Trust in big banks reaches lowest level in 20 months

Fewer Australians are placing their trust in the big banks, according to new research by Finder.

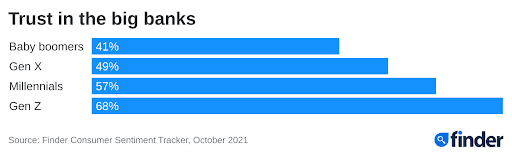

Finder's Consumer Sentiment Tracker, one of the largest chronological monthly consumer surveys in Australia, found trust in the big banks has fallen from the peak of 62% in April 2021 to 52% in October 2021.

Baby boomers are the least trusting of the Big Four – with just 41% placing trust in big banks. This compares to 68% of over-65s who put their trust in small banks.

Sarah Megginson, senior editor of money for Finder, said Australian savers are starting to feel more comfortable with smaller banks, credit unions and non-banks as a safe place to keep their money.

"There was a massive shift to 'safety' during the pandemic, with people flocking to established brands they could 'trust' with their hard-earned cash.

"But now that the immediate economic threat has passed, and consumers are more interested in innovation and returns, smaller lenders are catching a lot of customers on the way out."

Trust in small banks currently sits at 65% in October, down slightly from 66% a year ago.

"Australia is undergoing a significant shift in the financial system as the digital surge wins customers.

"Smaller lenders are innovating rapidly to compete with the bigger players and with open banking making it easier than ever to switch between different brands, consumers are not as loyal as they were in the past.

"The loss of trust in the big banks should hopefully lead to more people shopping around, getting a better deal and ultimately saving money," Megginson said.

Cash savings shrink

Finder's Consumer Sentiment Tracker also shows the average amount of reported month savings has been falling fairly consistently through 2021.

This figure hovered between $800 and $900 a month in late 2020, but has dropped to $714.45 in November 2021.

"While household savings increased dramatically during the first 12 months of the pandemic, Aussies have fallen back into old habits.

"While the monthly savings is still higher than pre-pandemic levels (around $600–$700 a month) – it does appear to be trending down," Megginson said.

Looking for a better rate on your home loan? Check out Finder's home loan comparisons page to find a better deal.

Ask a question

Are there are any small banks in Australia? I want to find alternatives to the BIG 4 and there close followers- looking for good quality smaller banks

Hello,

Yes there are a number of banks in Australia outside of the Big 4, see here for a comprehensive list:

https://www.finder.com.au/bank-accounts/list-of-banks-in-australia

Hope this helps!