8 tips to whip your household expenses into shape

Are your household costs out of control? Don't worry. Here's how to cut the fat and save cash.

Sponsored by Dodo. Unlimited NBN Internet with quick (and free!) set-up and no lock-in contracts. Switch your internet to Dodo Australia and get 1 month free or switch your internet and electricity to get 3 months free Internet!

Sponsored by Dodo. Unlimited NBN Internet with quick (and free!) set-up and no lock-in contracts. Switch your internet to Dodo Australia and get 1 month free or switch your internet and electricity to get 3 months free Internet!

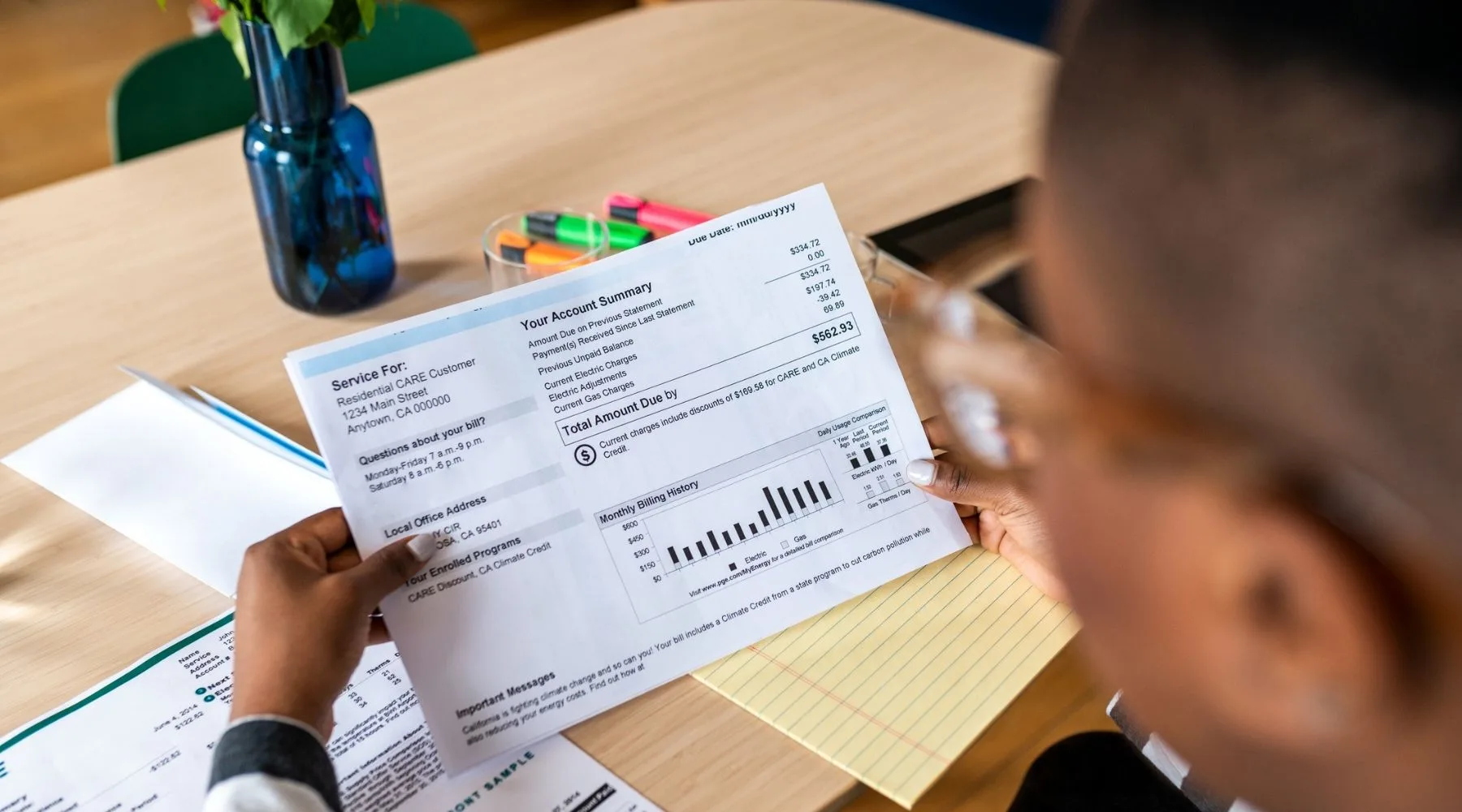

Our households are each entirely unique, but there's one thing they all have in common: Bills.

