Finder’s RBA Survey: Second cut means $2,500 yearly savings for average loan

In a move not seen since March 2020, the Reserve Bank of Australia (RBA) has cut the cash rate twice in three meetings.

In this month's Finder RBA Cash Rate Survey™, 41 experts and economists weighed in on future cash rate moves and other issues relating to the state of the economy.

The overwhelming majority (88%, 36/41) correctly tipped the easing from 4.10% to 3.85%.

According to ABS data, the average owner-occupier home loan stands at $659,920 as of March 2025. A reduction of 50 basis points would mean $213 in monthly savings and $2,553 in annual savings.

Finder will be tracking the rate changes as they happen at https://www.finder.com.au/rba-cash-rate/interest-rate-cuts/interest-rate-cuts

Finder's survey found that 3 in 4 experts* (73%, 24/33) forecast 2 or more cuts in the next 12 months.

If the cash rate is cut a further 50 points, the average homeowner would be paying $420 less per month and $5,044 less per year in interest.

Graham Cooke, head of consumer research at Finder, said today's cut is by no means the end.

"Frankly, two cuts might not be enough to ease the spike in mortgage stress we've seen since the cash rate started rising again in May 2022.

"But it's a step in the right direction and it's great news for homeowners. It's two down and maybe two more to go this year.

"On an average home loan, if your bank passes on both rate cuts in full, you could be saving almost $2,600 per year."

Cooke said, rate changes show the value of being on a lower rate, even if it is just a bit lower.

"There is a 40-point difference between the average and lowest rate available. You can potentially give yourself nearly 2 rate cuts by getting on the front foot and switching."

| Cash rate | Average home loan rate** | Average monthly repayment | Average monthly decrease | Average annual repayment | Average annual decrease | |

| January 2025 | 4.35% | 6.31% | $4,089 | – | $49,068 | – |

| February 2025 (first cut) | 4.10% | 6.06% | $3,982 | $107 | $47,785 | $1,284 |

| May 2025 (25bp rate cut applied) | 3.85% | 5.81%*** | $3,876 | $213 | $46,516 | $2,553 |

| December 2025 (50 points in additional rate cuts applied) | 3.35% | 5.31%*** | $3,669 | $420 | $44,024 | $5,044 |

| Source: Finder, RBA. **Owner-occupier outstanding variable rate. Repayments based on a 30-year $659,920 loan, ABS average OO loan size as of March 2025. ***Expected cut to current average rate. |

Expert advice to first-home buyers

We asked our experts for a couple words of advice for prospective first-home buyers in Australia.

Advice was varied, but the general themes leaned toward entering the housing market sooner rather than later, starting on the home-owner journey within your financial means, and being strategic about saving and preparation.

Here's what they said:

Shane Oliver, AMP: "Don't take on too much debt and buy when rates are high and the market is weak."

Stella Huangfu, University of Sydney: "Step in early — start small and affordable. It's better than waiting forever."

Rich Harvey, Propertybuyer: "Save early and save hard for a deposit. Work on your skill set to enhance your earning potential. Get your parents to help out (bank of mum and dad). Buy something affordable and get into the market. Consider rent-vesting as a viable alternative."

Leanne Pilkington, Laing+Simmons: "Irrespective of interest rate movements, first home buyers should be clear and comfortable with their repayment obligations, remembering that a first home is not necessarily a forever home."

Sveta Angelopoulos, RMIT University: "Enter the housing market sooner, rather than later."

Mala Raghavan, University of Tasmania: "Exercise caution when considering properties that are overly priced. It's essential to ensure that you have a reliable safety net in place, along with a generous financial buffer, to comfortably manage your mortgage payments."

Adj Prof Noel Whittaker, QUT: "Hang in there – and don't be frightened to live with your parents or even use the bank of mum and dad. It's very hard to do on your own."

Mathew Tiller, LJ Hooker Group: "Saving a deposit takes time, but government programs like the 5% deposit scheme (FHBG) can give you a head start. Get your finance pre-approved, speak to as many agents as you can about market activity and opportunities, being able to act quickly is key, so be prepared and do your research."

