Finder’s RBA survey: Almost half of experts expect another rate rise this year

For the first time this year, the nation's experts have unanimously agreed on the upcoming decision from the RBA.

In this month's Finder RBA Cash Rate Survey™, 38 experts and economists weighed in on future cash rate moves and other issues relating to the state of the economy.

Every panellist (100%, 38/38) believes the RBA will hold the cash rate at 4.10% in October.

The panel's forecast for the cash rate peak has now increased slightly from an average of 4.10% to 4.30%.

Graham Cooke, head of consumer research at Finder, said it was the first time this year that every expert in the survey had predicted a hold.

"Aussies are being hit with price increases almost everywhere – and we have seen a sharp rise in stress caused by housing, energy, petrol and grocery bills.

"Another rate hold will be welcome news to the many homeowners who are already at the end of their tether.

"Our data shows that many households are at breaking point – 36% of mortgage holders struggled to pay their home loan in September.

"Despite the RBA's prudent pause in interest rates since July, inflationary pressures are persisting," Cooke said.

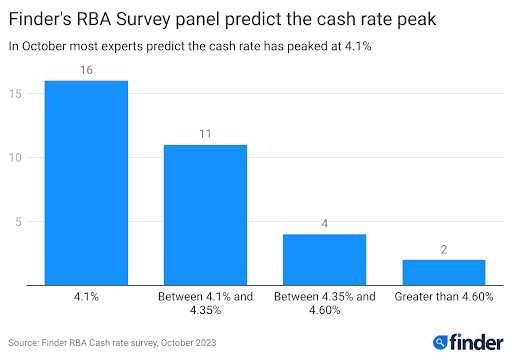

Almost half of the experts who weighed in* (48%, 16/33) believe the cash rate has peaked at 4.1%, but 42% believe the rate will peak at either 4.35% or 4.6%.

Leanne Pilkington from Laing+Simmons said recent speculation has focused on when the RBA will cut rates instead of hiking them again.

"Inflation is the variable to watch and as evidenced in the latest CPI data, the upward pressure applied by high petrol prices is concerning for mortgage holders.

"Still, we believe a hold pattern for at least the next few months is the most appropriate course of action," Pilkington said.

Thousands of Aussies could lose their job before Christmas

The panel predicts the unemployment rate will rise to 3.9% by the end of the year.

An alarming 44% of Aussie workers couldn't survive financially for more than a month if their income dried up, according to Finder's Consumer Sentiment Tracker.

Finder's research found 18% of workers are living day to day, only able to make ends meet for a week or less should they become unemployed.

At the Financial Review Property Summit, Gurner Group founder Tim Gurner said, "We need to see unemployment rise, unemployment has to jump 40–50%, in my view. We need to see pain in the economy. We need to remind people they work for the employer, not the other way around."

The majority of experts (85%, 22/26) do not agree with this statement.

Cooke said a worrying number of Aussies could lose their jobs.

"Even a small increase of 0.2 percentage points in the unemployment rate would mean over 30,000 Aussies losing their jobs," Cooke said.

James Morley from the University of Sydney agreed.

"There is absolutely no empirical evidence to support the idea that high unemployment increases productivity. Indeed, most of the evidence points the other way," Morley said.

Stella Huangfu from the University of Sydney said this is not the way to increase labour productivity.

"It is also not realistic to expect that unemployment could jump by 40–50% from its current level.

"People are suffering a lot already from the cost of living crisis and extremely high mortgage burden," Huangfu said.

Wage growth unlikely in 2024

RBA data shows that despite significant wage growth in the last 2 years, especially for those on lower incomes, the real value of wages declined by 3% in 2023 due to inflation.

Almost 3 in 4 panellists (73%, 22/30) do not expect any growth in real wages in 2024.

Peter Boehm from Pathfinder Consulting said increasing unemployment and higher immigration may put a damper on real wage growth.

"Additionally, most SMEs cannot afford to offer wage increases at inflation simply because of operating cost pressures," Boehm said.

Cooke encouraged Australians to double down on their expenses.

"Go through your spending with a fine-toothed comb to see where you can cut back or cut out.

"Remember loyalty rarely pays when it comes to financial products. If you haven't compared utility or insurance providers in the last 6 months, you could probably be getting a better deal.

"Make sure any money you are putting away is earning the best possible rate – high interest savings accounts are paying more than 5% at the moment."

*Experts are not required to answer every question in the survey

Here's what our experts had to say:

Peter Boehm, Pathfinder Consulting (Hold): "I believe the new Reserve Bank governor, despite underlying inflation ticking up, will want as much time to assess whether this new uptick reflects a new trajectory, or is a blip. If underlying inflation holds at this level for another month, the chances of a rate increase in November are almost certain."

