The lowdown on Finder Score

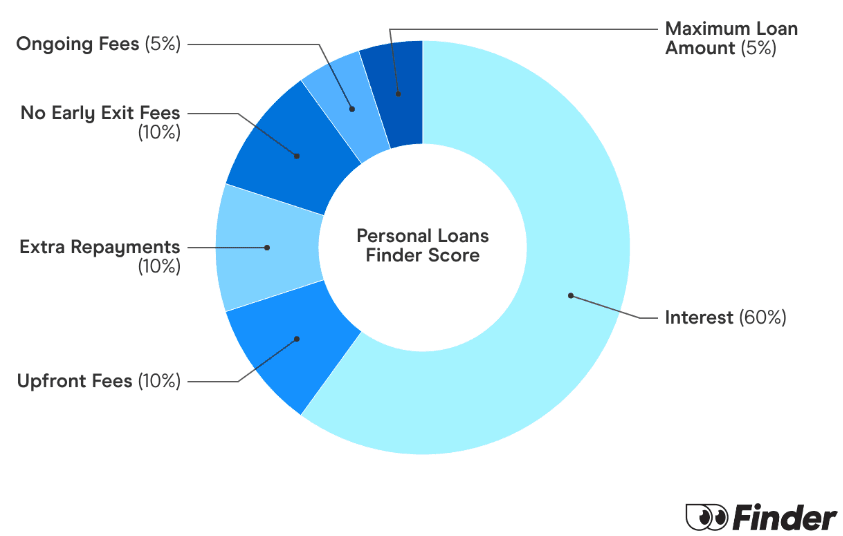

Wondering how we work out Finder Score? We look at 300+ personal loan products across 120+ lenders and we compare them against each other to get our simple score out of 10. Metrics like interest rates, fees and features are weighted and scaled to come up with individual Finder Scores.

To give a fair and true comparison, unsecured and secured personal loan products are scored separately. We then make assumptions on the interest rates charged for both excellent credit and average credit customers in each segment.

The Finder Score methodology is designed by our awesome insights team and reviewed by our just-as-awesome editorial team. Don't worry, commercial partners carry no weight and all products are reviewed objectively.

Finder Scores explained

- 9+ Excellent - The crème de la crème of personal loans. These products offer the lowest cost loans accompanied by the best features.

- 7+ Great - Slightly higher in cost and fewer features, but these products are still competitive.

- 5+ Satisfactory - Typically offering above average rates and possibly lacking in the features department.

- Less than 5 – Basic - The least competitive in terms of both cost and features.