MoneyGram review

- Number of Currencies

- 135+

- Minimum Transfer Amount

- $1

- Pay By

- Bank transfer, Credit card, Debit card

- Fees (Pay by Bank Transfer)

- Varies

Our verdict

Fast money transfers to 200+ countries worldwide, but watch out for weak exchange rates.

You'll most likely find MoneyGram locations at grocery stores, small corner shops and in many other places around your city. It has served nearly 150 million people across the globe in the past five years and has an extensive network of agent locations in more than 200 countries and territories. As a result, it provides customers with a range of transfer options and is often one of the fastest money transfer services. But this convenience comes at a cost in the form of more fees and weaker exchange rates than some of its smaller competitors.

Pros

-

Good for sending money almost anywhere in the world instantly and if your recipient doesn't have a bank account

Cons

-

Be wary of high fees and poor exchange rates.

Details

Product details

| Product Name | MoneyGram |

| Pay By | Bank transfer, Credit card, Debit card |

| Receiving Options | Cash pickup location, Bank account, Mobile wallet |

| Customer Service | Phone, Email |

| Maximum Transfer Amount | Varies |

| Number of Currencies | 135+ |

What do Australians think of MoneyGram international money transfer brand?

- 4.21/5 overall for Customer Satisfaction - lower than the average of 4.35

- 4.47/5 for Trust - lower than the average of 4.69

- 4.28/5 for Customer Service - lower than the average of 4.31

Based on MoneyGram international money transfer brand scores in Finder's 2024 & 2025 Customer Satisfaction Awards.

Why should I consider MoneyGram?

- Wide reach. MoneyGram has over 440,000 agent locations in more than 200 countries and territories - with partners in Australia including GSL Money Transfer, PFG Money Transfer, and Legal Remit.

- Diverse transfer options. Customers can send money online and in-person. Available payment methods include credit card, debit card, PayID, bank transfer, and cash (where supported). Transfer speed and fees vary depending on the method selected, so it's worth comparing options before sending.

- Speed. With same-day delivery available at many locations (subject to public holidays and compliance with regulatory requirements), your recipient can typically collect their cash within minutes during normal business hours when using the cash pickup service.

- Delivery options. Send money for pickup in different ways, including cash pickup, to a mobile wallet, to a bank account, and home delivery where available.

- Rewards. Sign up to MoneyGram Plus Rewards, which gives you discounts on fees every few transfers you send.

What to be aware of

- Maximum limits vary. When sending online with MoneyGram, your transfer limit will depend on the payment method, send country, destination country, and receive method selected.

- Transfer fees. As with most money transfer services, MoneyGram charges fees for international and domestic transfers. These fees vary based on the destination, transfer amount, and the selected payment and delivery methods. Fees are typically higher when paying with a credit or debit card, and lower when using bank transfer.

- Exchange rates. MoneyGram's exchange rates may vary depending on the payment method and how the funds are received. A currency exchange rate, which may include a margin, may also apply to your transaction.

- No hedging options. MoneyGram doesn't offer recurring transfers, scheduled transfers or any other hedging to help you save money.

How much are MoneyGram's transfer fees?

MoneyGram's fees vary based on the amount you are sending, destination, and payment method. You may find that sending multiple smaller transfers is more cost-effective than sending a larger amount in a single transaction, so it's worth comparing different amounts.

Paying via bank transfer and having the money delivered directly to a bank account is generally the cheapest way to send money through MoneyGram from Australia. On the other hand, paying by credit card or choosing cash pickup is typically the most expensive option, due to higher transfer fees and possible credit card charges.

How are MoneyGram's exchange rates?

MoneyGram sets its own exchange rates, which may include a margin above the mid-market rate. The actual rate you receive may change depending on how you are paying and how the money is being received.

Since these rates can fluctuate and vary by transaction, it's important to check the exchange rate and total cost shown before you confirm your transfer. You can also use the interbank rate as a benchmark for comparing the rates of other money transfer providers.

What your MoneyGram transfer could look like

Use the table below to find out more details about what making a money transfer with MoneyGram looks like. Click to Go to site button to visit MoneyGram's site and get a quote for your transfer.

Compare other products

We currently don't have that product, but here are others to consider:

How we picked theseFinder Score for money transfer

We review money transfer providers for different features to assign them a score out of 10. The higher the score, the more competitive the product.

What are the ways I can send money abroad with MoneyGram?

MoneyGram has a diverse range of transfer options. We'll go through each one and what the steps look like.

