Record refinance rush: Aussie homeowners turn over $14 billion in a month

Panicked homeowners are refinancing in record numbers, according to new analysis by Finder.

A record $14 billion worth of home loans were refinanced with a new lender in Australia in August, according to the latest data from the Australian Bureau of Statistics.

That's an increase of 13% over the month and 20% over the year.

This includes a record 27,667 mortgagors who refinanced with a new lender in August 2022 – up from 23,642 a year earlier.

Aussies with a $500,000 mortgage are facing a cumulative $735 a month hit to their family budget. That means forking out around $8,820 more per year since the RBA cash rate rises started in May.

Graham Cooke, head of consumer research at Finder, said rapidly increasing interest rates had led to a lot of pressure for borrowers.

"Borrowers are scrambling to cut costs on their mortgage where they can.

"Repayment spikes are just too much to manage for millions of households causing a rush to refinance."

Finder's Consumer Sentiment Tracker reveals that in the last 3 months, 1 in 4 (25%) borrowers struggled to pay their home loan.

Cooke said many had taken on too much debt when interest rates were low.

"Refinancing to a better deal can dramatically lower your costs and increase your savings.

"With at least one more rate rise predicted in the short term – the full impact of increasing rates is not expected to be felt until early next year.

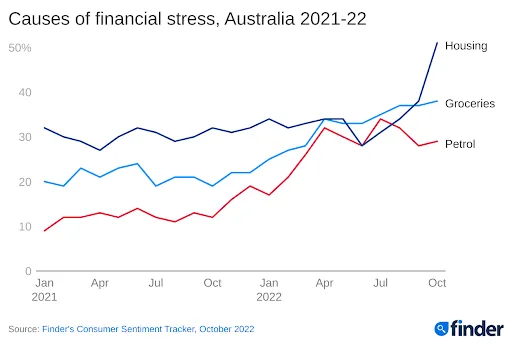

"Finder's Consumer Sentiment Tracker has seen a significant rise in the number of households who are stressed about their housing, grocery and petrol bills over the last 20 months."

Cooke said there were some simple steps to cutting back on everyday expenses.

"Loyalty doesn't pay – shop around for the best deals on all your expenses.

"It's also a good idea to start a budget if you haven't already. Knowing where your money is coming from and where it's going is a critical step in getting on top of your finances.

"There are plenty of free budgeting tools like the Finder app that let you see all your money in one place. Once you have a rough idea of your spending habits, you can figure out where there's room to cut back," Cooke said.

Looking for a better home loan deal? Check out some of Finder's top home loan picks.

Ask a question