Garry Barrett, University of Sydney: "Consider location, and once in the housing market, there will be opportunities to upgrade and relocate"

Jakob B Madsen, University of Western Australia: "If you don't have at least 20% down payment, don't buy a house/flat. Rent instead unless you can pay off the debt reasonably quickly and you won't face the uncertainty of looking for a lot of money."

Craig Emerson, Emerson Economics: "Buy sooner rather than later."

Tim Reardon, HIA: "Buy as soon as possible. The housing affordability problem will get significantly worse over the next 3 years as we complete a low volume of homes, and population growth remains extraordinarily high."

Nicholas Frappell, ABC Refinery: "At some point, you will look back and wonder how things ever got this crazy."

Michael Yardney, Metropole Property Strategists Pty Ltd: "Property prices will skyrocket in early 2026 when Labor's 5% deposit scheme comes into effect – get in before the crowd. Sure, prices seem expensive but that's what your parents said. Who wouldn't like to buy their parents' home for the price they paid."

Matt Turner, GSC Finance Solutions: "I am telling my clients to get in as soon as possible, with expanded FHB programs and reducing interest rates the ability to spend is increasing, so prices will follow. If you can get in now, do so, as it could save thousands."

Mark Crosby from Monash University, was the most succinct.

His advice?

"Move to the country."

Experts cautiously optimistic about the economy after the election

We also asked our experts to describe their feelings about the Australian economy in the post-election environment.

Experts by and large reported a prevailing sense of cautious optimism, tempered by significant concerns and uncertainties.

Garry Barrett, University of Sydney: "Cautiously optimistic, with a great deal on international uncertainty."

James Morley, University of Sydney: "Cautiously optimistic that we continue to be the "lucky country."

Stella Huangfu, University of Sydney: "Cautiously optimistic: inflation easing, rates likely to fall, but global risks persist."

Leanne Pilkington, Laing+Simmons: "Cautious optimism, as rates decline and home building hopefully picks up."

Sean Langcake, Oxford Economics Australia: "Economy in a good place, but productivity weakness a glaring problem."

Nalini Prasad, UNSW Sydney: "Australia is still in a good position economically but it is facing headwinds in terms of productivity and debt."

Shane Oliver, AMP: "We expect a moderate pick up in economic growth to around 1.6% this year helped by the tax cuts, rate cuts and real wages growth. Trade turmoil will constrain growth though."

Mark Crosby, Monash University: "Despite a lack of appetite for policy reform or proper policies to address challenges such as housing shortages the economy continues to chug along on the back of mining and government spending."

Others were less optimistic in their succinct outlook for the Aussie economy.

Matt Turner, GSC Finance Solutions: "Cautiously pessimistic"

Kyle Rodda, Capital.com: "Lacklustre and in need of a redoubled focus on productivity."

Evgenia Dechter, University of New South Wales: "High government spending; inflationary pressures; growth outlook remains uncertain."

Nicholas Frappell, ABC Refinery: "Constrained by so-so productivity, household debt and few ideas on energizing private sector growth."

Peter Boehm, Pathfinder Consulting: "Uncertain; upside risk of inflation; cost of living worsening; productivity reducing; government debt blowing out; energy prices to increase (inflationary) and small to medium businesses hit hard by government taxes and intervention. Look to the UK to see what our economic future may look like."

As to the vision of the two main parties, 78% of experts believe Labor had the better economic policy for everyday Australians when compared to the Coalition's offering.