How to send money transfer online with MoneyGram

MoneyGram allows you to send money online to destinations around the world. To do so you'll need to complete the following steps:

- Visit the MoneyGram website and create an account or log in if you already have one.

- Enter your recipient's details, how they want to receive their money, and how much you want to send.

- Choose your preferred payment method. You can either pay with your credit or debit card, or directly from your bank account. Keep in mind that fees will vary depending on which payment method you choose.

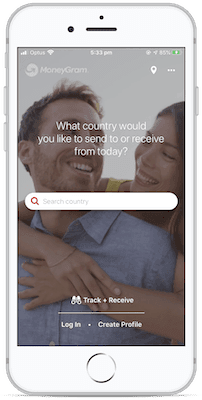

How to send money with the MoneyGram app

MoneyGram's Money Transfer app enables you to move your money around the globe.

- Download the MoneyGram Money Transfers app for free on the App Store or Google Play.

- Log in to your MoneyGram profile, or create a new one if you haven't done so already.

- Enter your recipient's details, how they want to receive their money, and how much you want to send.

- Choose your preferred payment method.

- Review and confirm all transaction details before completing your money transfer.

How to send money in-person at a MoneyGram location

Agent locations are in almost every country in the world. Take advantage of this network and send money in-person by completing the following steps:

- Find a MoneyGram agent location near you using the online "Find a Location" tool. While many agents are located in retail stores like Walmart or CVS, it's best to confirm availability before you go.

- Prepare for your agent visit by bringing your ID, your recipient's name and location, the amount to send (including fees), and, if applicable, their bank or mobile wallet details.

- To complete your transfer, fill out any necessary forms and give them along with your payment to the agent.

- Save your receipt and share the 8-digit reference number with your recipient for cash pickup, while funds sent to a bank account will be deposited directly into the account.

How can my recipient get the money?

MoneyGram has several options for how your intended recipient can get their money. You can choose from any of the following:

- Send to a bank account. Your recipient can receive funds directly in their bank account. Transfer times may vary depending on the receiving bank and country.

- Send as a cash pickup. You can opt for the funds to be picked up in cash at a MoneyGram location. The money will be ready at your chosen location within minutes after you've sent it.

- Send to a mobile wallet. A mobile wallet is a place to store funds digitally, with actual wallet types varying by country and user preference.

- Doorstep delivery. In some locations, you can choose home delivery as a receiving method. Your money will be delivered by a local MoneyGram agent.

- Pay bills through MoneyGram. MoneyGram supports bill payment to utility companies, credit cards and more. Use the online bill pay search to find out if the company you want to pay is supported by the MoneyGram network.

What payment methods does MoneyGram accept?

When sending money online, payments can be made via bank account, credit card, or debit card. For in-person transfers at a MoneyGram agent location, payment by cash is also accepted.

How long does an international transfer with MoneyGram take?

Transfer speed with MoneyGram varies based on the payment method and destination country.

If you choose to pay with a debit or credit card, you may pay higher fees, but your transfer is typically processed more quickly, often within minutes. Just keep in mind, your credit card may charge additional fees, such as cash advance charges, which can increase the total cost of your transfer.

Money transfers paid via bank transfer are typically cheaper but may take longer to process. Online bank transfers are usually processed in real time, but it can take up to 2 business days, especially around weekends or public holidays. For your first transfer through MoneyGram, you may need to verify your account. Most accounts are approved and opened within seconds of submitting the application, but if additional information is required, verification may take longer.

Transfers typically take![]()

2 days

Is MoneyGram safe to use?

MoneyGram prioritises protecting your banking information when you make a transfer. It has established a reputation for secure transfers with a number of safeguards.

- Established and licensed. Founded in 1940, MoneyGram is a licensed money transmitter that's successfully completed millions of transfers.

- Tracking. You can easily track your transfer online by entering your last name and the authorization or reference number in your confirmation.

- Secure connection. Moneygram's website uses physical, technical and administrative security measures to protect your information.

Money transfer scams

MoneyGram has increased its fraud prevention protocols to keep customers safer. It does this by monitoring transactions, educating customers on the dangers of money transfer fraud and providing numerous resources to customers to report potential fraud.

Common consumer scams, according to MoneyGram, include:

- Tax Extortion Scam. A person claiming to be from a government agency asks for money to cover back tax debts owed. To do so, the person claims you must send money or send a prepaid card to a "government account."

- Refund scams. A person claims to be working for a consumer protection agency and promises to help you get a refund from the agency, sent directly to your bank account.

- Disaster relief. After a major disaster, scammers set up fake charities and ask for donations through wire transfers.

