CurrencyFair review

We currently don't have this product on Finder

- Number of Currencies

- 24

- Minimum Transfer Amount

- $10

- Pay By

- Bank transfer, BPAY

- Fees (Pay by Bank Transfer)

- €3

Our verdict

"Bank-beating" transfers in 20+ currencies and 150+ countries.

CurrencyFair helps users access better exchange rates than traditional banks (up to 8x cheaper in some cases, it claims) through its peer-to-peer currency exchange marketplace and simple online transfer process. It offers one-off or recurring transfers, allowing customers to exchange funds at competitive rates before sending them to their recipients.

CurrencyFair applies an exchange rate margin on the amount being converted, along with a flat transfer-out fee (for example, €3 or the local equivalent). Australian customers can also fund their accounts via bank transfer or BPAY.

Pros

-

Same-day transfers for most major currencies

-

Low fees and competitive exchange rates

Cons

-

No cash‑pickup or mobile wallet options; bank transfers only

Details

Product details

| Product Name | CurrencyFair |

| Pay By | Bank transfer, BPAY |

| Receiving Options | Bank account |

| Customer Service | Phone, Live chat, Email, In person |

| Maximum Transfer Amount | $10,000,000 |

| Number of Currencies | 24 |

Why should I consider CurrencyFair?

- Competitive exchange rates and fees. CurrencyFair claims that, on average, the cost of sending a transfer is around 0.53% of the transaction amount. This is much less than what you would pay to send funds overseas using your bank.

- Mobile app available. If you need to send money on the go, CurrencyFair offers a mobile app for Android and Apple devices.

- Security / regulation. CurrencyFair is regulated in Australia by ASIC, holds an Australian Financial Services Licence (AFSL No. 402709).

What to be aware of

- Only supports major currencies. While CurrencyFair does support a decent range of currencies, you'll need to look elsewhere if you want to send money overseas in a rare currency.

- Costs may increase with larger transfers. Total costs can increase when sending larger transfers due to the exchange rate margin and flat fee.

- Limited payment methods. Credit card and cash payments are not accepted.

How much are CurrencyFair's transfer fees?

When it comes to making an international money transfer with CurrencyFair, there are two transfer fees you'll need to be aware of:

- A flat fee. This varies depending on the currency you send but is the equivalent of €3.

- A fee calculated as a percentage of your transaction amount. CurrentlyFair typically adds just 0.53% to the mid-market exchange rate, compared to the 3% to 6% markup, often added by traditional banks.

If you sign up for a CurrencyFair account online, your first 10 transfers are free for the first 6 months.

What your transfer with CurrencyFair could look like

Compare other products

We currently don't have that product, but here are others to consider:

How we picked theseFinder Score for money transfer

We review money transfer providers for different features to assign them a score out of 10. The higher the score, the more competitive the product.

Check if there are any CurrencyFair promo codes available

How are CurrencyFair's exchange rates?

CurrencyFair operated as a peer-to-peer currency exchange service, allowing users to set their preferred exchange rate and wait for a match with someone exchanging. While this option is no longer available, CurrencyFair typically completes the exchange at a competitive rate.

What are the ways I can send money abroad with CurrencyFair?

CurrencyFair only offers bank account transfers. If you want to send an instant cash transfer, you'll need to consider other providers.

How to create an account with CurrencyFair

To make an online money transfer with CurrencyFair, you first need to register an account. It's free to do, just complete the following steps:

