Why you need to start thinking like an investor

Investing your money can be risky, but it doesn't have to be. The same goes for your career.

Risk is the cost of entry to many pursuits and not all risk is bad.

I find the concept of risk particularly interesting.

During the countless hours I have spent talking to hundreds of clients over the years, investing risk has always been part of the conversation.

Risk and investing for beginners

A rule of nature is "the higher the risk, the higher the reward".

But a high risk doesn't mean the chances of the reward are higher – it's the opposite, actually.

Before you take a risk, it's important to get a basic understanding of how risk works.

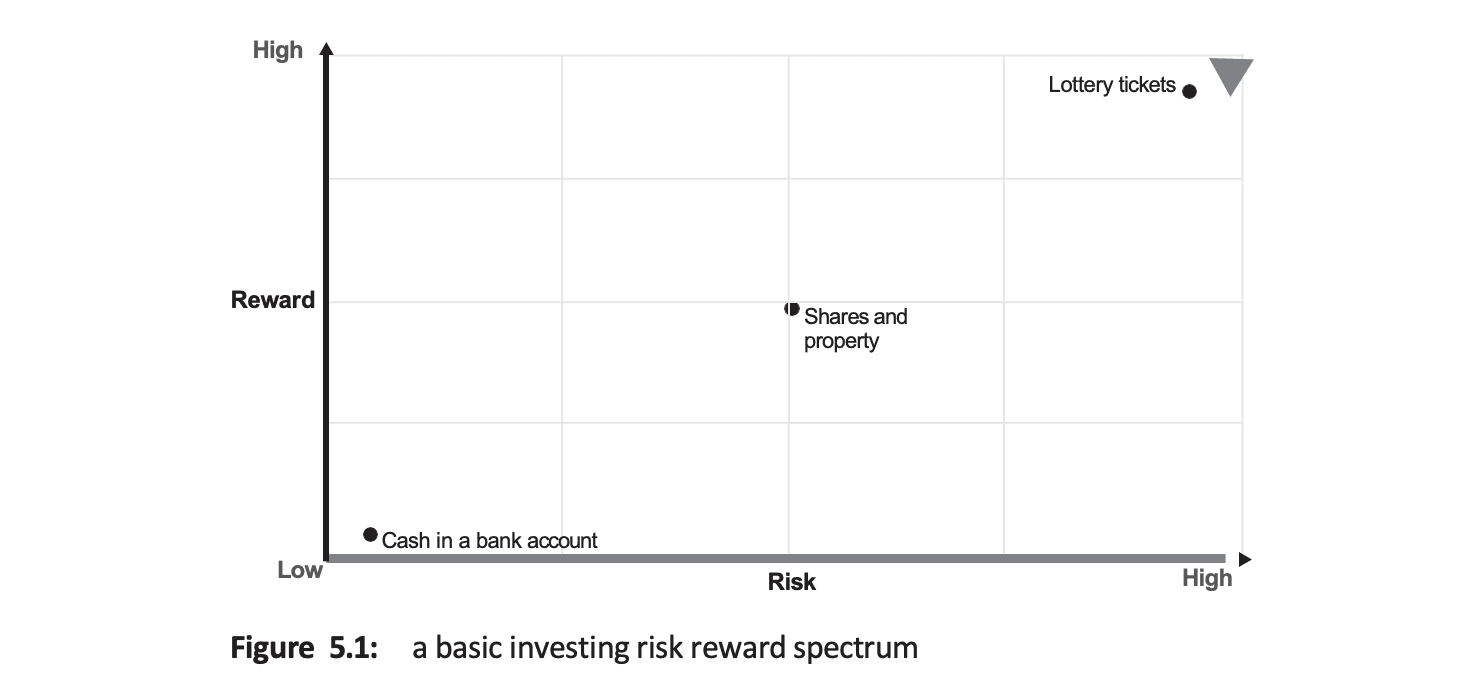

Figure 5.1 will be familiar to you if you have an interest in personal finance. If it's not, you might learn something money-related.

