Finder’s RBA Survey: “Not this time!” – Experts rule out September cut

Experts are united for the first time this year that rates will stay put this month.

In this month's Finder RBA Cash Rate Survey™, 32 experts and economists weighed in on future cash rate moves and other issues relating to the state of the economy.

For the first time in 2025, all panellists are in agreement that the RBA will hold the cash rate in September, keeping it at 3.60%.

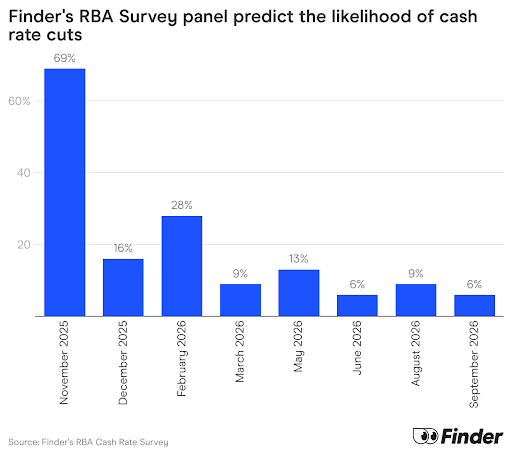

Economists do predict one more cut in 2025, with nearly 7 in 10 (69%, 22/32) calling for downward movement on 4 November when the RBA next meets.

Graham Cooke, head of consumer research at Finder, said this is the first time this year that the panel have been 100% certain of a forthcoming RBA decision.

"Mixed economic signals have kept the RBA in a holding pattern. While spending remains strong, rising inflation and increasing unemployment add complexity to the decision-making process.

"Despite full consensus of a pause, the majority of economists predict a further rate cut by November 2025, as inflationary pressures ease and the economy continues its slow recovery.

"However, September's increase in monthly inflation from 2.8% to 3% may keep the RBA's scissors in the sheath on Cup Day if the quarterly data follows suit."

When asked whether the RBA will cut rates this month, Tomasz Wozniak from University of Melbourne said, "Not this time!"

"No doubt the RBA is on a slide down with the cash rate. However, the several promised cuts will be spread over quite some time, and we should not expect a cut at every single meeting," Wozniak said.

Shane Oliver from AMP echoed this view, noting that the RBA has signalled a gradual, measured approach to easing interest rates, which suggests quarterly cuts.

"Since the August meeting nothing has happened to change this. Underlying inflation is around target and economic growth is recovering gradually…the RBA is likely to hold," Oliver said.

Experts call for government regulation on AI financial advice

More than 3 in 5 experts who weighed in* (63%, 12/19) believe AI models should never be able to provide financial advice in Australia.

An overwhelming majority (81%, 17/21) think the Australian government needs to step in and regulate the financial advice that AI models provide.

This comes as Finder research reveals 2 in 5 (40%) Australians trust AI chatbots to help them make financial decisions.

That's equivalent to 8.5 million people who have relied on artificial intelligence to help them with their finances.

The research found 1 in 10 (10%) trust AI explicitly to help them make financial decisions, while 30% say whilst they use the service to seek guidance with their finances, they make sure to check the advice elsewhere.

The younger generations are more likely to trust AI with their money – 3 in 5 (60%) gen Z say they use it to make financial decisions, followed by 49% of gen Y.

This is compared to 31% of gen X and just 13% of baby boomers.

Cooke said AI is offering Australians unprecedented access to financial guidance at their fingertips.

"While many embrace AI tools like ChatGPT for budgeting and investment insights, it's crucial to remember that these platforms are not designed to give financial advice.

"As AI continues to advance, Australians using these tools must critically evaluate the information they receive. Bots tend to hallucinate, so don't blindly accept what they suggest.

"The key to using AI successfully is to treat it as a tool for informed decision-making, not as something that dictates your financial goals. Always seek personalised human advice when you need it," Cooke said.

*Experts are not required to answer every question in the survey.

