Rental realities: 3 tips for mastering the rental market

How to get ahead when you're looking to rent

Thanks to a perfect storm of dwindling rental supply, growing tenant demand and additional pressure from recent devastating floods, it's getting harder and harder to find a suitable rental property.

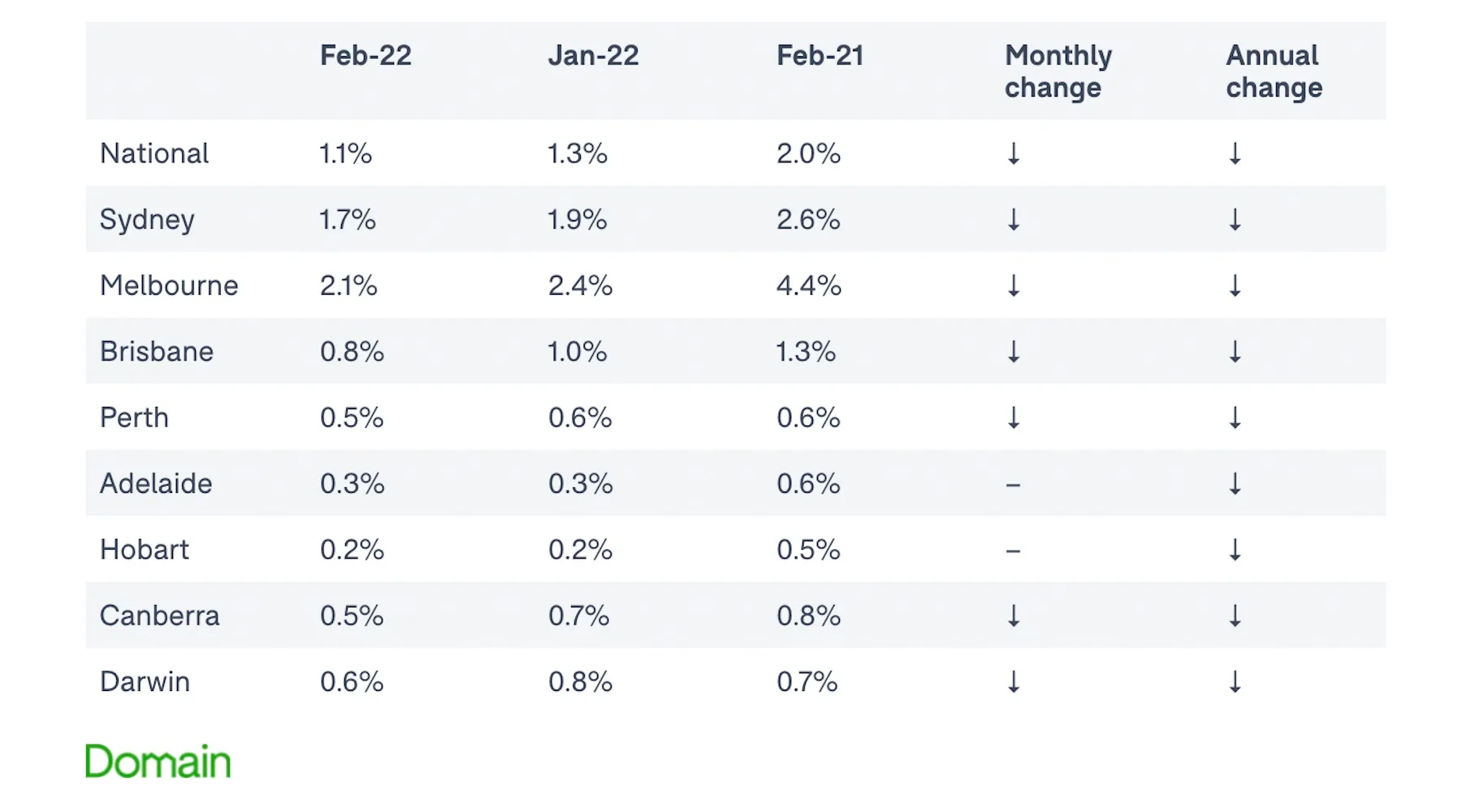

The latest data from Domain confirms that 6 out of our 8 capital cities currently have a vacancy rate of 1% or less, while the other 2 state capitals, Sydney and Melbourne, are 1.9% and 2.4% respectively.

But thankfully there's still things you can do to give yourself the best chance at landing a great place.

3 tips for getting the right rental property

Ray Dib, CEO and co-founder of MyBond, shares his advice for those looking to rent:

- Determine what your rental motivation is. Is it because you need to move out of your current place, you're trying to save money, or you're ready to move out? Are you trying to be closer to public transport and amenities, work or school? Work out your bottom line, to keep you focused during your search.

- Go to as many open homes as you can. Even if they're properties that don't seem to suit at first glance, check them out. You might be surprised by a property that actually presents differently to the photos, and you can also get an understanding of what other properties are renting for.

- Make your application stand out. "When you apply... make it super easy for the agent to say yes," Dib says. This could be with a rental CV that showcases your strong payment record, or confirmation that your bond is ready to be paid upon acceptance of your application.

Our renting guide can help you know your rights and navigate the rental market.

Ask a question