Back in 2007, Warren Buffett made a bet that a group of hedge fund managers wouldn't be able to beat a passive S&P 500 index fund over a period of 10 years.

Buffett (and the S&P 500) famously won the challenge in 2017, but years on, the debate over whether active funds or passive (index) funds are the better investment shows no sign of abating.

The question here is whether it's actually possible for stock pickers to beat the market after deducting fees.

So we thought we'd put it to the test ourselves by comparing the performance of Australia's passive index fund ETFs with actively managed ETFs, as covered recently by the AFR's Wealth Generation newsletter:

As part of the test, we analysed different timeframes including both bull market and bear market periods.

How do index funds compare to active funds over the last 5 years?

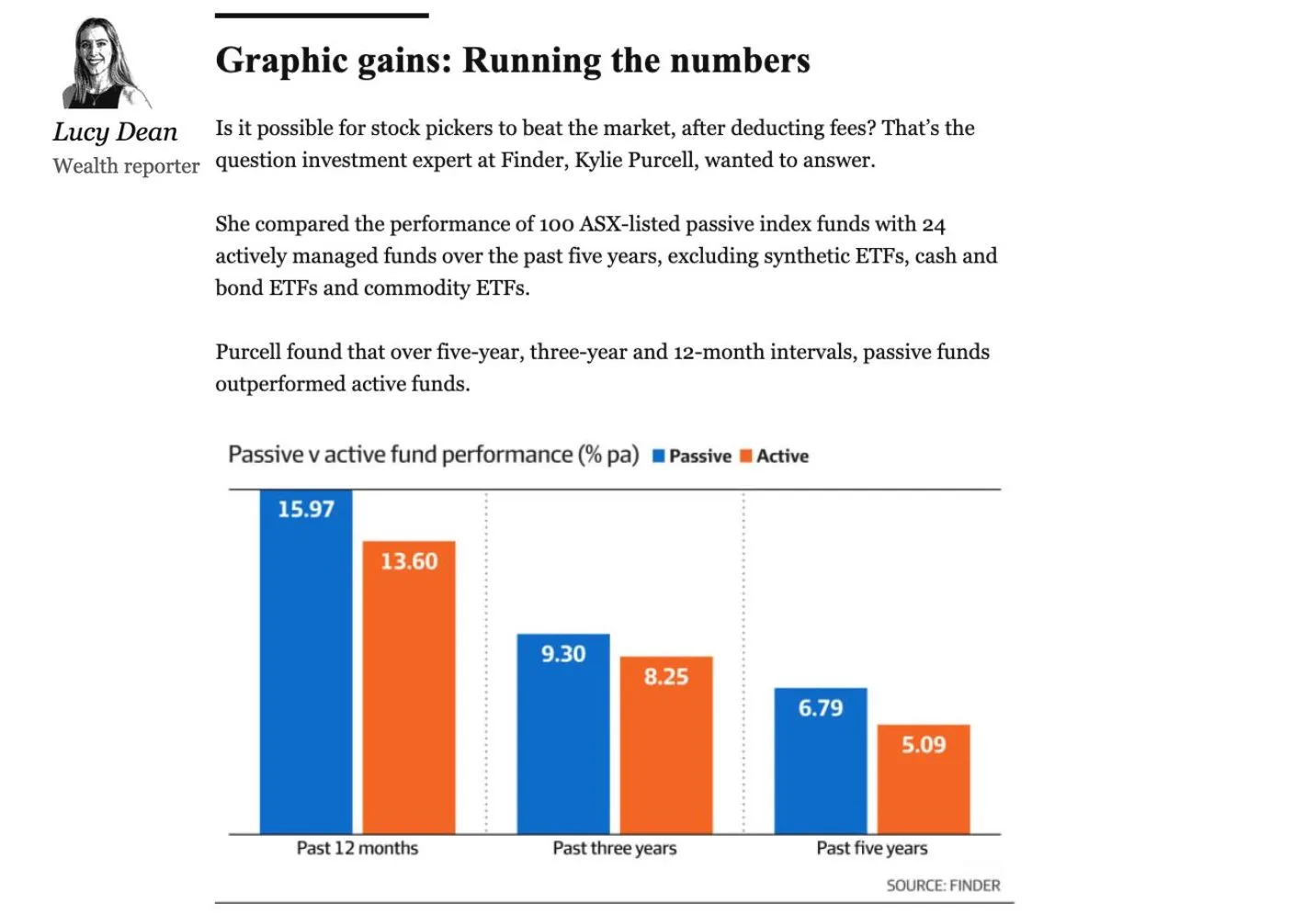

Over the past 5 years, our group of ASX-listed index funds returned 6.79% p.a. on average, net of fees.

