Revolut Australia hands-on review (after 1 month’s use)

This was my experience with Revolut's Australian app after using it for a month.

Revolut has been slowly signing up users to its Australian app for the past couple of months. While not everyone has managed to get their account yet, I jumped on the waitlist early and also invited friends to sign up to the app which bumped me considerably further up the list. So, in July, I signed up for a Premium account and got to testing. Here is how I found each feature of the app and my ultimate verdict.

Signing up to Revolut in Australia

The sign-up process was relatively smooth. I had to enter personal details such as my name, email address and residential address. I then had to verify my identity by taking a photo of my licence. While this is usually sufficient for a digital bank's sign-up process, I also had to snap a selfie to prove that I was in fact who I said I was. I may have spent a little too long trying to make it look like I didn't care how I looked in my selfie.

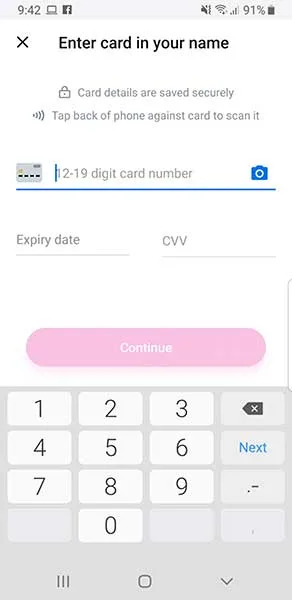

Adding funds to my account

With my licence, face and email verified, now it was time to add funds to my account. Doing this would make my account active. I added a CommBank debit card as it's the account I receive my regular salary into. To verify your card, Revolut will debit $1 from your funding card to verify the card and send you a six-digit card code.

