Finder’s RBA survey: Homeowners avoid cash rate hike, but energy bill stress hits record high

Homeowners can sleep easy for another month as the RBA holds the cash rate in August.

In this month's Finder RBA Cash Rate Survey™, 43 experts and economists weighed in on future cash rate moves and other issues relating to the state of the economy.

The majority of panellists (72%, 31/43) correctly predicted the cash rate would hold in August at 4.10%. This is the third meeting that has resulted in a hold since the RBA began raising the rate in May of 2022.

Richard Whitten, money expert at Finder, said the decision gives some much needed breathing room for homeowners.

"Today's hold is welcome news for borrowers who have been bracing themselves for another hike.

"Inflation is slowing down, which suggests that previous rate hikes are working," Whitten said.

Three quarters (76%, 29/38) of experts who weighed in* believe the cash rate will peak between July and September this year. The panel's forecast for the average cash rate peak is 4.4%.

Housing boom unlikely, experts agree

With the value and number of new owner occupier loans increasing steadily since February, 3 in 4 experts (73%, 19/26) do not expect this to be the start of a new housing boom cycle.

Dale Gillham from Wealth Within said the rising cash rate would limit property price growth.

"I don't think we have seen the full effects of interest rate rises just yet and indeed the last of the rises.

"Investors are leaving the market, especially in Victoria with new taxes coming into play. Whilst pockets will rise, I think broadly Australian housing will be flat for the next few years," Gillham said.

Jakob Madsen from the University of Western Australia agreed the bubble is over.

"Interest rates have climbed and the disposable income is stalling," Madsen said.

However Evgenia Dechter from UNSW Sydney said otherwise.

"Prices may go up because many households are waiting to enter the housing market," Dechter said.

Energy bill stress at highest level in 4 years

A third of Australians (30%) rated energy bills as one of their top most stressful expenses in July – tied for the highest level ever recorded since Finder's Consumer Sentiment Tracker first began in 2019.

Analysis from the Australian Competition and Consumer Commission has found that millions of customers are paying more than the default market offer for electricity.

The majority of experts (93%, 25/27) think consumers are likely to cut back on energy use over the next 5 months in order to combat rising costs.

This is in line with recent Finder data showing more than three quarters (79%) of Australians plan to cut back on electricity usage in winter as energy prices increase nationwide.

Whitten said the outlook is bleak.

"Retailers are ramping up electricity prices, and longer-term customers may now be on more expensive plans.

"Australians have no choice but to take charge.

"Don't assume you've got the best deal. The smartest choice you can make is to shop around and switch providers," Whitten said.

Over 70,000 Aussies could lose their job this year

The panel predicts the unemployment rate will increase from 3.5% to 4% by the end of the year – which would mean the reduction of 77,620 jobs.

rba-post

Panellists also cited unemployment would need to increase to 4.7% – an extra 179,473 people losing their jobs – before the RBA considers cutting the cash rate.

Malcolm Wood from Ord Minnett said a fall in inflation is dependent on an increase in the unemployment rate.

"Unemployment needs to be comfortably above estimates of the NAIRU to ensure inflation is heading back to the target band," Wood said.

Nalini Prasad from UNSW Sydney agreed.

"It's hard to see the RBA cutting interest rates without a large increase in unemployment and fall in inflation," Prasad said.

Matthew Peter from QIC noted the non-inflationary rate of unemployment is 4.5%.

"The labour market will remain tight well into 2023, accompanied by accelerating wages. The RBA will only be comfortable to cut rates once the unemployment rate is comfortably above 4%," Peter said.