I want to use money and investing as a baseline for explaining risk because, just like our careers, money applies to everyone.

Generally speaking, the following applies when we look at risk charts:

- Higher reward = greater success or monetary success

- Higher risk = high chance of not succeeding or failure

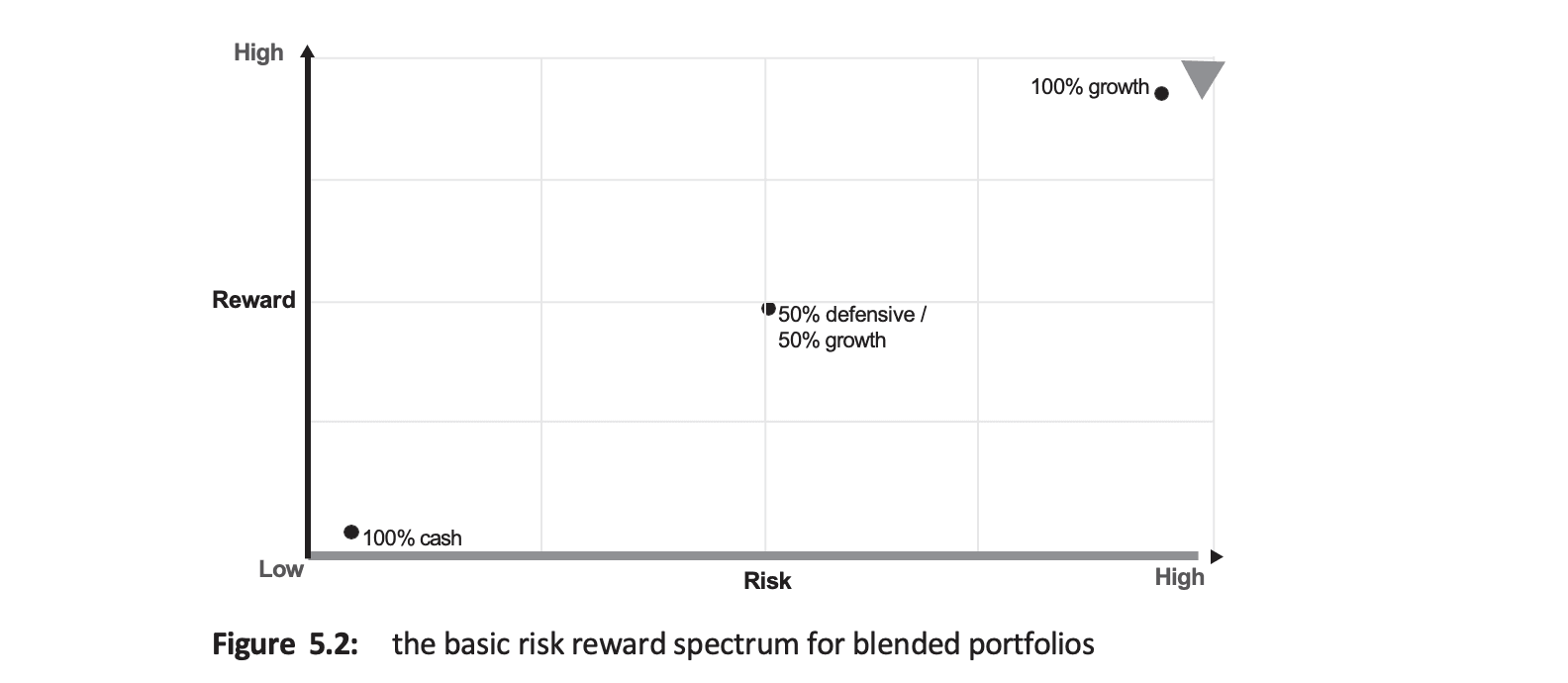

When investing in shares and retirement assets (e.g. superannuation), many people have a one-stop-shop portfolio managed by an investment company that is a blend of cash, bonds, property, shares, gold and more.

