Finder’s RBA Survey: Cost of living improving but overall economic positivity near record low

While consumers report their financial strain has diminished on average, many experts warn headwinds are still to come.

In this month's Finder RBA Cash Rate Survey™, 41 experts and economists weighed in on future cash rate moves and other issues relating to the state of the economy.

All experts correctly predicted a cash rate hold – keeping it at 4.35% in March.

Graham Cooke, head of consumer research at Finder, said as rates remain steady, strapped households are eagerly awaiting a reduced mortgage payment.

"This welcome news comes after a prolonged period of financial strain, but many homeowners are hoping for a lower cash rate.

"The next few months will be crucial in determining the trajectory of future interest rates."

Average Aussie mortgage repayments

| Cash rate | Average home loan rate* | Average monthly repayment | Average monthly increase | Average annual repayment | Average annual increase | |

|---|---|---|---|---|---|---|

| April 2022 | 0.10% | 2.41% | $2,402 | - | $28,824 | - |

| March 2024 | 4.35% | 6.27% | $3,796 | $1,394 | $45,552 | $16,728 |

| Source: Finder, RBA. *Owner-occupier variable discounted rate. Repayments based on the average loan of $615,174 over 30 years (ABS data analysed by Finder). |

Financial stress has started to subside but experts positivity near record low

Financial stress among consumers has started to decrease, according to Finder's Consumer Sentiment Tracker.

The proportion of Australians who are extremely stressed with their financial situation has dropped from 31% in July 2023 to 23% in March.

Experts are more split with nearly half of those who weighed in* (48%, 14/29) saying financial stress on households will continue to decrease in 2024, while the remaining 52% don't think the stress is going anywhere.

Leanne Pilkington from Laing+Simmons said don't expect cost of living stress to disappear immediately.

"Stable, and possibly declining, interest rates enable people to realign their budgets to the evolving cost of living reality but any easing in financial stress will be gradual," Pilkington said.

Stella Huangfu from University of Sydney said with the slowdown in the labour market on the horizon, there is a growing concern.

"As job opportunities diminish, more individuals may experience job loss, making it increasingly difficult for them to manage the ensuing financial stress," Huangfu said.

