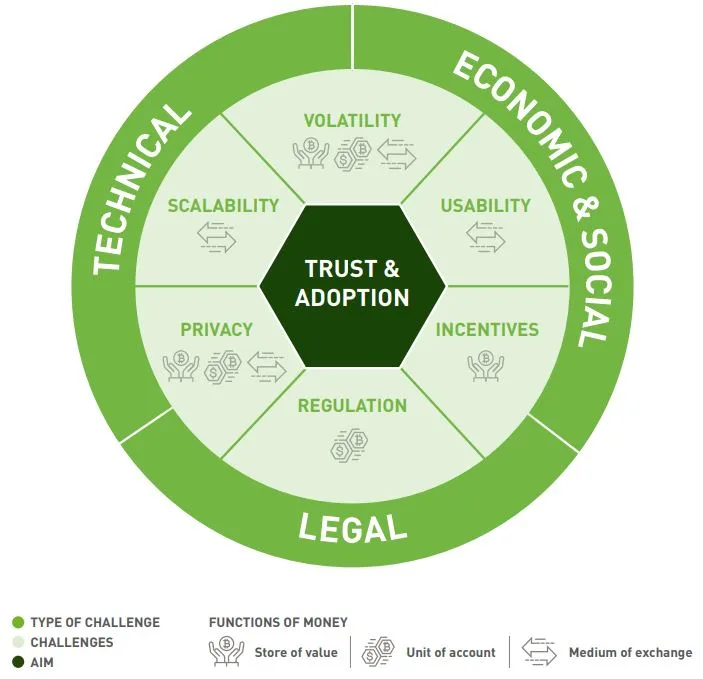

The six challenges and solutions for cryptocurrency adoption

By defining the purpose of money, you can see exactly where crypto stands in relation to it.

A new research paper by Imperial College London's Dr Zeynep Gurguc and Prof William Knottenbelt, commissioned by eToro, has examined the remaining challenges and barriers for wider cryptocurrency adoption and has come to the tentative conclusion that the wider use of cryptocurrencies is looking increasingly inevitable.

"The concept of money itself has evolved greatly in our lifetime from cash to plastic via use of debit/credit cards and even more so through the current use of contactless payments," the paper (PDF) reads. "The wider use of cryptocurrencies is the next natural step in reducing friction in the global economy, supported by the adoption of tokens in local contexts, be they specific to geographies or industry-sectors."

Can cryptocurrency be money?

The first question the researchers asked is whether cryptocurrency can be money. The rest would be a bit of a moot point if the answer were no.

To be money, they said, crypto needs to fulfil three core functions: being a medium of exchange, being a unit of account and being a store of value.

In response, the researchers noted that it's already a functional store of value by any measure, albeit a volatile one, and that the only real barriers to cryptocurrency functioning as a unit of account and medium of exchange are cryptocurrency trust and adoption.

It pointed out some of the similarities between cryptocurrency and other forms of traditional value in the process.

From there, the issue might be examined from the perspective of what obstacles remain for cryptocurrencies to become more widely accepted as currency, thereby fulfilling the other two functions and making the leap to being "real money."

In other words, what are the key obstacles to cryptocurrency trust and adoption? They came up with six key obstacles.

- Volatility

- Usability

- Scalability

- Privacy

- Regulation

- Incentives

The paper succinctly summarised each of the problems, the specific parts of currency-likeness they inhibit and the nature of the potential solutions like so.

Problem: Regulation, or the lack thereof

The researchers note that a lack of coherent regulation is inhibiting trust and adoption. The widespread scams in the crypto space, the long use of the technology for illegal purposes and a seemingly endless supply of drug-themed cryptocurrencies may be undermining the reputation of legitimate projects and sending some pretty alarming signals to potential adopters.

The natural solution to at least some of these problems is regulation, but the global nature of the technology can "cause problems for the traditional regulatory measures available to nation states."

With traditional measures unlikely to do the trick in the foreseeable future, the alternatives may be either a global regulatory framework or some kind of self-governance model or reputation system to let the ecosystem guide itself.

The research notes that global cryptocurrency regulations are currently being implemented in a haphazard and piecemeal way. While some countries are committed to working together on cryptocurrency regulation, others have committed to either doing the exact opposite or nothing at all.

As such, the combination of formal regulations along with voluntary regulatory compliance and wide use of identity-reputation systems might be a more likely way forwards.

Problem: Finding a balance of privacy and trust

It's tempting to look at blockchain technology as a transparent source of truth, the researchers note, but in the real-world, stakeholders all want different levels of privacy.

This conflicts with different regulatory expectations though. Authorities in Japan are bringing the hammer down on privacy coins, while regulators in the USA appear to be sizing up the shape of the problem before bringing the hammer down.