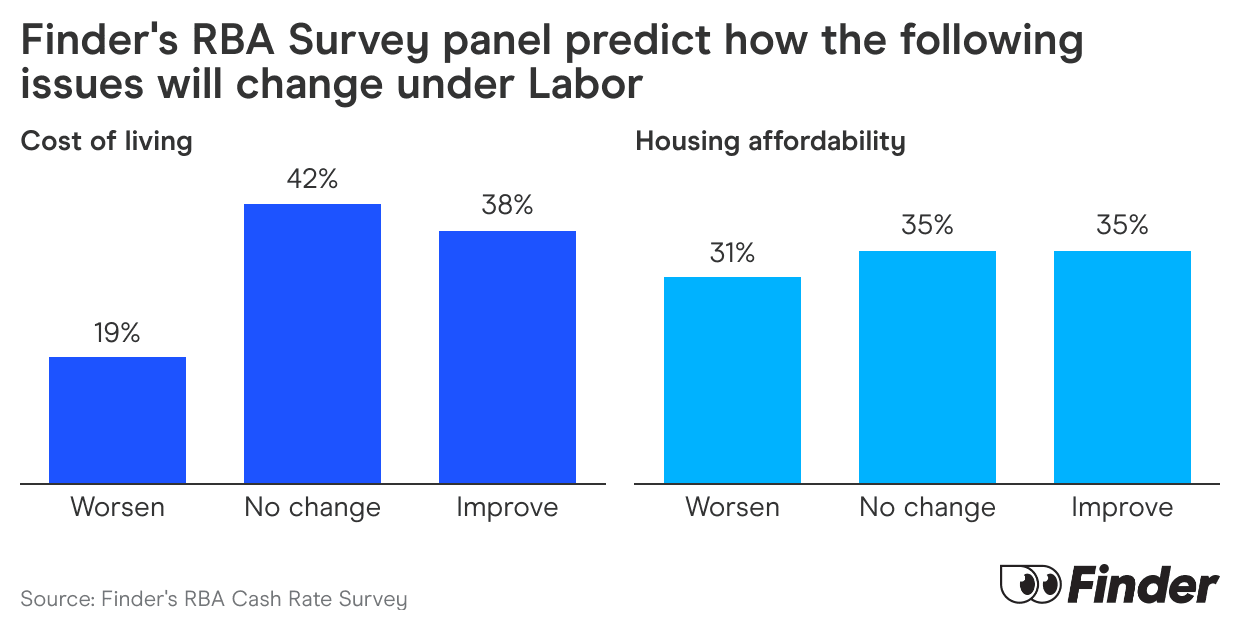

38% of panellists expect cost of living to improve over the next 4 years under Labor while 42% expect no progress to be made and 19% believe the cost of living will worsen.

Almost 1 in 3 (31% 8/26) experts believe housing affordability will get worse under Labor while 35% expect an improvement in affordability and a further 35% expect no change.

Cooke said decisions on housing and housing affordability will go a long way to determining Labor's success.

"If Labor can meaningfully increase home building, especially those reserved for first home buyers, I'd expect housing costs to improve – but that's a huge 'if'.

"My advice is don't wait for a silver bullet from the government, regardless which party is in power.

"Live within your means, get the best deal you can on your insurances and utilities, save your money and make it work for you," Cooke said.

*Experts are not required to answer every question in the survey

Here's what our experts had to say about the cash rate:

Evgenia Dechter, University of New South Wales (Decrease): "The headline inflation rate is settling within the target."

Tomasz Wozniak, University of Melbourne (Decrease): "Unsurprisingly! In line with expert opinions and market expectations, the combined forecasts from my models indicate a decisive CUT of the cash rate in May. The predictive intervals do not include the rate's current value and include a 25bp cut. All the bond yield curve models' predictions align with these projections, and those that rely more on exchange rates or cash rate persistence do not. Longer-term scenarios will become more realistic after two or three more cuts. My forecasts are available at: https://forecasting-cash-rate.github.io/"

Matthew Greenwood-Nimmo, University of Melbourne (Decrease): "Inflation continues to moderate, which creates space for a rate cut. The case for a cut is strengthened by the risks to confidence and economic activity posed by current global uncertainty and trade tensions."

Nalini Prasad, UNSW Sydney (Decrease): "Expectations are that the RBA will decrease the cash rate. I think the RBA will be concerned about developments in the global economy and look to cut the cash rate for this reason."

