Bitcoin price hits US$50,000: Is now the time for Aussies to buy?

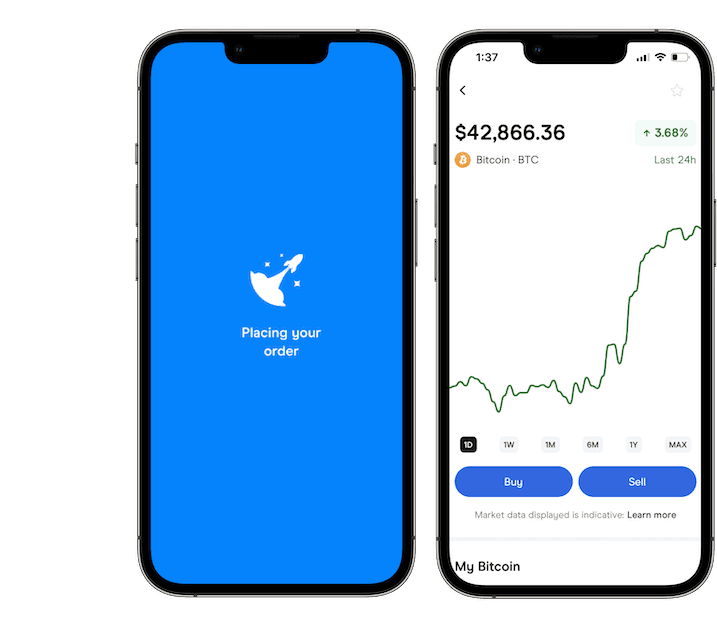

Bitcoin has crossed US$50k again after nearly 2 years – what are the catalysts and their implications for Aussie investors?

The largest cryptocurrency by market value, Bitcoin surged by more than 10% on Tuesday to over US$50,000, touching its highest level since 27 December 2021.

Let's look closely into factors driving Bitcoin's price surge and what this could mean for Aussie investors.

The confluence of 3 factors

Before going into the specifics, it's important to understand the broader context of Bitcoin's bullish performance.

According to Monochrome Asset Management chief executive Jeff Yew: "Putting aside the potential long term benefits of holding Bitcoin, the latest surge can be broken down into 3 main drivers: US ETF approvals, decreasing liquid supply, speculation around the halving. All three of these can be considered work in unison to produce a positive feedback loop in price."

Optimism around ETFs

A pivotal moment for the cryptocurrency market, particularly for Bitcoin, has been the US Securities and Exchange Commission's (SEC) approval of 11 applications for spot bitcoin ETFs.

The demand for these ETFs has also skyrocketed since the time of approval.

The assets under management at these issuers totalled around $28.35 billion and a market cap of $39.34 billion, according to Blockworks data. The trading volume over 24 hours reached $1.57 billion, indicating a high level of activity and interest.

The Grayscale Bitcoin Trust (GBTC) leads the pack with assets under management at $20.27 billion, followed by BlackRock's iShares Bitcoin Trust (IBIT) at $3.31 billion and Fidelity's Wise Origin Bitcoin Trust (FBTC) at $2.75 billion.

Learn more: How to buy Bitcoin ETFs in Australia.

The approval of these ETFs thereby significantly contributes to Bitcoin's price surge.

Decreasing liquid supply

Another critical factor is the decreasing liquid supply of Bitcoin.

The term 'liquid supply' refers to the amount of Bitcoin that is readily available for trading and purchasing on exchanges. A decrease in this supply suggests that fewer Bitcoins are available for buyers, which can lead to price increases when demand remains constant or grows.

But is that actually true?

