CommBank international money transfers

We currently don't have this product on Finder

- Number of Currencies

- 35

- Minimum Transfer Amount

- $0

- Pay By

- Bank transfer, Cash, PayID, BPAY, Phone banking

- Fees (Pay by Bank Transfer)

- From $0

Our verdict

CBA is a trusted name but it's one of the more expensive options for sending money overseas.

Commonwealth Bank is Australia’s largest retail bank with over $1 trillion in assets and 1,100 branches. As part of its range of financial services, CBA allows customers to make international money transfers. Using the bank’s services, you can transfer money to over 200 countries in more than 30 currencies. Banks are typically more expensive and slower than money transfer specialists but some people prefer sticking with a trusted name.

It's fine to use CBA if you're making small one-off transfer overseas. Once your transaction goes over $500, we recommend using a money transfer provider as CBA's poor exchange rates will eat into your money. With the cost of living crisis, it's worth comparing your options to find a better exchange rate.

Pros

-

No transfer fees via NetBank or the CommBank app.

-

Easily trace, amend, or cancel transfers with the Payment Tracker.

Cons

-

Daily transfer limits may apply.

-

Transfers may take up to 3 days or longer, depending on the recipient’s location and bank.

Details

Product details

| Product Name | Commonwealth Bank |

| Pay By | Bank transfer, Cash, PayID, BPAY, Phone banking |

| Receiving Options | Bank account |

| Customer Service | Phone, Live chat, 24/7 support |

| Maximum Transfer Amount | $5,000 (daily limit) |

| Number of Currencies | 35 |

What do Australians think of CommBank international money transfer brand?

- 4.11/5 overall for Customer Satisfaction - lower than the average of 4.35, and this was the lowest score in the category

- 4.44/5 for Trust - lower than the average of 4.69, and this was the lowest score in the category

- 4.1/5 for Customer Service - lower than the average of 4.31

Based on CommBank international money transfer brand scores in Finder's 2024 & 2025 Customer Satisfaction Awards.

CBA exchange rates

When we reviewed CBA's exchange rates in August 2023, they added a 4% markup when converting AUD to GBP and USD. In comparison, ANZ adds a markup of around 2.9% to those currencies. NAB and Westpac charge a 3-5% fee on top of the mid-market rate. CBA allows you to transfer money from common currencies like the Euro through to more exotic offerings like the Czech Koruna.

Markups on exchanging AUD to GBP

- $5,000 - 4.09%

Markups on exchanging AUD to USD

- $5,000 - 3.92%

"I had to use the CBA international money transfer service to send money domestically. Basically, there was no facility other than this to send a 20% house deposit to an REA Trust account. You'll pay a premium in % fee of the total amount, so make sure you have that available too, but the funds are received in 48 hours. "

CBA transfer fees

In June 2023, CBA announced they've started waiving transfer fees for customers making international transfers using NetBank, CommBank App or CommBiz. Transfers generally take 3 business days to process but can take longer depending on when you make the transfer, the currency and recipient bank.

It’s also worth noting that if you lodge a transfer via your local branch, you can request that any fees imposed by intermediary or receiving banks will be paid by you rather than the recipient. As an example, if you transfer money to the United States at a branch, you’ll have to pay a $30 fee.

| Description | Fees |

|---|---|

| Transfer made via NetBank or the CommBank app (FX conversion) | $0 |

| Transfer made via NetBank or the CommBank app (no FX conversion) | $22 |

| Cancel international money transfer | $25 plus overseas bank's costs |

| Trace international money transfer | $25.00 per investigation |

| Transfer made via bank branch | $30 |

| Cost to receive money transfer | up to $11 |

Minimum transfer amount and available countries

There is no minimum payment amount for an international money transfer with CBA. While the standard amount you can send overseas at any one time through NetBank is $5,000, you can apply to have this limit raised to up to $50,000.

While there’s no list available that outlines the countries you are unable to transfer to through CBA, transfers to countries such as Afghanistan, Russia, Cuba, Iran, Iraq, Syria and Somalia are not available.