Tomasz Wozniak, University of Melbourne (Hold): "The 68% forecasting interval from my predictive system containing nearly 200 models of weekly and monthly data spans the cash rate values from 4.09% to 4.25%. Therefore, it includes both the HOLD and RAISE decisions. Given that the monthly inflation for August increased to 5.2% for the first time since April, both options are on the table. The outcome will be indicative of the new governor's stance. In the longer perspective, my forecasts, especially those for weekly data, indicate possible decreases in the interest rates starting next year. These forecasts are available at: https://donotdespair.github.io/cash-rate-survey-forecasts/".

Nalini Prasad, UNSW Sydney (Hold): "The latest inflation numbers indicate that inflationary pressures are easing in the economy. I think the RBA will adopt a wait-and-see approach and keep the cash rate steady."

Matthew Greenwood-Nimmo, University of Melbourne (Hold): "The latest monthly inflation figures are broadly in line with expectations and do not provide substantial new information that would justify a rate change prior to the next quarterly data release."

Cameron Murray, Fresh Economic Thinking (Hold): "Inflation falling locally and globally."

Anthony Waldron, Mortgage Choice (Hold): "While the Reserve Bank's September meeting minutes did not rule out further rate hikes, and despite a slight rise in the August CPI inflation figures, we believe the cash rate will remain on hold in October."

Mala Raghavan, University of Tasmania (Hold): "The RBA is expected to maintain the cash rate at 4.1% in October. Nevertheless, there are several noteworthy factors to consider. In August, the inflation rate surged to 5.2%, surpassing July's 4.9% and persisting at approximately 5% since May. This sustained high inflation rate is a cause for concern, given that it significantly exceeds the RBA's target range of 2–3%. A closer analysis of the CPI data provided by the ABS reveals troubling trends. Notably, substantial increases in automotive fuel prices are poised to have a considerable ripple effect on transport costs and subsequently impact various sectors of the economy. Furthermore, essential household expenses like bread, dairy, rent, electricity and gas continue to experience persistent price hikes. These factors collectively contribute to an elevated cost of living index, particularly affecting vulnerable households in Australia. If the inflation rate remains stubbornly around the 5% mark in the coming months, the RBA may contemplate implementing a cash rate hike in early 2024. However, any decisions regarding adjustments to the interest rate will likely hinge on economic developments and the implementation of the new "full employment" definition, which will shed light on issues related to underemployment and labour underutilisation."

Garry Barrett, University of Sydney (Hold): "Although recent CPI data show increasing inflation, RBA will hold to see if it is sustained before increasing the cash rate."

Shane Oliver, AMP (Hold): "The RBA is likely to hold in October as household spending is continuing to slow, the jobs market continues to soften and the trend in inflation remains down. While it's not our base case, the risk of another rate hike by year-end remains high though given the increasing signs of wages growth pushing beyond levels consistent with 2–3% inflation."

Tim Nelson, Griffith University (Hold): "RBA will be holding rates until it is clear whether the rate of inflation is increasing or decreasing."

Harry Murphy Cruise, Moody's Analytics (Hold): "Although headline inflation's downtrend stumbled in August, it's still a story of improvement under the hood. Roughly half of the CPI categories saw annual inflation ease. Better still, when you strip out the volatile movements across fuel (which rocketed 9.1% m/m), holiday travel and fruit, inflation eased to 5.5% y/y from 5.8%. Of course, there are plenty of pain points. Rents and utility prices are heading skyward, and rising services inflation continues to dampen the "good" news – quickly falling goods inflation. Still, the positives outweigh the negatives. All that will see the RBA hold tight when it meets next week. Rates have risen quickly – a cumulative 400 basis points since April last year. And the full impact of those hikes has yet to be felt. What's more, a pause from the RBA won't be akin to a cut. Household budgets will be under pressure as long as interest rates hold at current levels; that will keep spending tight and put downward pressure on inflation."

Craig Emerson, Emerson Economics (Hold): "Insufficient reason in the monthly CPI data to warrant moving from hold to increase."

Stella Huangfu, University of Sydney (Hold): "It is true that the annual CPI inflation has increased from 4.9% (in July) to 5.2% (in August), however, the CPI inflation excluding volatile items and holiday travel decreased from 5.8% to 5.5% this month. It seems to me that inflation has continued its downward trend. The Reserve Bank should keep the interest rate on hold at 4.1% for at least 1 more month."

David Robertson, Bendigo Bank (Hold): "The uptick for inflation in the monthly data won't be enough to prevent another RBA pause in October for official rates, but November will be a closer call. Rates remain on a higher for longer path as core services inflation persists."

Stephen Miller, GSFM (Hold): "Inflation will be 'stickier' than forecast driven by accelerating wage growth and poor productivity."

Evgenia Dechter, UNSW (Hold): "The slowdown in the economy: slow GDP growth, decline in GDP per capita for 2 consecutive quarters, rising underemployment; and the slowdown in inflation (in terms of the monthly CPI, between December 22 and August 23, the CPI increased by 2.1%)."

