RBA survey: Experts predict slow recovery for Melbourne property market

Melbourne homeowners may need to wait at least two years before the property market shows signs of growth according to experts.

In this month's Finder RBA Cash Rate Survey™ – the largest of its kind in Australia – 40 experts and economists weighed in on future cash rate moves and other issues related to the state of the Australian economy.

All experts surveyed expect a cash rate hold in August (40/40), with the consensus being that no further cuts will be implemented this year. However, more than two-thirds (26, 72%) of experts forecast an increase in 2021 or 2022.

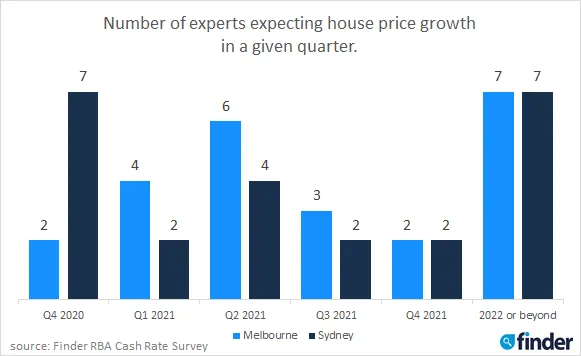

Of those who weighed in on property, the majority are pessimistic about Melbourne prices increasing before April 2021 (75%, 18/24), while one-third (29%, 7/24) expect the market to stagnate until 2022 or beyond.

The outlook is slightly rosier for the Sydney housing market, with 38% of experts (9/24) predicting that house prices will recover before April 2021.

Graham Cooke, insights manager at Finder, said that the unpredictability of COVID-19 has sent ripples of unease through the market.

"Both Melbourne and Sydney experienced double-digit growth throughout most of 2019. But widespread unemployment, travel bans and a second virus wave has caused a surge in property vacancies throughout both capitals.

"Melbourne's median house price fell by 3.5% to $881,369 between March and June 2020, and Sydney wasn't far behind with a 2% drop during this period.

"As Sydney teeters on the edge of a second major outbreak, prospects may be equally grim for homeowners here when it comes to the housing market recovery period," Cooke said.

A surprisingly high percentage of experts and economists (42%, 11) also believe that now is a good time to put your home on the market.

Only a quarter of experts (26%, 7) said homeowners should wait for 2 years before selling their home.

Said Cooke, "It is clear that there is widespread uncertainty in the market as to what prices will be in the near future.

"This environment has also pushed interest rates lower than ever. We've just seen the first sub-2% loan hit the market, and that could be a sign of things to come.

"With investors fleeing the market, banks are fighting tooth and nail for owner-occupier customers. It's the ultimate borrower's market. If your home loan has a 3 in front of it, you're paying too much in 2020," he said.

Where do you think is the best place to invest your money right now?

Despite reaching record high levels in July, gold was only cited by 14% of experts as the top place to invest.

| Investment | % |

|---|---|

| Property | 32% |

| Shares | 21% |

| Gold | 14% |

| Superannuation | 11% |

| Cash | 7% |

Source: Finder RBA Cash Rate

Survey, August 2020 of 28 experts

However, the largest group of respondents (9, 32%) picked property as the best investment option at present, followed by the ASX (6, 21%).

Further LMI reductions expected

In late July, St.George Bank announced that it will reduce lenders mortgage insurance (LMI) to $1 for first home buyers with a deposit of just 15%.

More than half of economists surveyed (14, 58%) believe that other banks will follow in St.George's footsteps, though most (20, 83%) believe that this will have negative repercussions.

Saul Eslake, economist at Corinna Economic Advisory, said that eradicating LMI may prove costly if miscalculated.

"Reducing LMI leaves borrowers (and potentially lenders themselves) more exposed in the event that property prices fall (which is quite plausible); and may encourage people to take on more debt than they can sustainably service," he said.

Cooke echoed this sentiment.

"Mortgage lending during the COVID-19 climate carries additional risk for both banks and their customers.

"Thousands of loans are already being deferred, and it's the younger Australians who are the most vulnerable to job loss or an income reduction.

"Banks that reduce upfront LMI costs may compensate by increasing costs elsewhere, however it's unlikely that first home buyers will bear the brunt of this," he said.

Here's what our experts had to say:

Nicholas Frappell, ABC Bullion: "Uncertainty around the timing of the recovery both within and without Australia, and the likelihood that the economic impact will extend well into 2021."

Shane Oliver, AMP Capital: "Having provided massive monetary stimulus back in March the RBA is still in "watch and wait" mode, with the focus on fiscal policy. It could still ease monetary policy a bit further later this year but the Bank does not see any value in going negative on rates, cutting to say 0.1% is hardly worth the effort (although it's possible) which leaves more QE as the main tool for any further easing. And rate hikes are still at least 3 years away."

Alison booth, ANU: "It's unlikely there'll be a change in the near future."

John Hewson, ANU: "[This is the] deepest economic contraction since the Great Depression."

Malcolm Wood, Baillieu: "RBA forward guidance – no change until significant progress toward full employment and inflation sustainably 2–3% year-on-year."

Rebecca Cassells, BankWest Curtin Economics Centre: "It will be some time before the RBA starts to signal that they are contemplating an increase in the cash rate. The prospect of a strong and swift recovery was evident in June, with a number of headline indicators forming healthy Vs. Thousands of jobs had been recovered in June, retail sales had recovered and business and consumer confidence was up. But virus outbreaks in Victoria and NSW have very rapidly undone this trajectory – particularly for Victoria. The commitment by the government to extend JobKeeper and JobSeeker offers some certainty, but getting the virus back under control will offer more. We only have to look to Western Australia to see how quickly an economy and labour market can bounce back when the virus is contained and business and activity restrictions minimal."