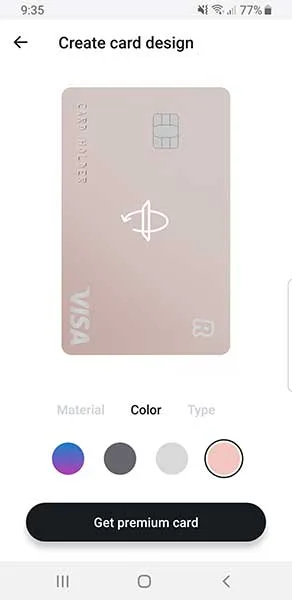

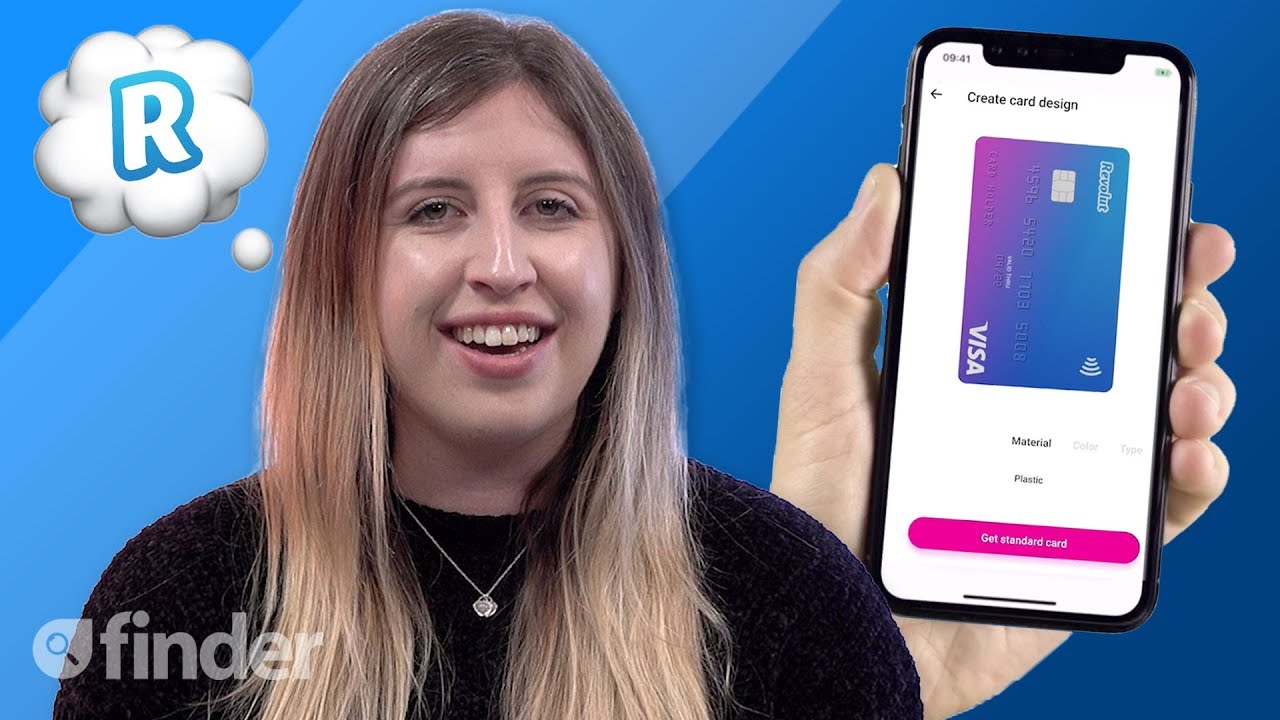

Ordering my Revolut card

I was shown multiple card options to choose from. However, while I was getting excited about choosing a design for my card, I forgot about Revolut's tiered account options and that card personalisation is only available with paid accounts. With the Standard account, you can only order the blue/purple Revolut card. I opted for Premium and chose a rose gold card. Premium account holders also benefit from express card delivery in three business days. The welcome pack it arrived in was impressive and very fun to open.

How much does Revolut Premium cost?

You'll pay $10.99 per month for Revolut Premium. Revolut Metal, which at the time of writing isn't currently available, costs $22.99 per month. Remember that there is a cost to downgrade your account if you decide that Premium or Metal isn't right for you. If you don't downgrade within 14 days of signing up and have a monthly plan you will need to pay $22 to downgrade a Premium plan and $40 to downgrade a Metal plan.

Making my first purchase

Keep in mind this was my own personal experience, but things were a little complicated with making a card purchase. In the Revolut app I was shown a message that the first purchase on your card cannot be contactless. I made the assumption that you would need to use your PIN for security reasons. However, after three different attempts to make purchases the card was declined each time.

I jumped on Revolut Help chat, which is easily accessible within the app, and was told that some of my security settings may be causing the issue. I had not changed any of my security settings, so these were the default settings for the app. I also read on a Revolut Help article that after three unsuccessful payment attempts you need to select "Unblock PIN/CVV" in the Cards section of the app. After doing this and enabling contactless payments in my security settings, I made a purchase via contactless in a coffee shop and it went through fine.

Using your Revolut card

After some initial difficulties, using the Revolut card was excellent. Every time I used it in a store I got a compliment on how nice the card was. Which, while not the main draw of a bank account, did make it nice paying for coffee.

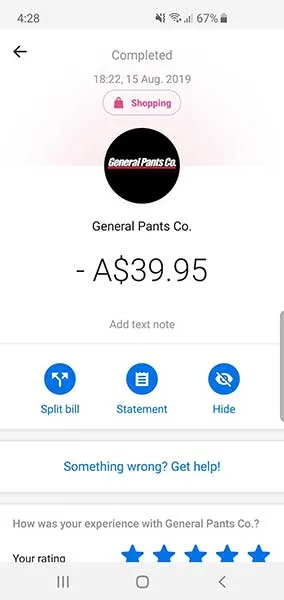

Each time you use your card you will receive a notification with the retailer's name, logo and the option to review your experience with that retailer out of five stars. You can then click through to the payment to add a receipt to the purchase, split a bill or see more details. Revolut also automatically categorises each purchase as you spend. You can edit the category if it is incorrect.

Using the Revolut Australia app

The Revolut Australia app has five tabs: Accounts, Analytics, Payments, Cards and Dashboard.

- The Accounts tab gives you an overview of your account with a graph of your incomings and outgoings. There are three buttons at the top easily lettings you add money, exchange money or give you more details about your account. Revolut also prompts you to take different actions on this tab, such as to make a donation.

- The Analytics tab lets you see a breakdown of your spending and saving. You can see your transactions broken down by category, merchant or country and you're also able to set up a global budget. This is the tab to jump in to see more details of your transactions.

