Finder’s RBA cash rate survey: 89% of experts support axing stamp duty nationally

An annual land tax should replace the one-off financial sledgehammer of stamp duty on property purchases, say experts.

In this month's Finder RBA Cash Rate Survey™, 40 experts and economists weighed in on future cash rate moves and other issues related to the state of the Australian economy.

Earlier In November, the state government announced that NSW will lead the way on tax reform with its plan to make stamp duty optional, granting homeowners the ability to pay an annual land tax instead.

Of those who weighed in on the topic, 9 in 10 experts (89%, 24/27) were in favour of the proposed stamp duty scrapping.

Graham Cooke, insights manager at Finder, said that stamp duty can be a dealbreaker for those looking to relocate, and this can impact property demand and supply.

"Buying a home in Australia is already an expensive affair and stamp duty makes it more so.

"It effectively raises the bottom rung of the housing ladder, burdens buyers with a huge up-front tax and inhibits the flow of property sales.

"In an ideal market, you buy when you can afford to and you sell when you want to. Stamp duty forces first-time buyers to save up for longer, and prevents current owners from upselling.

Cooke said removing stamp duty may result in a short-term boost to property prices.

"Axing the tax now also means buyers who are currently saving can get more bang for their buck," Cooke said.

Brisbane voted best-value city to purchase a property

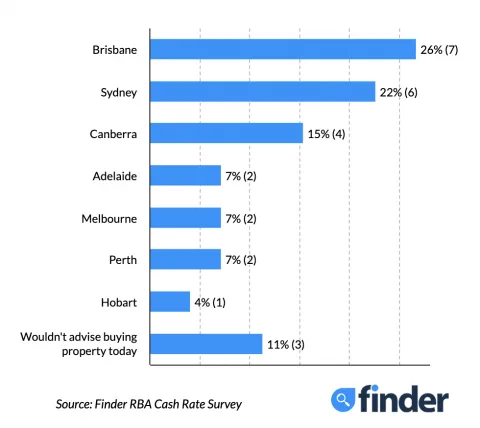

According to experts, buyers should look to the Sunshine State if they want the best return on investment, with over a quarter (26%, 7/27) nominating Brisbane as the best Australian capital city to buy a property.

Around 22% of respondents cited Sydney as the best city to buy in, followed closely by Canberra (15%, 4).

Hobart is at the bottom of the list, with only 4% (1/27) of experts tipping Tasmania's capital as a smart place to buy.

Interestingly, despite optimism about the economy and a vaccine for COVID, 11% (3/27) of experts wouldn't advise buying property in any capital city.

Cooke said that Brisbane is home to a host of up-and-coming suburbs which are gaining in popularity.

"In terms of value, Brisbane has been tipped as the city to watch over the next few years, with prices expected to surge between 2022 and 2023.

"First home buyers are taking advantage of affordable prices and government incentives, while investors from both Queensland and interstate are benefiting from strong rental returns.

"While Sydney is unsurprisingly a strong candidate, Melbourne near the bottom of the list is a shock – likely due to its prolonged lockdown and expected knock-on effects," he said.

Cash rate expected to hold in December

All experts surveyed (40/40) are predicting the cash rate to hold this month.

Low rates are expected to stick around for a while, with only 20% (8/40) of experts expecting the cash rate to increase within the next 2 years, and the earliest predicted rise occurring in Q3 2021.

According to John Rolfe of Elders Home Loans, we're unlikely to see a negative cash rate in Australia.

"The Reserve Bank won't go to zero, but we will want to see a few quarters of positive growth before increasing the cash rate," Rolfe said.

Here's what our experts had to say

Shane Oliver, AMP Capital: "Given that the cash rate is already at 0.1% and the RBA does not want to take it negative the next move is likely to be a hike. But given the high level of spare capacity in the economy, inflation is unlikely to meet the RBA's conditions for a hike of being sustainably within the 2-3% target range for another 3 years or so. As a result, the first rate hike is unlikely until sometime in 2024."

David Robertson, Bendigo Bank: "The RBA has cut the official cash rate to its effective lower bound at 0.1%, and will stay at this floor for some years. The next tightening cycle may commence in FY23. Further monetary stimulus if needed will come in the form of expanded QE, but negative interest rates are not on the table."

Sean Langcake, BIS Oxford Economics: "The RBA's forward guidance has turned a little more dovish. It will be quite sometime before their conditions for a rate increase are met."

Ben Udy, Capital Economics: "In May we were the first to forecast that the RBA would launch QE in earnest with markets and the consensus forecast only coming around to our view in recent months. In November we were proved right. Looking ahead we think the Australian economy is poised to recover faster than most expect."

Peter Boehm, CLSA premium: "There appears to be little justification for further cuts to the cash rate. In fact, interest rates have probably reached their floor. This is because the relative success of the Federal Government's stimulus packages combined with various State-based initiatives has carried the economy such that the time has come to focus less on monetary policy, and more on fiscal policy. The last thing the economy needs right now is zero or negative interest rates."

Saul Eslake, Corinna Economic Advisor: "I think the RBA's commitment not to raise the cash rate for at least three years is credible."

Malcolm Wood, EL&C Baillieu: "RBA commitment to keep rates at affective zero for 3 years."

