Raiz is hiking its fees again: Is it worth it?

Raiz Invest is increasing its monthly fee for customers with less than $15,000 in their accounts.

Micro-investment app Raiz Invest is once again hiking fees for users that have lower balances.

Raiz announced today that its flat account fee is increasing from $2.50 per month to $3.50 for accounts with less than $15,000 starting from 1 April this year.

So if you have $1,000 or less in your account, you'll now be paying upwards of 4.2% in fees each year.

Accounts of $15,000 or more will be charged the same as before at 0.275% a year. Meanwhile, fees on the newly launched Custom portfolio option also remain at $4.50 per month for balances up to $20,000 and 0.275% after.

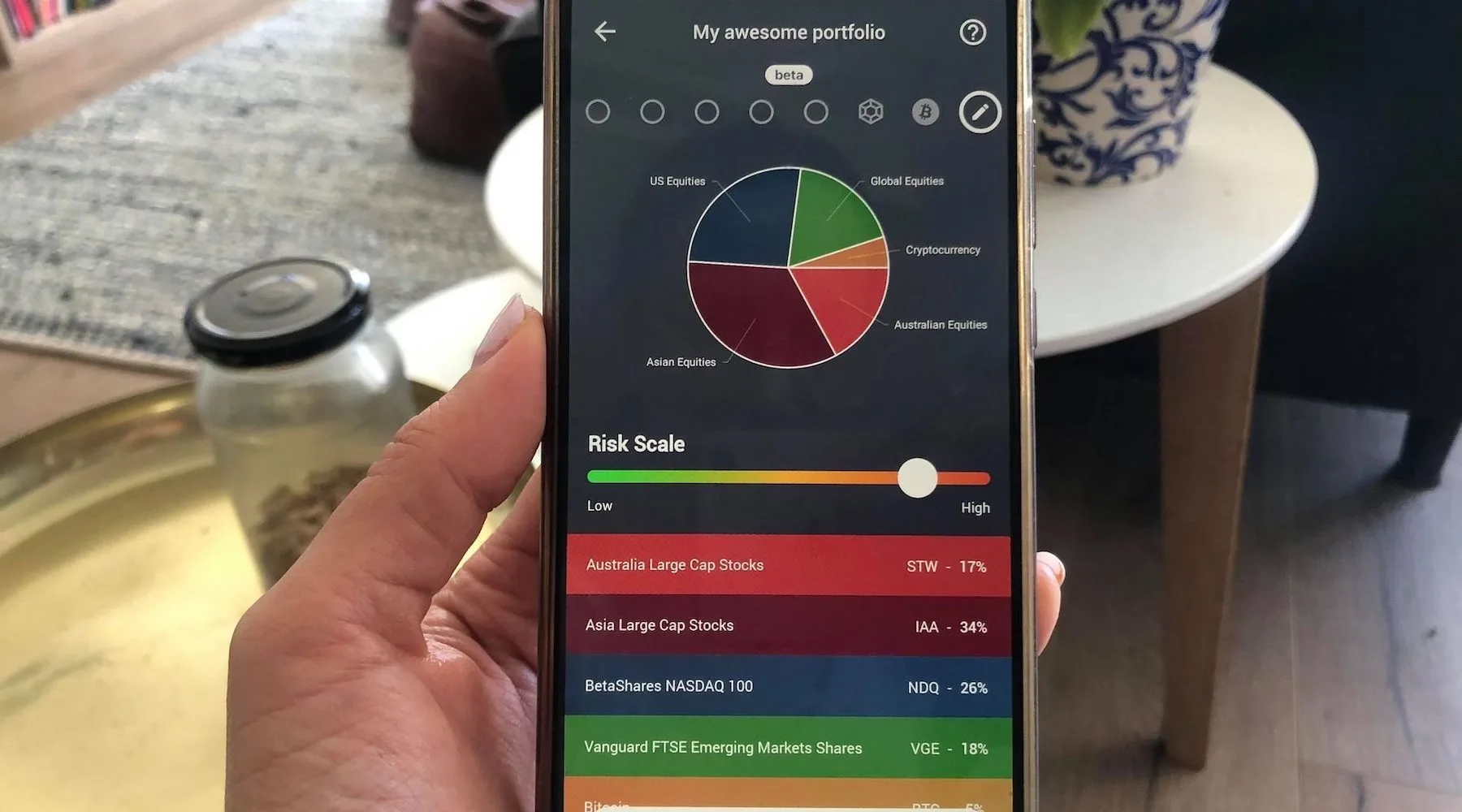

Raiz Invest, previously called Acorns, is an investing app that collects your spare change and invests it into an exchange traded fund (ETF) portfolio of your choosing.

Because it can take more than a year to accumulate over $1,000 in spare change, the fee hike is likely to impact many of its users.

Before now, users of the app with less than $10,000 in their accounts were charged a flat fee of $2.50 per month, while those with balances of $10,000 or more paid an account fee of 0.275% p.a.

