In this guide

- Our verdict

- Details

- Product details

- Your reviews

Binance Australia review

- Regulator registration

- AUSTRAC

ASIC - Supported assets

- 446

- Fiat currencies

- 98

Our verdict

Find out why Binance is more than just a cryptocurrency exchange.

Binance is the world's largest exchange by trade volume, offering over 440 cryptocurrencies and twice as many trading pairs. It’s been operating a dedicated Australian service since 2020 and is registered with AUSTRAC.

Binance pushes the limits of what a cryptocurrency exchange can offer. Traders have access to instant swaps, a fully featured spot market, P2P and margin trading. Investors can earn yield on their coins in a number of ways or take advantage of automated tools like recurring buys and a rebalancing bot.

There's a number of innovative features like a launchpad for early-stage investing, a learn and earn hub, an NFT marketplace and even access to DeFi services.

Importantly, in January 2026, Binance began restoring Fiat on/off-ramp via PayID & Bank Transfer for all users. This is a simple way for people to move real-world money in and out of their crypto account, using PayID or a bank transfer.

Binance are working closely with banking partners to gradually roll this out, with users benefitting from quicker, cheaper and less clunky transactions, along with stronger safeguards to protect your funds.

Customer service can be accessed through live chat and is quick to respond, although you will need to ‘talk’ to a bot first.

Pros

-

Insurance fund. Binance has been operating an emergency insurance fund since 2018. The fund includes cryptocurrencies and so its value changes inline with the market. In 2022 Binance topped up the fund to a value of US$1 billion.

-

Complies with the Australian Transaction Reports and Analysis Centre regulations in Australia. AUSTRAC is the peak body for regulating cryptocurrency exchanges in Australia which requires Binance Australia to comply with laws and regulations that are intended to provide certain protections for users.

-

Over 440 cryptocurrencies supported. Binance Australia supports 440+ assets, which should give you a good range of industries and asset types to invest in without needing to hop between multiple exchanges.

-

Supports a range of payment methods. Binance Australia supports several popular payment methods including AUD deposits via Credit card, Debit card and PayID.

-

Customer support available via live chat. Binance Australia is contactable through live text chat customer support.