These funds outperformed our group of active funds, which saw an average return of 5.09% p.a., also net of fees.

Even when narrowing down to the last 3 years and the previous 12 months (to 30 September 2023), passive funds continue to lead with returns of 9.3% and 15.97% against 8.25% and 13.6% for active funds, respectively.

However the difference between the worst and best-performing ETFs is large:

- At the top of the passive ETFs, the Betashares Nasdaq 100 ETF (NDQ), an ETF that tracks the tech-heavy Nasdaq 100 index, returned 16.92% p.a.

- Compare this to the worst index fund performer, the iShares China Large-Cap ETF (IZZ), which saw negative returns of -5.42% p.a. over the 5 years.

- Meanwhile the top-performing active ETF, the WCM Quality Global Growth Fund (WCMQ), returned 9.73%, compared to the worst performer at -1.66% p.a. (K2 Australian Small Cap Fund, KSM).

Can active funds beat passive funds in a bear market?

A common argument (made mostly by active fund managers) is that active strategies become most relevant during periods of economic uncertainty.

To test this theory, we looked at the performance of both active and passive ETFs during the 2 most recent bear and bull markets. Previous periods, such as the 2008 GFC, were excluded as very few ASX ETFs were listed at the time.

A bear market is when the stock market has fallen 20% or more from its peak, while a bull market is the same but in reverse.

Our findings showed actively managed funds actually performed slightly worse during market downturns.

During the short bear market between February and March 2020, ASX passive funds fell by 29% on average, closely followed by actively managed funds which fell by 29.37%.

Notably, specific funds like the ASX 200 index fund (IOZ) plunged by 35.59%, while the S&P 500 index fund (IVV) fell by 23%. On average, both passive and active funds showed nearly parallel performance.

The bear market of 2022 painted a slightly different picture. ASX passive funds saw a decline of 15.99%, while actively managed funds experienced a steeper drop of 17.78%.

The bottom line?

Aussie investors can rest assured that low-fee index fund investing in Australia can and does work, regardless of the volatilities of the market.

Our data suggests passive index funds in Australia tend to perform better on average than active funds and this mostly appears to be the case regardless of market conditions and length of time.

These results highlight just how difficult it is for even the most experienced stock pickers to beat the market, especially when fees are taken into account.

This doesn't mean passive index funds are the best choice for everyone or that all active funds underperform. When picking an ETF it's important to take your personal circumstances and financial goals into account. If in doubt, speak to a professional.

What was our methodology?

We used ASX categorisations to create 2 groups of passive and actively managed ETFs. We then excluded ETFs with the following features:

- Publicly listed for less than 5 years

- Synthetic ETFs

- Bond and cash ETFs

- Commodity funds (e.g. funds that track the price of a single commodity)

- Inverse ETFs

We were left with 100 passive index funds and 24 managed funds.

Looking for a low-cost online broker to invest in the stock market? Compare share trading platforms to start investing in stocks and ETFs.

Sources

Ask a question

More guides on Finder

-

Best growth stocks under $10 in Australia (2026)

We used Finder's proprietary algorithm to find the 10 best stocks under $10 on the ASX.

-

Best stocks under $5 in Australia (2026)

We used Finder's proprietary algorithm to find Australian-listed companies that have strong fundamentals and have a share price under $5.

-

The best ASX penny stocks (updated weekly)

Best performers included Latitude 66, Cosmos Exploration and Javelin Minerals.

-

The best ASX shares to buy in February 2026

Here are our algorithm-selected 20 Aussie stocks worth watching in 2026.

-

What are the best AI stocks on the ASX in 2026? Stocks and ETFs to watch

Here's what investors should know before adding AI stocks to their portfolios.

-

How to invest in the S&P 500

Find out the different ways you can invest in the S&P 500 index from Australia.

-

Best ASX dividend stocks for 2026

Following a couple of lean years for dividend investors, here are 10 ideas you could consider in your portfolio.

-

How to invest in index funds in Australia

Index funds are a hot topic right now, but how do you actually invest in them?

-

How to buy gold in Australia

If you’re thinking of investing in gold, our guide will explain how and where to buy gold in Australia as well as the pros and cons of investing in it.

-

The cheapest trading platforms in Australia (February 2026)

Find cheap stock brokerage in Australia when buying and selling shares on the ASX and other international exchanges.