Can I use Venmo in Australia?

We currently don't have this product on Finder

- Number of Currencies

- 1

- Minimum Transfer Amount

- $1

- Fees (Pay by Bank Transfer)

Summary

Venmo isn't available in Australia, you need to live in the US and have a US mobile number.

If you haven’t yet heard of Venmo, you certainly must have heard of PayPal. Think of Venmo as PayPal’s mobile-friendly cousin. Its approach speaks to something we've all faced: the annoyance of splitting a restaurant bill five different ways, the stress of borrowing money from a friend and never having the cash to pay them back, splitting rent and utility bills – the list goes on and on.

Instead of reaching for the calculator app to figure out how much to pay your friends, you can simply Venmo anyone you owe instantly. An app that's both practical and easy to use, Venmo stands out as a convenient method to send and receive money electronically.

Pros

-

Send money effortlessly

-

Popular and widely used

-

Allows social sharing and viewing of transactions

Cons

-

Credit card fees are relatively high

-

Available only to users in the United States

-

Venmo-to-Venmo transfers only

Details

Product details

| Product Name | Venmo International Money Transfers |

| Customer Service | Phone, Live chat, Email |

| Maximum Transfer Amount | $5,000 |

| Number of Currencies | 1 |

Must read: Can I use Venmo in Australia?

Unfortunately, Venmo hasn't launched in Australia at the time of writing. To be able to use it, you need to fulfil two requirements:

- Be physically located in the US

- Have a US mobile number

You'll also need a US bank account if you want to take your money out of your Venmo wallet.

Long story short – you won't be able to use Venmo in Australia. There are other options for you, however. If you want to send money to someone else in Australia, Revolut may be a suitable alternative.

If you want to transfer money to another currency, you'll need an international money transfer service. Read our guide on sending money overseas to make sure you get the best deal possible.

If I'm in the US, with an American mobile phone and bank account, how do I request and send money through Venmo?

1. Create a Venmo account. Sign up with your email address and credit or debit card information. Add your bank account info if you want to deposit the money you receive. Note that you may pay a transaction fee when using your credit card.

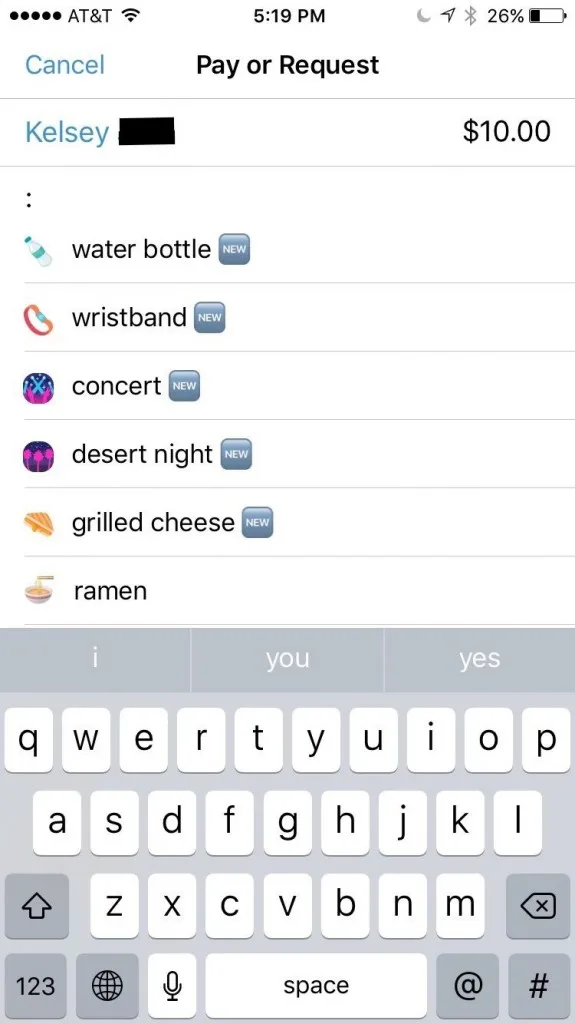

2. Request a transfer. Once you've created your account, request or send money by clicking pen and paper icon at upper right.

3. Enter your Venmo recipient or sender. Use the person's Venmo user name to send or request money, adding the transfer amount. Name your transaction with as fun or serious a memo as you'd like - or use Venmo's bitmoji shorthand for your transaction.