A basic balanced portfolio may consist of 50% defensive assets (cash, bonds) and 50% growth (property, shares and others) – see figure 5.2. This smooths out the overall return and doesn't put all of your eggs in 1 basket.

In investing your money, a higher-risk portfolio will be more volatile under normal market conditions and it's suggested that you hold growth assets for at least 5–7 years.

The reason for this is that if these assets decline in value, you need to give them time to recover.

Imagine if you were at retirement age and you had 100% of your money in an aggressive investment… and the market declined. This would put your retirement plans at risk.

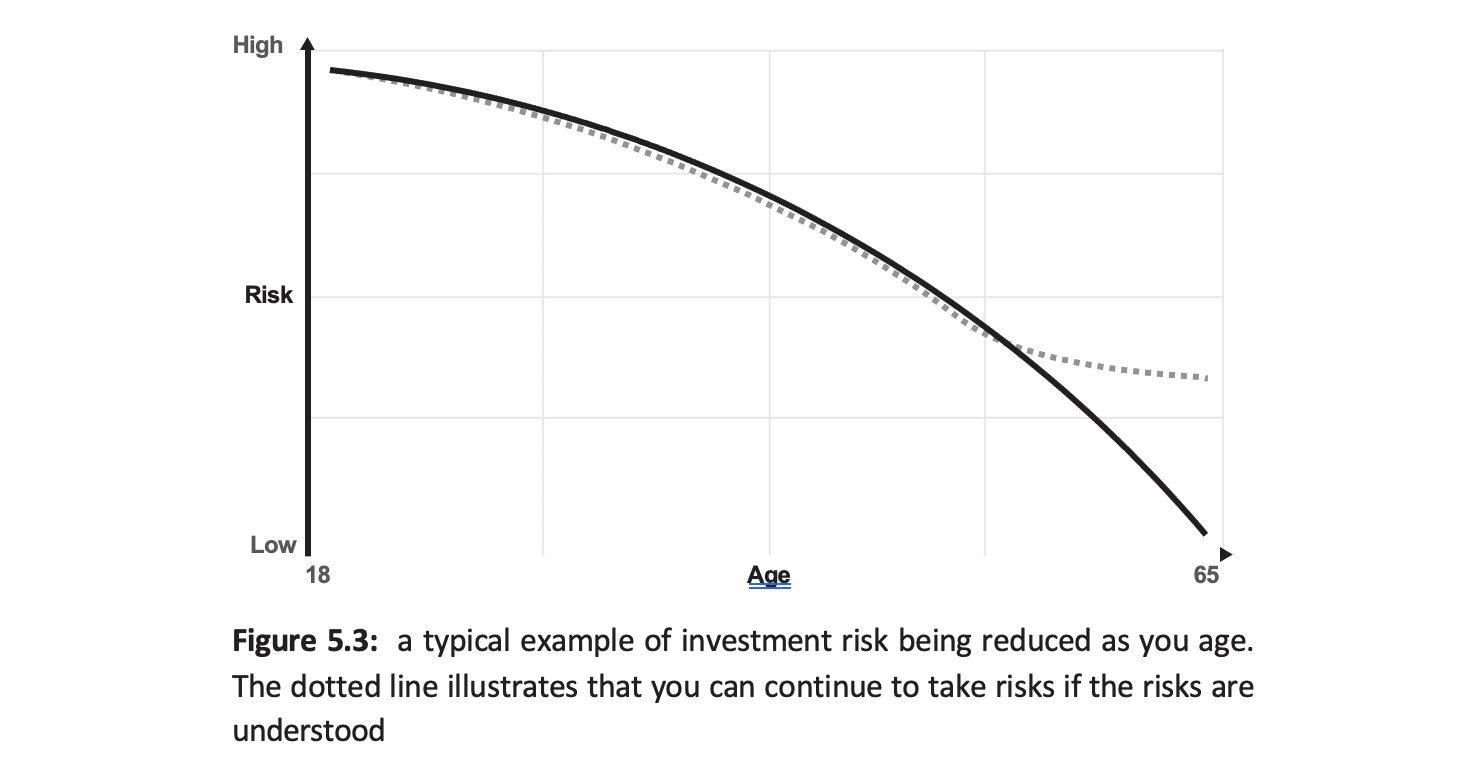

In the money world, it's accepted that the older you get, the less risk you should be taking on. This way, your money is preserved and ready for retirement.

But I disagree with this commonly accepted notion. Here's why.

In figure 5.3 you can see a dotted line that represents that you can continue to take risks if the risks are understood.

If you retire at, say, age 65, you still have a life expectancy of at least 20 years. So your money needs to be at work for you for at least another 20 years.

Where I'm from, that's a lot longer than the 5–7 years' hold time for a growth asset. In my opinion, you can still take a risk if you understand the risk.

While I do agree that your financial risks should be tempered as you age, I don't believe you should move all of your money to cash (in a bank account, that is) when you turn 65.

It's only a worry to be taking risks with your money if you don't understand the risks, have no solid goals or your values are not aligned.

This can lead to a catastrophic outcome. Likewise, you need to understand your career risks, which means having career goals that align with your values.

Commercial vs property investing in 2023: Which is better?

Assessing your career risk

There is risk in every area of our lives: crossing the road, taking medication for an illness, going on an overseas holiday and skydiving.

Many people don't even consider the downside of skydiving, for example. They only think about the joy and fun they will gain from it (unless the risk plays out, that is).

Why do people undertake risky activities on holidays with friends when they won't ask their team leader for a pay rise because it's too risky?

Maybe because there is not much resistance or buy-in for a risky holiday activity and endorphins are flowing. Any risk calculations are usually thrown out the window.

