In this guide

- Our verdict

- Details

- Product details

- Frequently asked questions

- Your reviews

- Ask a question

Gemini review

We currently don't have this product on Finder

- Regulator registration

- AUSTRAC

ASIC

FinCEN

FINTRAC

FCA-registered - Supported assets

- 76

- Fiat currencies

- 7

Our verdict

Gemini prides itself on being “the regulated cryptocurrency exchange”. What does that mean for you?

Gemini has a unique fee structure that may be appealing to certain users – this gives the exchange a competitive edge. Gemini offers referral incentives for newcomers to the platform and its easy-to-use interface lends itself to inexperienced and experienced traders alike. Gemini allows users from certain countries (United States, Hong Kong and Singapore) to earn interest on their balances.

However, this service isn't currently available for Australian users, so those looking to make passive income on their investments may wish to try an alternative exchange.

All in all, Gemini is a good, welcoming exchange for users of all skill levels.

Pros

-

Wide range of currencies to exchange

-

Incentives for newcomers, welcoming UI

-

Insurance on currency balances up to $250,000

Cons

-

Varying fee structure with highest fees on mobile app

-

Missing some notable top 20 currencies

-

Limited advanced features for Australian residents

In this guide

- Our verdict

- Details

- Product details

- Frequently asked questions

- Your reviews

- Ask a question

Details

Product details

| Product Name | Gemini |

| Fiat Currencies | USD, AUD, CAD, EUR, GBP, SGD, HKD |

| Cryptocurrencies | BTC, ETH, USDT, BNB, XRP, USDC, SOL, STETH, DOGE, ADA & 66 more |

| Deposit Methods |

Bank transfer Cryptocurrency Debit card Apple Pay Google Pay |

| Trading Fee | Maker: 0.00 — 0.20%Taker: 0.03 — 0.40% |

| Deposit Fees |

Wire transfer: None Cryptocurrency: None PayPal: 2.50% Debit card: 3.49% + Trading Fees Apple Pay: 3.49% + Trading Fees Google Pay: 3.49% + Trading Fees |

| Withdrawal Fees |

Wire transfer: None Cryptocurrency: Fees vary |

What is Gemini

Gemini is a cryptocurrency exchange with a simple UI that's user friendly and accommodating to newcomers and experienced traders alike. Gemini is a New York trust company, which ensures that the company is compliant with a number of security and financial regulations. It is one of the very few cryptocurrency exchanges in the world to own a New York BitLicense. Gemini allows users to earn interest on eligible cryptocurrency balances.

Some more notable currencies aren't available on the platform, namely some of the non-ERC20 tokens from the top 20 range of currencies.

Gemini's most notable weakness is its fee structure. Fees are competitive if you turn on ActiveTrader. However, if you don't, the fees can add up quickly. Buying through the mobile app has very high fees compared to using ActiveTrader, and the fees are the same on the desktop site without ActiveTrader on.

- If this is your first exchange: Gemini is a pretty good place to start given its intuitive design and tight regulations. Gemini's fee structure can punish small trades and may not be worth it if you make a large number of small trades.

- If you're switching exchanges: Gemini offers some pretty bold guarantees and assets held in their hot wallet are fully insured. Gemini also offers a number of compelling features, including Gemini Earn, however, this service isn't available for Australian customers.

What to know about Gemini

User balances are covered by a robust insurance plan and cold storage of wallets. However, it is worth noting that Gemini is still holding the private keys to these wallets. Additionally, Gemini's insurance does not cover losses due to theft from unauthorised access of an individual's account – so if, for example, somebody guesses your password, you wouldn't be protected by insurance.

Gemini is a good exchange to use as long as you activate ActiveTrader and execute trades on the desktop site. Otherwise, you are subject to very high fees that are outlined in Fees and costs.

