RBA survey: 58% experts say now not a good time to buy property, predict further price falls

Nearly 6 in 10 experts say now is not a good time to buy property, according to new Finder research.

This non-vote of confidence comes as the Reserve Bank of Australia (RBA) today announced a hold on the cash rate for the second consecutive month, an outcome which was accurately predicted by 40 of 42 members from the Finder RBA Cash Rate Survey™.

Experts and economists were asked how much they expect prices to dip by 2021, following recent predictions of a housing downturn due to COVID-19.

Of all the capital cities, Hobart is expected to see the largest average price drop of 10.5% by 2021, followed closely by Sydney at 10.2%.

Darwin and Melbourne were next with drops of 9.5% and 9.2% forecast, with Brisbane, Perth and Adelaide all expected to see drops of around 8%.

Canberra is expected to feel the sting the least with drops of only 6.4% projected.

Graham Cooke, insights manager at Finder, said with increasing unemployment and growing economic uncertainty house prices will slide over the rest of the year.

"Both househunter and seller demand has weakened in the last month as Australians hunker down to help stop the spread of coronavirus.

"It's not just experts, we've also seen consumer sentiment about whether it is a 'good time to buy' drop from a peak of 60% in July 2019 to just 42% in April," Cooke said.

Expected house value drops across capital cities:

| City | Drop predicted by %* | Current average house value** | Drop in $ | Projected 2021 house value |

|---|---|---|---|---|

| Hobart | -10.50% | $540,000 | ($56,700) | $483,300 |

| Sydney | -10.20% | $935,000 | ($95,370) | $839,630 |

| Darwin | -9.50% | $460,000 | ($43,700) | $416,300 |

| Melbourne | -9.20% | $791,000 | ($72,772) | $718,228 |

| Brisbane | -8.40% | $563,000 | ($47,292) | $515,708 |

| Perth | -8.30% | $515,000 | ($42,745) | $472,255 |

| Adelaide | -8.10% | $505,000 | ($40,905) | $464,095 |

| Canberra | -6.40% | $700,000 | ($44,800) | $655,200 |

Source: CoreLogic, Finder

*Average of predictions from 17–25 economists, depending on the city. Inflation has not been taken into account.

** As of 31 Jan 2020, price changes from February to May 2020 have not been taken into account.

In welcome news for the housing market, New South Wales and the Northern Territory will allow open-house property inspections and public auctions to restart this coming weekend (9 May) with other states expected to follow suit in the coming weeks.

Transaction volumes have collapsed in recent months as social distancing measures brought an end to traditional selling practices.

Cooke said borrowers could save on their mortgage by switching to a lower interest rate home loan.

"While falling house prices is great news for potential buyers, it poses no relief for current owners who will not see their outstanding loan amounts drop.

"With rates at rock bottom, now is a more important time than ever to bargain for better value from your bank or switch lenders.

"At a time when households are already stretched, people need to know they are getting the lowest interest rate – that means it needs to have a 2 in front," Cooke said.

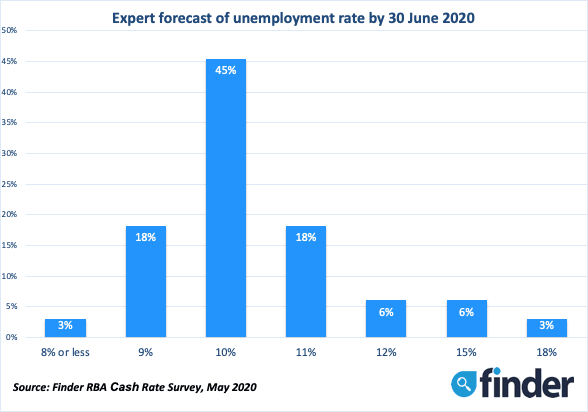

Unemployment to move towards 10%

Experts agreed with recent predictions that the unemployment rate could hit 10% with 80% of experts indicating a final low within 1 percentage point of that.

5 experts (15%, 5/32) pointed to a 12% or higher unemployment rate.

John Rolfe, head of Elders Home Loans expects unemployment to go as high as 18%.

Noel Whittaker, executive in residence and adjunct professor at QUT Business School said the full impact of COVID-19 is yet to be understood.

"This recession will be far worse than the government imagines...they can't close down so many businesses and not expect a severe hangover.

"As for real estate, it's never a bad time to buy a bargain," Whittaker said.

Economic Sentiment Tracker

Results from Finder's Economic Sentiment Tracker, which gauges five key indicators – housing affordability, employment, wage growth, cost of living and household debt – has seen modest progress since last month's survey.

