Finder’s RBA Survey: July rate cut is “in the bag”

More mortgage relief is on its way, according to a new poll from Finder.

In this month's Finder RBA Cash Rate Survey™, 34 experts and economists weighed in on future cash rate moves and other issues relating to the state of the economy.

Almost all (88%, 30/34) believe the RBA will cut the cash rate in July, bringing it to 3.60%.

If banks pass this on in full, an Aussie homeowner with a $500k mortgage will save $1,613 per year compared to what they were paying at the start of the year before the RBA started cutting the cash rate.

Graham Cooke, head of consumer research at Finder, said another rate cut would give mortgage holders the confidence boost they need.

"We've seen two cash rate cuts already, but homeowners are chomping at the bit for more.

"Inflation is continuing to reduce, which means the RBA is likely to cut and the banks will be under a lot of societal pressure to pass on the full rate cut again in July."

Cooke said banks really do need to pass on the full cut to their customers.

"Finder's Cost of Living Pressure Gauge has dropped a little to 74%, but it's still borderline extreme.

"The first bank to hold back some of the cut will be publicly shamed.

"Even if you get the full decrease, you may be able to give yourself another by switching. If your home loan is over 5.5% after this cut, you're paying too much," Cooke said.

Matthew Peter from QIC said "a July cut is in the bag".

"Underlying inflation is within the RBA's target band and falling, consumer spending is disappointing and the market is expecting a rate cut.

"No reasons for the RBA to wait," Peter said.

How much homeowners can save

Finder analysis shows Aussies with a $500k mortgage will save $80 per month – $956 per year – if their lender passes on a July rate cut in full.

The savings jump to $134 per month, or $1,613 per year, if you take into account all three rate cuts in 2025.

Aussies with a $1 million home loan will save $269 on average per month – $3,226 per year – compared to the start of the year, if the RBA cuts the cash rate in July and lenders pass this on in full.

Cooke said this was a golden opportunity for homeowners to lock in savings, or get ahead on repayments.

"If you can afford to, don't lower your repayments just because your rate has dropped.

"Keeping your repayments steady means you'll chip away at the principal faster, saving thousands of dollars in interest over the life of your loan," Cooke said.

Home loan savings compared to June 2025 (if lenders pass on 25 basis points cut)

| Home loan | Average monthly saving | Average annual saving |

|---|---|---|

| $500,000 | $80 | $956 |

| $750,000 | $120 | $1,435 |

| $1 million | $159 | $1,913 |

| $659,920 (average home loan in Australia according to the ABS) | $105 | $1,262 |

| Source: Finder, RBA. Based on home loan rate of 5.95% as at May 2025 (Outstanding owner-occupied home loan variable) |

Home loan savings compared to January 2025 (if lenders pass on 25 basis points cut, i.e. 3 rate cuts this year)

| Home loan | Average monthly saving | Average annual saving |

|---|---|---|

| $500,000 | $134 | $1,613 |

| $750,000 | $202 | $2,420 |

| $1 million | $269 | $3,226 |

| $659,920 (average home loan in Australia according to the ABS) | $177 | $2,129 |

| Source: Finder, RBA. Based on home loan rate of 6.12% as at Jan 2025 (Outstanding owner-occupied home loan variable) |

The RBA is just getting started

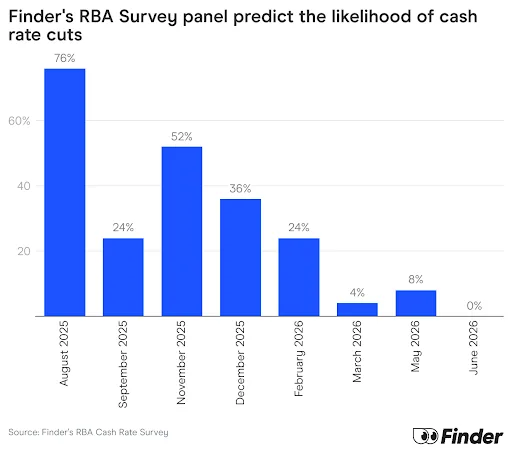

The majority of experts who weighed in* (76%, 19/25) expect another rate cut in August.

Just over half (52%, 13/25) are also predicting a cash rate cut in November.

While mortgage stress is at a two-year low, 34% of homeowners are still struggling to pay their home loan, according to data from Finder's Consumer Sentiment Tracker (CST).