Bills are the bane of my life, and I'm sure millions of Aussies agree with me. As soon as I've paid one, another pops up. Then, just when I think I'm on top of them, an electricity bill lands in my inbox which is twice as high as last quarter.

And that's before we even start to think about groceries, clothing, toiletries, healthcare or general repairs. The list is endless.

If this all sounds scarily familiar, you're going to want to keep reading, because we've partnered with Dodo Australia to bring you 8 tips on whipping your household expenses into shape.

1. Compare Internet providers

Switching Internet providers doesn't have to be stressful or expensive. (Yes, really.) Compare plans and you could find a cheaper connection that's up and running within a matter of days.

If you already have your own modem, you might be able to find a more affordable plan too. For example, Dodo is currently offering an exclusive NBN plan to Finder users. The plan, with typical evening speeds of 50 Mbps, costs $58.10 per month for the first 6 months. Then, it reverts to $75 a month.

The plan operates on a BYO-modem model, so if you already have one, it can be a solid money-saving move as set-up costs sit firmly at $0.

2. Compare utility providers

Using Energy Finder, I received quotes for electricity that ranged from $86 a month to $100 a month. That might not sound like much, but it's a potential saving of $162 over the course of a year.

For gas, quotes ranged from $38 a month up to $46 a month. Over the course of a year, that's a difference of $91.

If you were able to make switches of a similar saving, you could cut $253 from your annual household expenses without noticing any difference.

3. Compare insurances (all of them)

Insurance premiums come with a big potential for saving and lots of Aussies have multiple policies they can whip into shape.

Let's look at car insurance first. Finder requested 10 quotes for comprehensive car insurance, using the same driver profile, and received prices from $100 a month up to $183 a month.

What about home insurance? Well, Finder's researchers received quotes for the same property varying from $150 a month up to $294 a month. Over a year, that's a difference of $1,740.

That's before we even get to life insurance, health insurance or travel insurance. Just remember though, benefits may vary between insurance policies, so read the product disclosure statement (PDS) carefully.

4. Use an energy tracker

If you're like me, you can never predict whether your energy bill is going to be big or small. An energy tracker can help.

It can give you real-time insight into how much energy you're using, how much it's costing and, depending on the brand, you can even tell which appliances are chewing through energy.

While having an energy tracker won't automatically make you use less energy, it can help you be more aware of energy-guzzling gadgets and help you learn better habits too.

5. Look for deals

When switching utilities, insurance policies or service providers, check to see if there are any deals which would make it more affordable.

For example, Dodo is currently running a separate deal which offers 3 months of free Internet to new customers who switch their Internet service and electricity connection before the end of March. (This can't be used in conjunction with the deal we mentioned earlier, so you'll have to pick which is your favourite!)

You can also check Finder's deal page for a comprehensive list of deals across everything from utilities and insurance through to shopping and travel.

6. Consolidate credit card debt

If you have debt spread over multiple credit cards, you might be paying more fees or interest than you need to.

Consider consolidating your debt onto a single low annual fee credit card with an interest-free balance transfer period, and you could save money and get back in the black sooner.

For example, let's say you had $5,000 debt on 2 credit cards, each with a $99 annual fee and a 19.94% p.a. interest rate (that's the average credit card interest rate, according to the Reserve Bank of Australia).

If you transferred that debt over to a credit card with a $0 annual fee and 0% interest p.a. on balance transfers for 12 months, you could potentially save $924 in interest and $198 in account fees.

7. Pre-plan meals

Before you go grocery shopping, create a plan of all the meals you're going to eat until your next shop. Then write a list of all the ingredients you need.

There's a double benefit to doing this. First, shopping with a list means you're less likely to pick up food you don't need and won't end up using.

Secondly, having a planned-out week of meals is great motivation to cook at home, rather than eating out or ordering in.

8. Make your own cleaning products

I know what you're thinking. But making your own cleaning products is actually far less labour intensive than you might think – and it's a lot cheaper than buying big brand names.

Mixing white vinegar with water and lemon will cost you next to nothing, but will give you an effective surface spray. Baking soda can be similarly effective.

Next time you run out of a cleaning product, have a look online to see if you can make a replacement yourself. Not only will it save you money, but it'll reduce your household waste too.

Compare NBN plans from Dodo

Compare other products

We currently don't have that product, but here are others to consider:

How we picked theseHow the Finder Score helps you find a better broadband plans

We designed the Finder Score to simplify your search for the best NBN and Home Wireless plans. By analysing hundreds of options from over 40 providers, we evaluate pricing, speeds, data allowances and plan features. Each factor is weighted and combined to generate a score out of 10 — helping you quickly spot the most competitive plans on the market. Read the full breakdown.