9 Ways the 2024 Federal Budget impacts you

Energy rebates for every home, 1 million new homes and big tax cuts are coming our way.

The 2024 Federal Budget was announced last night, which means Federal Treasurer Jim Chalmers shared all the big ticket items the government is planning to spend on over the next 12 months.

These are the major announcements you'll want to know about:

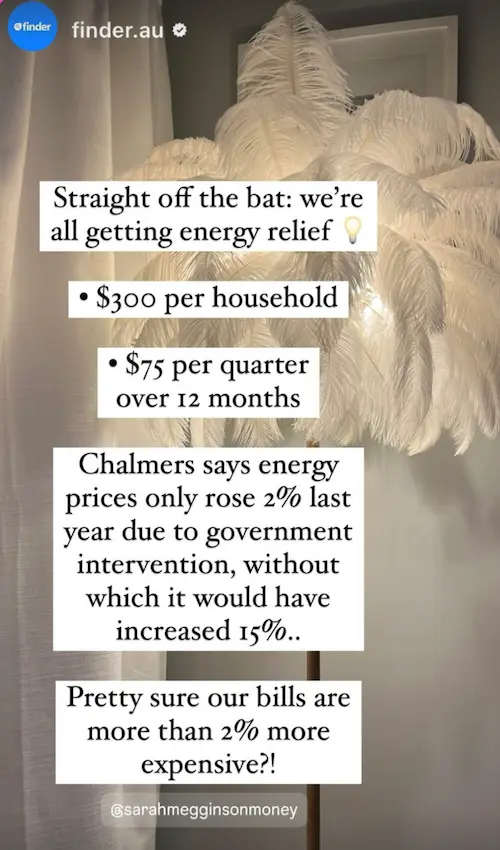

1. You get an energy rebate, you get an energy rebate...

The major announcement everyone is talking about: every household gets a $300 credit to help make our energy bills more affordable over the next 12 months. There's no eligibility criteria and no forms to fill out – the money gets credited automatically to your energy bills from July 1. It's not means-tested, meaning every household in Australia will get the $300 credit – even the wealthiest amongst us will get it – costing the government a tidy $3.5 billion. This is on top of State rebates, like Queensland's recently announced $1,000 energy credit, or WA's $400 per household.

2. Small biz gets an energy win, too

Around one million small businesses will receive $325, applied over 4 quarters as well.

3. Housing costs should get cheaper... eventually

Billions is being pumped into housing and building through a number of complex policies and projects, as the government has very ambitious plans to build 1 million homes over the next 5 years – 200,000 homes per year! The hope is that all of that extra supply will take some of the pressure out of our crushingly expensive housing market and that will flow through to our extraordinarily tough rental market. But it's a long-term play. In the meantime...

4. Rental assistance for those most at-risk

Around 1 million Aussie households renting in the private market or from a community provider will get a 10% increase on the maximum rate of rent assistance they're eligible for. It takes effect from September, at a cost to the government of $1.9 billion, and works out to be up to $70 more per fortnight.

Rental assistance was boosted by 15% last year as well, making this the first time in 3 decades that the government has increased rental assistance two years in a row.

5. And tangible support for those fleeing DV

$1 billion is earmarked for the National Housing Infrastructure Facility, to support housing women and kids experiencing domestic violence, and for youth. Practically, it'll be delivered via grants to support states and territories and community housing providers to deliver more housing for these groups.

6. Want a job in construction? Train for free

To build 1 million homes and deliver on all these projects, we'll need a LOT of tradies. One package announced was $88.8 million to fund 20,000 new fee‑free TAFE places, including increased access to pre‑apprenticeship programs, in courses relevant to the construction sector.

7. Super will be paid on parental leave

This was announced a couple of months back, but it's now funded and locked away in the budget: the government has allocated $1.1bn over the next 4 years to pay superannuation on government-funded paid parental leave from July 2025. This applies to all parents who are eligible for paid leave, but is designed to help women catch up with men in retirement savings: women currently retire with, on average, $60,000 less than men.

8. Everyone gets a payrise!

Tax cuts, too, was announced a little while ago, but it also needed to be accounted for in the budget. The tax cuts means every Australian will receive MORE money in their pay packet from July 1 this year – like a pay rise, without asking for it.

From 1 July this year, these changes will mean:

- the 19% tax rate drops to 16%

- the 32.5% tax rate drops to 30%

- the 37% tax threshold moves from $120,000 up to $135,000

- the 45% tax threshold moves from $180,000 up to $190,000.

A person earning around $90,000 is going to get $1,950 more in their pay each year - around $160 per month. All 13.6 million Australian taxpayers will receive a tax cut.

9. Inflation should decrease – and interest rates should, too

None of us have a crystal ball, but in his speech, Chalmers said the budget was designed not to splash cash and fuel the economy with loads of spending. The energy credit applied over 4 quarters, for instance, means a slow burn rather than one big saving. He estimates his Budget plans would take 0.75% off inflation this year and 0.5% next year, bringing our inflation well into "normal" territory – and giving the RBA a reason to consider dropping interest rates.

The Federal Budget aimed to help address the soaring cost of living, but there are steps you can take NOW to spend less on your everyday bills: save thousands with Finder's Financial Fitness Challenge.

Sources

Ask a question