David Robertson, Bendigo and Adelaide Bank: "The RBA still appear to have no appetite for negative interest rates, although a cut from 0.25 to 0.10 is possible. Most likely rates are on hold for 2 or more years, before very gradually rising."

Sarah Hunter, BIS Oxford Economics: "As with last month, we don't see the cash rate rising until the second half of 2023 at the earliest."

Sean Langcake, BIS Oxford Economics: "We expect the cash rate target will be on hold through to 2023. The board will want to ensure the recovery is on sure footing before increasing rates, and inflation will likely undershoot the target for some time yet. The next move will be up – the Bank has shown they have no desire to take rates into negative territory."

Ben Udy, Capital Economics: "We expect the RBA to launch fresh quantitative easing next year as it becomes clear inflation will be weaker than the Bank expects."

Peter Boehm, CLSA Premium: "Interest rate movements will do little to address present and ongoing economic challenges Australia faces as a result of the global pandemic. In economic or financial terms, the key focus must now be on Government Fiscal Policy, and in particular, the ongoing levels of financial support needed to save and support the economy."

Saul Eslake, Corinna Economic Advisory: "I think it's quite possible that the RBA won't raise the cash rate until 2023."

John Rolfe, Elders Home Loans: "I believe the RBA will not reduce cash rate any further and as the economy improves, will be keen to increase back toward 2%."

Craig Emerson, Emerson Economics: "We're in a world of deflation and unemployment, which will persist for the foreseeable future."

Angela Jackson, Equity Economics: "RBA will hold interest rates for the foreseeable future with the outlook for the recovery very uncertain."

Mark Brimble, Griffith University: "With little further room to move and impact to be gained, the RBA will want to keep the last traditional MP action in reserve for any further major deterioration. It will also want to see the impact of other stimulus and support measures being deployed by the government."

Tony Makin, Griffith University: "COVID-19 continues to create gross economic uncertainty, domestically and globally. However, given the large ongoing bond issues by federal and state governments to fund huge budget deficits due to responses to contain the virus' spread, market interest rates should continue to rise, with the 3-year bond rate already above the RBA's target 0.25%. The dollar has appreciated some 25% March–July reflecting capital inflow chasing Australia's AAA-rated bonds and could keep climbing as happened post-GFC, to the detriment of industries in the tradable sector of the economy, making economic recovery that much harder."

Stephen Miller, GSFM: "I think the policy rate will be unchanged between now and the end of 2022."

Leanne Pilkington, Laing+Simmons: "The outlook for the unemployment rate sent shivers up spines recently and should see rates remain steady and low for the foreseeable future, as attention turns to the Government's efforts to stimulate the economy."

Nicholas Gruen, Lateral Economics: "It's a wild guess. The RBA should reduce rates, including going negative not that it will make much difference, but it has said it won't. At some stage, it will increase them but it will be a long while coming."

Mathew Tiller, LJ Hooker: "The RBA has flagged that the cash rate will remain on hold until economic conditions are more positive and certain. Property markets have been one beneficiary of low-interest rates over recent months with LJ Hooker agents, across the country, reporting elevated levels of enquiry and solid attendance numbers at auctions and open homes."

Geoffrey Kingston, Macquarie University: "Inflationary pressure from the sustained expansionary policy should be manifesting itself, around this time."

Jeffrey Sheen, Macquarie University: "Forward guidance by the RBA indicates that the cash rate will remain unchanged for at least 3 years."

John Caelli, ME Bank: "The RBA will continue to keep rates where they are until there is a material improvement in repairing the economic damage done by COVID-19. Unemployment is likely to stay well above their targets for a long time."

Michael Yardney, Metropole Property Strategists: "The RBA has indicated that they will not change interest rates in the foreseeable future. They are not going to move to negative interest rates, and they will not raise interest rates until the unemployment rate is 4.5%. That won't happen for a number of years."

Mark Crosby, Monash University: "No way to know when the RBA will consider any change to rates until COVID-19 is behind us. Doubtful that they will reduce rates given that a rate reduction would not have much impact."

Julia Newbould, Money magazine: "All depends on what happens when the next stimulus package kicks in and what happens as companies start having to report more regular income changes."

Susan Mitchell, Mortgage Choice: "There is very little evidence to suggest that the RBA will change the cash rate at its August meeting. In a speech delivered on the 21st of July Governor Lowe reaffirmed the Reserve Bank board's strategy outlined in its March package and ruled out the possibility of negative interest rates in Australia. In the meantime, borrowers can continue to access an extremely competitive home loan interest rate environment."

Alan Oster, NAB: "[A rate change is a] long long time away, possibly beyond 2023, but very unlikely to cut."

Jonathan Chancellor, Property Observer: "Despite their stated intention not to go lower, the patchiness of the economy will see the RBA cut."

Rich Harvey, Propertybuyer: "[The] COVID crisis is causing unprecedented impact and [the] RBA must do all it can to stimulate investment and growth."

Noel Whittaker, QUT: "[The] future is still just so uncertain."

Cameron Kusher, REA Group: "The RBA has set themselves a number of targets that are required in order for them to lift the cash rate, they have also highlighted they think that will take around three years. Nothing that we are seeing at the moment makes me feel as if interest rate cuts are likely, nor do I think we will be getting hikes in the near future."

Jason Azzopardi, Resimac: "RBA commentary to the market rates will remain steady indefinitely."

Christine Williams, Smarter Property Investing: "We are in a very uncertain economic environment with COVID-19."

Other participants: Alex Joiner, IFM Investors. Andrew Wilson, My Housing Market. Janu Chan, St.George. Brain Parker, Sunsuper. Bill Evans, Westpac.

Hoping to enter the market? Check out our tips for first home buyers or compare home loans for low deposit borrowers.

Ask a question