Woolworths Everyday Extra is still worth paying for despite sneaky cuts

It's an easy way to spend less at the supermarket and score more points.

The cost of living in Australia has been rising since early 2022. In a nutshell, inflation – which is the difference between how much something cost 12 months ago compared to how much it cost now – has been on a steady climb. Our most recent inflation figure for September 2024 was 2.8%.

The cost of living in Australia has been rising since early 2022. In a nutshell, inflation – which is the difference between how much something cost 12 months ago compared to how much it cost now – has been on a steady climb. Our most recent inflation figure for September 2024 was 2.8%.

High inflation is not a good thing. For instance, a basket of fruits that cost $120 last year now costs $131.44, reflecting a 9.53% increase.

In the last couple of years, everything has increased in price (you may have noticed). Highest Inflation reached 7.8% in December 2022, meaning – in very general, very simple terms – that everything you bought for that month cost 7.8% more than it did in December 2021.

Realistically, prices increase at different rates. Another example, vegetables have seen an inflation rate of about 7.92%, meaning a basket that cost $150 in September 2023 would now cost $161.89.

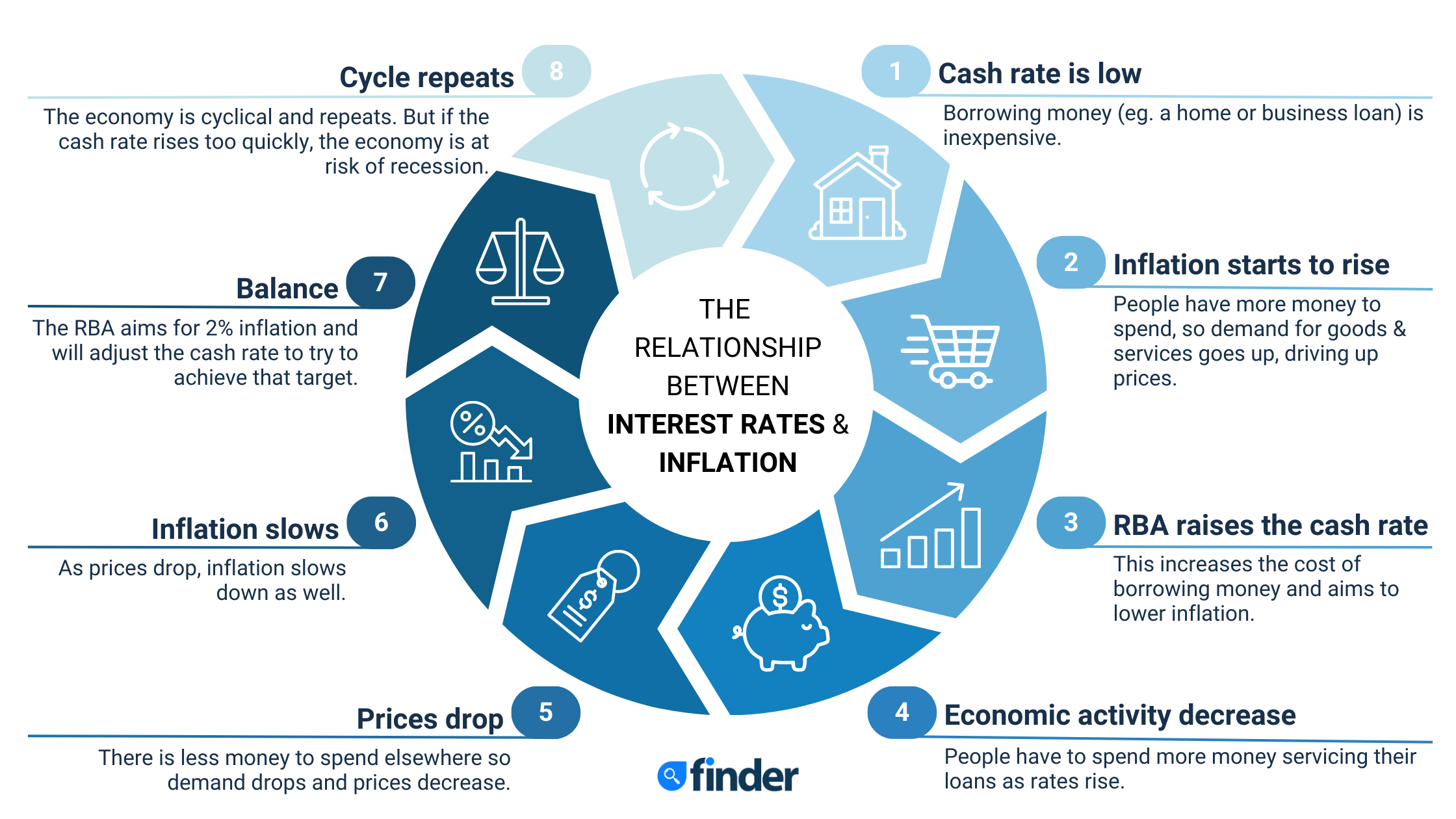

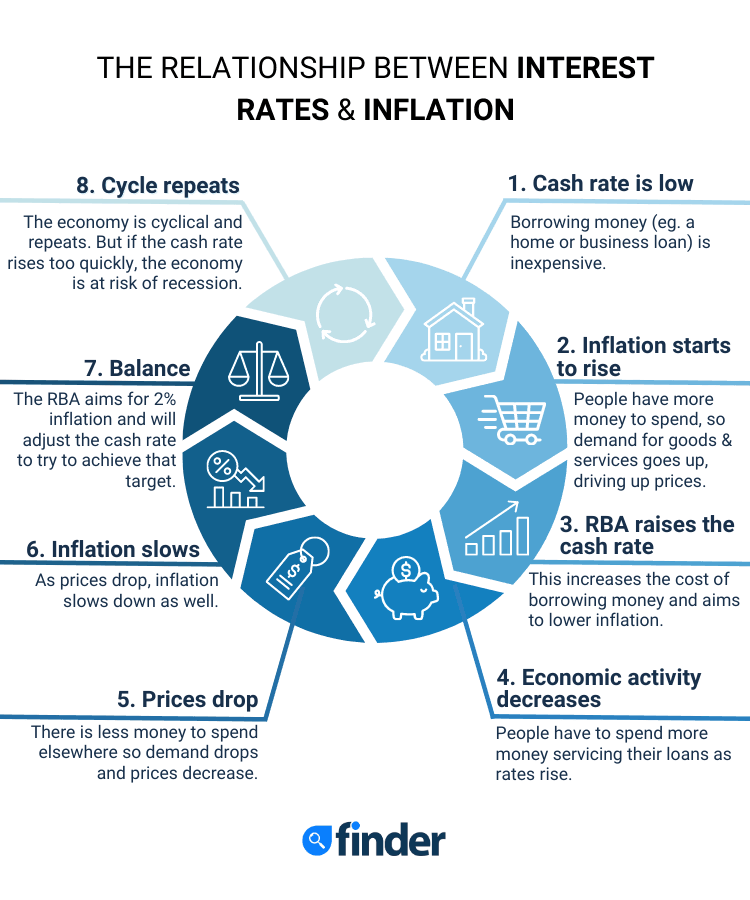

And that right there is what the RBA is chasing...

The RBA's job is keep inflation somewhere around 2-3%. That's enough for the economy to keep growing, but not so much that we're all struggling to keep up with rising costs. The main way the RBA influences inflation is by increasing the cash rate (which is the amount banks pay to get money they lend us). That pushes our mortgages up, and means we spend less on things like expensive cheese. As a result, inflation starts to come down – but in the meantime, anyone with a mortgage is potentially in a world of financial pain.

It's not a fun job for the RBA, because no-one really likes them for doing this. But if they let inflation keep soaring and kept our interest rates on hold, we'd all be complaining even more when cheese prices hit $20 (and prices of everything else hit bonkers prices).