*Experts are not required to answer every question in the survey

Here's what our experts had to say:

Evgenia Dechter, UNSW (Decrease): "The RBA may consider cutting the cash rate due to easing inflation, weak GDP growth, and heightened global uncertainty."

Shane Oliver, AMP (Decrease): "Since the last meeting we have seen a further fall in inflation and weaker than expected GDP and economic activity data so the RBA is likely to continue returning the cash rate to around neutral."

Tomasz Wozniak, University of Melbourne (Decrease): "Third time lucky! The forecasts from my predictive system indicate another CUT. The predictive intervals do not contain the current cash rate value. They include a 25bp cut, though. The forecast mean suggests a 15bp decrease. My forecasts are available at: https://forecasting-cash-rate.github.io/"

Matthew Peter, QIC (Decrease): "Underlying inflation is within the RBA's target band and falling, consumer spending is disappointing and the market is expecting a rate cut. No reasons for the RBA to wait. A July cut is in the bag."

Matthew Greenwood-Nimmo, University of Melbourne (Decrease): "With inflation seemingly under control and against a backdrop of significant global uncertainty, I suspect the RBA will cut the cash rate in July."

Anthony Waldron, Mortgage Choice (Decrease): "The latest data published by the ABS shows headline inflation is now on the lower end of the RBA's target band of 2-3%. In my view, this would give the RBA a solid reason for delivering a cut at the July board meeting."

Garry Barrett, University of Sydney (Decrease): "Easing of inflationary pressures, uncertainty in real economy."

David McQueen, Loan Market (Decrease): "We've seen some key economic indicators recently that point to a potential shift in the interest rate cycle. The March Quarter GDP came in under expectations and the trimmed mean annual inflation dropped to 2.9%, which sits right in the RBA's target range. Combined with the global impacts stemming from tensions in the Middle East, we feel the Monetary Board has reason to ease the cash rate this month. At Loan Market, in the four weeks following the RBA's May meeting, our pre-approval applications were 7% higher than the preceding period and 53% higher than the same time last year. Our brokers are seeing that shift in sentiment firsthand. That lift in pre-approvals tells us people aren't just hoping for change, they're preparing for it. Buyers are getting their finances in order, weighing up their options, and positioning themselves to act. It's a sign of growing confidence. If the RBA does cut the cash rate in July, while some lenders may pass on the full rate cut, some won't. It's important that borrowers take advantage of the improved affordability that cuts bring. Talking to a broker can help borrowers understand where they stand, whether the market has shifted in their favour and which lender is going to offer them the best deal."

David Robertson, Bendigo Bank (Decrease): "The RBA remain on a path to a more neutral cash rate, and the May monthly indicator for inflation allows the RBA the opportunity to cut in July rather than waiting for the full Q2 CPI data."

Nicholas Gruen, Lateral Economics (Decrease): "They're concerned about a slowdown."

Mathew Tiller, LJ Hooker Group (Decrease): "I expect the RBA to cut rates in July, with inflation now comfortably within the 2–3% target band. Slowing growth, rising unemployment and cost-of-living pressures make a strong case for easing. For property markets, lower rates mean improved borrowing capacity, easier mortgage serviceability and renewed buyer interest heading into spring, supporting further price growth."

James Morley, University of Sydney (Decrease): "Underlying inflation has come in below RBA forecasts, with latest May-to-May reading for trimmed mean inflation at 2.4%. Also, despite a lot of uncertainty globally and even domestically that could resolve in a less dire way than the worst case scenario, there is less sense of much upside risk for inflation in Australia if this happens. Meanwhile, if the more negative outcomes eventuate in the form of trade wars and a weakened global economy, Chinese demand for Australian exports will be lower and imports from China will be cheaper, so inflation could continue to fall below forecast."

Jeffrey Sheen, Macquarie University (Decrease): "Actual and underlying inflation have been within the RBA's target range for some months. The cash rate needs to be returned from its mildly restrictive to its neutral value."

Geoffrey Kingston, Macquarie University Business School (Decrease): "The latest CPI data say that inflation is now well within the target band. Likewise, the latest GDP data say the economy is soft, especially the private sector."

Stella Huangfu, University of Sydney (Decrease): "First, the latest national accounts show GDP grew just 0.2% in the March quarter, with annual growth slowing to 1.3%—well below the 0.6% rise in the December quarter and below trend. Second, the May CPI confirms disinflation is underway. Headline inflation eased to 2.1%, and trimmed mean inflation fell to 2.4%, the lowest since November 2021. Weak growth and falling inflation provide room for the RBA to cut."