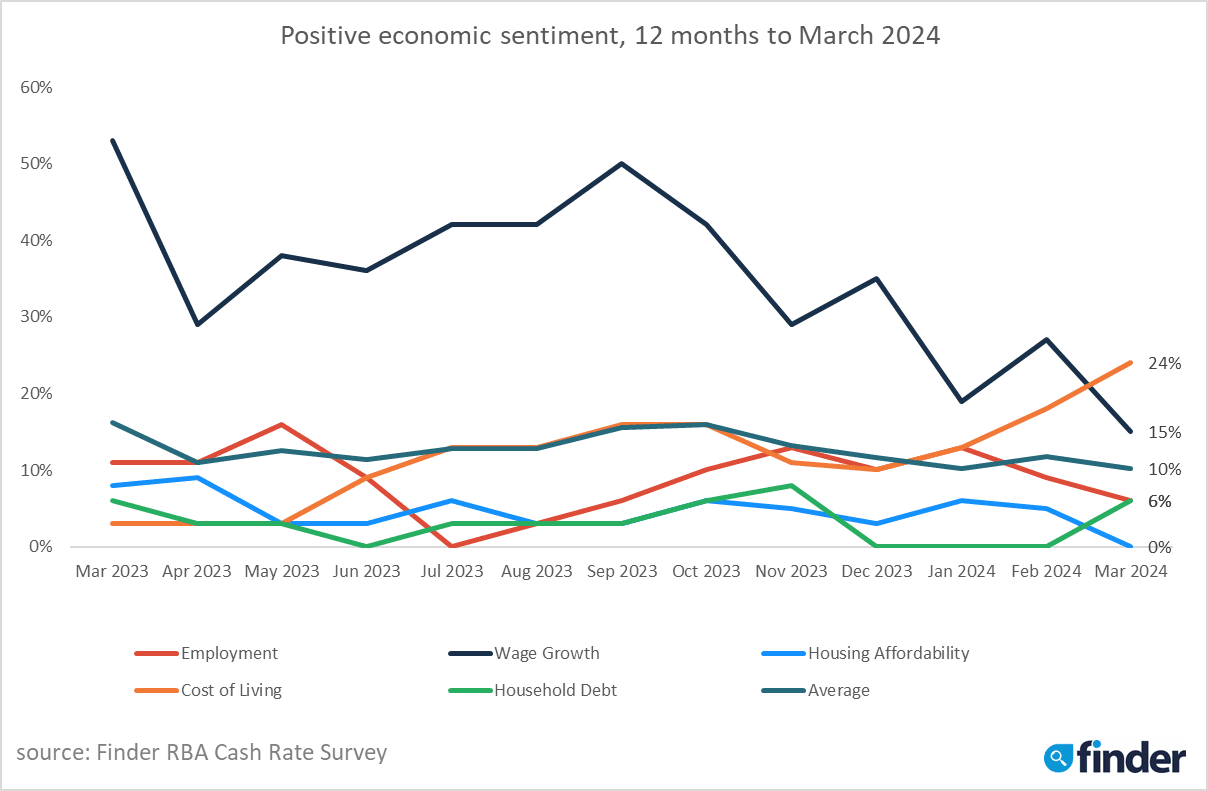

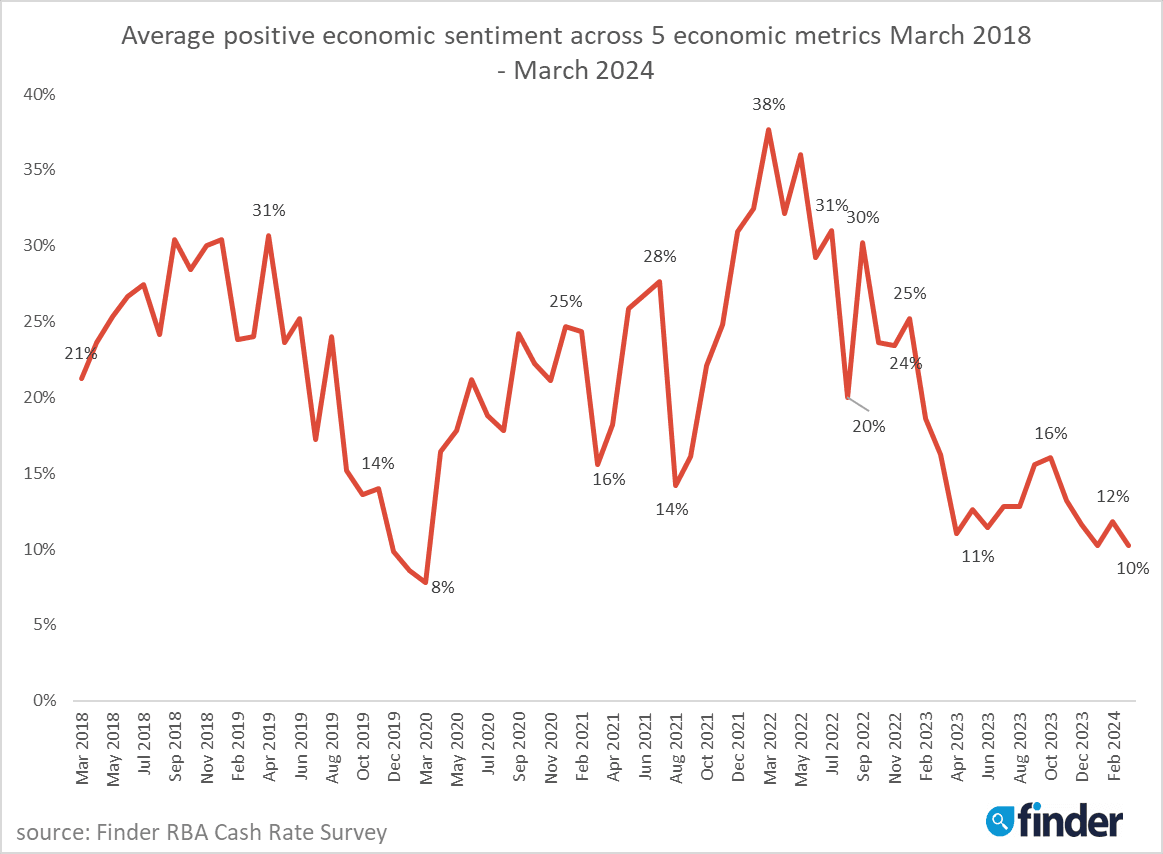

Finder's Economic Sentiment Tracker gauges experts' confidence in 5 key indicators over the upcoming 6 months: housing affordability, employment, wage growth, cost of living and household debt.