In an effort to fight high inflation, the RBA has increased the cash rate a total of 13 times since May 2022. It now stands at 4.35%, and once the banks add their profit margin on top, it means you're paying around 6% to 6.5% for your mortgage.

Over the last two years, the cost of living in Australia has soared. A home you may have rented for $550 a week in 2021 is now renting for $850 a week. The average mortgage has gone up over $1,000 a month, according to Finder research. Our household bills including insurance, energy, groceries and petrol have all gone up, too. In other words: people are doing it tough financially.

The latest quarterly inflation figure, released in September 2024, is 2.8%, with a core inflation rate of 3.1%.This is the main metric the RBA is looking at – and it has decreased every month for the last 7 months.

So, yes, the cost of virtually everything, from breakfast cereal and fruit to petrol and even rent, has been going through the roof. But now with inflation finally decreasing, we should start to see the RBA cut rates at some point in the next 6-12 months. The exact timing is anyone's guess, and our panel of experts and economists weigh in every month on exactly this (you can read their forecasts for the rest of 2024 and 2025 here).

In a nutshell, cost of living is a summary of how much it costs to live in a particular place (in our case, Australia).

At the moment, those costs are increasing. Day-to-day necessities like fruit and vegetables at the supermarket, your medications from the chemist, the petrol you put in your car, even your energy and gas bills, and your home loan or rent, are increasing due to something called inflation.

The cost of living looks at the cost of essentials, not luxuries. It's used to measure how expensive it is to live in one place compared to another.

The main way it's measured is with the Consumer Price Index (CPI).

The CPI measures the costs of 11 categories of necessary goods and services. The Australian Bureau of Statistics (ABS) looks at the prices of thousands of individual items and measures their price movements month to month.

From here it'll pull out a "basket" of everyday goods and measure the cost of these items.

In the past, the ABS has released CPI data on a quarterly basis. As of September 2022 it started releasing monthly year-on-year figures to get a better understanding of where inflation sits.

