Bitcoin breaks US$100,000 – here’s what’s going on

The price of Bitcoin just cracked six figures with traders eyeing a fresh record.

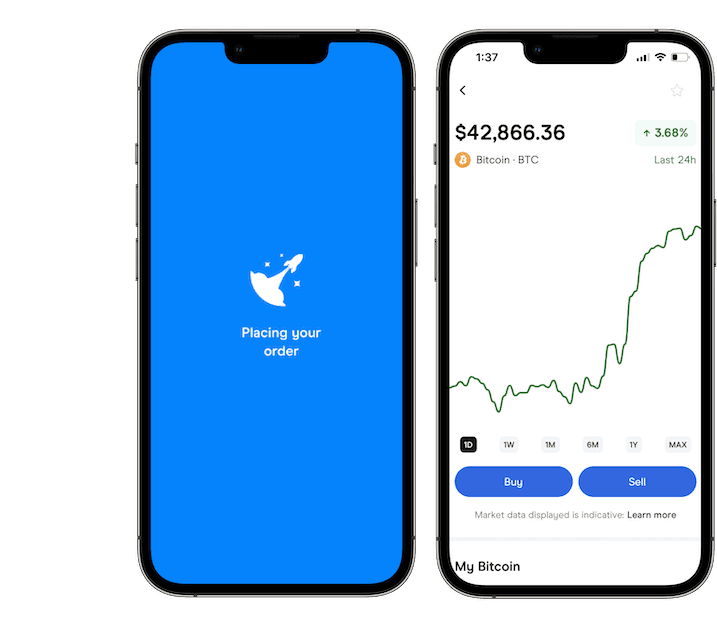

Sponsored by Swyftx. Swyftx is the 2025 Finder Award Winner for Beginners in the Finder Crypto Trading Platform Awards. With Swyftx, you can buy, sell and trade XRP, SOL, ADA & 440+ crypto assets, as well as keep track of your portfolio and profits.

Sponsored by Swyftx. Swyftx is the 2025 Finder Award Winner for Beginners in the Finder Crypto Trading Platform Awards. With Swyftx, you can buy, sell and trade XRP, SOL, ADA & 440+ crypto assets, as well as keep track of your portfolio and profits.

SPECIAL OFFER! Get AUD$30 in BTC when you refer a friend in May. T&Cs apply.

Bitcoin has broken through the magic US$100,000 mark (Approx. AU$155k) for the first time since February, fuelled by institutional flows and a social media post by President Trump.

In a post on Truth Social, Trump said there would be a "MAJOR TRADE DEAL" with a big country and "THE FIRST OF MANY!!!”, signalling (yelling?) a potential easing of trade tensions between the US and UK.

After dipping on the back of Trump's tariff announcement in early April, the price of Bitcoin has since jumped over 30%, making it one of the best performing assets of the year so far.

"It all just underscores how politically reactive crypto remains," says Pav Hunal, lead market analyst at Swyftx

The President’s social posts are now equivalent to a macro signal - Pav Hundal, Swyftx

But while Trump's trade announcement might be the latest catalyst for Bitcoin's break above 100K, the rally has been fuelled by a combination of factors.

The macro story

First, markets have been pricing in the possibility that the Fed might cut interest rates sooner than many predicted in 2025.

While traditionalists might view Bitcoin as a hedge against financial instability, similar to gold, in practice it still trades like a tech stock (that is, a risky asset).

So when the Fed hints at rate cuts, it's usually good news for crypto, as traders move funds out of lower returning cash accounts and into riskier assets, like Bitcoin.

Second, there has been some major movements in the Bitcoin ETF space.

In late April, there was an unprecedented surge of funds into spot Bitcoin ETFs, totalling over US$5 billion over the course of 2 weeks. On April 22, Bitcoin ETFs recorded a daily inflow of US$912.7 million, equivalent to the purchase of 10,430 BTC.

The spot bitcoin ETFs went Pac-Man mode yesterday, +$936m, $1.2b for week. Also notable is 10 of 11 of the originals all took in cash too. Good sign to see flow depth vs say $IBIT doing 90% of the lifting. Price up $93.5k. Pretty strong all things considered IMO. pic.twitter.com/HeLwffgT8F

— Eric Balchunas (@EricBalchunas) April 23, 2025

Then BlackRocks' iShares Bitcoin Trust (IBIT) drew a whopping US$970.9 million alone on April 28, marking its second-highest single-day inflow since inception.

Arguably the biggest driver behind the crypto ETF and Bitcoin price surge is clearer (and friendlier) legislation from US regulators.

The latest spot crypto ETF surge came after US President Donald Trump's appointment of crypto advocate Paul Atkins as the new SEC chair in late April, heralding in what is arguably the most crypto friendly US government yet.

Quite a turnaround, considering just a few years ago Trump said this about crypto:

I am not a fan of Bitcoin and other Cryptocurrencies, which are not money, and whose value is highly volatile and based on thin air. Unregulated Crypto Assets can facilitate unlawful behavior, including drug trade and other illegal activity....

— Donald J. Trump (@realDonaldTrump) July 12, 2019

Where to next?

The good news is spot market activity continues to mirror derivatives trading, suggesting the current rally is driven by genuine demand rather than short-term speculation, according to Hundal.

Though he warns the outlook remains fluid.

"A lot is going to depend on the signals that come out of US and China trade talks. For the time being, bitcoin looks nicely poised... and the altcoin market is flashing green," said Hundal.

What is clear, though, is the growing momentum behind crypto ETFs.

Since the SEC approved 11 spot Bitcoin ETFs last year, the market has opened the floodgates.

In the last month alone there have been 6 new filings for crypto ETFs, including Dogecoin, BNB and 2 funds that offer staking rewards alongside their tokens (SEI and TRX).

According to Finder's panel of industry experts, BTC is expected to hit $135,048 by the end of 2025 and $452,714 by 2030.

Join the crypto conversation – Follow us on X now

Trying to get a handle on the markets? Cut through the noise with our overview of the best cryptos to buy right now, explore some strategies for how to trade crypto or see if there's a better platform for you with our guide to the best crypto exchanges.

Disclaimer: Cryptocurrencies are speculative, complex and involve significant risks – they are highly volatile and sensitive to secondary activity. Performance is unpredictable and past performance is no guarantee of future performance. Consider your own circumstances, and obtain your own advice, before relying on this information. You should also verify the nature of any product or service (including its legal status and relevant regulatory requirements) and consult the relevant Regulators' websites before making any decision. Finder, or the author, may have holdings in the cryptocurrencies discussed.

Trusted by over 500,000 Aussies

Trusted by over 500,000 Aussies

Sources

Ask a question