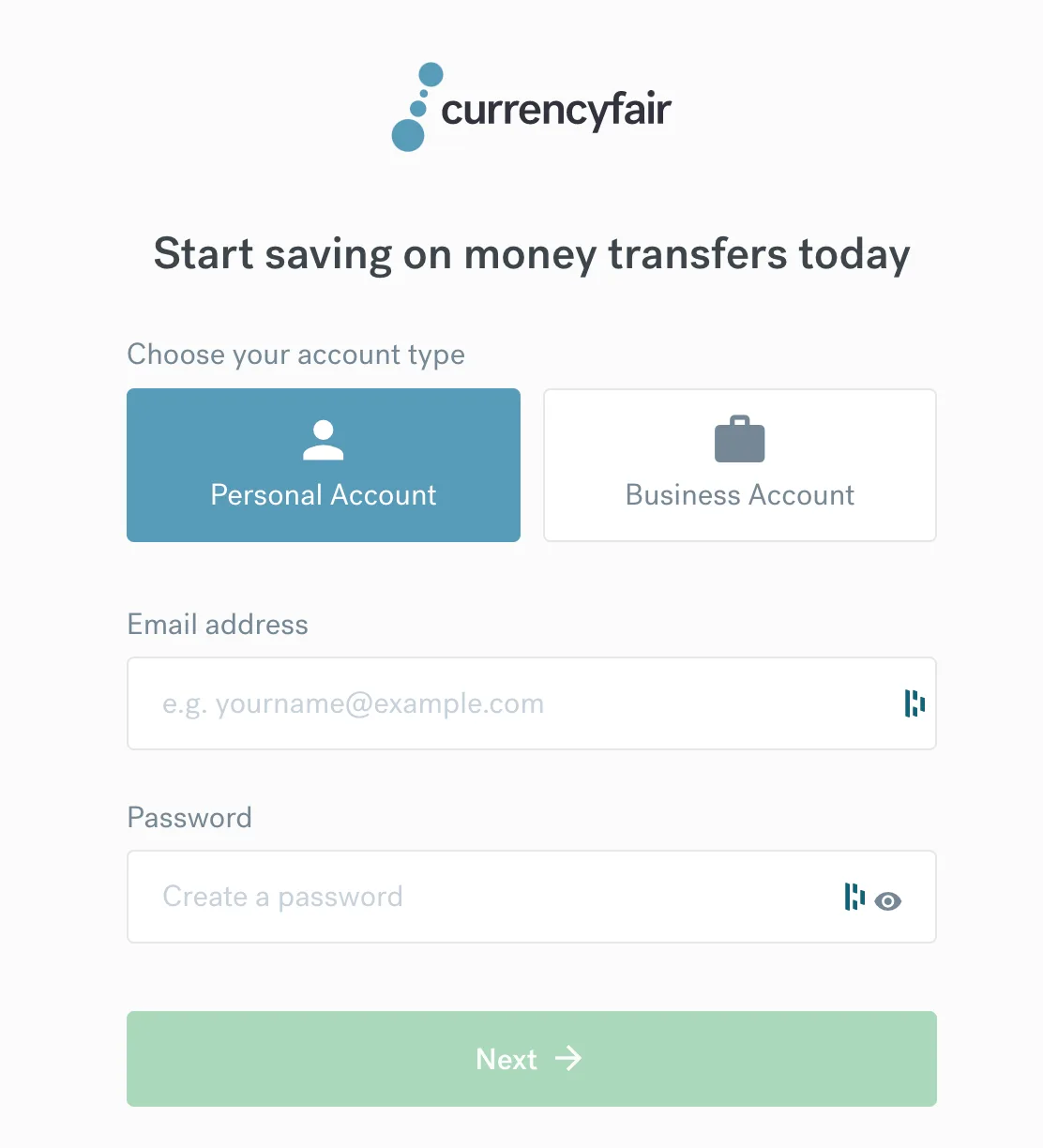

- Visit the CurrencyFair website and click the "Sign Up" link.

- Choose the type of account you want to open (personal or business), enter your email address and create a password.

- Provide your name, country of residence and why you're signing up for a CurrencyFair account. You'll also need to read the Terms and Conditions and other essential documents provided. Click "Create Account" when you're done.