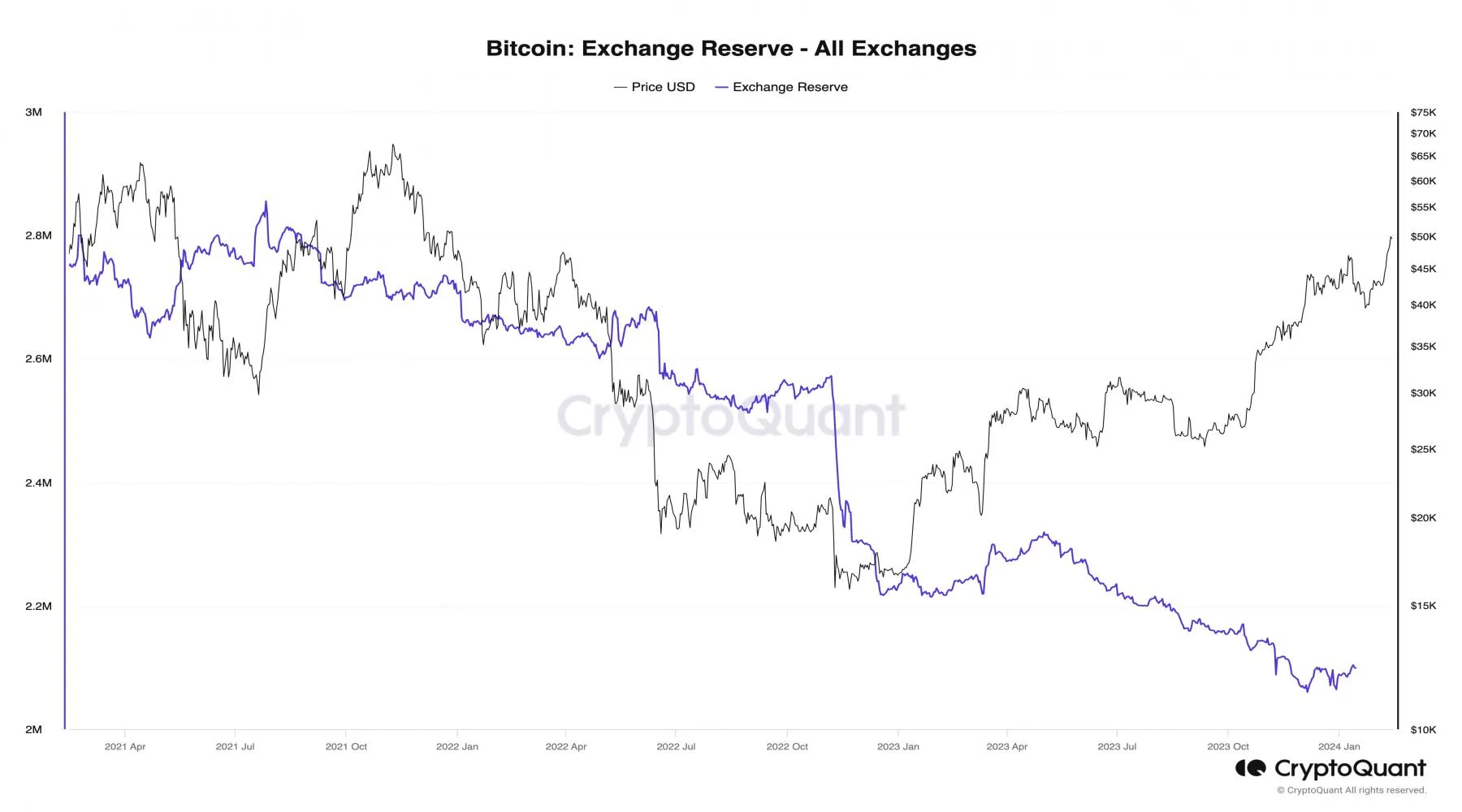

As per CryptoQuant data, there's a significant decrease in the amount of Bitcoin available on exchanges, a key indicator of liquid supply in the market.

Specifically, the quantity of Bitcoin held in exchange wallets has seen a notable decline, indicating that fewer Bitcoins are readily available for trading.

This is evident in the following graph.

This reduction in liquid supply is critical in understanding Bitcoin's price movements for a few reasons.

- It signals a trend where investors are moving Bitcoin off exchanges, potentially to hold them in more secure, personal wallets or for longer-term investment strategies. This behaviour suggests a growing confidence in Bitcoin as a long-term store of value, rather than a short-term speculative asset.