Cons

-

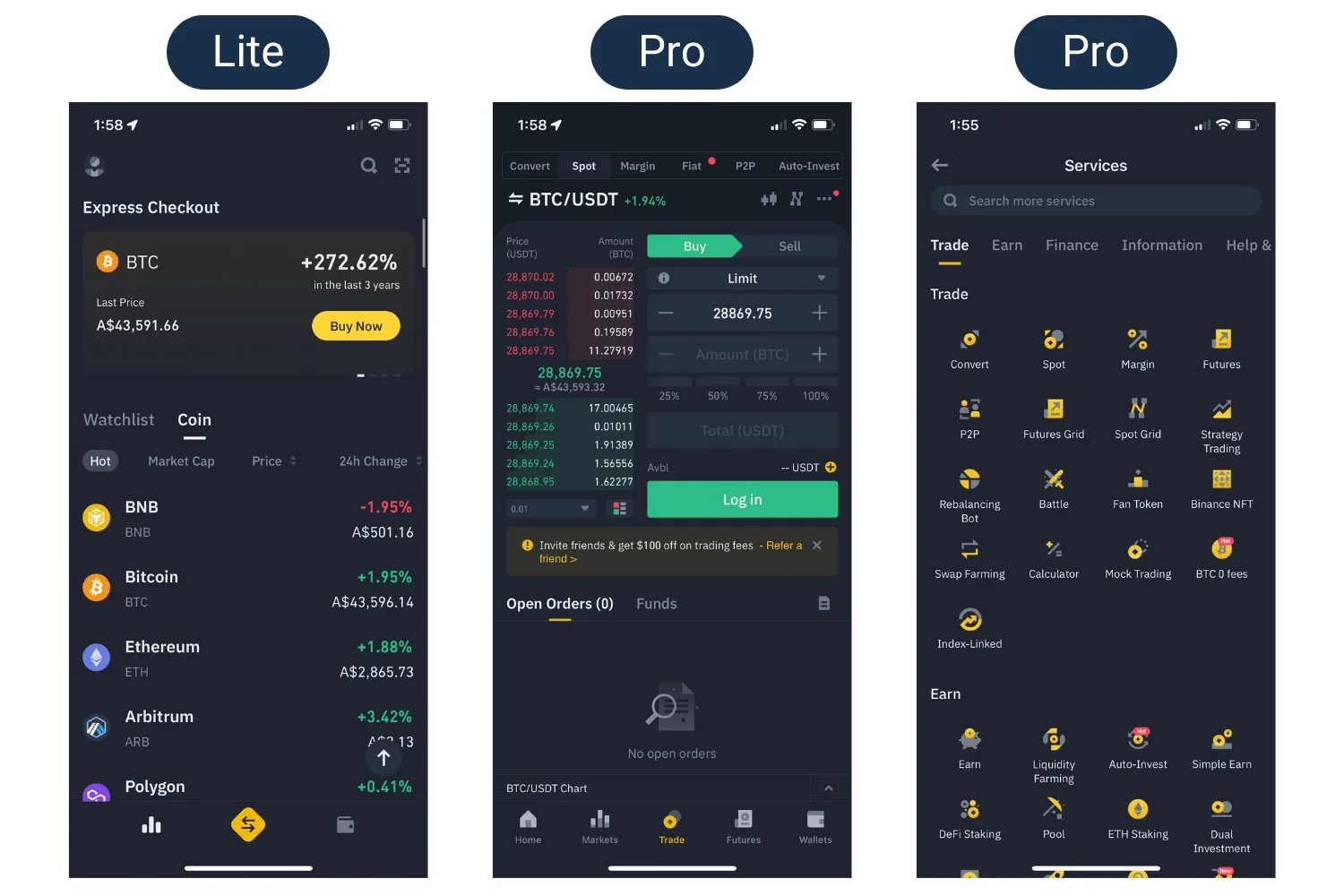

Overwhelming UI. Binance's great strength is its enormous range of features, although this can be overwhelming for new users. The Binance App offers a Lite mode which simplifies the user experience and can be a good starting point for beginners.

In this guide

- Our verdict

- Details

- Product details

- Your reviews

Details

Product details

| Product Name | Binance Australia |

| Fiat Currencies | AUD, EUR, GBP, USD, JPY, CAD, NZD, CHF, KWD, AED & 88 more |

| Cryptocurrencies | BTC, ETH, USDT, BNB, XRP, SOL, USDC, TRX, DOGE, ADA & 436 more |

| Deposit Methods |

Bank transfer Credit card Cryptocurrency Debit card PayID |

| Trading Fee |

Maker: 0.10% Taker: 0.10% |

| Deposit Fees | Cryptocurrency: None |

| Withdrawal Fees | Cryptocurrency: Fees vary |

Congratulations, Binance Australia!

The Binance Australia was highly commended for Best Advanced Crypto Trading Platform in the 2025 Finder Awards.

Full list of 2025 winnersAbout Binance Australia

Binance was launched in 2017. In the years since its launch, it has become the number one exchange in the world by trading volume.

It has operated a dedicated Australian service since 2020 and registered with AUSTRAC the same year.

In 2020, Binance built on its success and launched the Binance Smart Chain (BSC). BSC is a blockchain network that enables smart contracts and decentralised applications (dApps).

Binance Australia supported assets

Binance Australia supports over 445 cryptocurrencies, but some notable assets are missing. Namely, Lido Staked Ether, LEO Token and USDS, which are in the top 20 cryptos by market cap. In total, 17 of the top 20 cryptos are available on Binance Australia.