CBA allows transfers in the following currencies:

| CAD | CZK | DKK | EUR |

| FJD | GBP | HKD | HUF |

| INR | IDR | ILS | JPY |

| KWD | MUR | XPF | NZD |

| NOK | OMR | PGK | PHP |

| PLN | SAR | SGD | SBD |

| ZAR | KRW | LKR | SEK |

| CHF | THB | TRY | AED |

| USD | VUV | VND |

What are the pros and cons?

Pros

- Secure. Using a trusted provider means your transfer is conducted through the secure SWIFT international banking system.

- Range of options. You can lodge your transfer online, over the phone or in a branch.

Cons

- Exchange rates. You'll get better exchange rates with dedicated international money transfer companies.

- Range of currencies. CBA supports around 30 currencies, while the likes of Wise have 80+ currencies.

- Low transfer minimum. Initially you're limited to a daily limit of $5,000, providers such as OFX and TorFX have no transfer limits. You'll need to call customer support to lift your limit.

What types of transfers can you carry out with CBA?

- Internet banking. You can lodge an international money transfer through your NetBank account.

- In-branch banking. You can lodge a transfer by visiting a branch, but you’ll be charged more for the transaction than if done online.

- Phone banking. It’s possible to complete transactions via phone banking.

- Forward contracts. CBA allows you to lock in an exchange rate now for a transfer you want to make in the future.

- One-off transfers. You can lodge a one-off transfer with CBA.

- Regular transfers. You can also set up regular scheduled transfers to automatically send funds overseas.

If you ever need assistance when conducting a CBA international money transfer, there are plenty of customer service options available. As well as seeking help in branch, you can search the bank’s online help resources, ask a question on the CBA community, or even phone for assistance.

The registration and transfer process

You’ll need to be a CBA customer in order to use its money transfer services. You can open an account at a CBA branch by supplying appropriate identification and contact details. If you wish to sign up for NetBank, you can do this online by supplying details of your Commonwealth Bank debit card, credit card or keycard, plus your mobile phone number.

You’ll need to be a CBA customer in order to use its money transfer services. You can open an account at a CBA branch by supplying appropriate identification and contact details. If you wish to sign up for NetBank, you can do this online by supplying details of your Commonwealth Bank debit card, credit card or keycard, plus your mobile phone number.

The first time you lodge an international money transfer via NetBank, you’ll have to click on "Increase Your Limit Now" to set your international money transfer limit.

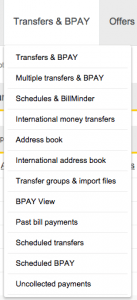

Once that’s done, select "Transfers and BPAY" and click on "International Money Transfer". Enter the country you’re transferring money to and the recipient’s bank code.

Next, type in the recipient’s bank details and select the account you would like to transfer the funds from.

Finally, enter the amount and currency, and then click "Next" to confirm your transfer.

What other products and services does CommBank offer?

- Foreign currency accounts. You can choose from 15 major global currencies and send and receive payments to and from overseas without having to repeatedly convert currencies.

- Travel money cards. A travel money card from CBA allows you to load up to 13 currencies onto your card, which is accepted at more than 35 million locations worldwide. No transaction fees apply to purchases.

- Travellers’ cheques. The bank offers American Express travellers’ cheques in US Dollars, Euros, Great British Pounds, Canadian Dollars and Japanese Yen.

- International bank drafts. CBA provides bank drafts in 14 currencies across 19 countries. Drafts are treated as local cheques, allowing recipients to access their money quicker.

Find cheaper alternatives to CommBank

Compare other products

We currently don't have that product, but here are others to consider:

How we picked theseFinder Score for money transfer

We review money transfer providers for different features to assign them a score out of 10. The higher the score, the more competitive the product.

FAQs about CommBank overseas transfers

Frequently asked questions

Sources

Your reviews

Shirley Finder

Publisher

You are about to post a question on finder.com.au:

- Do not enter personal information (eg. surname, phone number, bank details) as your question will be made public

- finder.com.au is a financial comparison and information service, not a bank or product provider

- We cannot provide you with personal advice or recommendations

- Your answer might already be waiting – check previous questions below to see if yours has already been asked

Finder only provides general advice and factual information, so consider your own circumstances, or seek advice before you decide to act on our content. By submitting a question, you're accepting our Terms Of Service and Finder Group Privacy & Cookies Policy.

This site is protected by reCAPTCHA and the Privacy Policy and Terms of Service apply.