Yes, you still have to pay tax on crypto in Australia – Here’s why

Despite the rumours, Bitcoin profits are unlikely to be tax-free any time soon. Sorry.

You might have seen headlines in recent weeks claiming a judge ruled that Bitcoin is a form of money, rather than an asset like shares or property.

The main implication is that any profits you make on crypto may be exempt from tax, in the same way your Australian Dollars can't be taxed.

But don’t rush to rewrite your tax return just yet.

The decision, made by Victorian magistrate Michael O’Connell, came from a criminal law case involving a former AFP officer accused of stealing Bitcoin during a raid. As part of the legal process, the judge had to decide whether Bitcoin counted as “property” under theft laws. He ruled it didn’t, because it acts more like a currency.

That decision, first published in the AFR, led to speculation that not only might Bitcoin profits be tax-free in the future, we might expect to get refunded on already paid capital gains taxes.

It's enough to peak the interest of even the most passive of investors.

But unfortunately, that’s not how Australian tax law works, according to Shane Brunette, co-founder and CEO of tax software platform Crypto Tax Calculator.

“The hype around this ruling is misguided,” Brunette told Finder.

“The case has nothing to do with tax law, and it does not override any guidance by the ATO. Bitcoin is still subject to capital gains tax in Australia.”

So, what does this mean for crypto tax in Australia?

Nothing’s changed. Under current ATO guidance, Bitcoin and other cryptocurrencies are still treated as regular property, which means they’re subject to capital gains tax (CGT).

That includes things like selling, swapping, gifting or even using crypto to buy goods and services.

In fact, because crypto is classified as property, Aussie investors can access the 50% CGT discount if they hold an asset for more than 12 months before disposing of it.

That tax benefit could actually be at risk if the rules ever change.

“In the highly speculative scenario where Bitcoin is reclassified as money,” Brunette warns, “that discount might be removed, and investors could instead be taxed under foreign-currency or ordinary-income rules.”

What you need to do this tax year

If you’ve been trading or earning crypto, you still need to follow the ATO’s crypto tax rules.

That means, you'll probably need to pay capital gains tax on any profits you've earned and income tax on reward earning activities like staking.

It's best to be prepared by:

• Logging all your crypto transactions

• Identifying capital gains and income events

• Tracking your cost base across wallets and exchanges

• Applying eligible deductions, including the CGT discount

Read more: Crypto tax in Australia

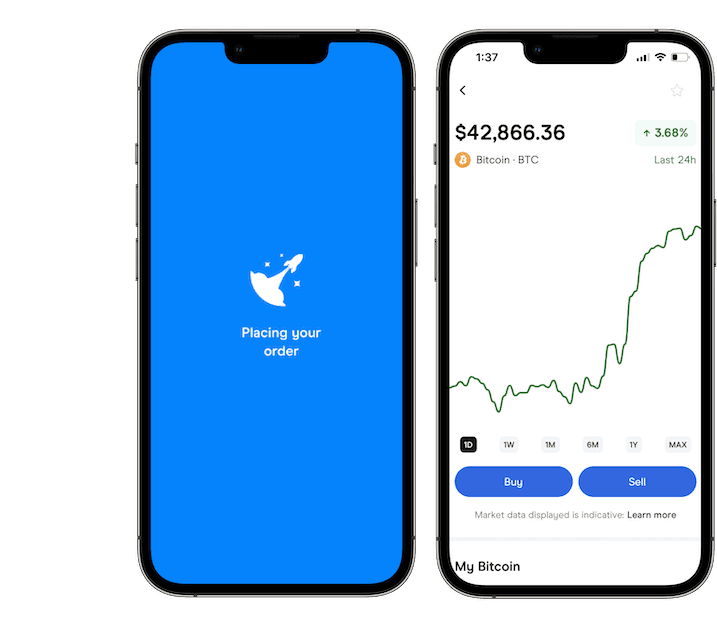

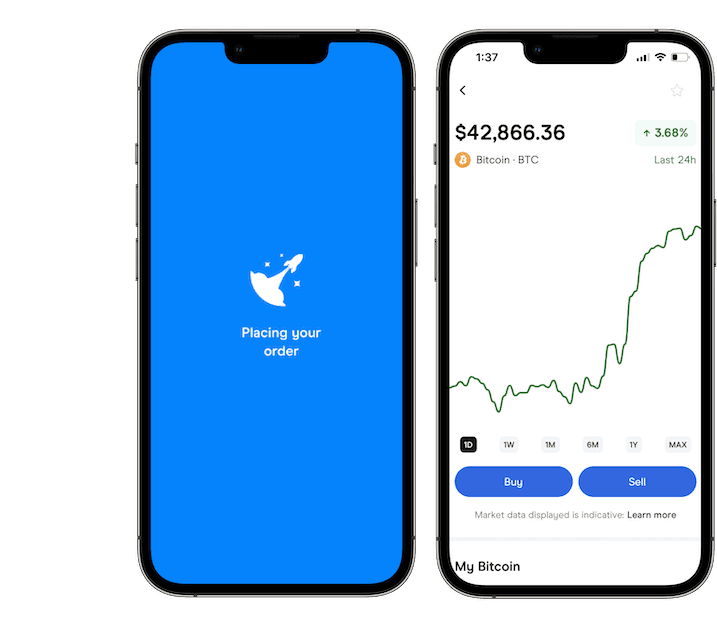

Specialised tax software tools like Crypto Tax Calculator and Koinly can make this rather complicated process much easier by automating transaction tracking and report generation.

TLDRL: Ignore the hype. Bitcoin hasn’t been reclassified for tax purposes. The ATO still expects Australian investors to report capital gains and income from crypto.

And with tax time around the corner, it’s a good reminder to get your records in order.

Join the crypto conversation – Follow us on X now

Trying to get a handle on the markets? Cut through the noise with our overview of the best cryptos to buy right now, explore some strategies for how to trade crypto or see if there's a better platform for you with our guide to the best crypto exchanges.

Disclaimer: Cryptocurrencies are speculative, complex and involve significant risks – they are highly volatile and sensitive to secondary activity. Performance is unpredictable and past performance is no guarantee of future performance. Consider your own circumstances, and obtain your own advice, before relying on this information. You should also verify the nature of any product or service (including its legal status and relevant regulatory requirements) and consult the relevant Regulators' websites before making any decision. Finder, or the author, may have holdings in the cryptocurrencies discussed.

Trusted by over 500,000 Aussies

Trusted by over 500,000 Aussies

Sources

Ask a question