Altcoins and cryptocurrency predictions to watch in June 2021

Experts highlight the most significant events that are likely to impact the cryptocurrency markets in June

Looking for the latest market predictions and insights? Check out our August predictions article to learn which coins and tokens are set to dominate this month.

June is set to be an exciting month for cryptocurrency markets, given the room for growth in the market following the historic crash on 19 May, an event now known as "Black Wednesday", where prices across the leading cryptocurrencies dropped by 30-70% (including Bitcoin).

On Black Wednesday Bitcoin (BTC) shed 30% to fall below US$40,000 for the first time since 9 February. Ironically Bitcoin first crossed the US$40,000 mark on the back of news that Tesla was investing US$1.5 billion in Bitcoin, while the recent crash was also driven by Tesla news. This time around the drop was triggered by Elon Musk's Tweets about Tesla withdrawing its acceptance of BTC as payment for its products on 12 May, citing environmental concerns about Bitcoin mining.

Since then, the market has shown a slow yet steady recovery which potentially paves the way for several opportunities in June, in particular for networks such as Ethereum, Cardano and Polygon.

History paints a positive picture for Bitcoin

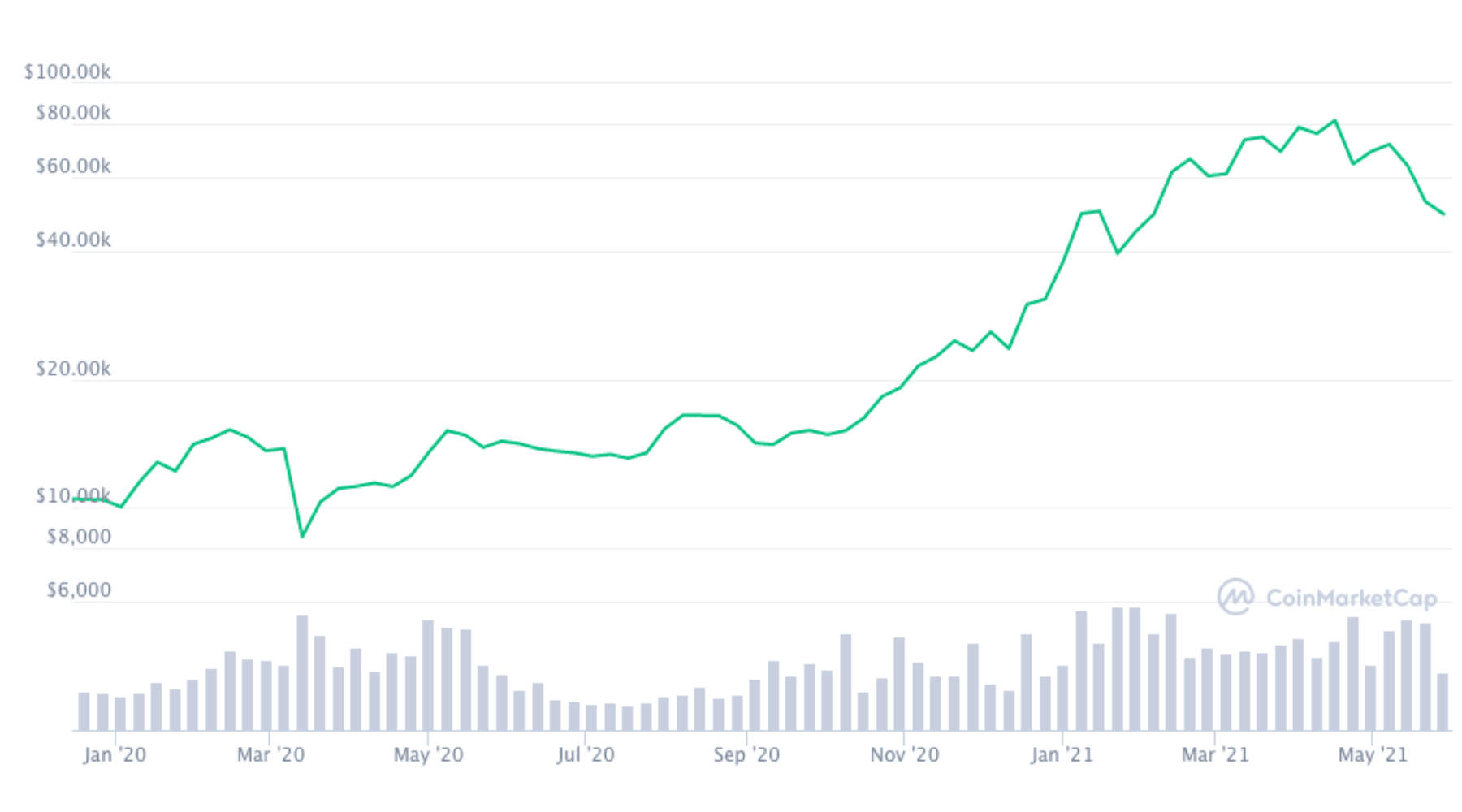

The logarithmic chart shows the bull market for Bitcoin intact despite Black Wednesday. Source: CoinMarketCap

Robbie Liu, Market Analyst at OKEx, a cryptocurrency exchange, points out why June could be a positive month for Bitcoin and the cryptocurrency market as a whole:

"It appears that Bitcoin will inevitably reap two consecutive months of negative yields. However, looking back at the bull market from 2016 to 2017, Bitcoin has never seen three consecutive months of declines. Given this, it would not be surprising if the market rallies in June instead of posting another red month."