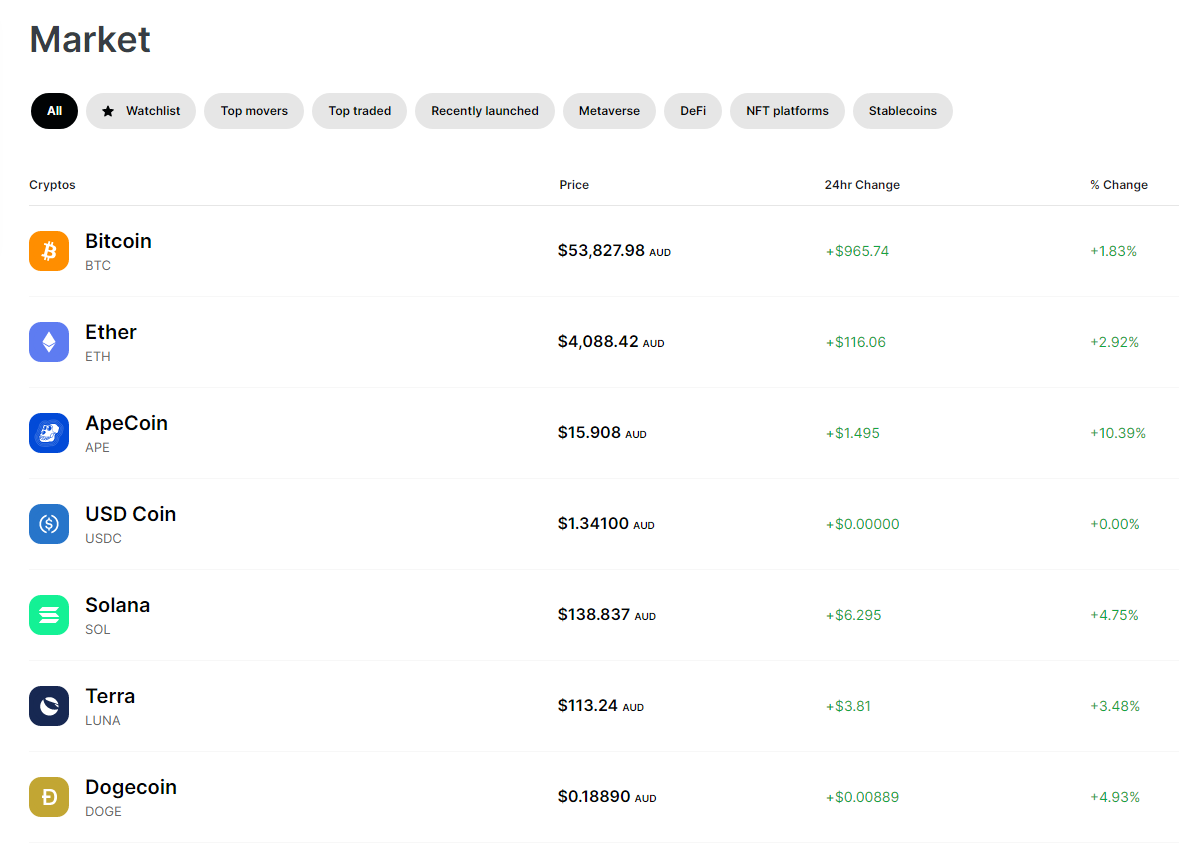

Supported cryptocurrencies

Gemini supports over 70 cryptocurrencies, including most of the top 20 by market capitalisation. Below are some of the supported coins and tokens on Gemini – be sure to visit the exchange for a full list:

- Bitcoin (BTC)

- Bitcoin Cash (BCH)

- Basic Attention Token (BAT)

- Quant (QNT)

- Chainlink (LINK)

- Shiba Inu (SHIB)

- Polygon (MATIC)

- Filecoin (FIL)

- Decentraland (MANA)

- Fantom (FTM)