The first monthly CPI figure was for the month of October 2022 and showed that inflation had fallen back slightly compared to the quarterly figure. However, the quarterly figure remains the principal measure of household inflation.

Inflation figure for October 2024: 2.1%.

The most significant rises were Food & non-alcoholic beverages, Recreation & culture, and Alcohol & tobacco.

Starting in 2024, the CPI weights are updated in January each year. This is to ensure that household spending patterns are accurately reflected in the CPI basket.

CPI is calculated by comparing the total cost of the basket last month to this month, and then it's expressed as a percentage.

"Most people look at cutting out their $5 coffees or $16.99 Netflix subscription, but the biggest expenses we generally have are housing, transport and food. So if we can find a way to reduce those expenses even a little bit, we can spend more on the fun expenses (like entertainment and eating out)! Have a look at your expenses from the past 3 months and see if there are any areas you could cut back on. Once you have an idea of how much you roughly spend each month, you can look into automating your savings by setting up automatic transfers to a savings account, or even investing if that's one of your goals. And finally, it's a good idea to look at ways to increase your income. You can only save so much, but by getting a pay rise, or even switching jobs into a higher paying job (studies have shown that new employees get paid 7% more than existing employees doing the same job!), you may not even need to cut anything out of your budget at all, and still be able to save more money."

Inflation measures our buying power – in other words, how much your money is actually worth.

If the cost of a basket of items has jumped 7.3%, but your income has stayed the same, your buying power has gone down as you can't buy as much with your money as you could last year.

With inflation rising at a fast pace, our money is essentially getting less valuable.

Unless your income goes up by at least the same rate, rising inflation will lead to financial pressure for many people who can't keep up with the increased costs of groceries, fuel and housing.

By using PocketSmith's Global Spending Map, we can see how much more Australians are spending across different areas thanks to inflation. For example, between November 2023 and November 2024, household spending on groceries decreased by 6%.

Recent Finder research has found 11 million Australians are taking action to deal with rising costs, including 48% who have dropped their living standards.

Inflation of 6.3% means, on average, you need $106.30 today to buy what $100 bought you 12 months ago.

Without getting too deep into economics, the primary tool the Reserve Bank of Australia (RBA) uses to control inflation is the cash rate.

When the cash rate is low (like it was in early 2020 through 2021), it stimulates spending and household investment. This spending is what drives inflation up.

When the cash rate gets higher, it generally translates to less household spending, which helps drive inflation down.

This is because when the RBA increases the cash rate, banks and lenders pay more for the funds they lend out, and charge more for a home loan. Overall, this makes borrowing money more expensive.

High inflation means it is more expensive to pay for things. It puts more pressure on household budgets and can lead to financial stress. Some groups of people significantly affected by inflation include:

Independent financial expert Nicole Pederson-McKinnon says, "The chances are the biggest pressure on your purse strings is coming from rising rates if you're a home owner or rising rents if you're not. The easiest ways to contain the pain are to get 'moving or mowing', respectively; move to a cheaper lender or make like many Aussies and barter your assistance and expertise for a discount from your landlord."

Inflation affects everyone to some extent, so it's a good idea to ensure your budget has some wiggle room.

If you're facing financial hardship, there are plenty of resources available. You can call the National Debt Helpline on 1800 007 007 for free and independent advice.

And if cost of living pressures are causing you distress, you're not alone. These free resources can help:

With inflation rising, it means your cash in the bank is worth less than it was before. However, there is some good news for your savings.

With the RBA increasing the cash rate, banks are increasing home loan rates too. This is bad news for home owners as it means they'll be paying more interest. However, banks are also increasing their savings rates. This is good news for savers as you'll be earning more interest on your cash.

Back in 2021, you'd have been lucky to find a savings account offering much more than 1.5% p.a. interest. Now, as of February 2026, there are several high interest savings accounts paying over 5% p.a. interest.

When we have rising inflation it means your money is effectively going backwards, unless your income is also increasing at the same rate. Unfortunately, the RBA is strongly advocating that employers don't give pay rises in line with inflation.

If everyone got a pay rise in line with inflation, the RBA fears it'd only push inflation even higher. This process is called a wage-price spiral, and it's the reason why you might not get much of a raise this year.

Finder's 2023 Cost of Living Report

Our team of 12 finance experts love the stuff that you don't (super, insurance, banking, debt management, you name it!) - and have put together a list of 20 things you can do right now to take control of your finances.

Have a car and want to make some extra dosh? Car sharing allows you to rent your car out and earn some extra cash on the side.

Everything you need to know about Airtasker including how to get started, how much you can earn and how tax and insurance work.

We compiled a quick list of easy side hustle ideas to get you started today.

Find out about each of these support options to determine which one will best meet your needs and help you get back on track.

The 8 best ways to earn extra money fast online or from your home.

Depending on your enrolled university, the fees and financing for your studies may differ. Learn more about paying for your higher education as a tertiary student.