Of course cash, prepaid debit cards and other mediums of exchange are also completely anonymous. On the whole, complete transparency is a much bigger obstacle to cryptocurrency adoption than privacy.

The solution will therefore need to be a system that can deliver varying levels of privacy on demand, which might also carry some wide-reaching benefits beyond what's currently available.

Problem: Volatility and the vague possibility of total collapse

Volatility can be an off-putting characteristic in a store of value. Stablecoins are a thing though, and they tend to work quite well.

There's also the problem of a cryptocurrency outright going to zero, and the risks of routing funds through centralised exchanges.

"Even though problems faced in traditional financial systems such as bank runs are relatively similar to those being faced by crypto-exchanges, the very high volatility of cryptoassets has the potential to negatively affect perceptions and hamper their use in all kinds of longduration transactions," the researchers note.

In the bigger scheme of things, every economy and currency that's not around today has collapsed. Clearly the possibility of total economic collapse isn't unique to cryptocurrency.

Problem: Scalability, the trilemma

There is a saying in regard to blockchains which states, you need speed, security and decentralisation but can only pick two. This is sometimes known as the scaling trilemma.

Most of the best-known coins like bitcoin and Ether opt for security and decentralisation, which leaves them slow and far too impractical for global adoption as a real currency system.

One popular school of thought holds that distributed ledger technologies will never be capable of supporting the needs of a global economy because they'll always be slower and less scalable than centralised systems. One popular rebuttal is that it would only matter if the world needed an infinite number of transactions.

It doesn't though, and functionally it doesn't matter that distributed ledgers are less fast than centralised systems as long as they're fast enough.

This problem is mostly technical in nature, the paper says, and it points out some of the many developments going on to solve this problem, including the bitcoin Lightning Network and Ethereum's suite of planned scaling solutions.

The problem is that it's slow and, appropriately enough, the solution is to just give it time.

Problem: Incentives and the need for built-in economic theory

One of the trickier obstacles for some cryptocurrencies might be that the network token needs to serve more purposes than just being a currency. They might need to act as a governance token, a network facilitator, a consensus mechanism or something else. In the case of bitcoin, for a relatively simple example, the coin needs to serve as the network transaction fee and miner incentive.

These jobs can naturally get in the way of cryptocurrency's secondary responsibility of being a currency.

It's kind of like if credit cards had to double as a cutlery set, or if cash had to be an effective emergency fire starter. It's quite doable, but still means extra design considerations that get in the way.

The paper points at developments in the fields of game theory, mechanism design and behavioural economics to help guide the future developments of cryptocurrency.

Problem: User friendliness

Cryptocurrency is relatively limited to technically-savvy audiences right now, the paper notes. As long as the barriers for entry remain as high as they are, cryptocurrency will not achieve the trust and adoption it needs to become real money.

This naturally impacts individual users in the form of maintaining multiple wallets, some of which are either user-unfriendly or outright user-hostile.

But it also affects industry operators, the researchers note. These problems take the form of interactions between crypto and traditional fiat banking facilities, specialised cybersecurity needs and a new field of best practices to get one's head around.

The solution might once again come with time. There have been many moves towards distributed ledger technologies in various capacities from traditional banking institutions, and every day brings new progress and developments.

The applications of distributed ledger technology make it hard for most businesses to ignore entirely, and as they start examining how to best use it, there will naturally be more and better systems and practices for managing cryptocurrency. Keeping your cryptocurrency in a regulated bank might not be the cypherpunk dream, but it sure is convenient.

A matter of time

All the problems between cryptocurrency and wider adoption have a solution, and sometimes that solution is just a bit more time as ongoing developments take their course.

"Given the speed of adoption, we believe that we could see Bitcoin and other cryptocurrencies on the high street within the decade. There are of course barriers to mainstream adoption, but they are far from insurmountable," says Iqbal Gandham, the UK Managing Director of eToro.

The idea of crypto as currency might seem far-fetched, but in a long enough time frame, it would be a lot stranger if something as practical and widely applicable as decentralised digital currency in some form didn't catch on.

To quote a "renowned bitcoin expert" quoted by the paper, "it is fiat money that is the greatest social experiment on the human race, Bitcoin is merely a techno-reaction to that."

You said it, renowned bitcoin expert!

Disclosure: At the time of writing, the author holds ETH, IOTA, ICX, VET, XLM, BTC and NANO.

Latest cryptocurrency news

-

The Coinstash Cryptocurrency Hub

30 May 2024 |

-

Ordinals and runes – the new crypto craze?

24 Apr 2024 |

-

Join the party: Finder’s giving away $200K worth of Bitcoin

23 Feb 2022 |

-

Australians have spent $50.9 million on crypto trading fees

31 Jan 2022 |

-

Stablecoins vs Bitcoin: What’s the difference?

3 Nov 2021 |

Picture: Shutterstock

Ask a question