Westpac, ANZ + more: smash your debt with February’s top Australian balance transfer credit cards

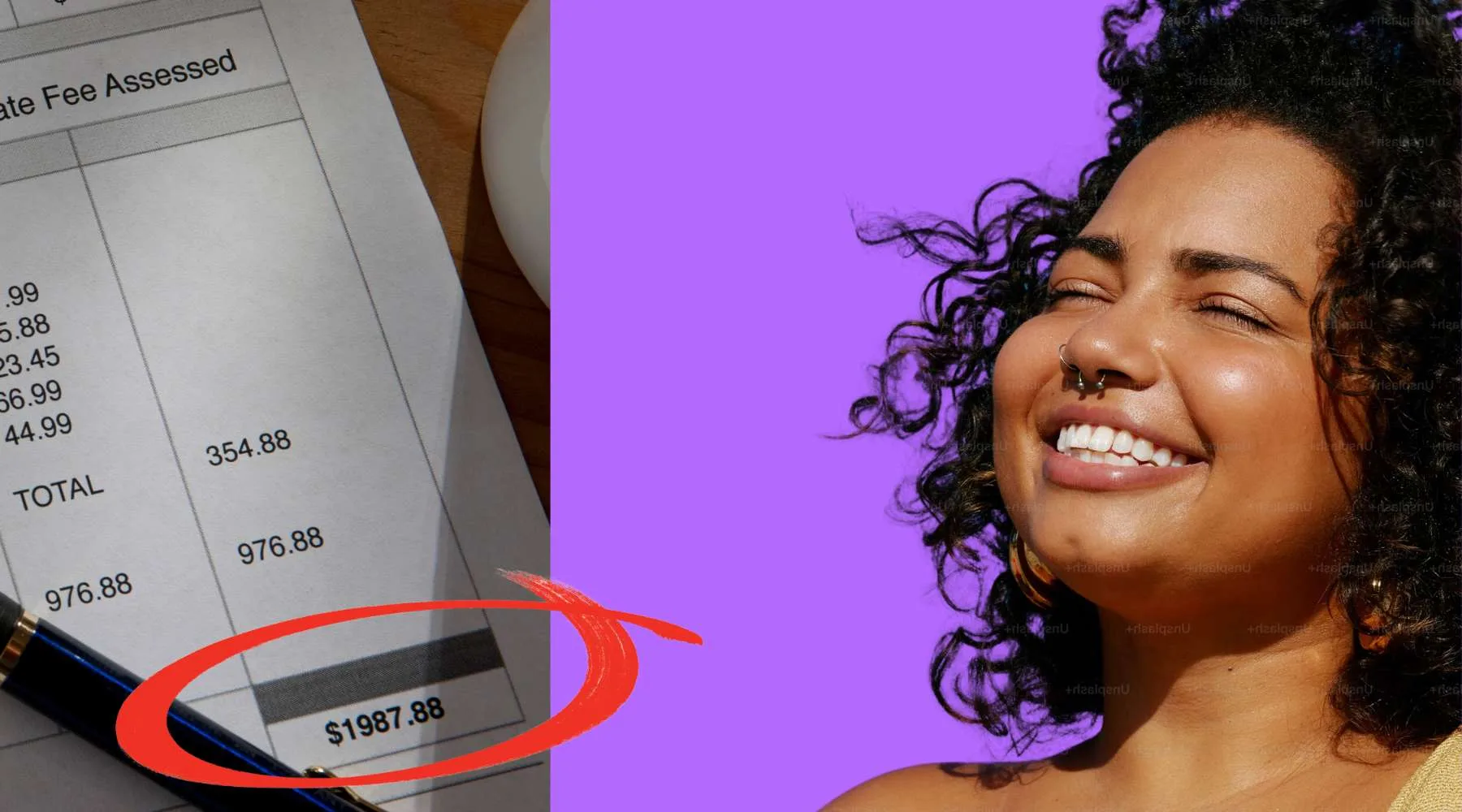

These debt-busting balance transfer offers give you 2 years or more at 0% interest, so you can get your credit card back under control.

A balance transfer credit card offer works like this: you apply for a new card with a balance transfer offer, move your old card balance(s) over, close the old cards, then start repaying the debt on the new card.

How does this save you money? Well credit cards charge interest of up to 20%. That's expensive. But the best balance transfer credit cards offer you 0% interest for a promotional period.

This gives you breathing room and time to get your card debt under control. Here are the 5 best offers on the Australian market this month.

1. St.George/Bank of Melbourne/BankSA Vertigo Card

The St.George Vertigo Card has a Finder Score of 8.38.

The Vertigo family of credit cards from St.George, Bank of Melbourne and BankSA all offer the same winning combo of a 0% balance transfer rate for 24 months with a low 1% fee. That gives you 2 whole years to sort your debt with no interest charges.

You save even more money with the card's $55 annual fee, which is about as low as it gets.

2. Virgin Money Anytime Rewards Credit - Balance Transfer Offer

The Virgin Money Anytime Rewards Credit Card - Balance Transfer Offer has a Finder Score of .

Like the Vertigo cards, Virgin's top offer gives you 24 months to sort your outstanding card debt at 0%. And the balance transfer fee is just 1%.

Why is this card lower scoring? Only because the annual fee is higher. But there's a reason for this: the card also lets you earn Virgin Money reward points. That's a nice perk, but remember that your priority should probably be paying off the balance transfer, not more spending.

3. Virgin Australia Velocity Flyer Card - Balance Transfer Offer

The Virgin Australia Velocity Flyer Card - Balance Transfer Offer has a Finder Score of .

This Virgin Money card is a similar deal to the Anytime Rewards card. 0% for 24 months, 1% balance transfer fee, $149 annual fee. But instead of earning Virgin Money reward points on your spending you earn Velocity Points. That's Virgin's frequent flyer program.

Basically Velocity Points are worth, depending on how you use them. And there's also a $129 Virgin gift card each year, which offsets that annual fee nicely.

But again, remember that earning points encourages you to spend on the card. That's the opposite of what a balance transfer offer is for. And you don't get interest-free days on spending if you have a balance transfer.

4. ANZ Low Rate Credit Card

The ANZ Low Rate Credit Card has a Finder Score of 9.9. It has a really strong balance transfer offer: 0% for 30 months.

The only catch is the fee is higher than most at 3%. But there's no annual fee for the first year so you can still save a bit on fees.

5. Westpac Low Rate Card

The Westpac Low Rate Card has a balance transfer Finder Score of 9.55.

0% for 26 months is a great offer. And the annual fee is a very low $59. The balance transfer fee is 2%, which is a little higher than some other cards. On a $5,000 balance that would cost you $100.

Low rate cards in general are a smart pick for those in need of a balance transfer. You get fewer perks or points but you can just focus on paying down your debt. And if you do need to spend on the card the purchase rate is lower.

Details of these cards are correct at time of publication and subject to change. All these cards were identified as the "best" cards using the Finder Score, a data-driven methodology that considers rates, fees and card features.

Want more options? Check out more balance transfer credit cards and get your credit card debt under control.

Sources

Ask a question