4. Tap Pay or Request to complete your transaction.

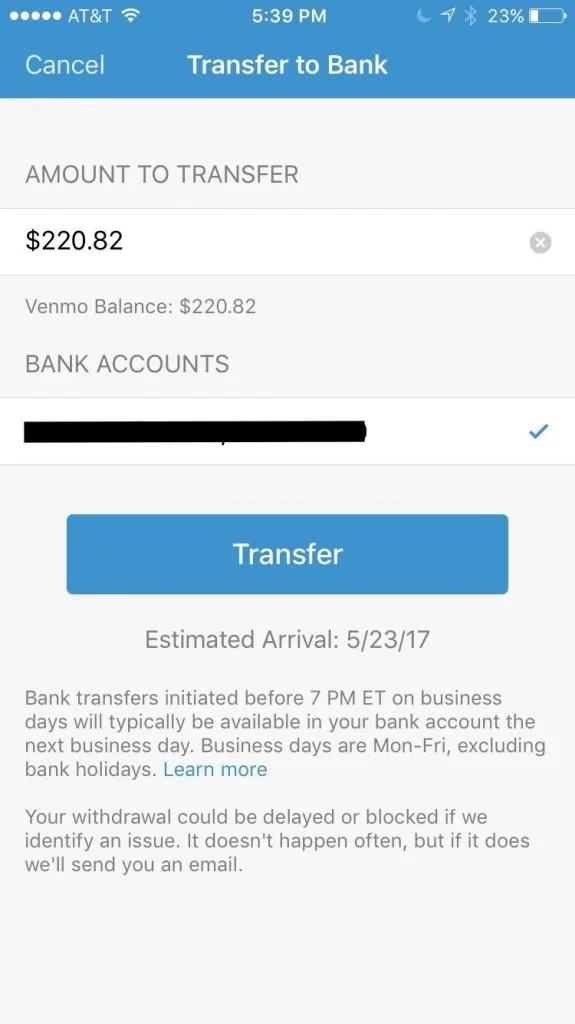

What happens when someone sends me money?

You'll receive notification from Venmo each time a user sends you money. Unlike other payment apps, the money you're sent doesn't go directly into your bank account. Rather, it stays linked to your Venmo account until you choose to transfer it. You can transfer all of your balance or only a portion of it.

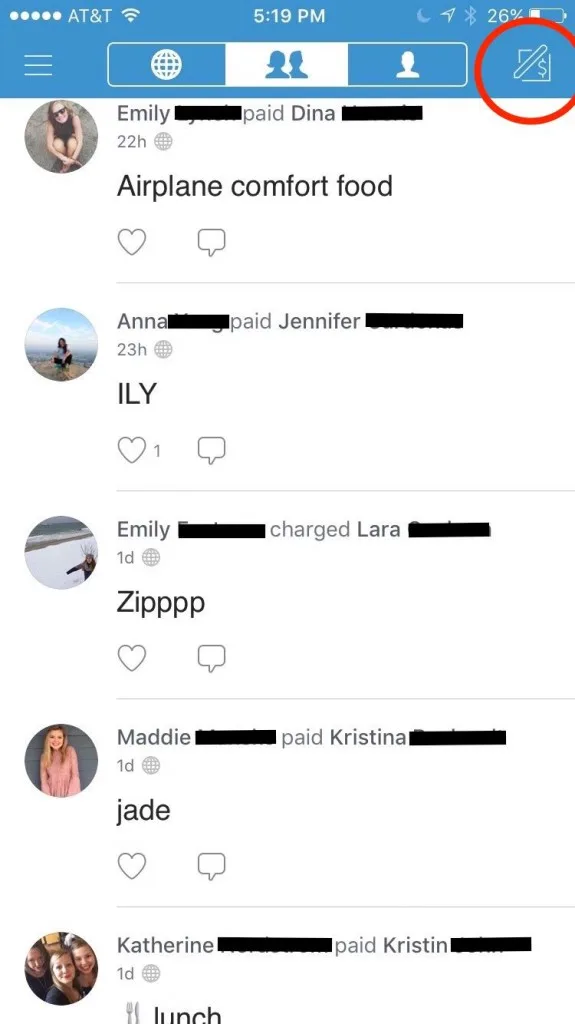

The social component

A feature that sets Venmo apart from other peer-to-peer payment systems is the social media aspect. Once you're sent money, it shows up on your friends' feeds, where they can see your transactions, but not the amounts. I don't particularly like this feature – I prefer to keep my transactions private. Thankfully, you can choose if you'd like to share your activity with just the participants, friends, or the Venmo community at large.

Compare alternatives for sending money overseas

Compare other products

We currently don't have that product, but here are others to consider:

How we picked theseFinder Score for money transfer

We review money transfer providers for different features to assign them a score out of 10. The higher the score, the more competitive the product.

Is Venmo safe?

Venmo encrypts your personal information and transaction details. However, whereas Payment Card Industry Security Standards Council gives Cash App, Google Wallet and other money transfer apps high ratings for standards security, Venmo is considered only "PCI compliant."

What is PCI compliance?

The Payment Card Industry Security Standards Council keeps track of companies that meet its strenuous security standards for development, enhancement, storage, dissemination and implementation for data protection. It determines the overall security of businesses that process payments online.

Like most companies, Venmo keeps the size of its user base private, so its lack of a standards rating could mean that it processes fewer than 6 million credit card transactions per year. It's possible: Venmo's additional fee for credit card payments all but encourages users to pay through a debit account instead. But it's worth considering safety, given the security breaches faced by Venmo over the years.

Sources

Your reviews

Adrienne Finder

Head of publishing and editorial

You are about to post a question on finder.com.au:

- Do not enter personal information (eg. surname, phone number, bank details) as your question will be made public

- finder.com.au is a financial comparison and information service, not a bank or product provider

- We cannot provide you with personal advice or recommendations

- Your answer might already be waiting – check previous questions below to see if yours has already been asked

Finder only provides general advice and factual information, so consider your own circumstances, or seek advice before you decide to act on our content. By submitting a question, you're accepting our Terms Of Service and Finder Group Privacy & Cookies Policy.

This site is protected by reCAPTCHA and the Privacy Policy and Terms of Service apply.