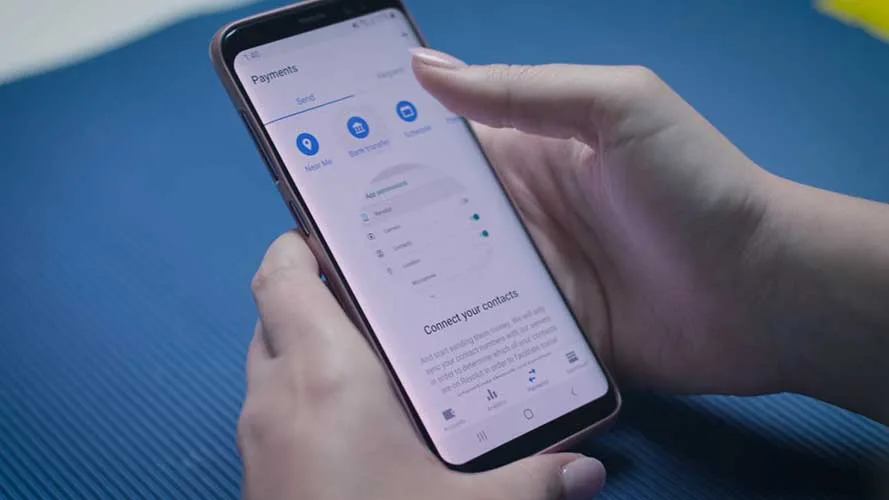

- In the Payments tab you can send and request money in Australia and overseas. To make or request a payment you can search for people near you, make a bank transfer, schedule a payment or use a Revolut payment link. Revolut also shows you which friends are on Revolut and pulls their contact details into the app.

- In the Cards tab you can see your card and order a virtual card if you want one. You also see your card settings in this tab including the ability the freeze your card, view your PIN, unblock your PIN/CVV, set your security setting and set monthly spending limits.

- The Dashboard tab gives you an overview of your Revolut features and accounts. In my Dashboard I can see I am a Premium member, invite friends and upgrade and see how much I have in my account. I'm also able to see how much I have in my Vault, Revolut's version of a savings account which doesn't give you any interest on your balance but encourages you to save regularly and lets you add lounge passes. You're able to customise your dashboard widgets to your liking.

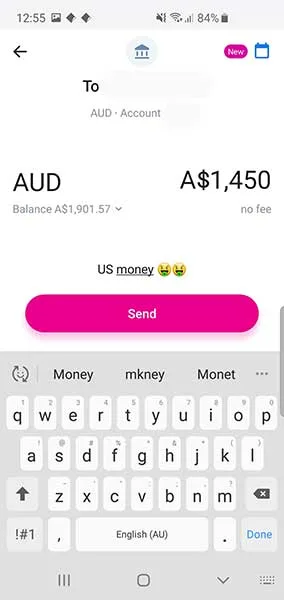

Transferring money

Transferring money is one of the biggest benefits and potentially one of the biggest cons for Revolut. Let's start with the benefits.

Revolut lets you transfer money internationally at the interbank exchange rate, which is the same rate banks charge each other to transfer funds. You can spend in over 110 currencies at the interbank exchange. If you have the free Standard account, you can transfer money for free up to $9,000 each month at this rate in 15 currencies. After this, there is a 0.5% fee. There is no limit for Premium customers.

The cons lie with making payments between Australian bank accounts. No matter if a payee is in Australia, you still have to create the contact as if it were an international payee. This means you need the residential address of everyone you want to transfer money to. While you only need to enter this information once, this is a huge inconvenience when you want to make a quick payment to someone with their BSB and account number or PayID.

Revolut also doesn't allow you to create a PayID for your account if that's something you're looking to do. You should also keep in mind there's a maximum transfer limit of $1,000 per day which is considerably lower than what other banks allow.

Security

Revolut offers a number of great features in Australia that make for a really secure app. You can control the majority of your card and payment settings in the app yourself including contactless payments, ATM withdrawals, online payments, freezing card access and location-based security. So, if your card is lost or stolen you will be able to block access quickly.

The only downside I found was that the security settings took some getting used to. For example, I had to adjust the default settings to be able to use my card in the beginning. I have also found that you need to log back in to the app no matter how much time has lapsed since you closed it, which can make jumping between apps to grab payment details or amounts frustrating.

Verdict

- This account suits: People who travel often or who make regular international transfers.

- Best features: Security features, international transfers and card personalisation.

- Great features: Insights into purchases and spending and lounge passes for Premium account holders.

- Not-great features: Australian bank-to-bank transfers are more complicated than they need to be and the security features can take some getting used to. Revolut can also not be used as your main bank account just yet.

- Is it right for you? If you're considering signing up to Revolut Premium make sure you're planning on using the features on offer, otherwise the cost will outweigh the benefits.

Video review of Revolut Australia

Latest news

-

The $423 million credit card mistake Australians keep making

5 Feb 2024 |

-

Overseas credit card spending soars: how much is too much in fees?

5 Jan 2024 |

-

Amex could be accepted more widely in 2024 – here’s why

18 Dec 2023 |

-

Use it or lose it: The Virgin Australia credits expiring in December

14 Dec 2023 |

-

3 tips to manage this year’s holiday credit card spending

8 Dec 2023 |

Ask a question