Transferring fiat and cryptocurrency with Gemini

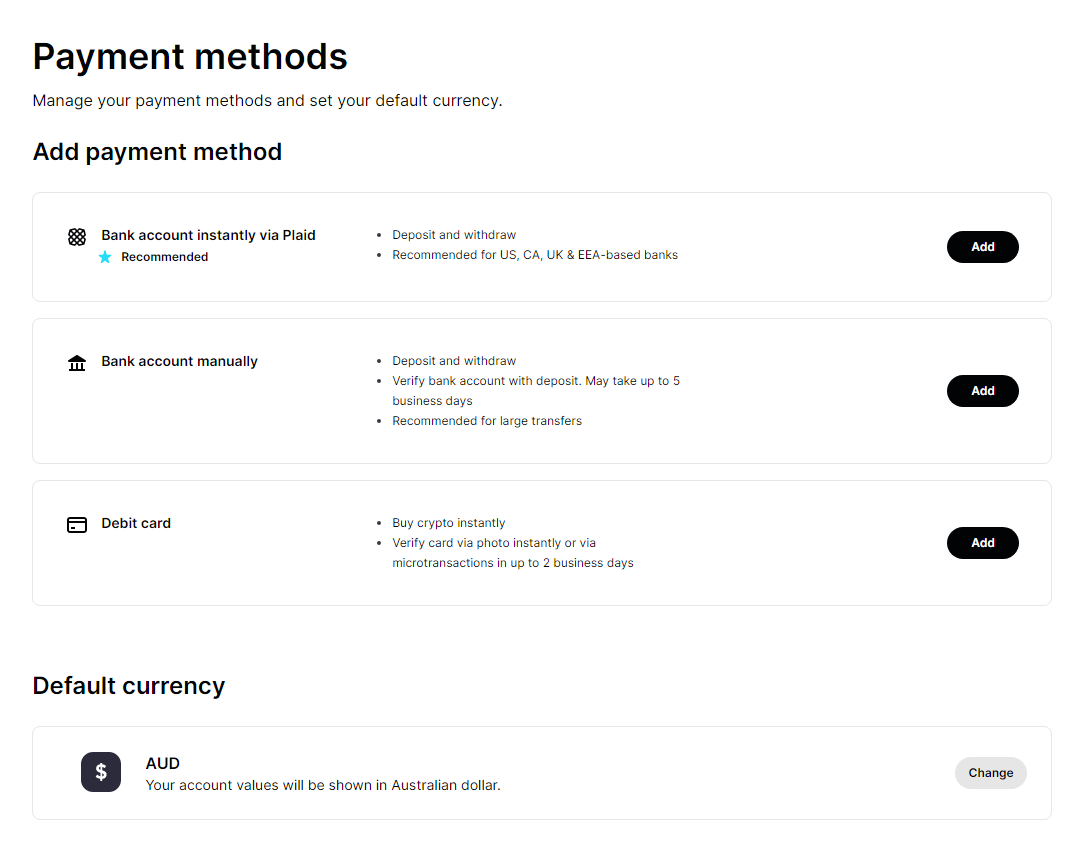

New users can connect their bank accounts instantly to Gemini using the Plaid system, however there are no Australian banks supported for this method. Manual bank transfer deposits are made available for trading immediately. However, the account must first be verified using a deposit, which can take up to 5 business days. Debit cards can also be added to process crypto instantly, although these incur a higher fee than other transfer methods. Crypto deposits and withdrawals are processed immediately and their wait times depend on network congestion.

Gemini Fees and costs

Deposit fees for fiat are free unless using a debit card, which incurs a 3.49% fee. Withdrawals are free via bank transfer. Crypto fees are free for deposits. Crypto withdrawals are free as well, as long as you are within your free withdrawal quota.

Gemini uses a relatively complicated tiered fee structure. There are different fees for using the mobile app and the desktop site, in addition to there being an ActiveTrader setting that can be turned on.