Popular assets on Binance Australia-

- BTC

- ETH

- XRP

- BCH

- XVG

- LTC

- ADA

- XLM

- TRX

- NEO

- DASH

- VET

- USDT

- ETC

- ICX

- QTUM

- BNB

- ZEC

- ZIL

- LSK

- ONT

- STEEM

- ZRX

- SC

- WAN

- DCR

- DOGE

- IOST

- DGB

- BAT

- LRC

- ARK

- ARDR

- PIVX

- KNC

- GAS

- BNT

- FUN

- SYS

- LINK

- POWR

- HOT

- NEXO

- MANA

- RLC

- REQ

- THETA

- CVC

- STORJ

- GTC

- ZEN

- ENJ

- GNO

- MTL

- DENT

- DATA

- ADX

- UTK

- RVN

- MLN

- DAI

- STX

- AMP

- ATM

- MDT

- NMR

- TUSD

- DOT

- NTRN

- BIO

- SAGA

- ONG

- GUN

- TRUMP

- ATOM

- IMX

- LUNA

- GMT

- UNI

- CHESS

- SCRT

- XTZ

- FTT

- QKC

- USDC

- IOTX

- EDU

- PORTAL

- ANKR

- RIF

- CELR

- TFUEL

- ALGO

- ONE

- CHR

- HYPER

- QNT

- LPT

- HBAR

- SNX

- WAXP

- DUSK

- IQ

- WBTC

- PAXG

- STO

- VTHO

- NKN

- IOTA

- CHZ

- CTK

- SHELL

- ARB

- RAD

- ARPA

- TIA

- OP

- APT

- XVS

- USDE

- COMP

- ASTR

- PHB

- BAND

- COS

- OXT

- KAVA

- AT

- BAR

- MBL

- CKB

- RSR

- BIFI

- OGN

- HIVE

- AVA

- KSM

- SXP

- COTI

- CTSI

- SOL

- TRB

- TWT

- RPL

- JST

- AR

- WIN

- DIA

- UMA

- YFI

- FIO

- CRV

- AVAX

- SUN

- SUSHI

- SAND

- RUNE

- EGLD

- FIL

- AAVE

- BEL

- CAKE

- IDEX

- INJ

- NEAR

- AUDIO

- ROSE

- STRAX

- AXS

- SLP

- WOO

- ACH

- DF

- PHA

- JUV

- PSG

- SKL

- GRT

- GLM

- 1INCH

- CELO

- ASR

- DEXE

- GHST

- OG

- SFP

- TRU

- API3

- FLOW

- POND

- DODO

- AUCTION

- ACM

- OM

- DEGO

- ALICE

- ALCX

- FIDA

- FORTH

- CFX

- TLM

- TKO

- ICP

- SHIB

- ATA

- FARM

- LQTY

- QUICK

- MASK

- JUP

- FLUX

- PUNDIX

- XEC

- MINA

- XNO

- CVX

- PYR

- STRK

- JASMY

- ILV

- METIS

- RAY

- QI

- TON

- FRAX

- C98

- PENDLE

- GALA

- LDO

- MBOX

- USDP

- YGG

- RARE

- ORCA

- SPELL

- CITY

- AGLD

- DYDX

- MOVR

- LAZIO

- SSV

- ZK

- FLOKI

- ENS

- PEOPLE

- PORTO

- SANTOS

- BICO

- GMX

- HIGH

- OSMO

- JOE

- SYN

- GLMR

- ACA

- COW

- MAGIC

- AXL

- BTTC

- T

- DOGS

- ALPINE

- APE

- STG

- LUNC

- USTC

- GNS

- EUL

- POLYX

- HOLO

- FET2

- PROM1

- VELO1

- HFT

- HOOK

- RDNT

- BONK

- ACX1

- BLUR

- CGPT

- ID2

- SUPER1

- PEPE

- SUI

- TURBO

- ORDI

- CETUS

- MAV

- WBETH

- WLD1

- ARKM

- FDUSD

- CYBER

- SEI

- RON1

- G

- C

- TAO1

- BIGTIME

- PYTH

- JTO

- MEME4

- POL1

- VANRY

- 1000SATS

- VIC

- ONDO

- WIF

- MANTA

- AEUR

- DYM

- AI5

- BEAM2

- XAI1

- NFP2

- ACE2

- ALT6

- BOME

- ETHFI

- AEVO

- ENA

- W

- TNSR

- KMNO

- REZ

- NOT

- BB

- PIXEL1

- VIRTUAL

- RENDER

- IO

- ZRO

- LISTA

- BANANA5

- COOKIE1

- HMSTR

- CATI

- EURI

- EIGEN

- NEIRO1

- SCR1

- LUMIA

- PNUT

- ACT1

- BNSOL