Shane Oliver, AMP (Decrease): "Since the last meeting we have seen a further fall in underlying inflation to within the target range and wages growth in line with RBA forecasts adding to confidence inflation is falling sustainably to the mid-point of the target range. At the same time GDP growth looks to be running weaker than expected with flat consumer spending in the March quarter and global trade uncertainty poses a downside risk to the economic outlook."

Anthony Waldron, Mortgage Choice (Decrease): "Given inflation has continued to ease and is now sitting within the Reserve Bank's target band, I expect the RBA will cut the cash rate at its May monetary policy meeting. We've also seen a number of lenders reduce their fixed rate home loans recently, a sign that the market is anticipating that the cash rate will fall."

Tim Nelson, Griffith University (Decrease): "Inflation within target range. Global tariff uncertainty may cause the RBA to seek to get ahead of any business confidence declines etc."

Stella Huangfu, University of Sydney (Decrease): "Both headline and underlying (trimmed mean) inflation have now fallen within the RBA's 2–3% target range — a key milestone that opens the door to possible rate cuts."

Rich Harvey, PROPERTYBUYER (Decrease): "Given that the inflation rate is now well and truly in the RBA preferred band and the drag higher interest rates are having on the economic growth, and unsettled international economic conditions, the time is justified for a rate cut. I am predicting a 0.35% cut this month which will be followed by another 4 cuts over the next 12 months taking the cash rate to its equilibrium level at 3%."

Leanne Pilkington, Laing+Simmons (Decrease): "With inflation moderating back to the Reserve Bank's target range, and the global economy continuing to grapple with the actual and potential fallout of a fluctuating tariff situation, household spending is constrained. This supports the case for a rate cut."

Adelaide Timbrell, ANZ (Decrease): "Uncertain global backdrop, weak consumption Q1, encouraging trimmed mean inflation Q4 and Q1."

Sveta Angelopoulos, RMIT University (Decrease): "Uncertainty and risk in the global environment may weaken the domestic economy."

Sean Langcake, Oxford Economics Australia (Decrease): "News from abroad on the tariff front has improved. But the economy will still need to weather a sizable 'uncertainty shock' through Q2 at least. With upside inflation risks dissipating, the RBA can afford to lend the economy some more support."

Nicholas Gruen, Lateral Economics (Decrease): "It's generally expected."

Jeffrey Sheen, Macquarie University (Decrease): "It's been reasonably clear for a while that inflation has stabilised within the RBA's target range. The RBA should immediately return the cash rate from being restrictive to its neutral level. The RBA may need to ease further later this year in the event of a global recession induced by the policy chaos of the White House."

Adj Prof Noel Whittaker, QUT (Decrease): "This is a difficult call but markets are pricing a cut in and inflation is now within the banks target range. But I say that with less than perfect certainty."

Brodie Haupt, WLTH (Decrease): "While inflation has fallen substantially since the peak, the RBA board mentioned they needed to see sustainable progress towards the target band. Furthermore, wage pressures have reportedly eased which could give the RBA more confidence about a rate cut."

Mathew Tiller, LJ Hooker Group (Decrease): "At its last meeting, the RBA held steady seeking more evidence that inflation was sustainably returning to the target range. Since then, inflation has eased further, with both headline and underlying figures now sitting within the band. With a slight softening in jobs data, ongoing cost-of-living pressures and global trade uncertainty clouding the outlook, a May rate cut is highly likely."

Garry Barrett, University of Sydney (Decrease): "Easing of inflationary pressure."

James Morley, University of Sydney (Decrease): "Even underlying measures like 2.8% trimmed mean inflation have come back into the 2-3% target range in the latest reading. So the RBA can continue a gradual return to a neutral stance of policy. Global uncertainty and likely economic weakness due to tariffs also argues for cutting rates even if Australia is not so directly exposed to US tariffs. The US tariffs on China are likely to lead to cheaper prices of imports in Australia, so the RBA can forecast that inflation is likely to remain in the target range even if the government removes energy price rebates at some point."

Devika Shivadekar, RSM Australia (Decrease): "With headline inflation sitting below the mid-point of 2.5% for two consecutive quarters and trimmed mean inflation breaching the target range in the previous quarterly print, the RBA should feel comfortable to deliver another 25bps cut."