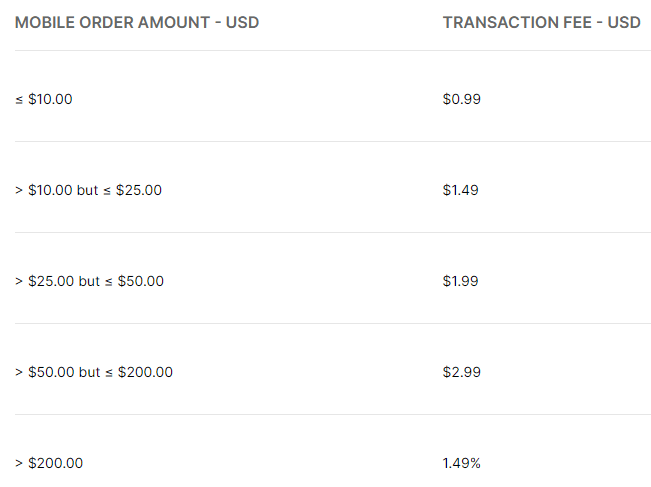

Without ActiveTrader turned on, users are subject to a set fee structure that is quite high (see the image below). With ActiveTrader turned on, fees can drop as low as 0% on maker fees and 0.03% on taker fees. The only way to use ActiveTrader on mobile is to use your web browser with the setting turned on and access the exchange that way. Using the mobile app incurs the fee structure below.

Note: Gemini fees for using the desktop site without turning on ActiveTrader are the same as for mobile.

Fiat withdrawal and deposit fees

| Deposit | Withdrawal |

|---|---|

| Free for bank transfers. 3.49% of total purchase amount for debit card transfers. | Free |

Crypto withdrawal and deposit fees

| Deposit | Withdrawal |

|---|---|

| Free for all cryptocurrencies | Free if you make less than or equal to 10 withdrawals a month as an individual customer, or less than or equal to 50 withdrawals a month as an institutional customer. Going above those limits will begin to incur fees. Each currency has its own respective fee associated with it. |

What is it like to use Gemini?

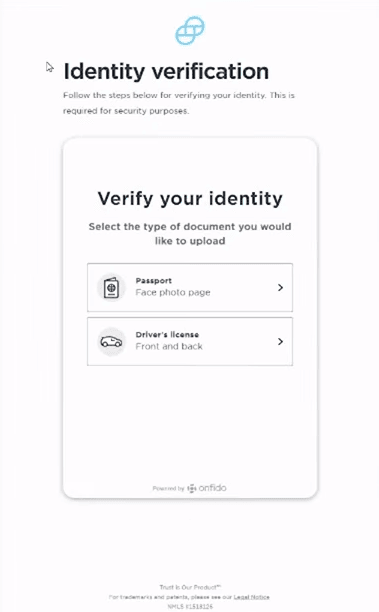

Before you can even get started trading on Gemini, you have to go through the rigorous verification process. This can take quite a long time, although the process is automated. The reason for this is Gemini's commitment to certifications, and compliance with regulations and insurers. The upside is when it's time to do your taxes, you won't have to worry about the status of your crypto. Gemini's compliance makes it quite easy to manage your obligations.

Gemini has 2 interfaces: the basic interface which is very newbie-friendly, and the ActiveTrader interface for the advanced trader. Gemini prides itself on being easy to use and it achieves just that.

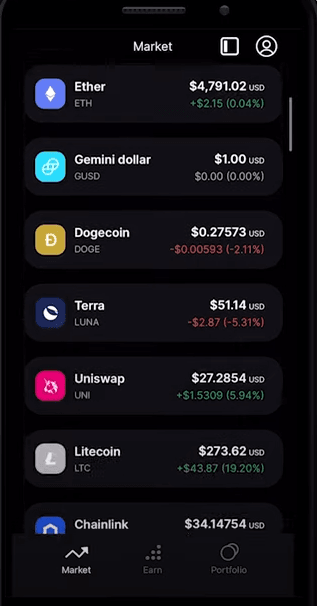

Gemini app

Gemini's mobile app is robust and easy to navigate. All of Gemini's features are made easy-to-use in a mobile setting.

Getting started with Gemini

Gemini offers a quick and simple way to navigate getting started. A more detailed guide of setting up an account can be found below. It is a simple process, but users have reported long wait times when registering financial data.

