MasterRemit review

We currently don't have this product on Finder

- Number of Currencies

- 23 (number of countries: 29)

- Minimum Transfer Amount

- $1

- Pay By

- Bank transfer, Credit card, Debit card

- Fees (Pay by Bank Transfer)

- From $0

Summary

Enjoy real-time international money transfers with MasterRemit.

MasterRemit offers a convenient way of making transfers to countries situated in the Middle East, Africa, South Asia and Southeast Asia. If you're specifically looking to make payments through a debit or credit card, through Internet banking or through a mobile wallet service, MasterRemit could be a good choice for you. Just be aware that it has particular destinations it supports and places a limit on how much you can transfer at any one time.

Pros

-

Good for exchange rates that are more competitive than rates from the major banks

Cons

-

Not so great if you want to remit popular currencies like CNY.

Details

Product details

| Product Name | MasterRemit |

| Pay By | Bank transfer, Credit card, Debit card |

| Receiving Options | Cash pickup location, Bank account, Mobile wallet |

| Customer Service | Phone, Email |

| Maximum Transfer Amount | Unlimited |

| Number of Currencies | 23 (number of countries: 29) |

Why should I consider MasterRemit?

- Speed. MasterRemit promises real-time transaction processing to help your money reach the recipient.

- Regulation. MasterRemit is headquartered and licensed in Australia.

- Competitive rates. MasterRemit offers market-beating exchange rates, especially for destination countries in Africa.

- Refer a friend. Invite a friend and earn 75 AUD for every friend that you invite who transfers at least 300 AUD. Your friend will also get 30 AUD.

What to watch out for

- Limited reach. It allows a limited number of destination countries and currencies for remittance.

- Transaction limits. MasterRemit limits how much you can transfer at any one time.

How much are MasterRemit's transfer fees?

MasterRemit's fees depend on a number of factors including:

- Amount

- Destination

- The currency you are sending

Fees can range from $0 to $27.20 depending on your destination country. You may also incur some third-party charges such as fees from financial institutions for receiving wire transfers. You'll need to check with your recipient's bank to find out how much this will be.

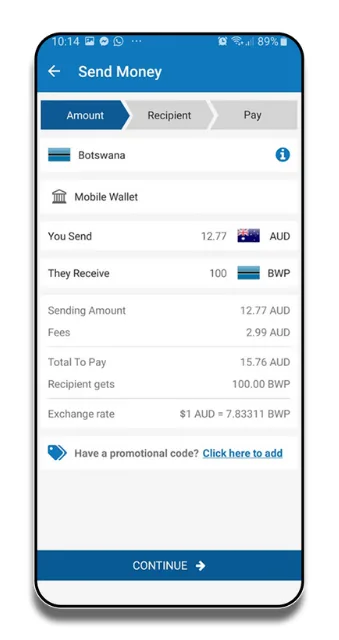

What your transfer with MasterRemit could look like

Compare other products

We currently don't have that product, but here are others to consider:

How we picked theseFinder Score for money transfer

We review money transfer providers for different features to assign them a score out of 10. The higher the score, the more competitive the product.

How are MasterRemit's exchange rates?

MasterRemit does include a small mid-market margin markup on its exchange rate. This will vary depending on your transfer destination. However, unlike traditional money transfer services that make most of their profit on the spread )the difference between the price your receive for a transaction and the price it actually costs companies to complete that trade), it seems that MasterRemit generally makes its profit from the fees it charges.

What are the ways I can send money abroad with MasterRemit?

There are numerous ways to send money with MasterRemit. However, these are also largely dependent on where you are sending money. Some of these methods include the following:

How to make an international money transfer with MasterRemit

Making a transfer through MasterRemit is a simple process. Here's how it works:

How long does an international transfer with MasterRemit take?

According to MasterRemit, most of its money transfers are sent within minutes since there are zero banking intermediaries. Some of its transfers might take longer, but these can be tracked via real-time status updates to your email.

Do note that your bank may take extra time to transfer money to MasterRemit when you're setting up the transfer. MasterRemit will only start your money transfer once it has received the funds from your bank account.

Transfers typically take![]()

Minutes

Is MasterRemit safe to use?

MasterRemit was established in 2019 and is regulated by the Australian Securities and Investments Commission (ASIC). It uses SSL technology and 2-factor authentication as well as advanced Know Your Customer (KYC) and Anti-Money Laundering (AML) compliance features to protect its customers.

Due to regulation by ASIC, MasterRemit has to keep its customers' funds separate from its own. This means that should the company have any financial difficulties, your funds are protected.

What payment methods are accepted?

You can pay for your international money transfer with MasterRemit using the following methods:

- Credit/debit or prepaid card (only Visa and Mastercard)

- Bank transfer

Is there a MasterRemit app?

Yes, MasterRemit has an app on both Google Play and the App Store. The app makes it possible to:

- Check exchange rates on the go. Current currency exchange rates and fees can be found in the app.

- Make instant transfers. Send money to your loved ones at home within minutes.

- Track your orders in real-time. Stay up to date on the progress of your transfer with real-time updates on your app dashboard.

| Ratings accurate as of 17 August 2023 | |

|---|---|

| Google Play | 4.8 out of 5 - based on 109 customer ratings |

| Apple App Store | 4.6 out of 5 - based on 34 customer ratings |

How does MasterRemit compare to other money transfer services?

Compare other products

We currently don't have that product, but here are others to consider:

How we picked theseFinder Score for money transfer

We review money transfer providers for different features to assign them a score out of 10. The higher the score, the more competitive the product.

Frequently asked questions

Sources

Your reviews

Kate Finder

Money expert

You are about to post a question on finder.com.au:

- Do not enter personal information (eg. surname, phone number, bank details) as your question will be made public

- finder.com.au is a financial comparison and information service, not a bank or product provider

- We cannot provide you with personal advice or recommendations

- Your answer might already be waiting – check previous questions below to see if yours has already been asked

Finder only provides general advice and factual information, so consider your own circumstances, or seek advice before you decide to act on our content. By submitting a question, you're accepting our Terms Of Service and Finder Group Privacy & Cookies Policy.

This site is protected by reCAPTCHA and the Privacy Policy and Terms of Service apply.