- Foreign lottery. A person contacts you claiming you won a foreign lottery or sweepstakes, but due to international tax laws requires you to pay a fee upfront to claim your price.

Fraud can be reported through MoneyGram's website.

More on money transfer scams and how to avoid them

Does MoneyGram have a mobile app?

Yes, MoneyGram has an app on both Google Play and the App Store. The app makes it possible to:

- Log in using biometrics. Both face and fingerprint recognition can be used to log in.

- Check exchange rates on the go. Current currency exchange rates and fees can be found in the app.

- Track a transfer. You can share your transfer reference number with your recipient, so they can easily track the status of the transfer online.

- Find an agent location using GPS. Use the in-app map to find agent locations based on your GPS or around the world.

| Reviews accurate as of 8 October 2025 | |

|---|---|

| Google Play Store | 3.9 out of 5, based on 119K ratings |

| Apple App Store | 4.9 out of 5, based on 604K ratings |

How does MoneyGram compare to other services?

Compare other products

We currently don't have that product, but here are others to consider:

How we picked theseFinder Score for money transfer

We review money transfer providers for different features to assign them a score out of 10. The higher the score, the more competitive the product.

Want to compare MoneyGram with other services side-by-side?

Frequently asked questions

Sources

Your reviews

Andrew Finder

Editor

You are about to post a question on finder.com.au:

- Do not enter personal information (eg. surname, phone number, bank details) as your question will be made public

- finder.com.au is a financial comparison and information service, not a bank or product provider

- We cannot provide you with personal advice or recommendations

- Your answer might already be waiting – check previous questions below to see if yours has already been asked

Finder only provides general advice and factual information, so consider your own circumstances, or seek advice before you decide to act on our content. By submitting a question, you're accepting our Terms Of Service and Finder Group Privacy & Cookies Policy.

This site is protected by reCAPTCHA and the Privacy Policy and Terms of Service apply.

Jeni Velasco Finder

May 11, 2018

Hi Nawa,

Thank you for getting in touch with finder.

Sending money overseas with MoneyGram is simple. All you need to do is log in to your account on MoneyGram’s official website and specify the amount you’re transferring, and then accept the quote. You can either pay with your credit or debit card, or directly from your bank account-doesn’t matter if that’s a US bank account or from Australia.

Make sure that your receiver have the reference number – his number is on the receipt and included in confirmation emails for online transfer, and I.D. with him for pick-up – bring a valid photo I.D. (passport, national I.D. or residence permit) and may also be asked to provide proof of your address (bank statement or utility bill).

I hope this helps.

Have a great day!

Cheers,

Jeni

Show more Show less

Donnie

January 03, 2018

I am Donald, my wife is in Aus and am here in Nigeria, can she send me $10,000 at money gram shop in a day?

Rench Finder

January 04, 2018

Hi Donnie,

Thanks for your inquiry. Please note that we are not affiliated with Moneygram or any company we feature on our site and so we can only offer you general advice.

Yes, she can transfer $10,000 AUD to Nigeria in a day with MoneyGram money transfer.

MoneyGram has a minimum transfer amount of $250, meaning it can’t be used for small transfers, and has a large maximum of $100,000.

MoneyGram charges a flat transfer fee. If you’re transferring under AUD$10,000, you’ll be charged a flat fee of AUD$15 per transfer.

Best regards,

Rench

Show more Show less

Hughes

September 28, 2016

Can I send $2000 to Indonesia?

May Finder

September 28, 2016

Hi Hughes,

Thanks for your question.

Yes, you can. To start the process, please register for a free account first with MoneyGram on their website. The registration will require you to enter a few details about yourself, including whether you’ll be making bank account to bank account transfers or cash transfers.

Cheers,

May

Show more Show less

Genevieve

August 11, 2016

Can I cancel a MoneyGram? If so, how?

Shirley Liu Finder

August 11, 2016

Hi Genevieve,

Thanks for your question.

You generally can’t cancel your Moneygram transfer unless you suspect fraud.

To cancel your Moneygram transaction, please call 1800 049 087.

KIGOZI

August 04, 2016

my auntie from Houston sent me money but the email she used were she had to get the confirmation code is block,she had done the all process.want can she do?I have received the money because I haven’t got the reference number.

Shirley Liu Finder

August 04, 2016

Hi Kigozi,

Thanks for your question.

Please contact MoneyGram directly about this enquiry, they should be able to track the transfer for you using other means, like your Auntie’s full name / driver’s licence.

Nawa

May 11, 2018

Can I send money from the USA bank without using moneygram agent to Moneygram branch in Taiwan for cash pickup? What are the requirements?