Markets

Gemini's desktop markets are easy to navigate. Users are able to favourite coins and add them to a watchlist.

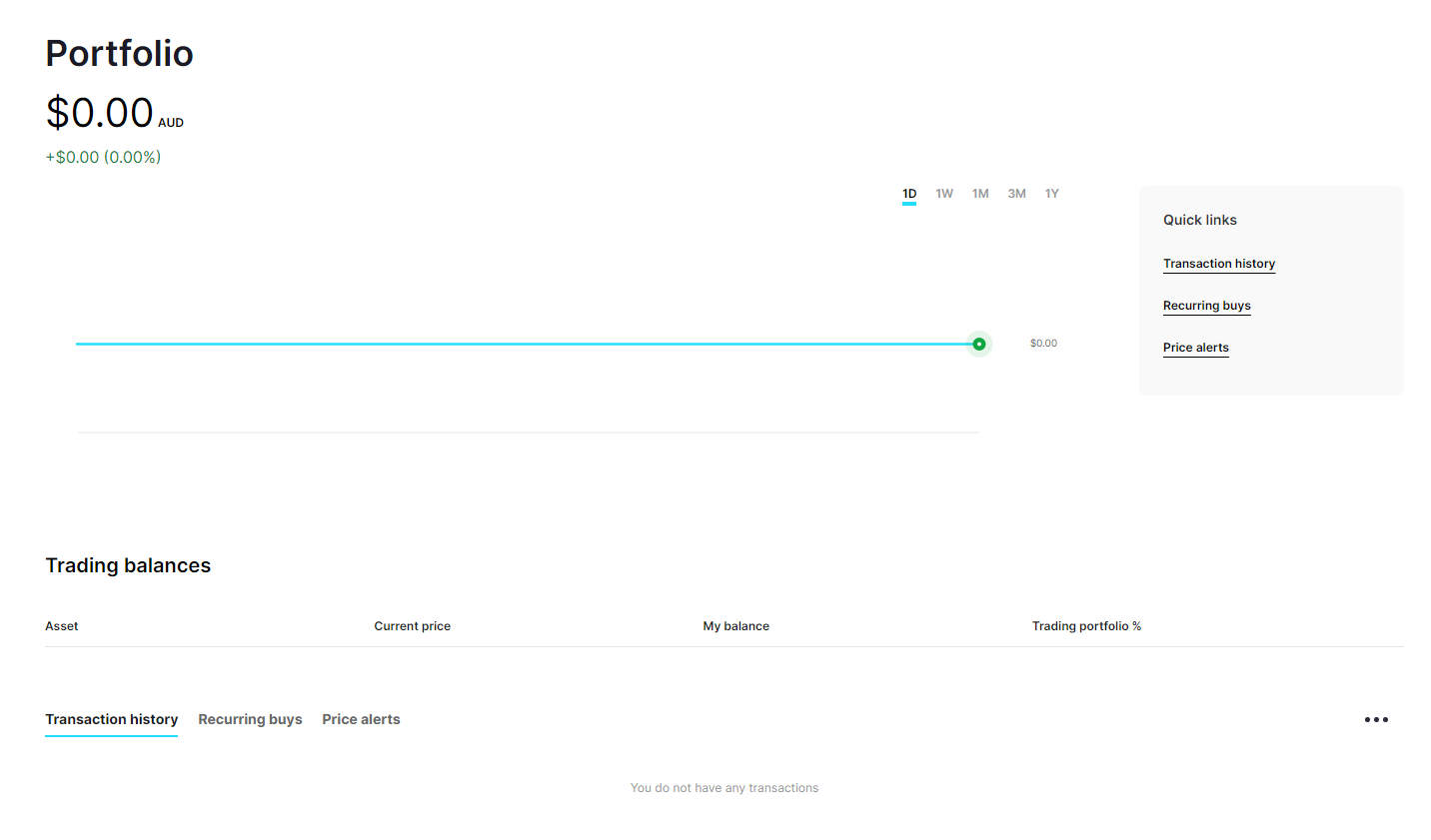

Portfolio hub

Gemini has a live-tracking portfolio where you can view your assets in real-time. You can also view any outgoing or upcoming transactions.

