Why should you consider iRemit?

- Fast transfers. Your recipient can withdraw money from all local ATMs within minutes of loading the iRemit Visa Card.

- Mobile-optimised. Download the iRemit app to easily transfer money on your device.

- Global presence. iRemit is available in over 39 countries to send money to the Philippines.

What to watch out for

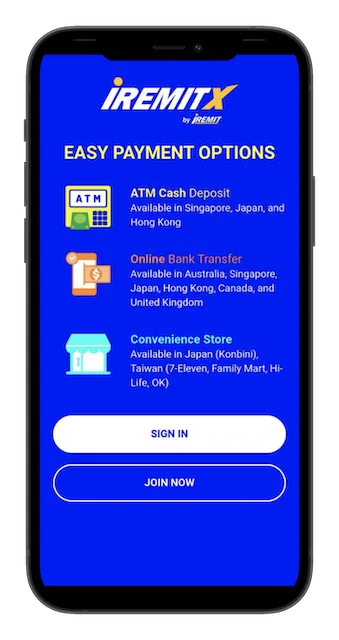

- Limited payment options. If you’re located in Australia, funds can only be sent using online bank transfers or deposited in-person at a branch.

- Single branch. iRemit in Australia has one branch located in Perth, which is inconvenient if you need to send money in-person.

- Limited currencies available. Seven currencies can be converted into Philippine peso - including Australian Dollars, Japanese Yen, British Pounds, Hong Kong Dollars, Canadian Dollars, New Taiwanese Dollars and Singaporean Dollars.

- No transparency in fees. You won’t see the full breakdown of fees until you confirm your transfer.

- Limited transfer amount in app and online. You’re limited to sending up to $9,999 unless you’ve set up your transfer at an office or with an agent.

iRemit’s exchange rates and fees

A remittance fee of $8 is charged for each credit card to bank transfer, which is not clear from the payment calculator on iRemit's homepage. For cash pickups, this fee is $9. Your exchange rate will be locked in until 23:59:59 of the day that you confirm your transaction.

The breakdown of fees is shown right before you confirm the transaction. No other fees will be applied.

Calculate how much your transfer with iRemit could cost

Compare other products

We currently don't have that product, but here are others to consider:

How we picked theseFinder Score for money transfer

We review money transfer providers for different features to assign them a score out of 10. The higher the score, the more competitive the product.

How long does an iRemit money transfer take?

iRemit money transfer times depend on what service you choose.

- Loading funds onto the iRemit Visa Card: minutes

- Online bank transfers: 4 Filipino working days

- Door-to-door delivery: up to 14 days

- Cash pickup: 24 hours

Is iRemit safe to use?

iRemit gives users tips on how to stay aware of security and fraud practices. It encourages customers to contact iRemit in the case of suspicious fraudulent activity.

- iRemit may call customers to verify certain details regarding a transaction.

- iRemit is regulated by Bangko Sentral ng Pilipinas and the Securities and Exchange Commission.

What iRemit’s reviews say

iRemit has received a number of negative to average reviews on Trustpilot. General feedback included bad customer service and transaction delays. One reviewer talked about difficulties in sending less than $200 despite no minimum limit. As of 6 March 2023, it is rated 1.6 out of 5 stars.

What payment methods does iRemit accept?

iRemit accepts two payment methods:

- Transfer from a bank account

- Over-the-counter payment at a branch

What are the ways you can send money with iRemit?

Customers can make payments with iRemit in four methods.

- Credit bank transfer. Funds can be transferred as credit into the recipient’s bank account.

- Cash pickup. The beneficiary can pick up the cash from an iRemit branch 24 hours after the deposit.

- Home delivery. Funds can be delivered to the recipient’s door.

- iRemit or Chinatrust Visa Card. Recipients can withdraw the money from their Sterling Bank of Asia account using the iRemit Visa Card. The same can be done using a Chinatrust Visa Card.

What do you need to send money online through iRemit?

You’ll need a few key pieces of identification before you can send money through iRemit:

- An iRemit account. Creating an account is free.

- Photo ID. Valid ID is required to transfer with iRemit. Acceptable forms are your passport or driver’s licence.

- Beneficiary’s name and contact information. You will need to enter your beneficiary’s name, contact and payment details to confirm the transaction.

How to make your first transfer with iRemit

- Log into your account and go to “Send Money”.

- Enter the amount you want to send.

- Select the method of transfer.

- Choose the source of transfer.

- Enter recipient’s information.

- Enter payment information.

- Send money.

Reviewer's experience with signing up

The first stage of signing up – inputting personal information – was straightforward. However, verifying my ID took longer than expected. There is no option to upload photo evidence. It can only be submitted by taking a photo with your device at the time of verification which lagged considerably.

Like many other reviewers, my app experienced delays and the website did not have an intuitive design. Apart from this, the rest of the app worked as I expected.

How to track an iRemit transfer

You can track the status of your transfer by contacting iRemit’s customer service team and quoting the reference number. You can also do this online by checking the "My History" tab once you are logged into your account.

Is there an iRemit app?

Yes, IREMITX is the company's app and is available on the App Store and Google Play. Through the app, you can:

- Send money. Choose from different payment options for sending your money.

- Make payments. Manage payments for Philippine government contributions, insurance premiums, real estate authorisations and more.

- Shop. Make purchases from selected partners such as food stores and gift retailers.

- View your history. Get a list of past transactions for your records.

The app has mixed reviews, with the latest posts complaining about slow load times. iRemit's customer service team has acknowledged this, claiming that it is caused by an ongoing system upgrade. There is no indication of when it will be completed at the time of writing.

| Ratings accurate as of 6 March 2023 | |

|---|---|

| Google Play | 4.2 out of 5 – based on 388 customer ratings |

| Apple App Store | 2.2 out of 5 – based on 88 customer ratings |

How does iRemit compare to other services?

Compare other products

We currently don't have that product, but here are others to consider:

How we picked theseFinder Score for money transfer

We review money transfer providers for different features to assign them a score out of 10. The higher the score, the more competitive the product.

Bottom line

iRemit offers basic money transfer services to the Philippines. Once registered, you will be able to easily manage your transfers on the go through the app. But if you want greater flexibility and transparency to transfer larger amounts, check out what other services are available that meet your money needs.

Frequently asked questions

Sources

Ask a question

More guides on Finder

-

How to open a bank account in the UK from Australia

The steps you need to follow to open a UK bank account as an Australian.

-

Revolut international money transfer review

Find out whether Revolut is the right choice when you need to send money overseas.

-

Western Union vs MoneyGram

To find the best rate for your next money transfer, check out our comparison of the fees, exchange rates and transfer speeds of Western Union and MoneyGram.

-

Best money transfer services for 2026

If you're looking to transfer money out of Australia, read our guide on the six best transfer companies.

-

Revolut vs Wise (TransferWise)

Compare Revolut with Wise on speed and cost to see which is best for your next money transfer.

-

OFX review

Read our review of OFX and see if it’s right for your next international money transfer.

-

IBAN vs SWIFT: how bank codes work

You’ve likely encountered these codes when sending money worldwide. But what are they and how do they help?

-

OrbitRemit international money transfers

Read our detailed review of OrbitRemit international money transfers, including exchange rates, fees, payment methods and safety.

-

MoneyGram review

We go into detail on MoneyGram's fast transfers to 200+ countries and territories worldwide.

-

CurrencyFair review

Check out our comprehensive review of CurrencyFair international money transfers, including fees, exchange rates, security and transfer times.