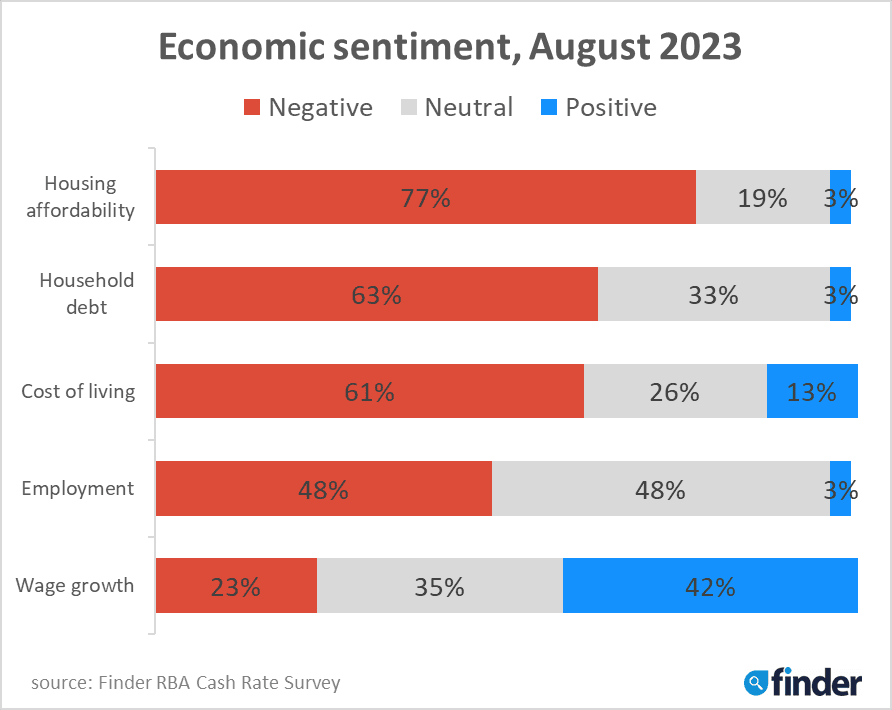

Finder's Economic Sentiment Tracker gauges experts' confidence in 5 key indicators: housing affordability, employment, wage growth, cost of living and household debt.

In what might be a good sign for inflation, but a bad sign for some workers, positivity towards employment decreased from 79% in March 2022 to 3% in August 2023.

On the bright side, 42% of experts reported positive sentiment toward wage growth.

*Experts are not required to answer every question in the survey

Here's what our experts had to say:

Stephen Miller, GSFM (Hold): "Inflation will prove "sticky" as the Fair Work Commission wage decision impacts in H2 2023."

A/Prof Mark Melatos, School of Economics, University of Sydney (Hold): "Inflation appears to be moderating more quickly than expected. However, it still remains significantly above the Bank's target range. There is still upside risk to rates especially if inflation stagnates above the 2-3% target."

Nalini Prasad, UNSW Sydney (Hold): "Inflation has slowed down in the past six months, suggesting that previous interest rate rises are having an effect. The RBA has indicated that they are likely to pause increases in interest rates to see the effect on inflation. So far it looks like previous rate hikes are working."

Stella Huangfu, University of Sydney (Hold): "Quarterly CPI inflation is 0.8% for the April – June quarter. Annual inflation is 6% over the year to June. We have seen the peak of inflation (which is 7.8% in December). The inflation is coming down much more quickly than expected. The chance of the RBA increasing the interest rate in August is low."

Harry Murphy Cruise, Moody's Analytics (Hold): "What goes up must come down and Aussie inflation is coming down fast. Last month, we put the chances of a further interest rate hike at slightly greater than even odds. The June inflation data has tipped those odds the other way. The narrow path to a soft landing remains precarious, but it is less perilous than it was just a handful of months ago. Inflation will track lower from here. By the end of the year, we see inflation sitting at 3.9% y/y. It should return to the RBA's 2% to 3% target band by the September quarter of 2024 almost a year ahead of the RBA's projections."

Evgenia Dechter, UNSW Sydney (Hold): "Recent data shows a slowdown in inflation. Unemployment rate is still low but we do not observe substantial increases in wages. Other macroeconomic indicators suggest a slow down in the economy. As the full effect of the recent monetary policy measures is still passing through, the RBA may consider holding the cash rate."

Matthew Greenwood-Nimmo, University of Melbourne (Hold): "Inflation seems to be falling faster than many expected, giving the RBA room to pause and assess the impact of their previous rate hikes, which take time to feed through to the economy. However, wage growth relative to productivity is still a cause for concern."

Rich Harvey, PROPERTYBUYER (Hold): "There's likely to be one more interest rate increase given that inflation has printed at 6% in the last month. The RBA has repeatedly pointed out that it will do whatever it takes to get the inherent inflation rate back down into their target range so that it does no further long-term economic damage to the economy."