Does Gemini have good customer support?

Gemini has customer support, but user reports vary. Averages reported by the company look favourable, but customers report waiting for as long as weeks to receive emails back from the company and long hold times.

| Support offered | Wait times | |

|---|---|---|

| Contact Us form | ✅ | Under 2.5 hours on average |

| Live chat | ✅ | Live chat is offered, but it's a bot that directs users to other support lines. |

| ✅ | At least 24 hours after receiving the email on average. |

List Gemini services

Trading on Gemini

There are earning opportunities on Gemini, but they're limited to residents from certain countries. Australians can perform most basic buy/sell functions on Gemini, as well as place recurring orders as part of a dollar-cost averaging strategy.

Gemini Mastercard

Gemini is offering a credit card that is yet to be released, but is coming soon. Once implemented, it will allow users to spend their crypto anywhere Mastercard is accepted. This service will not initially be available for Australian residents, but this may change in the future.

Promotions on Gemini

Currently, new users can earn $10 in Bitcoin when someone they've referred buys or sells US$100 within 30 days of creating their account.

Trust rating

Gemini rates highly for security. Gemini has never been hacked. Security features of Gemini include 2-factor authentication, SOC 2 compliance (the first-ever cryptocurrency exchange to do so), and insurance for assets held in the platform's hot wallets.

Past hacks

No hacks have ever taken place.

Security audits

Gemini has undergone heavy-duty auditing. Gemini is the first ever cryptocurrency exchange to pass the SOC 2 type 1 examination. They will be audited for compliance with this examination every year.

Insurance

The company has full FDIC insurance, just like a bank does, for fiat currencies up to $250,000.

Signing up on Gemini

-

-

Before you can start trading, you have to add your bank account to your Gemini account. There are a number of options to choose from, so choose the option most compatible.

-

-

After all that is processed, you're ready to trade on Gemini.

Compare Gemini against other exchanges

Compare other products

We currently don't have that product, but here are others to consider:

How we picked theseFrequently asked questions

-

Gemini is an independent company, co-founded by the Winklevoss twins, Cameron and Tyler of early Facebook fame.

-

Gemini is a reliable crypto exchange that has undergone thorough audits.

-

Yes, Gemini is FDIC insured.

-

Gemini USD is a stablecoin managed by Gemini.

Sources

-

Finder writers are subject matter experts and use primary sources, in-depth research and interviews with other experts to ensure you're getting accurate, up-to-date information. Articles are fact checked in line with our editorial guidelines.

Your reviews

Keegan Finder

Writer

Hi there, looking for more information? Ask us a question.

You are about to post a question on finder.com.au:

- Do not enter personal information (eg. surname, phone number, bank details) as your question will be made public

- finder.com.au is a financial comparison and information service, not a bank or product provider

- We cannot provide you with personal advice or recommendations

- Your answer might already be waiting – check previous questions below to see if yours has already been asked

Finder only provides general advice and factual information, so consider your own circumstances, or seek advice before you decide to act on our content. By submitting a question, you're accepting our Terms Of Service and Finder Group Privacy & Cookies Policy.

This site is protected by reCAPTCHA and the Privacy Policy and Terms of Service apply.

Keegan Francis was a cryptocurrency writer for Finder. He has been invested in cryptocurrencies since 2013 and writing about them since 2018. He has written and edited for CryptoVantage. In 2020 he and his wife Mrugakshee Palwe opted entirely out of the world of traditional finance and went "full crypto", covering their experience in the Go Full Crypto podcast and via a Substack newsletter. Keegan holds a Bachelor of Computer Science from Acadia University, and has attained graduate certificates from Ivan On Tech's lightning network course and the Consensys Academy Ethereum bootcamp. When Keegan is not working on cryptocurrency, he enjoys travelling, rock climbing and playing piano. See full profile