have a full banking license in Australia.

Because Revolut doesn't have an Australian Deposit-Taking Institution (ADI) license, the money you hold in your Revolut account isn't covered by the government guarantee scheme. TransferWise doesn't have an ADI license, either.

Up bank, 86 400, Xinja and Volt have all been granted an ADI licence in Australia (Up uses the license of Adelaide and Bendigo Bank). This means that your deposit of up to $250,000 with these banks is guaranteed by the Australian government if something were to happen to the bank. They each also offer debit cards with their accounts, which you can use here and overseas.

Spending analytics, payment insights and integration with other apps

The Revolut app automatically groups your transactions into different spending categories, so you can see exactly how much you're spending on entertainment, eating out and shopping. You can track this in real time and create your own budgets for each category to help you stick to your savings goals.

Revolut also allows you to split bills with friends via the app and round-up your transactions to the nearest $1 and put the spare change into another account. However, the account that you add your spare change to isn't an interest-earning account yet.

This spending categorisation feature is also offered with Up's app, and Up even allows you to break down your spending by merchant. Up also offers integration with Afterpay, allowing you to see your past Afterpay repayments and the details of what you bought.

The 86 400 banking app scans your past transaction history and detects any regular payments or bills you have to let you know when you've got one coming up. 86 400 is also unique in the way that it allows customers to link their accounts from other banks to their 86 400 app, so they can track their spending all in the one place.

The Finder app also allows you to connect all your bank accounts to monitor them in one place, including your super and share trading account. Going one step further than 86 400, the Finder app will compare your current accounts with others in the market and prompt you to compare where you could find a better deal.

Crypto and share trading

Local neobank Xinja was among the latest to announce it will launch commission-free share trading for US stocks via its product named Dabble. Xinja plans to launch Dabble to customers by mid-August. In line with other zero-commission stock brokers eToro and Stake, Dabble will only offer US stocks, not ASX shares.

Revolut says it will allow its Australian customers to buy, hold and exchange cryptocurrency later down the track, a feature already offered to its international customers. As well as cryptocurrency, Revolut will introduce commission-free stock trading via its app, but there's no planned time frame for this just yet.

Ask a question