Mala Raghavan, University of Tasmania (Hold): "The RBA is expected to put a pause on its cash rate hike in August, not primarily because of falling inflation but rather due to the upcoming appointment of a new Governor Bullock, who will take office in September. As the outgoing Governor's tenure comes to an end, there might be less pressure on Governor Lowe to raise the cash rate. However, it's worth noting that despite the inflation rate of 6% in the June quarter being lower than the previous recording of 7% in the March quarter, it still remains significantly higher than the desired target range of 2-3%. The gradual decline in the overall inflation figure indicates that the previous cash rate hikes have been effective in curbing the overall price level. Upon closer examination of the CPI figures provided by the ABS, it becomes evident that two essential household categories continue to experience high prices. Housing costs have remained at a significant level of approximately 8.1%, while food and non-alcoholic beverages have increased by 7.5%, thus impacting the overall cost of living index for vulnerable households in Australia. Considering this situation, the RBA may consider implementing one or two additional rate hikes in the future if inflationary pressures on these essential items persist. However, any decisions on rate adjustments would likely depend on the economic developments and the effectiveness of previous measures."

Anthony Waldron, Mortgage Choice (Hold): "The latest data from the Australian Bureau of Statistics showed that inflation slowed in the June quarter, with the lowest quarterly rise since September 2021. This information should give the Reserve Bank space to keep the cash rate on hold in August."

Craig Emerson, Emerson Economics (Hold): "Inflation is falling and there is contractive force in the economy from previous cash rate increases that haven't been fully felt yet."

David Robertson, Bendigo Bank (Hold): "The RBA board is still likely to tighten policy further but the Q2 inflation data offers the opportunity to extend last month's pause and gather further data. Tight labour markets and stubborn services inflation adds to upside risks, but another pause would be welcome."

Michael Yardney, Metropole (Hold): "The latest quarterly CPI stats show that the growth in inflation has eased and come in under the RBA's forecast. Even though job numbers in June came in surprisingly strong, the RBA now has less pressure to raise rates again"

Tim Nelson, Griffith University (Hold): "The rate of change for inflation is now negative indicating that inflation is slowing. Prior rate increases are now biting and the RBA may wish to wait to see the impacts of these play out given monetary policy lags."

Jonathan Chancellor, The Daily Telegraph (Hold): "Inflation is heading in the right direction, with the higher interest rates taking effect too."

James Morley, The University of Sydney (Hold): "Headline and underlying measures of inflation have peaked in Q1 and are all tracking lower in Q2. Also, the monthly measure of CPI continues to show substantially lower inflation at 5.4% year-ended for June. Given this, I think the RBA will hold rates. There are likely some concerns on the Board that services inflation is higher at 6.3% year-ended for Q2. But I also think that the Board will likely wait until the new Governor commences in that role before the October meeting to make any surprise moves of tightening and only if there are other indicators such as a substantial rebound in monthly inflation, which I don't expect to happen. The RBA will likely cite continued impacts of past hikes and increasing real interest rates as inflation falls as reasons to hold at this meeting."

Cameron Kusher, REA Group (Hold): "Both headline and underlying inflation for June 23 has come in lower than the RBA's current forecasts. Even though services inflation is strong year-on-year it has slowed over each of the past two quarters which should, in my mind, be enough evidence for now that rate hikes are working and inflation is slowing, resulting in a pause."

Jason Azzopardi, Resimac (Hold): "The June quarter CPI will allow the RBA to delay further increases for a short period of time. I do however believe lowering inflation to the target band will require further increases."

Leanne Pilkington, Laing+Simmons (Hold): "Inflation remains high but is slowing and with the recent changes to the Reserve Bank, not to mention the increased scrutiny it faces, we believe 'hold' is the most likely outcome."

Noel Whittaker, QUT Business School (Hold): "I think the Reserve Bank would be looking for an excuse to put rates on hold given the amount of anecdotal evidence that the interest-rate rises are having some effect on consumer spending. However, July has been a big month for price increases, but they are not reflected in last week's CPI figures. But they will be in play at next month's board meeting. So my view is hold this month but increase next month. We are not out of the woods yet."

Geoffrey Harold Kingston, Macquarie Business School (Hold): "The August decision will be line ball. However, two things may incline the RBA to hold. First, this month's below-expectations read of the CPI. Second, this month's data showing a fall in job ads."

Sean Langcake, Oxford Economics Australia (Hold): "The Q2 CPI print surprised to the downside, showing a welcome moderation in services inflation. While the outlook for unit labour costs is still concerning over H2 2023, we think the disinflation in the headline measure likely buys the RBA some time to continue to 'wait-and-see'."