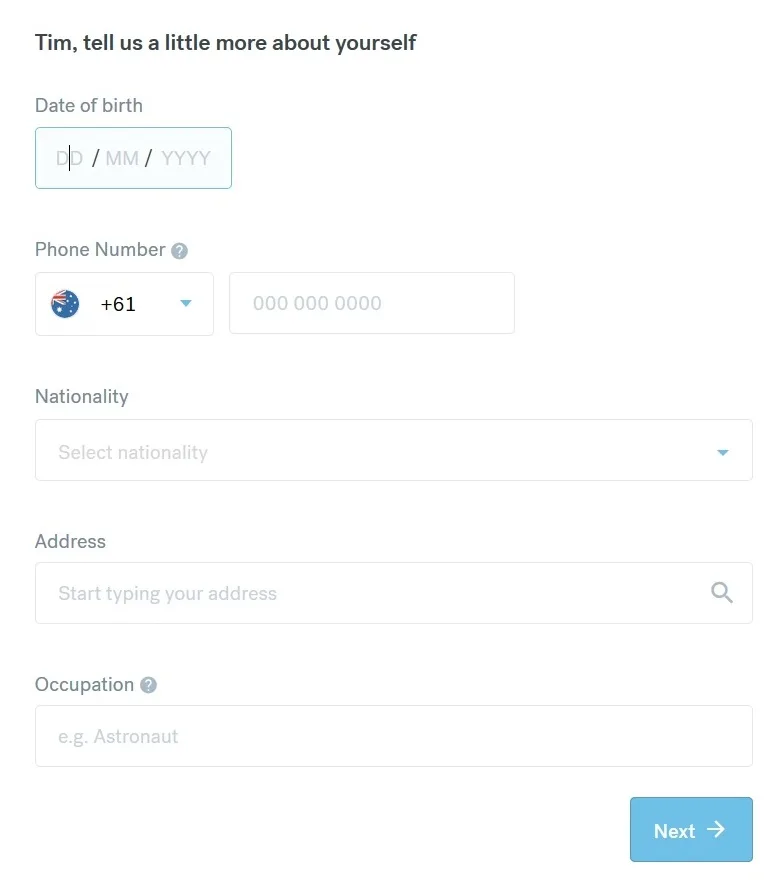

- Enter your date of birth, phone number, address, nationality and occupation.

- The final step is to verify your identity. You'll need to submit a photo ID, such as your driver's licence, National ID, or passport, and provide proof of address.

How to make an international money transfer with CurrencyFair

Once your account is set up, you can send a transfer by completing the following steps:

- Log in to your account, enter the amount you want to transfer, and review the available currency options.

- Enter the bank account information of the person or business you're sending money to.

- Select how you'll transfer the money to your CurrencyFair account. Choose your payment method - this is typically by bank transfer or BPAY. CurrencyFair will provide the deposit details, including your reference number.

- Once your funds arrive, CurrencyFair will exchange them at the available rate and transfer them to your recipient.

What are CurrencyFair's payment options?

You can deposit funds into your CurrencyFair account via two methods:

- Online bank transfer

- BPAY

How long does a transfer with CurrencyFair take?

The time it takes for your funds to arrive in your CurrencyFair account depends on the currency and deposit method used.

- Deposits in AED, CAD, CHF, CZK, DKK, HUF, NOK, NZD, PLN, SEK, USD, and ZAR are generally received within 1-2 business days.

- Deposits in EUR, GBP, HKD, and SGD usually arrive on the same day or the next business day.

- Deposits in VND may take up to 3 business days.

Transfers typically take![]()

24 hours

Is CurrencyFair safe to use?

- Regulation: Regulated in Australia by ASIC, AFSL No. 402709

- Established: 2009

- Security: Customer funds are kept in separate accounts, ensuring they remain protected and can be repaid to customers if CurrencyFair becomes insolvent.

- Reviews: TrustScore of 4.3 out of 5 from more than 9,700 reviews on Trustpilot (as of 10 October 2025).

CurrencyFair is based in Ireland and regulated by the Central Bank of Ireland. Its Australian branch, CurrencyFair Australia Pty Ltd, is regulated by the Australian Securities & Investments Commission.

As part of the regulatory process, the Irish Central Bank requires CurrencyFair to maintain a minimum level of assets at all times. The company also keeps client funds in segregated accounts with major financial institutions, and requires two-factor authentication for specific actions, such as sending a transfer.