- SYRUP

- SKY1

- MORPHO

- USUAL

- ME

- MOVE1

- F

- PENGU

- SOLV

- S

- ANIME

- AIXBT

- D

- GPS

- PLUME

- VANA

- THE1

- BERA

- KAIA

- HEI

- KAITO

- BROCCOLI

- BANANAS31

- LAYER1

- MUBARAK

- RED3

- BMT1

- TST1

- EPIC1

- FORM2

- WAL1

- NIL2

- PARTI

- TUT

- BABY1

- KERNEL

- RLUSD

- WCT1

- 1000CHEEMS

- 1MBABYDOGE

- 1000CAT

- XUSD

- HAEDAL

- INIT

- SIGN1

- DOLO

- USD1

- NXPC

- SXT

- AWE

- HUMA

- A

- SOPH1

- LA1

- RESOLV

- SPK

- TREE

- PUMP2

- SAHARA

- NEWT

- HOME1

- PROVE

- ERA1

- TOWNS

- WLFI

- LINEA

- SOMI

- AVNT

- SAPIEN

- A2Z

- ASTER

- XPL

- BARD

- 2Z

- HEMI

- ZKC

- NOM1

- MIRA

- YB

- ENSO

- FF

- 0G

- ALLO

- MET1

- GIGGLE

- MMT1

- KITE

- ZKP1

- BFUSD

- 币安人生

- BREV

- OPEN4

- ZBT1

- BANK1

- EDEN2

- MITO

- TURTLE

- KGST

- FOGO

- U1

Binance Australia fees review

Deposit and withdrawal fees

| Transaction type | Fee |

|---|---|

| Deposit funds | Cryptocurrency: None |

| Withdraw funds | Cryptocurrency: Fees vary |

Binance Australia uses a maker taker fee structure for spot market trading. Instant purchases incur a separate fee.

| Type | Fee |

|---|---|

| Maker | 0.10% |

| Taker | 0.10% |

Maker fee explained. A maker fee is the fee charged when you propose an order for other traders to take. In other words, this fee is charged when you place a limit order to sell an asset, but that order is not filled immediately.

Taker fee explained. A taker fee is a fee charged when a buy order is matched immediately with a sell order on the books. This is the fee charged when you place a market buy order.

Binance Australia deposit methods

- Bank transfer

- Credit card

- Cryptocurrency

- Debit card

- PayID

How to sign up on Binance Australia

Before you can get started trading on Binance Australia, you'll have to go through a Know Your Customer (KYC) verification process (which usually involves proof of identification).

- Get started

Visit Binance Australia's site. After selecting the Get Started button, fill in the create account form. - Set up payment

Before you can start trading, you have to add your bank account to your Binance Australia account. There are several options to choose from, so choose the option most compatible. - Provide identification

Before you can make withdrawals and increase your transaction limits, you must submit proof of address and some additional identification. Use either a passport or a driver's license for this. - Start trading

After all that is processed, you're ready to trade on Binance Australia.

About the Binance Australia app

The Binance app lets you toggle between a Lite mode and a Pro mode.