John Rolfe, Elders Home Loans: "The RBA won't go to zero but will want to see a few quarters of positive growth before increasing."

Craig Emerson, Emerson Economics: "The RBA has a new target: it won't increase the cash rate until actual (not forecast) unemployment is much lower and actual (not forecast) inflation is in the 2-3 per cent range. That will be well beyond end-2022."

Tony Makin, Griffith University: "Large scale monetisation of government bonds must eventually put upward pressure on inflation as economies recover from the Covid recession. If economic theory and history are any guides, a rise in the official cash rate will then be necessary. World interest rates should start to rise as markets become saturated with government bonds that continue to be issued on a massive scale. A rate to watch is the rate on long-dated US bonds."

Tim Nelson, Griffith University: "Conventional monetary policy is unlikely to be utilised to manage stimulus out of covid, but will be used to manage a quickly growing economy post-covid."

Michael Witts, ING Bank: "[The RBA] have indicated the cash rate will remain unchanged for 3 years however the recovery from covid appears to be going faster than anticipated hence the RBA may adjust the cash rate earlier than 3 years although the timing is highly uncertain."

Leanne Pilkington, Laing+Simmons: "Like most industries and consumers as well, we're hopeful the cash rate remains unchanged for some time. The Reserve Bank recently made the landmark move and it will take some time to ascertain its success in supporting the economic recovery. We see the cash rate remaining steady until well into the new year."

Nicholas Gruen, Lateral Economics: "All I'm saying is that increases look to be a long time coming."

Mathew Tiller, LJ Hooker: "After last month's reduction in the cash rate to close to zero, the RBA will look to support and stimulate the economy via other measures moving forward. One of the main beneficiaries, of the ongoing record low rates, has been property markets with LJ Hooker agents reporting a significant increase in enquiry and strong levels of sales transaction volumes."

Sam White, Loan Market Group: "There's renewed confidence in the marketplace. The next change in the cash rate will be an increase but the timing on that is difficult to predict as there are numerous factors, including the availability of a COVID-19 vaccine, to consider. The market doesn't need a rate cut at the moment - it needs easier access to finance. There's no shortage of pre-approvals at the moment. In many suburbs, it's now cheaper to pay a mortgage than to rent. We're seeing the economy stabilise relatively quickly. The economy has proved to be much more resilient than first thought."

Jeffrey Sheen, Macquarie University: "The RBA has provided forward guidance that the cash rate should not be increased until about 3 years after the COVID-19 shock."

Geoffrey Kingston, Macquarie University: "I expect - without high confidence - that inflationary pressures will emerge by the second half of 2022."

Michael Yardney, Metropole Property Strategists: "The RBA will now wait and see how effective their recent interest rate cut and the QE program is."

Mark Crosby, Monash University: "The RBA has signalled holding rates low until 2023 at the earliest."

Julia Newbould, Money magazine: "I think that by the second half of 2021, there should be signals that the rates have achieved their goals and there will be a review."

Susan Mitchell, Mortgage Choice: "I expect the RBA to hold the cash rate at its last meeting in 2020. In the minutes of the November monetary policy meeting, members said that negative rates were extraordinarily unlikely, suggesting we may not see another reduction to the cash rate so soon. That being said, the historic low cash rate is supporting the lowest borrowing cost on record and driving activity in the nation's housing market. It is also encouraging a surge in refinancing from borrowers looking for a better deal."

Alan Oster, NAB: "Nothing for forecast period re-rate rises, If further support is needed it will be via QE."

Jonathan Chancellor, Property Observer: "Next time is up, but who knows just which year."

Rich Harvey, Propertybuyer: "No further rate cuts. RBA has said they will not go to negative rates. Rates likely to stay at this level for 3 years."

Noel Whittaker, QUT: "Low rates are here for years. The big question is whether they will move to negative rates."

Cameron Kusher, REA Group: "I think the RBA is extremely reluctant to cut further and take rates negative while I also think they may be somewhat optimistic in their forecasts around a rebound in inflation. I don't see an increase until after 2022 and if anything a move lower, albeit very reluctantly, looks more likely than an increase but I am still unsure that would occur."

Jason Azzopardi, Resimac: "RBA monetary policy indicates QE and a period of sustained low rates will remain."

Christine Williams, Smarter Property Investing: "Global rates will remain low due to Covid-19."

Besa Deda, St. George Bank: "Subdued economic conditions will continue to require strong monetary stimulus for at least the next three years."

Dale Gillham, Wealth Within: "Whilst Australia is coming out of the covid climate that has plunged us into a recession, things are not as bad as they could be and so the recession is likely to be short-lived and so interest rates are unlikely to fall further. The release of figures around retail spending and GDP in this second quarter will be an indication as to whether rates will rise in 2021 or remain at current levels. If retail spending is strong then a movement in rates will occur earlier rather than later."

Other participants: Nicholas Frappell, ABC Bullion. Alison Booth, ANU. John Hewson, ANU. Rebecca Cassells, Bankwest Curtin Economics Centre. Angela Jackson, Equity Economics. Mark Brimble, Griffith University. Alex Joiner, IFM Investors. Stephen Koukoulas, Market Economics. Dr Andrew Wilson, My Housing Market. Bill Evans, Westpac.

Ask a question