Mark Crosby, Monash University (Decrease): "Weakness in the economy and inflation now inside the target range."

Peter Munckton, Bank of Queensland (Decrease): "Inflation is at target and the cash rate is above neutral."

Peter Boehm, Pathfinder Consulting (Decrease): "With inflation falling and economy stalling, it seems highly likely rates will come down. Yet, there is still a considerable international economic uncertainty which could give rise to inflationary pressures but on balance, I suspect will drop by 25bps."

Adj Prof Noel Whittaker, QUT (Decrease): "Inflation appears to be getting under control, and there's a lot of anecdotal evidence that people are doing it tough, especially smaller businesses."

Brodie Haupt, WLTH (Decrease): "Headline and underlying inflation have both reportedly decreased to the lower half of the 2-3% target band, giving the RBA more confidence to cut the cash rate. Furthermore, with ongoing conflict in the Middle East, the RBA board should consider how oil price shocks could hamper growth in our economy."

Kyle Rodda, Capital.com (Decrease): "I'd be inclined to say that the RBA would wait for the next quarterly CPI print before cutting again. However, the pivot at the last meeting, where the balance of risks appeared to tip towards downside risks to growth and the labour market from upside risks to inflation, suggests the bar for an RBA cut is much lower. In addition, the markets are pricing in a 95% chance of a rate reduction with little push back from officials just yet."

Michael Yardney, Metropole (Decrease): "With inflation falling faster than expected and now tracking within the RBA's target band, the case for an interest rate cut in July is strong. Key cost pressures like fuel, goods, and even rents are easing, while consumer sentiment and spending remains weak. Given these signs of a slowing economy, the RBA has room to ease monetary policy without risking another inflation spike. A July rate cut would help support growth and signal a shift toward a more balanced approach."

A/Prof Mark Melatos, School of Economics, University of Sydney (Decrease): "Monthly inflation readings have been falling precipitously for a while. The March quarter CPI report showed headline and underlying inflation within the RBA's target range (2.4% & 2.9% respectively). The monthly May rate was 2.1% from 2.4% in April. The RBA has already felt sufficiently confident to cut rates at its February and May meetings and, if anything, the inflation situation appears to have moderated even more since then. Given that the Federal election has been held, and the increased geopolitical uncertainty, there seems to be little (apart from inexorably increasing house prices) stopping the RBA moving to ease further now."

Saul Eslake, Corinna Economic Advisory Pty Ltd (Decrease): "Underlying' inflation is now below the mid-point of the target band and FWIW headline inflation is only just above the bottom of the target band, and economic growth is still sluggish, so there is no need for monetary policy to be as restrictive as it still is."

Jakob Madsen, The University of Western Australia (Decrease): "Inflation rate decreased in May while the economic prospects remain unaltered."

Nicholas Frappell, ABC Refinery (Decrease): "Lower CPI print keeps the door open for easing, against a background of weaker private sector activity, and the possibility of weaker global demand in H2."

Tim Nelson, Griffith University (Decrease): "The annual Consumer Price Index (CPI) rose by 2.1% in May, below the anticipated 2.3%. More notably, the trimmed mean inflation—a core measure closely watched by the RBA—fell to 2.4%, its lowest level since November 2021, and within the RBA's 2–3% target range. The RBA didn't cut in June but with this new data may feel more comfortable cutting another 25 bps without feeling like it will be fuelling inflationary pressures."

Matt Turner, GSC Finance Solutions (Decrease): "Inflation is now well within the target band for the RBA, and all other indicators are trending in the right direction. Cost of living is still biting households which is leading to weak growth and the hospitality sector in particular is really battling."

Stephen Miller, GSFM (Decrease): "Tepid growth. Benign inflation. RBA Board fears on the international outlook."

Stephen Koukoulas, Market Economics (Decrease): "Weak growth and risk that inflation falls below target."

Tim Reardon, Housing Industry Association (Hold): "Unemployment still low and the RBA will prefer to see the official quarterly CPI data at the end of July."

Cameron Murray, Fresh Economic Thinking (Hold): "CPI is in the target band. Not sudden changes to key economic metrics."

Andrew Wilson, My Housing Market (Hold): "Current rate settings have achieved a balance between growing consistency in maintaining the RBAs inflation target and a strong economy reflected in a robust and resilient labour market."

Nalini Pr, UNSW Sydney (Hold): "I think the RBA will wait and see what happens in the next quarterly CPI before making any decisions about the path of interest rates."

Ask a question