Positivity towards the cost of living has been increasing for four consecutive months – from 10% in December to 24% in March – a sign that economists are increasingly feeling positive about the pressure easing on Aussie households.

Whilst cost of living may be moving in the right direction, expert's average positive sentiment across the five key indicators is at its second lowest point in the history of Finder's RBA Survey at 10% – second only to March 2020 (8%).

This is driven by positivity toward housing affordability hitting rock bottom, along with wage growth.

Cooke says that while cost of living pressures are finally starting to subside, consumers need to stay vigilant.

"With major retailers already reporting grocery deflation, 2024 could be the year consumers get their cost-of-living groove back.

"That said, with positivity towards unemployment, housing affordability and wage growth waning, we might not get our dancing shoes on just yet."

Panellists weigh in on gender pay gap

More than 2 in 5 (42%, 11/26) economists believe childcare subsidies would be the most effective policy in closing the gender pay gap.

This was followed by mandatory equal parental leave for both parents (12%, 3/26).

Panellists commented that the issue in pay stems from women being more likely to work part-time or reduced hours to take care of children.

Nicholas Gruen from Lateral Economics said, "It is a 'time out of the workforce looking after kids gap'. That's how it should be tackled – not as a gender gap."

Cooke said while many companies, like Finder, now offer great paid parental leave to both parents, fathers often feel societal pressure to take less leave if they are not the primary caregiver.

"Making a set number of weeks mandatory would ensure a more equal distribution of leave between parents, and help chip away at the gender pay gap," Cooke said.

*Experts are not required to answer every question in the survey

Here's what our experts had to say:

Tomasz Wozniak, University of Melbourne (Hold): "Yet unlikely! My forecasts using monthly and weekly, domestic and foreign series indicate the beginning of a downward trend in the cash rate. However, the uncertainty around this trend remains large enough to suggest a HOLD decision. For the first in my forecasting exercise term structure of interest rates models for monthly data exclude the hold decision from the forecast interval in favour of a cut. Other groups of models and those for other data balance this effect out in my pooled forecast, though. These forecasts are available at https://forecasting-cash-rate.github.io/".

Matthew Greenwood-Nimmo, University of Melbourne (Hold): "I think the cash rate is likely to be maintained at the current level for some time, until the economic climate justifies a rate change. It seems likely that the next change to the cash rate is likely to be cut, but we're not at the stage to see that happen yet."

Adj Prof Noel Whittaker, QUT Business school (Hold): "It is obvious the economy is slowing down, and there is no way they will put up rates in this environment."

Aarti Singh, University of Sydney (Hold): "Inflation seems to be slowly coming down and the monthly CPI indicator rose 3.4% in the 12 months to January."

Anthony Waldron, Mortgage Choice (Hold): "The latest economic data published by the Australian Bureau of Statistics shows that the economy is slowing, inflation is easing and households are cutting back on spending. The cumulative effect of these factors will likely give the RBA reason to keep the cash rate steady."

Kyle Rodda, Capital.com (Hold): "With inflation trending lower and slack apparently building in the labour market, there's little need for the RBA to tighten any further. If the economy continues to trend in this direction, rate cuts could be coming by the second half of the year."

Stella Huangfu, University of Sydney (Hold): "In January, inflation stayed at its lowest level since November 2021, standing at 3.4% on an annual basis, the same inflation rate as observed in December 2023. Concurrently, the real GDP experienced a modest growth of 0.2% in the December quarter, marking the most subdued quarterly growth rate throughout 2023.It is highly unlikely that the RBA will hike the interest rate in March or May."

Matthew Peter, QIC (Hold): "Inflation continues to abate, while the outlook for the economy weakens. Rate hikes are now off the table. However, elevated migration, coming tax cuts and ongoing wage increases will stop the RBA from easing back on monetary policy until later this year."

Nalini Prasad, UNSW Sydney (Hold): "Inflation is moderating, giving the RBA some time to wait and see what happens."

