Raiz launches share trading feature and hikes fees – should you invest?

Micro-investment app Raiz Invest has launched a new feature that lets you buy and sell shares directly from $5.

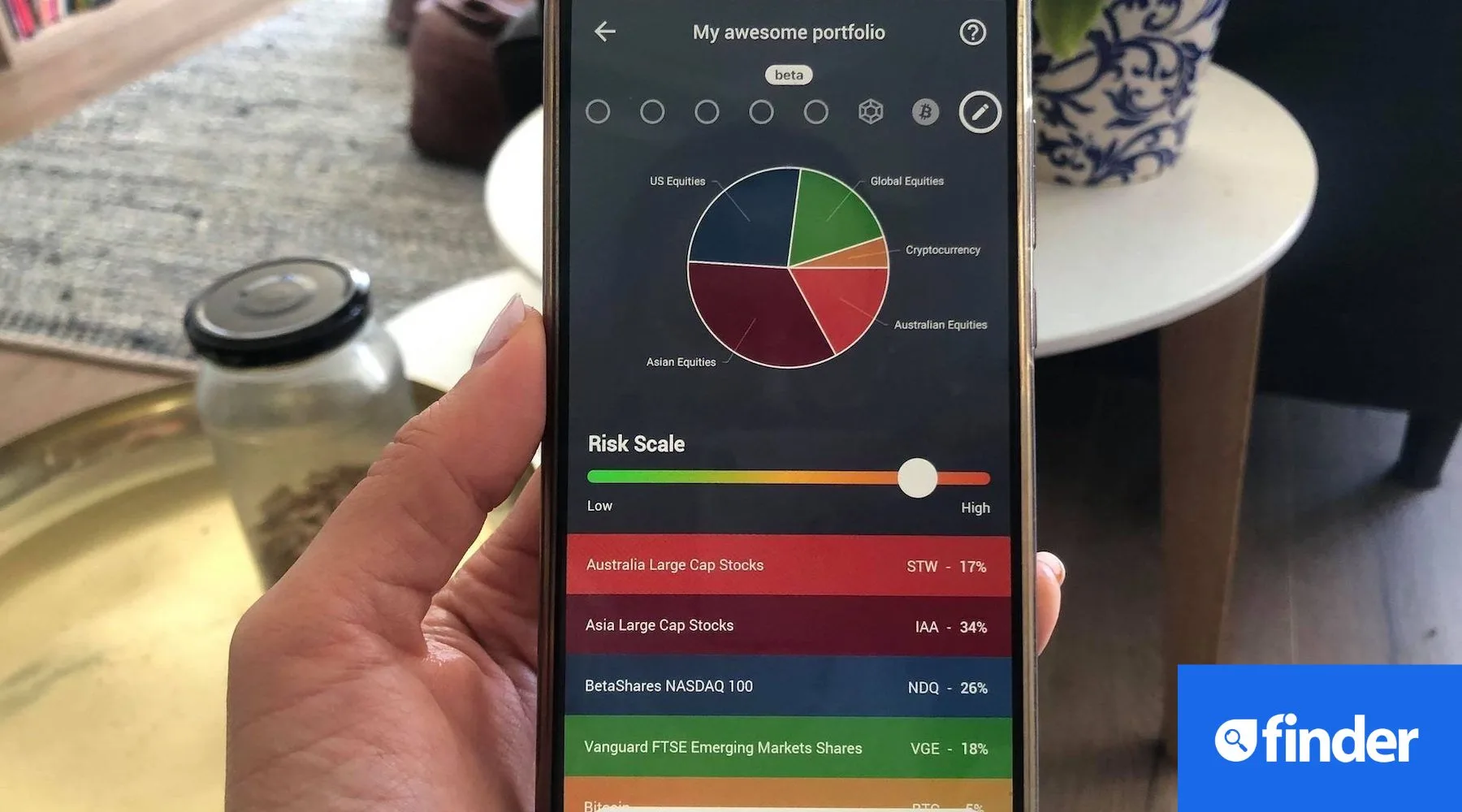

Raiz Invest's new portfolio 'Plus' lets you invest in fractional stocks from the S&P/ASX 50 index (the biggest 50 companies in Australia), as well as ETFs, Bitcoin and residential property.

Fractional share trading is where you can purchase fractions of shares, rather than whole shares. For instance, you could buy one-tenth of CBA stock for $10 rather than 1 stock for $100.

Plus replaces the previous 'Custom' portfolio and is fully customisable, so you decide how much you want to allocate into individual stocks or other assets.

CEO Brendan Malone said the new feature reflects their customer's growing investment experience.

“It’s quite a unique product in that you can construct your own portfolio from a diverse range of assets, and actually invest into all of them as often as you like for just one monthly fee," said Malone.

Raiz launched in 2016 and quickly gained popularity thanks to its round-up feature that lets you invest spare change into a portfolio of your choosing.

The original investment portfolios were made up of ETFs and weighted depending on risk, from conservative to aggressive.

Assets including Bitcoin and a property fund, plus customisable features, were later added to the mix.

What are the new fees?

Raiz also announced that it has increased fees across several portfolios starting from August 1.

All custom portfolios will transition to the new Plus account and maintenance fees will increase to $5.50 per month from $4.50 for active accounts below $25,000. Balances over $25,000 will be charged 0.275% of their total balance per year.

Standard portfolio fees also increase from $3.50 to $4.50 per month for active account balances of less than $20,000 - up from the previous $15,000 threshold.

For the Sapphire Portfolio, the monthly fee will also jump from $3.50 to $4.50 for active account balances, plus 0.275% per year.

You don't need to pay a brokerage fee to buy and sell shares through the Plus portfolio - you get unlimited trades covered by your regular monthly fee.

Should you buy shares on Raiz?

If you're looking to get serious about trading shares, Raiz is probably not the best platform for you.

It offers a very limited range of stocks (50 vs. the 2000+ that are on the Australian Securities Exchange) and only basic buy and sell functionality.

That being said, it is relatively cheap compared to some other trading platforms as you only pay a monthly fee rather than a brokerage fee per trade. For instance, Australia's most popular online broker CommSec charges brokerage of $5 for every trade of less than $1,000.

How does Raiz compare?

| Platform | Brokerage fee per trade | Monthly fee |

|---|---|---|

| Raiz Invest | $0 (ASX shares only) | $4.50 - $5.50 |

| Douugh | $0 (US shares only) | $4.99 ($0 if you make no investments) |

| Pearler | $6.50 (ASX and US shares) | $1.70 - $2.30 |

| Syfe | ASX trades $4.99 / US trades: US$1.49 | $0 |

| Sharesies | ASX shares: 1.9% with a cap of $6 / US shares: US$5 / NZ shares: NZ$25 | $5 - $20 |

Of course, how cost-effective that fee structure is will depend on how often you plan to place a trade.

Raiz does feature a low minimum investment of just $5 per trade. While it's not the lowest out there, most trading platforms require a $500 minimum investment into Australian stocks.

It's worth pointing out that it's still relatively rare to find a platform that offers both share trading and micro-investment or auto-invest options, making it a top choice for those looking to both actively and passively invest from the same platform.

Sharesies, Raiz, Douugh and Syfe are among the few to do so.

While Raiz's trading feature may not be drawing traders any time soon, it's a nice and relatively low-cost addition for customers that may want to try their hand at buying individual stocks.

Looking for a low-cost online broker to invest in the stock market? Compare share trading platforms to start investing in stocks and ETFs.

Ask a question