Which coins are the winners from Trump’s crypto executive order?

The formation of a national digital asset stockpile could be good news for these cryptocurrencies.

President Donald Trump has signed an executive order calling for the formation of a crypto working group and a US cryptocurrency stockpile.

While it wasn't the announcement of a strategic Bitcoin reserve many had hoped for, it's still a new positive for the sector.

But which cryptocurrencies and projects are likely to benefit from a national crypto stockpile, and which aren't?

The winners

World Liberty Financial (WLFI)

World Liberty Financial, the Trump family-affiliated cryptocurrency platform is an obvious potential winner from Trump's new executive order.

With its direct ties to the Trump family, it may place a role in the formation of Trump's crypto stockpile, especially given Trump's record of combining his political and business dealings.

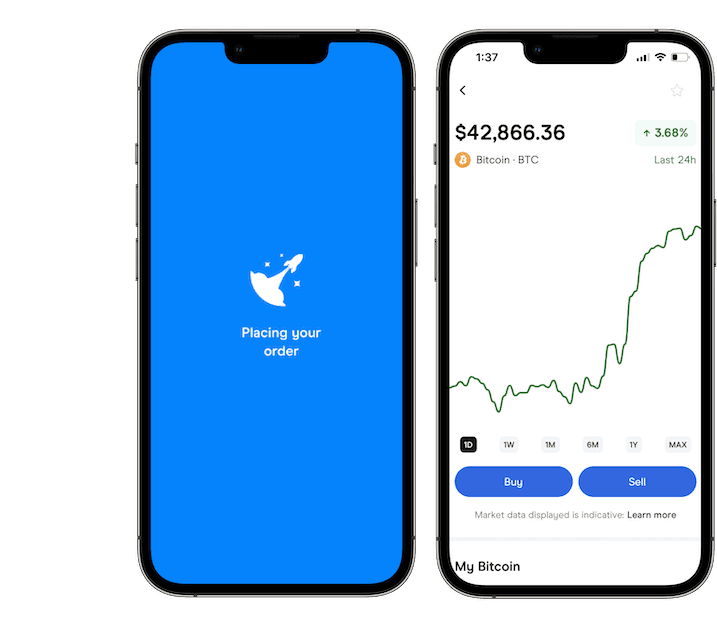

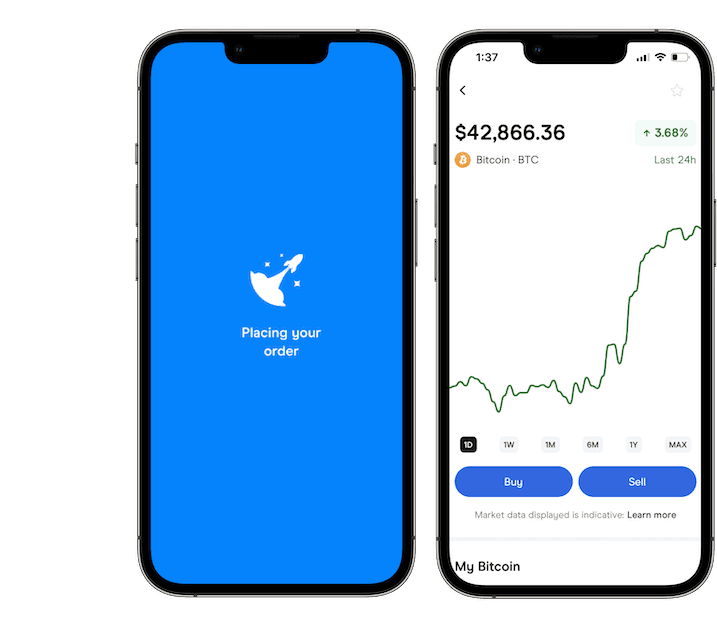

It has already accumulated millions of dollars of various cryptocurrencies, including the following:

Depending on whether World Liberty Financial is involved, these coins may even make up some of the national crypto stockpile.

Multicoin

Multicoin Capital is a cryptocurrency investment fund that counts new US crypto czar David Sacks as one of its investors.

Given Sacks' role as the head of Trump's new crypto working group, the fund is likely to have close links to crypto regulation and strategy under the new taskforce.

Mutlicoin is predominantly focused on Solana, with Sacks himself a long-time supporter and investor in the Ethereum rival.

Other notable Multicoin holdings include:

- NEAR Protocol (NEAR)

- Aptos (APT)

- Render (RNDR)

- Helium (HNT)

- Toncoin (TON)

- Algorand (ALGO)

XRP

Ripple Labs, the company behind XRP has close ties to Trump and may also be one of the coins to benefit from a US crypto stockpile.

It is one of the leaders in digital payment processing, including stablecoins, and looks to be involved in the tokenisation of real world assets.

The loser

Bitcoin

It may seem counterintuitive, but Bitcoin is arguably the biggest loser from Trump's recent order.

Despite expectations, there was notably no announcement around a Bitcoin strategic reserve may mean it isn't a primary focus for Trump's crypto taskforce.

However, it's not all bad news for Bitcoin.

The US government is actually one of the biggest holders of Bitcoin in the world, having seized billions of dollars of Bitcoin in various law enforcement actions, including the shutdown of Silk Road.

Even if the Trump administration decide against a strategic reserve, Bitcoin is still likely to feature in any national crypto stockpile.

Trump's executive order specifically mentions the government's existing holdings as the potential foundation of the new stockpile.

Join the crypto conversation – Follow us on X now

Trying to get a handle on the markets? Cut through the noise with our overview of the best cryptos to buy right now, explore some strategies for how to trade crypto or see if there's a better platform for you with our guide to the best crypto exchanges.

Disclaimer: Cryptocurrencies are speculative, complex and involve significant risks – they are highly volatile and sensitive to secondary activity. Performance is unpredictable and past performance is no guarantee of future performance. Consider your own circumstances, and obtain your own advice, before relying on this information. You should also verify the nature of any product or service (including its legal status and relevant regulatory requirements) and consult the relevant Regulators' websites before making any decision. Finder, or the author, may have holdings in the cryptocurrencies discussed.

Trusted by over 500,000 Aussies

Trusted by over 500,000 Aussies

Sources

Ask a question