Review: WireBarley international money transfers

We currently don't have this product on Finder

- Number of Currencies

- 18

- Minimum Transfer Amount

- $1

- Pay By

- PayID

- Fees (Pay by Bank Transfer)

- From $0

Summary

Enjoy 24/7 online transfers with bank-beating fees and exchange rates.

Pros

-

Good for sending money to bank accounts, cash pick-up locations and straight to your recipient's home. Also offers multilingual support.

Cons

-

Only has a limited number of transfer destinations.

Details

Product details

| Product Name | WireBarley |

| Pay By | PayID |

| Receiving Options | Cash pickup location, Bank account, Mobile wallet, Alipay (China only) |

| Customer Service | Phone, Email |

| Maximum Transfer Amount | $5,000 |

| Number of Currencies | 18 |

WireBarley exchange rates and fees

WireBarley's exchange rates are updated regularly in line with fluctuations to the mid-market rate. The company adds a margin on top of the mid-market rate for each transaction, but the size of this margin is typically much smaller than what you could expect from a bank.

Fees also apply to all transactions. The size of the fee varies depending on where you are sending money, how much you transfer and how your recipient will access the funds.

Available currencies

WireBarley allows you to send money overseas using more than a dozen currencies, including the following:

- CNY Chinese yuan

- EUR Euro

- GBP British pound

- INR Indian rupee

- KRW South Korean won

- MYR Malaysian ringgit

- PHP Philippine peso

- USD US dollar

What types of transfers can you make with WireBarley?

WireBarley offers three types of money transfers:

- Bank account transfers

- Cash pick-up transfers

- Home delivery transfers

You can send money online through the WireBarley website or by using a mobile app, but please note that not all transfer methods are available for all destinations.

How long does a transfer with WireBarley take?

Transfer times vary depending on where you are sending your funds, but most transactions are processed within one to two business days.

What payment methods does WireBarley accept?

WireBarley only accepts PayID transfers, which means you can't pay with your credit or debit card.

Transfers typically take![]()

within minutes

Is WireBarley safe to use?

- Security and regulation: Regulated in Australia by ASIC and AUSTRAC

- Established: 2012

- Number of customers: 650,000+*

- Support: Multilingual customer support in 12 different languages

*According to WireBarley on 11 May 2023.

WireBarley Corporation is licensed by South Korea's Ministry of Strategy and Finance to provide cross-border remittance services. Its Australian subsidiary, WireBarley Australia Pty Ltd, is regulated by the Australian Securities and Investments Commission (ASIC) and listed on the Australian Transaction Reports and Analysis Centre (AUSTRAC) Remittance Sector Register.

To help offer the safest possible transactions, WireBarley claims to offer security measures in line with those offered by global banks. These include password encryption, treating all transaction information with SEED encryption and using SSL technology on its server.

How does WireBarley make money?

WireBarley makes money in two ways:

- By charging transaction fees

- By adding a margin on top of the mid-market exchange rate – the mid-market rate is the "true" exchange rate you see listed on Google and is the rate at which banks and transfer companies buy and sell currency from one another

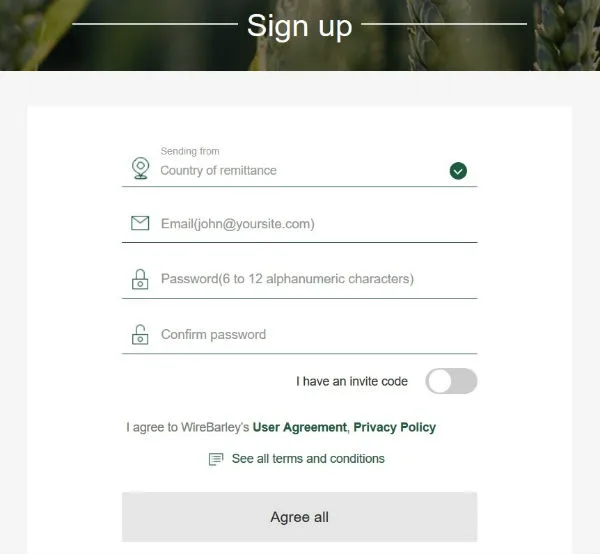

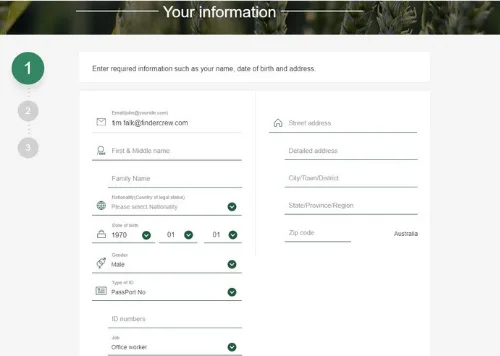

How to register an account

You can register for an account with WireBarley by completing the following steps.

How do I make an international money transfer with WireBarley?

You can send money overseas with WireBarley by completing the following steps:

- Log in to your account and start a new transaction.

- Specify where you want to transfer money, enter the amount you want to send and select a delivery option.

- Provide your recipient's name and details. If sending to a bank account, you'll need to provide your recipient's bank account information.

- Review the details of your transaction, including the exchange rate and fee.

- Submit payment for your transaction.

- You'll receive an email notification when your transaction has been completed.

What is WireBarley?

WireBarley is a South Korean fintech company that specialises in online and mobile cross-border remittances throughout the Asia-Pacific region. Headquartered in Seoul, it has been offering transfer services to Australian customers since 2012. In addition to South Korea and Australia, WireBarley also has operations in New Zealand and the United States.

In a nutshell

Pros

- Multiple transfer options. WireBarley offers online and mobile transactions, and it allows you to send bank account, cash pick-up and home delivery transfers.

- Competitive exchange rates and fees. The exchange rates and fees offered by WireBarley are typically much better than those you would receive from your bank.

- Quick and easy to use. Whether you're sending funds via the WireBarley website or mobile app, the registration and transfer process is simple and straightforward.

- Multilingual customer support. If you need help with your transaction, WireBarley offers customer support in Korean, English and 10 other languages.

Cons

- Only supports a limited number of transfer destinations. WireBarley only supports transfers to 45 countries from Australia, so your desired transfer destination may not be supported.

- Limited payment methods. PayID is the only supported payment method. So if you want to pay using a credit card or cash, you'll need to consider other transfer providers.

- Not suitable for large transactions.While transaction limits vary depending on where you're sending money, WireBarley is typically not suitable for sending amounts over $7,000.

How does WireBarley compare to other providers?

Compare other products

We currently don't have that product, but here are others to consider:

How we picked theseFinder Score for money transfer

We review money transfer providers for different features to assign them a score out of 10. The higher the score, the more competitive the product.

Frequently asked questions

Sources

Your reviews

Tim Finder

Writer

You are about to post a question on finder.com.au:

- Do not enter personal information (eg. surname, phone number, bank details) as your question will be made public

- finder.com.au is a financial comparison and information service, not a bank or product provider

- We cannot provide you with personal advice or recommendations

- Your answer might already be waiting – check previous questions below to see if yours has already been asked

Finder only provides general advice and factual information, so consider your own circumstances, or seek advice before you decide to act on our content. By submitting a question, you're accepting our Terms Of Service and Finder Group Privacy & Cookies Policy.

This site is protected by reCAPTCHA and the Privacy Policy and Terms of Service apply.