However, your career is different.

There is no peer pressure from excited friends while on holidays as you're "in the moment", but there is office politics plus the confrontation that comes with putting yourself out there. There are awkward conversations and the chance of rejection… the list goes on.

We fear things we haven't experienced before or don't understand.

We feel the pain of loss more than the joy any gain gives, so avoiding loss is a normal reaction.

With your career and the risks you take, it's about understanding that you may be "out of shape" and you didn't even know it. You need to start exercising your "risk muscle".

I want to encourage you to lean into risk and start small. Walking across the street does have a low risk of failure, but the risk is still there (you could get hit by a bus).

Start comparing investment accounts to grow your wealth.

Conversely, playing Russian roulette has an "okay" risk on paper – a 1 in 6 (16.6%) chance of failure – but the failure is absolutely catastrophic and irreversible, so it should be avoided at all costs.

Thankfully, in our day-to-day career life, we aren't presented with such catastrophic failure risks even if it might sometimes feel like it.

I think a healthy baseline level of career risk is asking your employer to chat about issues, salary, education and training opportunities – which are all similar to walking across the street.

This is an edited extract of Sort Your Career Out: And Make More Money by Shelley Johnson and Glen James (Wiley Publishing, February 2023).

Shelley Johnson

Shelley is an HR consultant and has led HR teams within medium and large businesses for the past 10 years. She has also worked in senior roles within international not-for-profit organisations. Shelley has a true depth of understanding around employment lifecycle, career mapping and recruitment. She is the host of the my millennial career podcast, which was a finalist in the 2020 Australian Podcast Awards.

Glen James

Glen is a multiple award-winning retired financial adviser with experience helping countless people get on top of their finances. Glen has a particular interest in personal finance and small business for millennials. He is a regular contributor to a variety of national money publications, the author of the successful Sort Your Money Out (Wiley, 2021) and creator and host of the my millennial money podcast and platform.

Image: FinderAsk a question