The Lite mode is the default setting and is designed for beginners. It streamlines the experience and lets you buy and sell cryptocurrencies, track prices and manage your portfolio.

The Pro mode offers all of the features of the desktop exchange which makes it an incredibly powerful trading app.

| App store | Rating | Total reviews |

|---|---|---|

| Google Play | 4.4 stars | 3m reviews with 100m downloads |

| Apple Store | 4.6 stars | 43.9k reviews |

Is Binance Australia safe?

Despite some hacks in the past, Binance has a good reputation for trust because of its response to these incidents. It operates a sizeable insurance fund, conducts security audits and frequently improves site security.

Past hacks. In 2019 a group of hackers stole US$40 million worth of Bitcoin (7,000 BTC) along with 2-factor user codes and API tokens from the Binance exchange. The hack was successful in targeting the Bitcoin that was being stored on the Binance hot wallet (connected to the Internet) which accounted for around 2% of the total Bitcoin held by Binance. The other 98% remained protected in a cold storage wallet offline. The hack used phishing techniques and viruses to bypass the security on Binance.

Fortunately, Binance was able to cover the losses out of its Secure Asset Fund for Users (SAFU) and the affected users had their funds returned. The fact that the hackers were only able to access 2% of the Bitcoin reserves on Binance because the remaining 98% is secured in cold storage should offer comfort to users.

Insurance. On July 3, 2018 Binance announced the creation of its Secure Asset Fund for Users (SAFU). This has been used to pay back users who were affected by the hacks on the exchange. SAFU is funded with portions of trading fees collected by the exchange. Binance attempt to maintain a balance of around US$1 billion in the fund, although it includes cryptocurrencies so the value fluctuates in line with the market.

Proof-of-reserves. In response to the collapse of FTX in 2022, Binance introduced a proof-of-reserves system to prove user assets are held on a 1:1 basis. It uses a Merkle Tree system which uses on-chain data to let users verify their account balance.

Keeping your crypto secure

All centralised exchanges, including Binance Australia, are vulnerable to counterparty risks like hacking, theft and insolvency. Using a self-custodial or hardware wallet is widely accepted as the best way to improve the security of your funds. We've shared some of our top picks below.

Ledger Nano X Wallet |

Trezor Model T Wallet |

SafePal S1 Wallet |

|

|

|

|

|

|

|

|

|

|

|

|

Supported assets 5,500+ |

Supported assets 1,000+ |

Supported assets 30,000+ |

|

Price (USD) $99 |

Price (USD) $129 |

Price (USD) $49.99 |

See more of the best crypto wallets

Binance Australia customer support

Binance offers a comprehensive support hub which includes help centre articles, FAQs, contact forms and a live chat.

The live chat system uses a chatbot, however you can request to speak with a person. When we tested this, it took less than 1 minute to be put in touch with a customer service representative, although it did require several prompts.

How to reach Binance Australia customer support

- Live chat

Alternatives to Binance Australia

Compare other products

We currently don't have that product, but here are others to consider:

How we picked theseSources

-

Finder writers are subject matter experts and use primary sources, in-depth research and interviews with other experts to ensure you're getting accurate, up-to-date information. Articles are fact checked in line with our editorial guidelines.

James Edwards is a seasoned cryptocurrency expert and content creator with over a decade of experience in blockchain, DeFi and Web3. An early adopter of Bitcoin, he has contributed to major outlets like Nasdaq, CoinDesk, and The Street, and has reported at leading industry events such as TechCrunch Disrupt and CoinDesk Consensus. James has produced over 200 YouTube videos, including interviews with influential figures like Changpeng Zhao (CZ) and Tim Draper, and holds a Bachelor of Liberal Arts & Sciences in Psychology from the University of Sydney, along with a Tier 1 Generic Knowledge certification in compliance with ASIC standards. James created cryptocurrency content at Finder as a video producer, writer and editor from 2018 to 2023. See full profile