Here's what our experts had to say:

Evgenia Dechter, UNSW (Hold): "Recent indicators show that economic growth has picked up, especially in private spending, the labour market is relatively steady, while inflation is still at the higher end of the target range. A wait and see approach looks the most likely."

Tomasz Wozniak, University of Melbourne (Hold): "Not this time! No doubt the RBA is on a slide down with the cash rate. However, the several promised cuts will be spread over quite some time, and we should not expect a cut at every single meeting. I believe this was well understood since the beginning of this year. The most surprising was the media drama about the HOLD decision in July. My forecasts are firmly centred around the HOLD decision this month. I interpret this as the markets accepting the RBA's pace of interest rate cuts. My forecasts are available at: https://forecasting-cash-rate.github.io/"

Matthew Greenwood-Nimmo, University of Melbourne (Hold): "The RBA appears to be on a gradual easing path, so I think they will hold this time before weighing further rate changes at future meetings."

Anthony Waldron, Mortgage Choice (Hold): "Although inflation has come down, the latest ABS data showed economic growth rebounded in the June quarter. As a result, I expect the Board will hold the cash rate at this month's meeting. By the next RBA Board meeting in November, the September quarterly CPI will have been released. This will help provide more certainty around whether inflation is staying on track before the Board considers further cash rate cuts."

Tim Nelson, Griffith University (Hold): "Inflation remains within the accepted range but not certain that the rate of change indicates it will stay there."

Craig Emerson, Emerson Economics Pty Ltd (Hold): "The RBA seems to feel it has the balance right - between inflation reduction and maintaining low unemployment."

Stella Huangfu, University of Sydney (Hold): "Headline CPI has reached a one-year high, and monthly CPI excluding volatile items and holiday travel has also climbed to its highest level in a year."

David McQueen, Loan Market (Hold): "While employment data released this month was weak, the Reserve Bank of Australia's Monetary Board will want further evidence of a trend before adjusting the cash rate. Additionally, annual trimmed mean inflation data for August was marginally higher than expected, but still within the RBA's preferred 2-3 percent band. The RBA meeting also comes amidst the backdrop of the spring selling season where more buyers have entered the real estate market. In the first three weeks of the peak buying season, Loan Market's pre-approval figures were up 29.5% compared to the same time last year. Property listings are down year-on-year. Auction clearance rates have hit a high 70 percent mark in Sydney and Melbourne as more people compete for limited stock. The RBA will also hold-off on adjusting the cash rate because it will want to see the impact of the fast-tracked changes to the First Home Guarantee. Loan Market's brokers have received an increase in enquiries from first home buyers since the Prime Minister announced the Scheme's amendments were being brought forward to October 1. Increased price caps and the removal of income thresholds on the Scheme will create greater choice for first home buyers."

Shane Oliver, AMP (Hold): "The RBA has indicated that it will take a gradual and measured approach to easing interest rates which implies quarterly cuts. Since the August meeting nothing has happened to change this. Underlying inflation is around target and economic growth is recovering gradually. So the RBA is likely to hold."

Mala Raghavan, University of Tasmania (Hold): "Considering the lagging effects of the cash rate, it is likely that the RBA will temporarily pause its current expansionary policy. While inflation remains relatively stable, it is still facing upward pressures from various global events such as geopolitical tensions, trade wars, supply chain disruptions, and volatile exchange rates. These events could lead to increased price pressures, channelled through rising import prices."

Kyle Rodda, Capital.com (Hold): "The RBA has definitively shifted its assessment of the balance of risks to the economy. However, it's also signalled a cautious approach to policy easing, suggesting it will wait for more data before cutting rates again."

Jeffrey Sheen, Macquarie University (Hold): "The RBA is likely to hold since it seems to be waiting to see if CPI inflation for Q3 (due 29 October) remains in the target range. Monetary policy remains mildly restrictive, which I believe is not necessary, and so the cash rate should be cut to neutral immediately. There is significant uncertainty but the downside risks are greater than the upside ones."

Geoffrey Kingston, Macquarie University Business School (Hold): "Inflation is within the target band. While there is near-term weakening of the labour market, it has probably not yet progressed to the point of triggering an immediate cut."

