Why investors should include green stocks in their portfolios

As major mining companies move away from coal, investments expert Rudi Filapek-Vandyck examines how renewables and sustainable investments can fill the gap.

Forget about your political beliefs and alliances, as editor of an online media company specialising in finance and investing, it is my task to inform you about emerging trends that will have an impact on asset prices.

In the wake of unprecedented bushfires in Australia and global investment manager BlackRock announcing it considers thermal coal exposure a no-go for the future, the focus among investors is increasingly shifting away from "dirty" coal; the kind used by utilities including AGL Energy and Origin Energy to supply power to Australian businesses and households.

Of course, thermal coal will remain in use for decades to come across the globe, but that won't stop the world's institutional investors selling their exposure and avoiding involvement with the sector ever again. Which is what is happening today.

How this scenario exactly is going to play out is anybody's guess, but I'd wager both Rio Tinto (RIO) and BHP Group (BHP) did not sell their thermal coal operations for no reason. Plus BHP-offshoot South32 (S32) is now also in the process of divesting its exposure in South Africa.

Maybe the share market is not the first place to focus on. Last year, Peabody Energy, a US-based company that advertises itself as the largest private-sector coal company in the world, was forced to pull an US$800m junk-bond raising that sent shivers through the global corporate bond market.

Earlier this month, one of the local experts in corporate credit in Australia sent a written warning to his clientele: institutions are selling their corporate bonds. They are of the intention to never return. It is but logical to expect a profound impact on liquidity and on the traded value of these corporate bonds.

The warning stated that while the companies behind such bonds might still look solid, from a fundamental credit analysis perspective, it is plausible such bonds will start trading at a discount to intrinsic value and might not recover from it. Moreover, when refinancing comes along, there might not be enough appetite around to provide ongoing financial support.

In other words: the corporate credit market is shifting into "risk-off" mode for thermal coal exposure. No more appetite. Investors better take note.

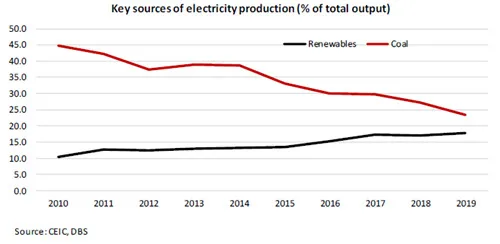

Below is a recent chart showing trends for coal and renewables as the key source for electricity generation in the US. Sure, coal is still more important than all renewables combined, but is that the real message here?

In today's share market, share prices for producers including Coronado Global Resources (CRN), Whitehaven Coal (WHC) and New Hope Corp (NHC) are low because the price of the commodity has fallen sharply, and there will always be a class of investor who remains interested as long as the share price looks cheap enough, but here too new trends are building momentum. Green energy and sustainable investing are two of them.

I have observed this shift over the past few years, with active interest. Since late 2018, FNArena has also been running a dedicated news section to ESG (environmental, social and governance) matters on its website: ESG Focus.

Don't just take my word for it. On 23 January 2020, Saxo Bank released a fresh outlook assessment for global equity markets with the premise being the world is about to experience a seismic shift on the back of disruption to and shortages of food, clean water and clean air.

Both governments and their citizens, including businesses and investors, will increasingly direct their focus towards the realisation the current model is based on "unsustainable economic activity", in the words of Saxo Bank, which now predicts rising climate awareness will drive a "green mega trend" in global equities.

"We believe that these green stocks could, over time, become some of the world's most valuable companies – even eclipsing the current technology monopolies as regulation accelerates during the coming decade. Investors should consider tilting their portfolios towards green stocks so they don't miss this long-term opportunity."

Starting today.

This is an edited extract of Rudi Filapek-Vandyck's Weekly Insights. The full article was published exclusively for FNArena subscribers on 30 January 2020.

Rudi Filapek-Vandyck has been in journalism for over three decades, with more than half of it in finance. After publishing his own journals and magazines, he successfully built up an electronic financial news service in the Netherlands from 1995-2000. In 2002, Rudi founded FNArena in Australia, where he has developed various unique features and tools that help investors conduct their own market research.

Rudi's market observations and analyses are regularly picked up and re-published by other media such as The Australian, Livewire Markets and First Links. He has appeared on Sky Business and Your Money, and occasionally travels to present his analyses to investors by invitation from the Australian Investors Association (AIA), the Australian Technical Analysts Association (ATAA), the Australian Shareholders Association (ASA) and others. He is also the author of two books: Change, investing in a low growth world and Who's Afraid of the Big Bad Bear?

Disclaimer: The views and opinions expressed in this article (which may be subject to change without notice) are solely those of the author and do not necessarily reflect those of Finder and its employees. The information contained in this article is not intended to be and does not constitute financial advice, investment advice, trading advice or any other advice or recommendation of any sort. Neither the author nor Finder has taken into account your personal circumstances. You should seek professional advice before making any further decisions based on this information.

Read more Finder X columns

-

All the big savings account interest rate rises: ING, AMP, Westpac + more

6 Feb 2026 |

-

Australian credit card debt soars 10% in a year: How can you escape the trap?

6 Feb 2026 |

-

4 cashback home loan offers to ease the pain of RBA rate hike

4 Feb 2026 |

-

Finder’s RBA Survey: Easing cycle ends as RBA delivers first rate hike since 2023

4 Feb 2026 |

-

Ubank Save is increasing its bonus rate up to 5.35% p.a.

3 Feb 2026 |

Images: Getty Images, supplied

Ask a question