- With fewer Bitcoins available for immediate purchase on exchanges, any increase in demand can lead to sharper price increases. This is because the reduced supply on exchanges limits the ability of new buyers to purchase Bitcoin without driving up the price.

The CryptoQuant data indicates this decrease in supply coincides with periods of increased buying activity, contributing to the upward price momentum Bitcoin has experienced.

"The new regulated pathways into the BTC spot market have then begun reducing the already decreasing pool of BTC readily available, as institutions and players with investment mandates now being able to access the market," Yew said.

Speculation around Bitcoin halving

Investors might be looking ahead to several key events that could influence Bitcoin's supply and demand balance. Among these potential drivers is the expected Bitcoin halving event in April.

Bitcoin halving is a much-anticipated event that reduces the reward for mining new blocks by half, effectively decreasing the new supply of Bitcoin entering the market.

Theoretically, a supply shock to the network, according to basic supply and demand theory, suggests that the value should increase if demand remains constant or grows.

Based on the Bitcoin Halving Clock, around 9,843 blocks are left until the halving event, which is projected to take place by 17 April. Also reducing block rewards from 6.25 to 3.125 BTC per block.

According to Yew, for investors to prepare for this event they should gain an understanding of why this occurs and the fundamentals of how bitcoin works.

"Ultimately, each halving event brings Bitcoin closer to its 21,000,000 BTC supply cap, solidifying it as an emerging way to store value in an inherently scarce digital asset," he said.

What investors should know

With Bitcoin's price reaching new heights, Australians may be reevaluating its place within their investment strategies. But it is important to understand both sides of the coin.

Talking about the positives, there's a high level of familiarity with digital currencies among Australians.

Long-term approach

An October 2023 survey, titled 'Regulating the Crypto Industry' mentioned in the Treasury's proposal found that Australia has significantly embraced Bitcoin and cryptocurrencies. Approximately 1 in 4 Australians currently own or have previously owned cryptocurrency.

As we consider the recent surge in Bitcoin's price and ponder whether now is the moment for Australians to consider buying, it's crucial to acknowledge the varied perspectives within the investment community.

Yew suggests a focus beyond immediate fluctuations.

"We don't comment on short-term price movement; however, most longer-term holders that bought Bitcoin over recent years would be very comfortable seeing the recent price appreciation off the back of the Bitcoin ETF approvals in the States, particularly as we lead into the upcoming halving."

Built around hype

Peter Schiff, known for his critical views on Bitcoin, interprets the latest price movements as another example of a "classic pump-and-dump" scheme. Schiff tweeted:

"It looks like another classic pump-and-dump is going on with Bitcoin and the exchange ETF. The four-day conference kicked-off on Super Bowl Sunday and ends on Valentine's Day. There's a lot of hype surrounding the newly listed Bitcoin ETFs. I wonder when the massacre will begin."

This scepticism towards Bitcoin's value proposition and its recent market performance reflects a cautionary stance towards investing in digital currencies.

Bottom line: Understand the basics

Such contrasting viewpoints underscore the speculative nature of Bitcoin and the broader cryptocurrency market.

For Australians intrigued by Bitcoin's potential, the current market dynamics underscore the importance of a well-informed, thoughtful approach to investment.

Understanding the intricacies of ETF approvals, the implications of decreasing liquid supply, and the historical context of halving events can equip investors with the knowledge needed to navigate the volatile cryptocurrency landscape.

Trusted by over 500,000 Aussies

Trusted by over 500,000 Aussies

Join the crypto conversation – Follow us on X now

Trying to get a handle on the markets? Cut through the noise with our overview of the best cryptos to buy right now, explore some strategies for how to trade crypto or see if there's a better platform for you with our guide to the best crypto exchanges.

Disclaimer: Cryptocurrencies are speculative, complex and involve significant risks – they are highly volatile and sensitive to secondary activity. Performance is unpredictable and past performance is no guarantee of future performance. Consider your own circumstances, and obtain your own advice, before relying on this information. You should also verify the nature of any product or service (including its legal status and relevant regulatory requirements) and consult the relevant Regulators' websites before making any decision. Finder, or the author, may have holdings in the cryptocurrencies discussed.

Sources

Ask a question