James Morley, The University of Sydney (Hold): "Monthly CPI for August confirms year-on-year inflation has come down from Q2 levels. Also, global inflationary pressures are easing. So I think the RBA will hold. Although domestic demand is weak, the domestic economy looks robust for the time being. So I don't think the RBA will cut for a while, but will let past hikes work their way through to help bring inflation down. The probability of a recession in the next year is definitely less than 50%. However, there are risks from weak growth in China. If the US economy deteriorates, then a recession in mid-2024 is possible (although not the most likely scenario). Inflation will likely have dropped further by then, so the RBA would cut if there were enough indicators of recession."

Geoffrey Kingston, Macquarie University Business School (Hold): "Bad news this month on oil prices, the CPI and futures pricing of the cash rate call for 1 (maybe 2) rises in the next 6 months or so. However, Bank inertia should see to it that this rise is later rather than sooner."

Malcolm Wood, Ord Minnett (Hold): "Cost pressures remain elevated. This will keep services inflation high, inconsistent with the RBA inflation target."

Sean Langcake, Oxford Economics Australia (Hold): "The case for a rate hike is no stronger than it has been over the past 4 months, when the RBA have held rates steady. The RBA have clearly flagged they are willing to tolerate a protracted period of above-target inflation and let earlier rate hikes work their way through the economy."

Kyle Rodda, Capital.com (Hold): "Although restrictive, policy is probably not sufficiently restrictive. The cash rate remains too low to get inflation back down to target within the RBA's desired time frame."

Mathew Tiller, LJ Hooker Group (Hold): "Despite an uptick in the latest monthly headline inflation figure (due to fuel and housing costs), underlying inflation continues to moderate. This should provide the RBA with enough comfort to hold steady this month. The next step will be evaluating the quarterly inflation data scheduled for release at the end of October, as this will determine the likelihood and timing of the next interest rate increase by the RBA."

Leanne Pilkington, Laing+Simmons (Hold): "Recent speculation has focused on when the RBA will cut rates instead of hiking them again. Inflation is the variable to watch and as evidenced in the latest CPI data, the upward pressure applied by high petrol prices is concerning for mortgage holders. Still, we believe a hold pattern for at least the next few months is the most appropriate course of action."

Saul Eslake, Corinna Economic Advisory Pty Ltd (Hold): "The small uptick in monthly inflation in August won't have come as any surprise to the RBA and was largely attributable to a 12% rise in petrol prices. 'Underlying' inflation is still trending down but remains 'too high' to warrant any thought of cutting rates or signalling that any reduction in rates is on the horizon. If the RBA were to do anything over the next 6 months it would be to raise rates again (on a "least regrets" basis similar to that used by the ECB at its last meeting), but I think the odds of that are less than 50%."

Cameron Kusher, REA Group (Hold): "The economy appears to be shifting in-line with the RBA's expectations. Although the monthly CPI indicator was slightly higher yoy in August 2023 I don't believe inflation was strong enough to necessitate a change to the cash rate."

Andrew Wilson, My Housing Market (Hold): "No significant relevant change in recent macro data."

Jason Azzopardi, Resimac (Hold): "I don't believe we are on a linear trajectory to inflation target rate and expect some data to indicate 1 further cut is required."

Nicholas Gruen, Lateral Economics (Hold): "Things seem to be about right on rates now, and it's unclear when the Bank will feel it should change rates."

Jeffrey Sheen, Macquarie University (Hold): "I expect inflation to be close to reaching the RBA's target range by mid-2024, accompanied by a growth slowdown."

Rich Harvey, Propertbuyer (Hold): "Inflation is trending down as expected and the real pain of higher rates is biting consumers. Consumer sentiment is still low and likely to trend that way until the first rate cut mid-way through next year."

Tony Sycamore, IG Markets (Hold): "We continue to look for 1 more rate hike in November as fine tuning of the RBA's monetary policy, before a period of on hold during the first half of 2024."

Nicholas Frappell, ABC Refinery (Australia) Pty Limited (Hold): "Higher energy costs and likely stickier inflation that remains above target suggest 1 more hike."

Alan Oster, Nab (Hold): "Inflation likely to rise more than expected in the near term. Then increased unemployment will see RBA cutting in H2 2024."

Tim Reardon, HIA (Hold): "Inflation will be sticky on the downside and will be slow to get under 3%. The elevated volume of building activity on the ground continues to obscure the adverse impact that rise in the cash rate has had on the economy. The full impact of the rate rising cycle will become apparent in 2024."

Noel Whittaker, QUT Business School (Hold): "Interest rates are trending downwards in most countries – and nothing would be gained by increasing our interest rate at the next meeting. It's really a wait-and-see month-by-month thing."

Jakob Madsen, UWA (Hold): "Na."

Michael Yardney, Metropole Property Strategists (Hold): "While there are still plenty of mixed economic messages, the recent flow of data is consistent with inflation returning to the RBA's target within a reasonable timeframe."

Associate Professor Mark Melatos, School of Economics, University of Sydney (Hold): "Inflation remains above the RBA's target band and could potentially remain elevated for an extended period. There is inconclusive evidence as to the impact of monetary tightening on consumption. Moreover, house prices appear to have shrugged off the rate increases to date."

Ask a question