Cooke said positive sentiment about housing affordability has taken an interesting journey over the last 12 months.

"Just under half of experts felt positive about this metric in mid-2019 as prices were falling.

"When the market started surging again in December and January this began to plunge, reaching 6% by February 2020.

"One positive of COVID-19 is that economists are once again feeling fairly positive about housing affordability.

"Buyers with a deposit ready to go could be the most powerful players in the market right now," Cooke said.

Here's what our experts had to say:

Nicholas Frappell, ABC Bullion (Cut): "The impact of the slow down with expectations of a 10% contraction in H1, combined with expectations in the cash futures market tilted towards a reduction. With effective cash rates at around 0.15%, another reduction may just formalise the current effective rate scenario."

Alison Booth, ANU (Cut): "[The RBA will cut] because of the state of the economy."

Nicholas Gruen, Lateral Economics (Hold): "They should cut to zero or below, but they've said they won't. I hope they change their mind. Anyway, the important things are now happening in fiscal policy as monetary policy can't do much in this situation."

Shane Oliver, AMP Capital (Hold): "The cash rate is as low as it's going to go and the next move in rates will be up but it's at least three years away, probably more. The RBA has said on several occasions that it regards 0.25% as the effective lower bound for the cash rate. Based on the experience of other countries there is no value in taking rates negative. So any further easing in monetary policy will have to come from quantitative easing. In the meantime the coronavirus related shutdown will cause a big hit to growth that will take years to fully recover from. This in turn will mean that it will be many years before we see full employment and inflation in the target range of 2–3% which in turn will mean rate hikes are many years away."

John Hewson, ANU (Hold): "Recession/flat economy will last longer than expected."

Malcolm Wood, Baillieu (Hold): "RBA on hold at effective zero for many years."

David Robertson, Bendigo and Adelaide Bank (Hold): "No more interest rate cuts required (not effective below this 'lower bound' of 1/4 %) – and no increases will occur until 'full employment' achieved: 2022/23?"

Peter Boehm, Boehm (Hold): "I think interest rates will stay where they are for the foreseeable future and until such time as there is more certainty on where the economy is heading after COVID-19 is brought under control. Right now, I don't expect the outlook to be overly positive for the remainder of this year and probably into next year as well, either here in Australia or overseas. It is difficult to predict if/when interest rates might move when it's hard to forecast with reasonable certainty what the economy might look like over the next six months, let alone next year."

Ben Udy, Capital Economics (Hold): "I don't think the RBA will change the cash rate in the next two years as the governor has said."

Saul Eslake, Corinna Economic Advisory (Hold): "The RBA has explicitly indicated that it won't raise the cash rate until it has made progress towards full employment and inflation within the 2–3% target band. I am sceptical of forecasts of a 'V-shaped' recovery from the current downturn, and think that the RBA will keep the cash rate at its current level for at least 2 years."

Craig Emerson, Craig Emerson Economics (Hold): "The RBA has publicly stated the cash rate at 0.25% is the lower bound."

Trent Wiltshire, Domain (Hold): "The RBA won't be raising the cash rate for the next few years."

John Rolfe, Elders Home Loans (Hold): "We are going into an enforced recession. I cannot foresee when this will end as we are showing little or no chance to reverse whilst still in lockdown. The recovery rate will drive."

Mark Brimble, Griffith Uni (Hold): "COVID impacts seem likely to endure for a period of time and the economy will need support in the medium term to stabilize and then rebuild."

Tony Makin, Griffith University (Hold): "The timing of any future cash rate change will depend on how and when the lockdown restrictions are lifted, and on how quickly the economy is expected to spring back."

Peter Haller, Heritage Bank (Hold): "The RBA has committed to a cash rate at the effective lower bound for at least the next two years."

Alex Joiner, IFM Investors (Hold): "It will be a very long time before the RBA returns to conventional policy. It will wind back its unconventional policy first and then need to see material progress, in terms of recovery, of the labour market the timeline for this is unknowable at this stage but I was suspect it will be beyond 2022."

Andrew Wilson, Independent Economist (Hold): "There are unlikely to be any moves in the near future. The RBA are likely to take a "wait and see" approach and retain the remaining leverage they have. No decisions are likely until the economic repercussions of COVID-19 become clearer."

Leanne Pilkington, Laing+Simmons (Hold): "The Reserve Bank Governor recently challenged the Government to focus on growth and productivity strategies to help the economy, eventually, emerge from the COVID-19 crisis. More efficient taxation solutions including the removal of stamp duty is an obvious place to start. Interest rates are already rock bottom and on this score the RBA has done its part."