Geoffrey Kingston, Macquarie University Business School (Decrease): "The Bank will probably lower the cash rate because the latest data show that trimmed mean inflation is now within the target band and the labour market is slightly weaker."

Craig Emerson, Emerson Economics (Decrease): "GDP growth is slow and there is no sign of a price-wage spiral."

Tim Reardon, HIA (Decrease): "CPI back in target band."

Kyle Rodda, Capital.com (Decrease): "Trimmed mean CPI is back within the RBA's 2 to 3% target band and the central bank has scope to ease policy to take pressure off households and get ahead of a likely slowdown in global growth."

Peter Munckton, Bank of Queensland (Decrease): "Inflation is compatible with target"

Nicholas Frappell, ABC Refinery (Decrease): "Weakness in consumer spending and lowering inflation expectations."

David Robertson, Bendigo Bank (Decrease): "I expect the RBA to cut rates by another 25 basis points on May 20, with some risk of a larger cut (35 bp would be ideal) but in the absence of a sudden sharper downturn in global conditions a 50bp cut appears unlikely."

Michael Yardney, Metropole Property Strategists Pty Ltd (Decrease): "Inflation has finally fallen within the RBA's 2–3% target band, with underlying inflation now at 2.9%, and services inflation has cooled from 4.3% to 3.7%. Even energy price pressures are moderating."

A/Prof Mark Melatos, School of Economics, University of Sydney (Decrease): "Monthly inflation readings have been falling precipitously for a while. The March quarter CPI report showed headline and underlying inflation within the RBA's target range. The RBA might be tempted to wait for further confirmation of this reversion of the trimmed (quarterly) mean to the target range. However, for this they would need to wait until next quarter's reading. The monthly readings have already been within the target range since late 2024. Given that the Federal election has been held, there seems to be little stopping the RBA moving to ease now."

Peter Boehm, Pathfinder Consulting (Decrease): "The economic outlook is still a bit uncertain but there is considerable political and public pressure to reduce interest rates and this may hold sway with the RBA rate setting board."

Stephen Koukoulas, Market Economics (Decrease): "Weak growth, low inflation and a softening labour market make the current 4.10% cash rate too high – by a large margin. 50bp cut is needed.

Matt Turner, GSC Finance Solutions (Decrease): "With the trimmed mean inflation measure very much in the target band and macro-economic issues caused by trade wars, there is a case that the RBA could do more, however given the economy is reasonably healthy they would probably exercise caution and decrease slightly."

Saul Eslake, Corinna Economic Advisory Pty Ltd (Decrease): "Because 'underlying' inflation is now back within the 2-3% target band, and will likely fall some more. And the economy is still sluggish."

Stephen Miller, GSFM (Decrease): "Inflation is OK in line with projection. Policy is currently "restrictive". Downside risks to global growth and by extension Australian growth and inflation abound."

Richard Holden, UNSW (Decrease): "Trump tariff concerns."

Malcolm Wood, Ord Minnett (Hold): "The labour market remains tight, driving above trend wages growth. With no productivity growth, this puts unit labour costs above the RBA's inflation target."

Mala Raghavan, University of Tasmania (Hold): "Though the "Trump Tariff" created lots of anxiety and uncertainty, looking at some of Australia's key indicators, they appear to be moving in the right direction. Inflation rate is within target i.e. 2.4% (12 months to the March quarter), while consumer spending remains unchanged and the selected living cost indexes are between 2.4% to 3.5% while business indicators are pointing to the right direction. Given these scenarios, I think the RBA will hold the cash rate this round."

Mark Crosby, Monash University (Hold): "US policy randomness is settling into a pattern of reversals which make US and global slowdowns less likely."

Cameron Murray, Fresh Economic Thinking (Hold): "Honestly, a bit of a guess. Inflation is in the target band. Not big changes globally. So where would be the economic impetus for change?"

Jakob B Madsen, University of Western Australia (Hold): "Not much has changed since last meeting."

Ask a question