Shane Oliver, AMP (Hold): "The RBA is likely to still be waiting for more confidence regarding the fall in inflation at its March but the combination of slowing growth, rising unemployment and falling inflation should see it in a position to start cutting at its June meeting (if not then in August)."

Cameron Kusher, REA Group (Hold): "Inflation is moderating and the economy continues to slow. There's no reason to expect the RBA to make any changes to monetary policy at this stage."

Harry Murphy Cruise, Moody's Analytics (Hold): "Australia's fight against inflation is ahead of schedule. Headline inflation dropped to 4.1% year on year in the final three months of 2023—a monumental improvement from 5.4% in the September quarter. On top of that, core inflation, which strips out volatile movements, fell to 4.2% from 5.1%. Meanwhile, annualised inflation over the six months to December sat just 0.5 percentage point above the RBA's 2% to 3% target range. Better still, some of the stickiest drivers of inflation are being tamed. In the December quarter, service inflation dropped to its lowest year-on-year reading since September 2022, while non discretionary inflation fell to its lowest since December 2021—before the RBA began its tightening cycle."

Cameron Murray, Fresh Economic Thinking (Hold): "Although many are expecting rates to fall, unemployment is still low, inflation is falling but at a slower rate, and global growth is still high."

James Morley, The University of Sydney (Hold): "Economic conditions will continue to weaken for the Australian economy, with slow growth and rising unemployment throughout 2024. Inflation is also likely to continue falling, but could remain above the target range until 2025. The RBA will continue to be concerned about services inflation and, in my mind, be unlikely to cut until they see further progress on lower services inflation and also start to see rate cuts in the United States and other countries. I believe a weakening of economic conditions and progress on inflation will see the RBA begin rate cutting in the second half of 2024, possibly with the September meeting."

Evgenia Dechter, UNSW (Hold): "Most indicators suggest a significant downturn in economic activity, with recent inflation measures also indicating a decline. Given the cautious approach of the RBA, it will likely wait for a few more months to confirm these indicators before considering lowering the cash rate."

Nicholas Gruen, Lateral Economics (Hold): "They should cut now, but they'll leave it, because it's part of RBA psychology not to admit that immediate past changes were a mistake, which is what a cut now would be interpreted as."

Mala Raghavan, University of Tasmania (Hold): "Despite a 3.4% rise in the CPI over the 12 months to January 2024, the RBA is expected to maintain the cash rate at 4.35% in March. Further, the monthly CPI increases to 4.1% when excluding volatile items. Concerns arise from the uptick in essential items like housing costs, food, non-alcoholic beverages, and financial services, mainly impacting low-income households in Australia. These factors provide a rationale for the RBA to retain the cash rate before considering a rate cut around the middle of the year."

David Robertson, Bendigo Bank (Hold): "The RBA will likely retain its tightening bias in March before moving to a neutral position in May (after the next quarterly CPI data) but no rate cuts until November at the earliest. A more patient approach delivering 5 cuts next year remains our basecase forecast, while earlier cuts (in spring) may only result in a couple of cuts."

Nicholas Frappell, ABC Refinery (Hold): "Australia is in a per-capita recession however the RBA may stick it out for the final leg in curbing inflation."

Jeffrey Sheen, Macquarie University (Hold): "Inflation is closing in on the RBA's target band. The final descent will be slow and turbulent. By mid-year, global and Australia's growth will weaken, which should lead to some monetary policy easing from August."

Mark Crosby, Monash University (Hold): "The economy remains robust enough, and inflation is still trending slowly towards the target. Current settings are appropriate and don't warrant changes through at least H2 this year."

Garry Barrett, University of Sydney (Hold): "Latest data is not sufficient to support decreasing or increasing the cash rate at the moment."

Peter Munckton, Bank of Queensland (Hold): "That is when it will be clear that inflation will be within the RBA's 2-3% inflation target."

Peter Boehm, Pathfinder Consulting (Hold): "With negative per capita GDP and overall GDP flatlining, Australia is effectively in a recession. Cost of living pressures, falling standards of living and falling optimism about the future all point to at least a hold and I suggest a reduction in interest rates later in the year. It would seem the RBA's November 23 rate increase was overkill and there are no tangible signs that cost of living pressures will be eased anytime soon. Rate reductions are now the only way to go given the Federal Government's inability to address fundamental cost of living issues."