Nicholas Gruen, Lateral Economics (Hold): "They should cut to zero or below, but they've said they won't. I hope they change their mind. Anyway, the important things are now happening in fiscal policy as monetary policy can't do much in this situation."

Mathew Tiller, LJ Hooker (Hold): "The RBA is expected to maintain its current policy to support the economy through COVID-19."

Geoffrey Harold Kingston, Macquarie University (Hold): "Following 1–2 years of falling inflation, there is a good chance inflation will eventually pick up, as a belated consequence of massive stimulus."

Jeffrey Sheen, Macquarie University (Hold): "Indications from RBA that cash rate is likely to remain at its all-time low for a few years."

Stephen Koukoulas, Market Economics (Hold): "The recovery will be in full swing and inflation pressure may be emerging."

John Caelli, ME Bank (Hold): "The RBA has clearly indicated that the cash rate will not go up for much of the next 3 years."

Michael Yardney, Metropole Property Strategists (Hold): "It is unlikely the cash rate will move for a number of years."

Mark Crosby, Monash University (Hold): "There is too much uncertainty re the duration of the impact of COVID19. Further rate cuts would not stimulate the economy, and the question now is of the form and nature of QE in 2020 and 2021."

Julia Newbould, Money (Hold): "I think there may have been some signs of recovery."

Susan Mitchell, Mortgage Choice (Hold): "I expect the Reserve Bank to hold the cash rate at its monetary policy meeting in May. In his speech on the 21st of April, Governor Lowe said that the cash rate was to remain at 0.25% until we make sustainable progress towards the goal of full employment and inflation. We are still waiting for economic data to reveal the extent of the impact of the COVID-19 pandemic but the latest indicators suggest that interest rates will have to stay low for longer. As expected, consumer sentiment plummeted to an all-time low in April, with Westpac reporting the single biggest monthly decline in the 47 year history of the survey. Social distancing measures have knocked the wind out of the sails of the property market but time will tell if this will translate to declining dwelling values."

David Lowe, Newcastle Permanent (Hold): "The RBA have been consistent in promoting the lower for longer rate environment, and by targeting the 3 year bond rate at 0.25%, it is indicating a period of around three years of rates at the current level."

Jonathan Chancellor, Property Observer (Hold): "The RBA has advised they won't go to zero, so the next move must be up, but to a completely unknown timeline."

Rich Harvey, Propertybuyer (Hold): "No change. Rates are already at the lowest level the RBA has indicated they are prepared to go. Next move from here is QE and new fiscal policies to kick start the economy after hibernation."

Matthew Peter, QIC (Hold): "The RBA will not be in a position to raise rates for at least four years. The current impact on growth dictates rates at the lower bound until the end of 2021. After that, high levels of government and private sector debt will mean the RBA cannot lift interest rates."

Noel Whittaker, QUT (Hold): "We are living in an uncertain world, even the budget has been pushed back to October. There are too many unknowns to make any sort of meaningful predictions."

Jason Azzopardi, Resimac (Hold): "Inflation will not increase for a long time keeping rates low."

Sveta Angelopoulos, RMIT University (Hold): "Hard to estimate at this point and will depend on the rate of restrictions being eased and businesses being able to return to trading will also depend on whether the easing of restrictions result in another outbreak and if restrictions are imposed again."

Christine Williams, Smarter Property Investing Pty Ltd (Hold): "I believe once we come out of ISO and Retail, Tourism (within Australia) and Hospitality are at full working capacity the RBA will increase the rate to recoup our holdings."

Besa Deda, St.George Economics (Hold): "Governor Lowe has made it clear in his speeches that the cash rate will remain at its lower bound for some time. We will need to see the removal of the three-year bond target and the associated unwinding of quantitative easing. A rate hike is therefore not likely to occur within the next three years."

Brian Parker, Sunsuper (Hold): "Next rate increase is beyond the scope of the dates provided."

Mala Raghavan, University of Tasmania (Hold): "I am not sure if any accommodative (conventional and unconventional) monetary policy measures will help to revive the economy, considering that the COVID-19 crisis has a larger effect on the supply-side of the economy relative to the demand-side. I am not sure if flushing the economy with liquidity helps to stimulate the economy, unless and until the pandemic is contained."

Andrew Reeve-Parker, NW Advice (Hold): "The rate won't change for a long time."

Other participants: Bill Evans, Westpac (Hold). Angela Jackson, Equity Economics (Hold).

Ask a question