Fear thy neighbour: What first home buyers are most afraid of

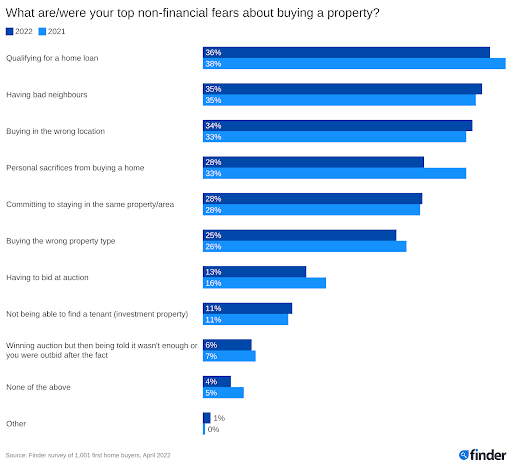

First home buyers are just as terrified of bad neighbours as they are of not qualifying for a loan, according to new research from Finder.

According to Finder's First Home Buyer Report 2022, which surveyed 1,001 first home buyers in Australia – more than one-third of buyers (35%) are afraid of having bad neighbours.

That's close in comparison to the 36% who fear being rejected for a loan.

The research found buying in the wrong location is another top first home buyer fear (34%).

Having to make personal sacrifices in order to buy a home (28%) and committing to staying in the same property or area for a while (28%) also rank as major non-financial fears among buyers.

Richard Whitten, home loans expert at Finder, said many homeowners enjoy a sense of local community.

"Having nice neighbours is a common want for Australians but can often be the luck of the draw.

"A friendly and safe neighbourhood goes hand in hand, which is a priority for more than a quarter of first home buyers."

Whitten said the fear of loan rejection is understandable.

"Applying for a home loan can be nerve-racking, but there are things you can do to increase your odds of approval.

"Your lender will look at your financial statements and spending behaviour, so it's a good idea to avoid splurging too much in the months leading up to your application.

"If you don't already have a budget, now is a great time to start. Plus, finding areas where you can save will give you more of a buffer when it comes to making your loan repayments."

Whitten said it was also a smart idea to check your credit score.

"This is what your lender will look at to assess whether you're a good borrower, and it can also impact what interest rate you get.

"You can check your credit score for free on the Finder app ahead of time. You might even find mistakes in your report, which you should rectify before applying."

The research found younger buyers are more concerned about the lack of flexibility that comes with owning a home.

Nearly a third of gen Z (31%) and millennials (30%) fear committing to staying in the same property or area for an extended period, compared to 20% of gen X.

Hoping to enter the market? Check out our tips for first home buyers or compare home loans for low deposit borrowers.

Ask a question