Dale Gillham, Wealth Within (Hold): "We are seeing inflation easing and indeed spending habits have changed as more are struggling with financial hardship."

Mathew Tiller, LJHooker Group (Hold): "The latest data shows that households, businesses and the broader economy are starting to feel the impact of last year's interest rate increases. Spending has decreased, unemployment is rising and inflation is falling. Although the economy hasn't softened sufficiently for the RBA to implement rate cuts, the next anticipated move, following a period of unchanged rates, will likely be a decrease."

Rich Harvey, PROPERTYBUYER (Hold): "Mortgage pain is becoming more acute for households as the year progresses. Evidence of households cutting back in spending in retail and other sectors is showing through and inflation is trending down steadily. Likely that RBA may be able to start the cutting cycle in Aug or Sept. But still a careful balancing act not to re-ignite the economy too quickly."

Jakob Madsen, University of Western Australia (Hold): "The inflation is getting closer to the target rate."

Malcolm Wood, Ord Minnett (Hold): "Sticky inflation and fiscal stimulus."

Richard, Holden (Hold): "Inflation is still far too high and is becoming entrenched."

Stephen Koukoulas, Market Economics (Hold): "Low inflation, weak growth and rising unemployment."

Leanne Pilkington, Laing+Simmons (Hold): "Slowing inflation and minimal economic growth mean the RBA is expected to consider cutting rates but should this occur, it's more likely to begin later in the year, once these trends are more established."

Geoffrey Kingston, Macquarie University Business School (Hold): "The Bank is making decent progress in slowing down inflation. Accordingly, the economy continues to slow. By the same token, services inflation is sticky and the Bank is traditionally inertial. For example, the Bank is unlikely to cut before the Fed. Indeed, it remains possible that one more rate rise will be necessary, given that fiscal policy is looking increasingly expansionary."

Tim Nelson, Griffith University (Hold): "Inflation is less of a concern than falling GDP per capita. The RBA will not want to push the economy into recession."

Sean Langcake, Oxford Economics Australia (Hold): "Inflation is on the right track. But it is still above target and the next segment of the disinflation will be more of a struggle as cost of living subsidies roll off and upward pressures on services prices persist. The RBA will take a wait-and-see approach through most of 2024."

Stephen Miller, GSFM (Hold): "Not enough evidence yet but the economy is soft and inflation will probably fall in line (or at a faster pace) than the RBA projects, allowing a cut in the second half of the year."

A/Prof Mark Melatos, School of Economics University of Sydney (Hold): "Inflation remains above the RBA's target band despite moderating in recent months. House prices appear to have significantly decoupled from incomes and shrugged off the rate increases to date. As long as low unemployment (effectively full employment) persists, the cash rate is unlikely to be reduced."

Craig Emerson, Emerson Economics Pty Ltd (Hold): "The economy is slowing sharply."

Stephen Halmarick, CBA (Hold): "Holding as inflation decelerates."

Saul Eslake, Corinna Economic Advisory Pty Ltd (Hold): "I think the RBA has decided it is willing to tolerate inflation being above its target for longer than its 'peer' central banks are willing to allow inflation being above their respective targets, in order to preserve as much as they can of the gains made in recent years in reducing unemployment and under-employment. That's one reason why they haven't raised their cash rate as much as their peers (in the eurozone, UK, Canada, US and NZ). But the corollary of having been later to start lifting rates, and having lifted them by less, than their peers, is that the RBA will also be slower to start cutting rates than their peers. And even more so when you also take into account that Australian households will, on 1st July, be getting income tax cuts which, in terms of their impact on aggregate household cash flows, are equivalent to two 25 bp rate cuts - which households in the euro area, UK, Canada, US and NZ will not be getting."

Michael Yardney, Metropole Property Strategists (Hold): "The most recent inflation data came in much softer than many commentators expected, which was much to everyone's relief and the RBA had no reason to raise interest rates, but it's still too early to drop rates. There are lots of different ways to look at how inflation is coming down, but if you look at the most recent quarter and annualise it, we're now at the bottom of the RBA's target range."

Ask a question