Finally, CurrencyFair claims that all customer information is stored in a secure facility which is safeguarded around the clock.

How does CurrencyFair compare to other providers?

Compare other products

We currently don't have that product, but here are others to consider:

How we picked theseFinder Score for money transfer

We review money transfer providers for different features to assign them a score out of 10. The higher the score, the more competitive the product.

Want to compare CurrencyFair with other services side-by-side?

Frequently asked questions

Sources

Your reviews

Tim Finder

Writer

You are about to post a question on finder.com.au:

- Do not enter personal information (eg. surname, phone number, bank details) as your question will be made public

- finder.com.au is a financial comparison and information service, not a bank or product provider

- We cannot provide you with personal advice or recommendations

- Your answer might already be waiting – check previous questions below to see if yours has already been asked

Finder only provides general advice and factual information, so consider your own circumstances, or seek advice before you decide to act on our content. By submitting a question, you're accepting our Terms Of Service and Finder Group Privacy & Cookies Policy.

This site is protected by reCAPTCHA and the Privacy Policy and Terms of Service apply.

Joshua Finder

August 27, 2018

Hi Nina,

Thanks for getting in touch with finder. I hope all is well with you. :)

Yes, it is possible for you to send money from Australia to Micronesia. The only fee you need to worry about is 3 Euros for each transfer. Please remember as well that CurrencyFair adds a small margin to each transfer when converting currencies. CurrencyFair doesn’t have any limit maximum transfer amount.

I hope this helps. Should you have further questions, please don’t hesitate to reach us out again.

Have a wonderful day!

Cheers,

Joshua

Show more Show less

Caroline

November 16, 2016

hi

I would like to transfer $17350 American dollars from Egypt to Australia , same currency , how can I do that

thank you

Harold Jacob Finder

November 16, 2016

Hello Caroline,

Generally, you open an account with the service, deposit the money you want to send via your local bank account so you’re not charged any fees. Then, you indicate what country you want to send the funds to by providing the recipient’s IBAN/SWIFT number, BSB and account number. The service then processes the transaction for you usually at a better exchange and lower fees due to economies of scale. Also, you may want to check our international money transfer guide for your reference.

I hope this information has helped.

Cheers,

Harold

Show more Show less

Carol Miers

October 20, 2016

Please can you tell me how I can transfer British Pounds to a Bank account in Kenya that is in US dollars? I have a currency fair account. Thank you

Clarizza Fernandez Finder

October 24, 2016

Hi Carol,

Thanks for your question.

You will need to first open a CurrencyFair account then send your funds to the client account. Next, you convert your funds into your chosen currency, and then you give CurrencyFair the account details to receive your funds. You can open an account with CurrencyFair direct from our site by clicking the ‘Go to site’ button. You will be taken to the CurrencyFair website where you can select the currency you will be sending and the currency your recipient will receive.

Hope this has helped.

Regards,

Clarizza

Show more Show less

alic

July 31, 2016

can I send money from Kenya to Norway and how do I go about it

May Finder

July 31, 2016

Hi Alic,

Thanks for your inquiry.

Unfortunately, sending money from Kenya to Norway through Currency Fair is not possible. But you can send through Western Union, Worldremit and Moneygram.

Cheers,

May

Sunny

April 17, 2016

Can i send from Singapore dollars in Singapore bank to Canadian dollars in Vancouver

Shirley Liu Finder

April 19, 2016

Hi Sunny,

Thanks for your question.

You can send money from Singapore to Canada with CurrencyFair, though you can only conduct this online and not through a Singaporean bank.

When you open a CurrencyFair account you’ll be asked to deposit funds.

If you conduct it through your bank it’s likely to be a bank international money transfer instead.

Show more Show less

Nina

August 21, 2018

Hi, I am about to move to Micronesia (currency USD). I plan to open a local bank account, but will still need to transfer money from my Australian bank account to the Micronesian one. Is this possible with currencyFair and how much would I likely be charged in fees for a $1000 AUD transfer?

Thanks.

Show more Show less