David Robertson, Bendigo Bank (Hold): "The RBA will remain on hold in September awaiting further data on jobs and inflation, but should continue the easing cycle in November maintaining the pace of quarterly cuts at a quarter of a percent."

Nicholas Gruen, Lateral Economics (Hold): "I think it should be cut, but the 'consensus' seems to have emerged – perhaps cultivated by the Bank – that it will be cut later."

Leanne Pilkington, Laing+Simmons (Hold): "The weaker-than-expected employment figures might support the case for another rate cut; however, we expect the Reserve Bank's preference will be to take more time to understand the full impact of the previous cuts before taking further action."

Nicholas Frappell, ABC Refinery (Hold): "Inflation is below the RBA's target range, and the labour market looks firm. The RBA believes that upcoming data releases will show that the economy is doing well enough not to need a cut at the September meeting, even if one is anticipated in November."

Mathew Tiller, LJ Hooker Group (Hold): "I expect the RBA to hold in September, the jobs market is still a bit tight and services inflation needs to keep easing. Recent cuts have lifted property market activity, demand is up while listings remain tight, keeping prices moving higher."

Mark Crosby, Monash University (Hold): "RBA will probably wait before any further rate cuts this year."

Brodie Haupt, WLTH (Hold): "We are forecasting the RBA to hold rates in September, with a further cut anticipated in November. Market sentiment remains cautious following the recent reduction in August."

James Morley, University of Sydney (Hold): "Although the RBA is in a cutting cycle, they are taking a gradual approach to make sure inflation stays in the target range. Also, domestic conditions look a bit stronger than previously thought. So they are likely to hold this time and maybe cut in one of the next two rounds."

Sean Langcake, Oxford Economics Australia (Hold): "The next move is down. But we think the RBA will wait for the full Q3 inflation picture before moving. That means a November cut."

Garry Barrett, University of Sydney (Hold): "With mixed data – weaker labour market statistics though higher CPI – I anticipate the RBA will be cautious and maintain current cash rate setting"

Noel Whittaker, QUT (Hold): "Inflation is not yet under control, and the government's initiative to ease the conditions on the first home buyer mortgage insurance scheme is going to cause another surge in prices. We don't need to add increased rates to this heady mix."

Matthew Peter, QIC (Hold): "The RBA is playing a conservative game. They have flagged that the quarterly CPI inflation data is their trigger for rate cuts. This means the next rate cut will have to wait until their November meeting."

Matt Turner, GSC Finance (Hold): "Not enough data that would suggest that they need to deviate from their slow approach."

Jakob Madsen, UWA (Hold): "The economy has not changed much the last month"

Stephen Miller, GSFM (Hold): "Inflation is still a little sticky. Unit labour costs are elevated. The labour market has been resilient."

Peter Boehm, Pathfinder Consulting (Hold): "With inflation ticking up it would seem the RBA's last rate cut was premature. It seems highly unlikely to me that the RBA would risk a further rate cut when the direction of inflation is upwards, fuelled by high levels of government spending and expensive power due to significantly high domestic and commercial power prices."

Cameron Murray, Fresh Economic Thinking (Hold): "Stable macro conditions."

Saul Eslake, Corinna Economic Advisory Pty Ltd (Hold): "The RBA has said it will adjust monetary policy gradually, reiterating this in the minutes of the most recent meeting and subsequent comments from the Governor. Data since the last meeting hasn't warranted diverting from that stance by cutting rates at consecutive meetings. I remain of the view that they will be cut by 25 bp in November."

Michael Yardney, Metropole Property Strategists (Hold): "Inflation has eased, but isn't out of the woods as economic growth showing signs of strength GDP rose by ~0.6% in the June quarter, helped by stronger household spending. This suggests that the demand side is picking up, which could reignite inflationary pressures if interest rates are dropped too soon. The RBA tends not to react to temporary dips in inflation or volatile signals. They will wait for consistent data showing inflation is moving sustainably toward their target, rather than bouncing around."

Ask a question