Finder’s First Home Buyer Report: Blown budgets, buyers remorse, and the struggle to buy solo

Record-high deposits and soaring prices are pushing Australia's first home buyers to their financial limits, according to a new report by Finder.

Finder's First Home Buyer Report 2025 – based on a survey of 1,006 first home buyers in Australia – explores the growing financial pressure and changing behaviours of new homeowners.

Below are some of the key findings from the report:

Over budget and under pressure

- Almost half (47%) of first-time buyers paid more than they budgeted, a significant increase from 38% in 2022.

- 1 in 7 (14%) Australians who bought their first home in the past 12 months have no savings left, while 1 in 3 (33%) have less than $10,000 remaining.

- Spending an extra $50,000 over budget, which 18% of first-time buyers did, adds more than $3,500 to annual loan repayments on an initial budget of $500,000.

Buyers remorse: 45% are unhappy with their purchase

- Almost half (45%) of first home buyers who purchased in the past year say they regret their decision.

- The two most common regrets are paying too much for the home (26%) and not saving a large enough deposit (11%),

- Interestingly, 77% of first-time buyers who bought their house at auction regret their purchase, compared to just 37% of buyers who bought off the plan or directly from a real estate agent.

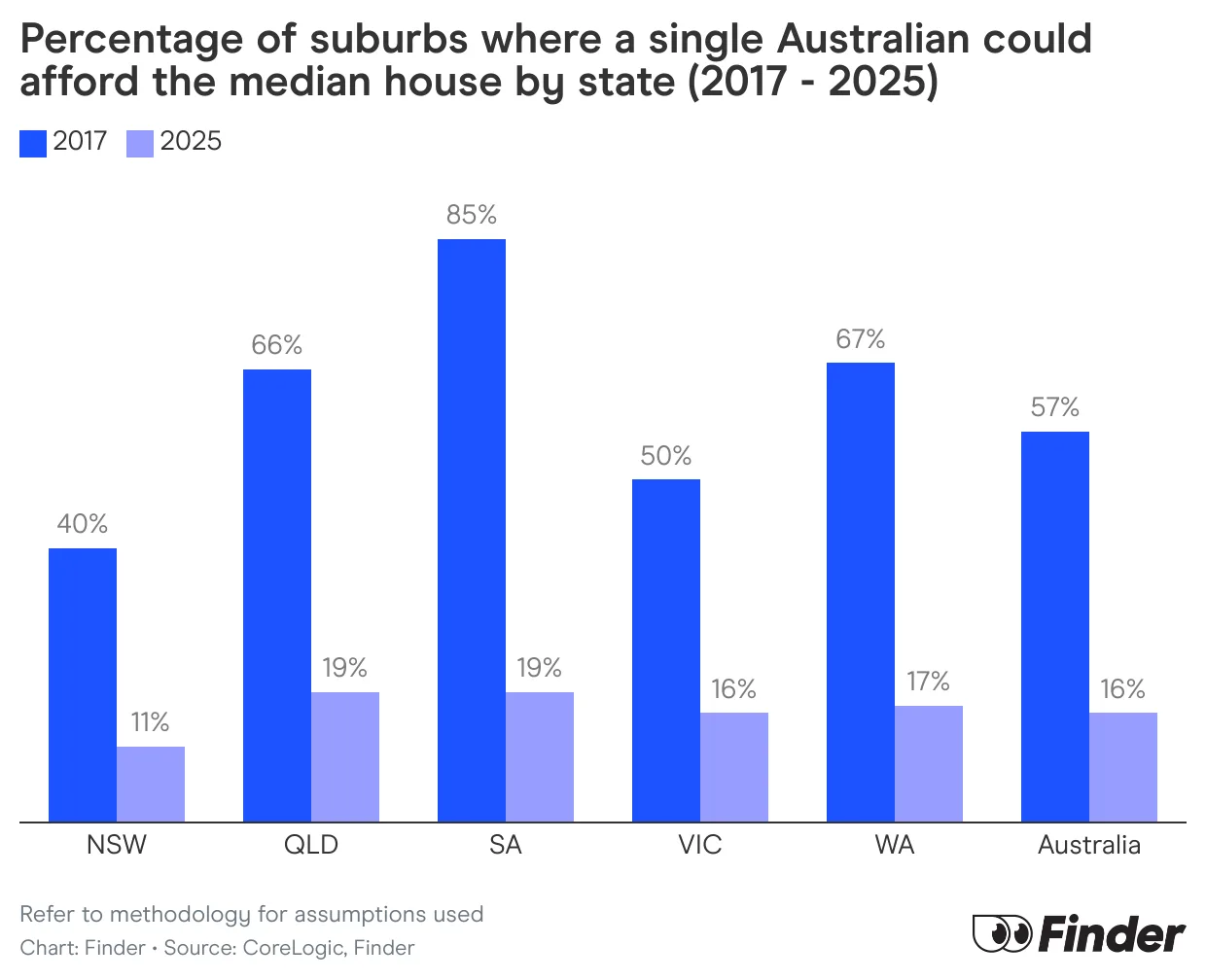

Single buyers priced out: just 16% of suburbs are affordable for house hunters

- The proportion of suburbs where the average Australian can afford a mortgage on the median house has fallen from 57% in 2017 to just 16% in 2025.

- The decline is only slightly less severe for units, dropping from 66% in 2017 to 28% in 2025.

- In NSW, SA and WA, the number of suburbs where the average single Australian could afford mortgage repayments on the median house has fallen by around three-quarters.

Sarah Megginson, personal finance expert at Finder, says:

- "Buying a home is harder than ever, especially if you're trying to do it on your own without a partner or family member.

- "First home buyers are not expecting to step into a mansion for their first property, but even those with realistic expectations are shocked that even entry-level homes carry eye-watering price tags."

- Megginson said with prices so high and pressure to get in before they go up even more, regret is becoming increasingly common among first home buyers.

- "Saving a deposit is now a multi-year grind and many first-time buyers rely heavily on the 'bank of mum and dad' to bridge the gap between what they have and what they need."

- Megginson warned that mortgage stress poses serious risks for first time buyers.

- "Many buyers are stretching themselves to the limit with their finances and they have little buffer for unexpected expenses – and ironically when you're a homeowner, the risk of an unexpected expense increases as things can and do break around the home.

- "Without emergency savings, you could end up in a seriously stressful financial situation.

- "With up to three interest rate cuts predicted before Christmas, that will help current mortgage-holders ease some pressure.

- "But demand – especially in affordable markets – is expected to surge, which could potentially push entry-level prices even higher and squeeze first home buyers further," Megginson said.

To read the full report, visit https://www.finder.com.au/insights/first-home-buyer-report-2025

Ask a question