So far, Bitcoin has recovered from a recent low of US$32,337 on 23 May back up to a recent high of just above US$40,000 on 28 May, demonstrating that there is still plenty of demand in the market.

Liu further elaborated on the implications of the recent crash:

"Looking at on-chain data, retail investors panic-sold their coins in this recent crash. The Net Realized Profit/Loss, which shows the net profit or loss of all moved coins, hit a record low of $2.66 billion during Wednesday's sell-off, meaning on-chain investors sold their coins and realized their unrealized losses. This realized loss figure even reached twice the loss incurred during the flash crash in March 2020."

Panic amongst retail investors typically prevents buying opportunities for institutions, which is no doubt why firms like MicroStrategy bought the dip on 18 May by acquiring another US$10 million worth of BTC. The firm headed by Bitcoin bull Michael Saylor bought 229 BTC at an average price of US$43,662 per coin. The company now holds a total of 92,079 BTC valued at US$3.57 billion, which is 78% of the company's total market cap.

MicroStrategy CEO Michael Saylor also brokered a meeting between Elon Musk and North American Bitcoin miners on 24 May, which led to the emergence of the Bitcoin Mining Council to reduce the carbon footprint of the digital currencies mining operations.

Ben Caselin, Head of Strategy at AAX exchange, opined further on what the near future might hold for Bitcoin:

"Macro projections over 250k are still on the table. Perhaps more importantly, this bull run may end up to be drawn out much longer than expected, given the exceptional macro conditions around the loss of purchasing power and general friction between citizens and institutions."

On 4-5 June, the Bitcoin community will witness the largest Bitcoin event in recent history. The Bitcoin 2021 conference will be held in Miami, Florida. It will include eminent guests including Saylor, Former Congressman Ron Paul, United States Senator Cynthia Lummis, CEO of Twitter and Square Jack Dorsey, smart contract creator Nick Szabo, and legendary skateboarder Tony Hawk amongst others.

Considering these events and the general market consensus, June could turn out to be a positive month for BTC. Even the billionaire Ray Dalio, the founder of the world's largest hedge fund Bridgewater Associates, has revealed that he owns some Bitcoin and that he prefers it as an investment vehicle over bonds.

Updates for Ethereum and Cardano could be game-changing

The crash in Bitcoin's price also triggered a loss in confidence in altcoins, including Ethereum.

ETH was on a historical rise in the first two weeks of May and hit its all-time high of US$4,299 on 12 May. In the aftermath of the bloody Wednesday, ETH fell over 55% to a low of US$1,922 on 23 May before rebounding to trading in the US$2,800 range at the time of writing.

Despite this, prospects for Ethereum look good over the near term.

As far as the Ethereum network goes, there is a heavily anticipated upgrade (EIP-1559) in early July which will overhaul gas fees on the network. Users should see a reduction in transaction fees, while the overall supply of ETH will reduce as a portion of every transaction fee is burnt (destroyed) instead of sent to miners.

Given the massive impact this should make on both usability and ETH supply, it is generally expected to have a positive impact on the price of Ether.

Another important altcoin that is often touted as an "Ethereum killer" is Cardano (ADA).

June is set to be an important month for ADA as the Cardano network is scheduled to undergo the Alonzo upgrade this month. This update brings the smart contracts to the network, bringing its functionality closer to Etheruem. Hunain Naseer, Senior Editor at OKEx, elaborated on what the update could imply for the network:

"ADA has put up a strong performance in this bull run, and the upcoming upgrade is a major development for the Cardano network. Support for smart contracts will allow developers to launch DApps on the blockchain, and we could see a DeFi ecosystem taking shape on Cardano, resulting in increased network usage and ADA price appreciation."

Polygon adoption set to continue

Despite the market-wide sell-off on Black Wednesday, one token remained to be one of the top performers in the crypto sphere, Polygon (MATIC). Polygon is a layer-2 platform that helps Ethereum scale, reducing transaction fees by more than 100x in most cases.

As we predicted in last month's report, MATIC hit its all-time high of US$2.43 on 18 May before the Black Wednesday crash and outpaced many other coins in the top 100 in the aftermath, to now sit at rank 13 on CoinMarketCap's list of coins by market capitalisation.

According to Robbie Liu, Market Analyst at OKEx, upgrades in June are set to increase adoption further, with a few caveats:

"As one of the recent favorites by the DeFi community, Polygon continues to develop its scalability solutions and will launch zk rollups and optimistic rollups soon. However, traders suffered from impermanent losses when trading MATIC in DEXs like Uniswap. In the case of MATIC, traders left Uniswap for Bancor that offers impermanent loss protection for their liquidity. We believe that the offering of impermanent loss protection will be the core focus for DEXs in the near future."

As Bitcoin gets closer to the Taproot upgrade and Ethereum closer to the E-1559 launch, June could be the moment of truth for the price discovery as the aftermath of Black Wednesday continues to unravel.

Interested in cryptocurrency? Learn more about the basics with our beginner's guide to Bitcoin, dive deeper by learning about Ethereum and see what blockchain can do with our simple guide to DeFi.

Disclosure: The author owns a range of cryptocurrencies at the time of writing

Picture: Getty

Ask a question