Here's how much more you'll pay for your Raiz account*

Account balance | What you paid before (approximately) | What you pay from 1 April (approximately) |

|---|---|---|

| $100 | $30 p.a. (30%) | $42 p.a. (42%) |

| $1,000 | $30 p.a. (3%) | $42 p.a.(4.2%) |

| $5,000 | $30 p.a. (0.60%) | $42 p.a. (0.84%) |

| $10,000 | $27.50 p.a. (0.275%) | $42 p.a. (0.42%) |

| $15,000 | $41.25 p.a. (0.275%) | $41.25 p.a. (0.275%) |

| $50,000 | $137.50 p.a. (0.275%) | $137.50 p.a. (0.275%) |

*Note: The above fees don't include ETF issuer fees, which range from 0.22% p.a. to 0.43% p.a. depending on the the portfolio you're in.

As a general rule of thumb, a fee of 1% is often used as a benchmark limit to how much you should be paying into an investment fund such as superannuation or an ETF, in order to maximise your return on investment.

Applying that same rule, the new fees only come within the ideal range once you reach a balance of $4,000.

How does Raiz compare to others?

The fee increase has left some customers questioning whether the investment is worth the cost. On the Raiz Central Facebook group, some members pointed out that other investment options such individual ETFs or competitors like Spaceship might be a better bang for buck.

Others argued that the shopping rewards feature, which offers bonuses whenever you shop through the app, made up for the fee increase.

To break it down, we compared the fees of two other popular investment platforms, CommSec Pocket, which allows you to invest in individual ETFs, and micro-investment app Spaceship.

Similar to Raiz, Spaceship invests as little as a few cents at a time into an investment portfolio on a regular basis. CommSec Pocket allows you to invest from $50 into several individual ETFs.

For Raiz and Spaceship, the investment figure assumes a balance, while CommSec Pocket assumes a single investment into an ETF.

Investment* | Raiz (standard portfolio) | Spaceship (Universe portfolio) | CommSec Pocket |

|---|---|---|---|

| $100 |

|

|

|

| $1,000 |

|

|

|

| $10,000 |

|

|

|

| $15,000 |

|

|

|

| $50,000 |

|

|

|

Note: Assumes an investment balance for Raiz and Spaceship and a single deposit for CommSec Pocket.

Among the three choices, Raiz Invest is the most costly at every investment tier, deducting 0.275% for higher balances and as much as 42% for a balance of $100.

Comparatively, Spaceship doesn't start charging fees until your balance hits above $5,000, then it's only 0.10% of your investment, low by any measure. CommSec Pocket has no monthly fees, instead charging a transaction (brokerage) fee of $2 for investments of $1,000 or less and 0.2% above that.

The cheapest option depends on how often you plan to invest and how much. For example, if you plan to invest one or two large sums, CommSec Pocket, which has no ongoing fees, is an attractive option. However, if you're investing small amounts regularly you're probably better to stick with Raiz or Spaceship.

What's the verdict?

The higher fees offered by Raiz will doubtless ruffle some feathers. For new members to the app, paying $42 per year in fees could make up a big chunk of your balance.

There are also cheaper options out there, particularly if you're unlikely to grow your balance beyond a few thousands dollars.

However, both CommSec Pocket and Spaceship are relatively minimalist compared to Raiz when it comes to features.

While Raiz offers shopping rewards, a portfolio tracker, budgeting options and the ability to round up your spare change, CommSec Pocket and Spaceship feature little more than the selection of investments.

All three apps also have quite different investment options available. While Raiz Invest offers eight ETF portfolios to choose from, from conservative (lower risk) to aggressive (higher risk), Spaceship has just three stock portfolios. Meanwhile CommSec Pocket offers seven individual ETFs – similar to any share trading app, but with a lower minimal investment and lower fees.

Whether the app is worth it comes down to how you prefer to invest. Yes, Raiz fees are high when you have little in your account, but would you be saving as much otherwise?

Since launching in 2016, Raiz has had more than 1.4 million people sign up and over $639 million funds under management as at 31 January 2021.

Looking for a low-cost online broker to invest in the stock market? Compare share trading platforms to start investing in stocks and ETFs.

Ask a question

I am over 69 years old and have 15000 invested in Raiz this some my cash outside of my super and i have a deduction of $20 daily out of my bank account into my Raiz i have just changed it to there plus SP500 they told me the fee is $5 per month for this EFT. Is this fee too high?

Hi Robert, it sounds like you’ve moved all of your funds into the Plus account and chosen to invest it into the iShares S&P 500 ETF (IVV). That means you’ll be paying $5.50 per month in account fees to Raiz for the service of purchasing ETFs units for you. Are there cheaper options out there if all you want to do is invest in one ETF? Yes. However it comes down to how much you’re depositing each time and how frequently.

Other trading platforms with ETFs typically do not charge an account fee like Raiz does but they do charge a brokerage fee for every transaction. So if you’re set on investing small daily amounts, the fees will typically be higher with other online brokerage platforms ($2 – $20 per transaction). However, it can be quite a bit cheaper if you’re investing larger amounts less frequently, e.g. a quarterly amount instead of daily.

There are also platforms such as Superhero and CMC Markets that will charge $0 brokerage fees for the same service if you’re investing less than $1,000 each time, although most platforms will require a minimum transaction amount – (Superhero is $100, CMC is $500). Ultimately, it comes down to your personal investment style.

As a final point, always remember the ETF itself will also be charging a management fee (MER fee) – if you’re with the IVV ETF, that will be 0.03% of your funds each year taken out of the fund automatically. So all of these fees can add up in the long run.