Tony Sycamore, IG Markets (Hold): "The softer than expected Q2 2023 inflation numbers released today means the RBA can stay on hold for August and likely September, before one more rate hike before year end."

Jakob Madsen, University of Western Australia (Hold): "The inflation is still well above the RBA target."

Saul Eslake, Corinna Economic Advisory Pty Ltd (Hold): "The latest quarterly and monthly CPI data provide further evidence that inflation, though still "too high", is on its way down towards the RBA's target. However, with the labour market still very tight, the RBA will be paying attention to any indication of an acceleration in labour costs, and will need to see some easing in labour market conditions before it can contemplate any reductions in interest rates."

Jeffrey Sheen, Macquarie University (Hold): "Inflation has continued to fall, and should eventually converge to the RBA's target range. There is no sign of a wage breakout, which would otherwise recommend an interest rate increase."

Garry Barrett, University of Sydney (Hold): "Signs of slowdown in economic activity, particularly consumption, with evidence of easing in inflation"

Nicholas Gruen, Lateral Economics (Hold): "I'm guessing they may hold off till they see more, and that the economy slows. But who knows?"

Cameron Murray, University of Sydney (Hold): "Inflation has peaked, and globally, inflation is rapidly falling."

Matthew Peter, QIC (Hold): "The RBA is close to finishing its tightening cycle, as is the Fed. The next few RBA meetings will continue to be data driven. We expect to see the June quarter CPI continue to trend down, which will enable the RBA to stay on hold in August."

Mark Brimble, Griffith Uni (Hold): "The economy, wages and employment not slowing quickly enough to create a sustained downward pressure on inflation."

Nicholas Frappell, ABC Refinery (Increase): "The latest CPI data may give the RBA scope to pause again although inflation and labour market data is actually strong enough to justify further hikes."

Stephen Halmarick, Commonwealth Bank (Increase): "One further rate hike in August to complete the process."

Tomasz Wozniak, University of Melbourne (Increase): "My forecasts indicate a 15 basis point rise in the cash rate, with further increases up to 4.5% in October. The narrow forecast interval, spanning the values from 4.16 to 4.33% for August, leaves little doubt about the projected raises. However, the quarterly reading of year-to-year inflation at 6%, putting it on a speedy path towards the RBA's target, makes this raise somehow less likely this month. My forecasts are available at: https://donotdespair.github.io/cash-rate-survey-forecasts/."

Andrew Wilson, My Housing Market (Increase): "Booming economy shows no sign of slowing down with another month of remarkable record results for the labour market. Although inflation has eased it remains well above the target range with recent falls due to lower fuel costs and house building costs which would have occurred regardless of interest rate rises. July's extraordinary decision to hold rates in the face of clearly strong data is another lost opportunity to maintain higher rate momentum to reduce demand."

Shane Oliver, AMP (Increase): "Our base case is now for just one more rate hike as the RBA likely remains concerned about high and still rising services inflation and upside risks to wages growth. However, the RBA has likely already done enough and inflation is now falling rapidly so it's a very close call."

Malcolm Wood, Ord Minnett (Increase): "Ongoing labour cost pressures that are not compatible with the inflation target."

Mark Crosby, Monash University (Increase): "While the latest inflation read is lower, it is still high, and the real interest rate is still negative. I now see one more rate rise before year end before a pause to wait on the next inflation read/s."

Dale Gillham, Wealth Within (Increase): "According to the ABS, CPI rose 0.8% in the last quarter, so whilst CPI is down on a yearly basis, I suspect it is not coming down as fast as the RBA might like. Given this and looking at what other countries are doing, they may start to take a more aggressive approach."

Peter Boehm, Pathfinder Consulting (Increase): "Despite a reprieve last month, rates will need to increase again to counter high inflation, high house prices and a strong labour market."

Tim Reardon, HIA (Increase): "The CPI will remain elevated. Unemployment remains very low."

Alan Oster, NAB (Increase): "Inflation is still too high. But the economy is weakening. Need to get back to around 3% from mid 2024."

Brodie Haupt, WLTH (Increase): "The strength of the labour market will continue to keep upward pressure on wages and inflation. Another rate rise is most likely on the cards."

Ask a question